Michael M. Santiago/Getty Images News

Amid broad economic optimism that is starting to brew in the back half of this year, there’s one major holdout among sectors: legacy media companies. Disney (DIS), for example, is struggling with the death of linear TV and even growth in Disney+ is unable to comfort investors from the loss of once-juicy carriage fees.

The New York Times (NYSE:NYT) is no different. Though this iconic newspaper company has pivoted toward a subscription-bundle strategy for its online products, declines in print and especially print advertising have weighed sharply on the company’s margins. In spite of this, the stock has rallied more than 20% year to date, leading some to question whether the stock and its fundamentals have become disconnected.

I remain incredibly skeptical and bearish on The New York Times. To me, there’s a grab bag of red flags here for The New York Times, including sinking advertising revenues, a slowdown in subscriber-only growth, potential integration issues with The Athletic as the Times sheds its own sports desk, leaner liquidity as the company continues to pursue M&A, and a general lack of interest in mainstream news brands as more and more younger generations get their news fix from social media and other free sources.

When we take a step back, we have to ask ourselves the question: how many of us are truly “loyal” to a single news brand? With the rise of news aggregators and push notifications on our phones, so many of us feel like we are already inundated with enough headlines to make the notion of paying monthly for a premium news service feel unnecessary. The Times, at least optically, continues to grow digital subscribers – but I continue to believe that is driven in large part by incredibly attractive introductory pricing, which often lasts up to a year.

Here is my full long-term bear case for The New York Times:

- Organic growth is faltering. Digital revenue growth is currently only held up by the acquisition of the Athletic, and the pace of subscriber additions is paling in comparison to 2020, which was a super-cycle year for news (COVID plus a presidential election). To boost its growth, the Times has turned to acquiring several different companies. Moreover, growth in digital is hardly enough to offset declines in print and advertising.

- Losing focus? The acquisition of The Athletic makes sense. But the addition of Wordle only has a loose connection to the Times’ long-standing history of crossword puzzles. It has become apparent that The New York Times is primarily interested in purchasing companies to keep up digital subscriber growth numbers at any cost, even when large purchases like The Athletic are dilutive to the bottom line. In my view, management is spreading itself too thin in trying to form a conglomerate of different news brands and games.

- Will people continue to pay for the news? The internet and a variety of applications are now serving up news for free. Social media applications like Twitter and Instagram now somewhat function as a news-absorption channel for many younger users. Looking ahead to the future, the concept of paying for news may cease to become mainstream.

- Inflation is a real profit killer for The Times. Unfortunately, we are already in an age where lots of news is available for free (or consumed in other ways, such as via social media) – so the thought of raising prices is unthinkable. In fact, The Times’ chief tactic for attracting new subscribers is via lowball introductory offers, such as $1/week for four weeks. At the same time, inflationary wage pressure means that The Times is having to shell out a lot more to keep its newsroom staff afloat. This exploding cost burden, plus the losses at recently acquired companies, is eroding The Times’ profit margins. Avoid this stock: I think the upcoming earnings cycle in August will give the stock a long-overdue walloping.

The Times’ latest quarterly results, which we’ll discuss in the next section, don’t do much to instill confidence in the company’s trajectory. Overall, my recommendation on the stock is to steer clear – in fact, the stock’s double-digit gains since the start of the year may open up opportunities to take a few mild short positions, such as buying puts (I personally think the overall market will fall a few percentage points by year-end as well, once enthusiasm over falling inflation and the potential of slowing Fed hikes fades).

Q1 paints a picture of declining ARPU and slowing growth

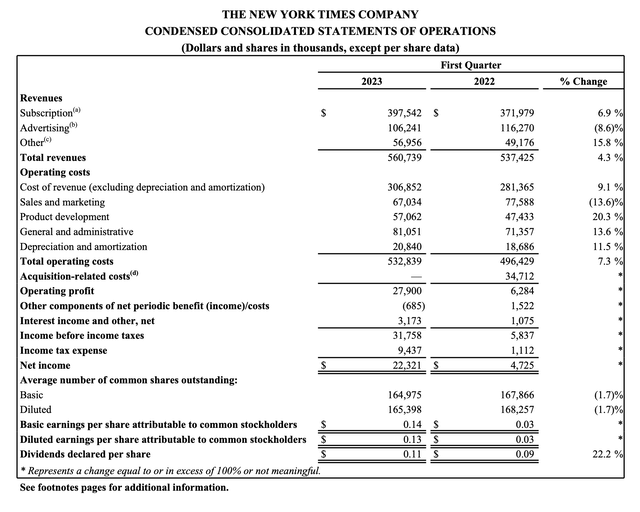

Let’s now discuss the New York Times’ latest quarterly results in greater detail. The Q1 earnings summary is shown below:

New York Times Q1 results (New York Times Q1 earnings release)

Revenue grew only 4% y/y to $560.7 million, missing Wall Street’s expectations of $569.1 million (+6% y/y) by a two-point margin. A 7% y/y growth rate in subscription revenue was offset by a -9% y/y decline in advertising revenue. And note that it’s not just print revenue that’s in decline, but digital advertising revenue also fell -9% y/y in the quarter to $61.3 million (slightly over half of total advertising revenue), driven by the tougher macro climate that has sapped advertiser demand. Also, useful to note: The Athletic, which has gotten a lot of recent focus after The Times made the decision to shutter its sports desk, drove $28 million of revenue in the first quarter, or 7% of the total subscription haul. This grew at more than a 2x y/y pace, but it’s difficult to assess The Athletic’s true organic contribution at this point because only two months of revenue contribution are recorded in the prior-year Q1, and The Times is now allocating subscription bundle revenue to The Athletic that colors the y/y compares.

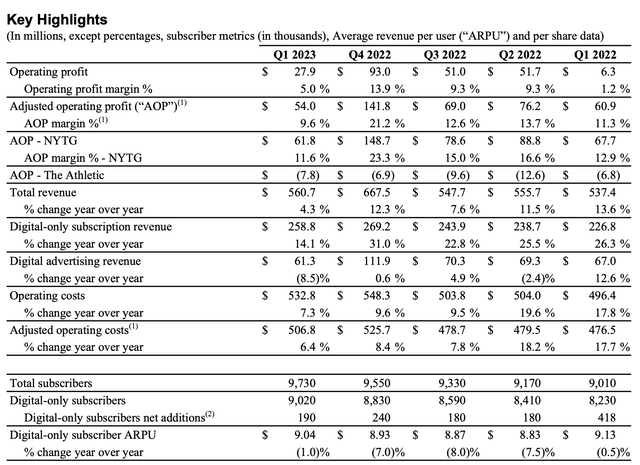

The schedule below, meanwhile, shows some key subscriber metrics:

New York Times key metrics (New York Times Q1 earnings release)

Digital-only subscription additions in the quarter were 190k, sharply lower than 418k in the prior Q1 (though that was boosted by the acquisition of The Athletic itself) and 240k sequentially versus Q4. One of the key worrying metrics for me: digital ARPU continues to fall at -1% y/y to $9.04,

The question here is: does The New York Times charge enough in aggregate, including its hefty promotions (which offer the full All Access subscription at $1/week for the first year, versus $6.25/week at the true rate), to support the “high quality journalism” that is part of its brand? Adjusted operating profits fell -11% y/y to $54.0 million in the first quarter, representing a 9.6% adjusted operating margin – 170bps worse than the year-ago quarter.

Management notes that the company is finding success in converting promotional customers to full-price subscribers. Per CEO Meredith Kopit-Levien’s remarks on the Q1 earnings call:

We also continued to have success in the quarter stepping up subscribers on promotion to interim and full prices at the one-year mark. And the high levels of engagement we see with early tenure bundled subscribers give us confidence that we’ll be able to continue stepping up subscribers to higher prices as their tenure increases. We also began rolling out price increases for tenured non-bundled news and games subscribers toward the end of the quarter, and we are pleased with the early results.

We expect this component of the playbook to increase digital ARPU in Q2 and beyond, while driving even more people to the bundle as its relative price becomes more attractive. The net result is that in Q1, we had our fully coordinated value-based pricing strategy in action aimed at maximizing the lifetime value of our growing subscriber base.”

In my view, however, especially in this tough macro environment with a more cautious consumer, a lot of people are going to notice prices going up from $1/week to $6.25/week, and we may see heightened churn going forward.

Key takeaways

The New York Times is facing fairly visible secular declines. The company’s subscription counts continue to be supported by lofty promotions, while declines in print and advertising (both print and digital ads) are eating into margins amid higher newsroom costs. Continue to avoid this stock.

Credit: Source link