PrathanChorruangsak

Cannabis stocks, led by the AdvisorShares Pure US Cannabis ETF (NYSEARCA:MSOS), soared on Wednesday upon news that the U.S. Department of Health and Human Services sent a recommendation to the US Drug Enforcement Administration to reschedule cannabis to a Schedule III drug. While there is no guarantee of eventual action, the ramifications of any action are quite significant, and cannabis stocks have been too cheap for far too long. Still, though, one could make the argument that cannabis stocks did not rise nearly far enough, given that valuations remain dirt cheap across the sector. In this report, I highlight some of my top picks in the sector that may benefit the most from potential reform.

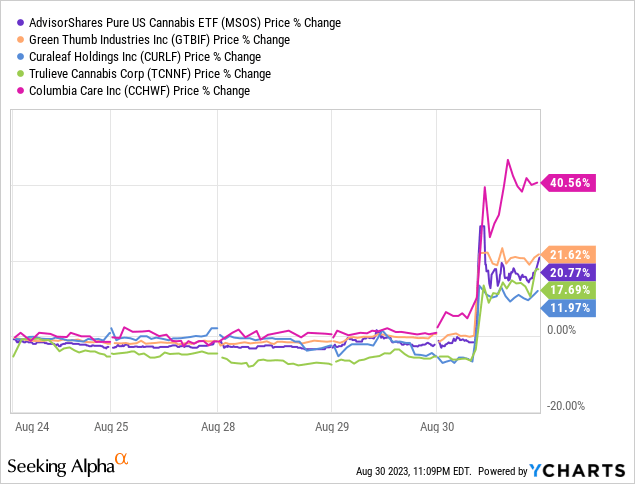

MSOS ETF Stock Price

Cannabis stocks, including names like the MSOS ETF and Green Thumb Industries (OTCQX:GTBIF), soared in the deep double digits on Wednesday. In the grand scheme of things, though, this rally barely made up for the brutal losses suffered over the past two years.

Cannabis investors may have grown wary about counting on reform – but this time it might be different.

Why Are Cannabis Stocks Up Today?

Back in October of last year, President Biden had called upon the U.S. Department of Justice and HHS to review how cannabis was scheduled under federal law. Cannabis is currently a Schedule I drug, giving it the same classification as heroin and a higher classification than cocaine. Wednesday’s news was a direct continuation of that process, as the HHS officially sent their letter of recommendation to reschedule cannabis to Schedule III. This is big news because the ball is now in the DEA’s court to potentially make any scheduling changes, as they are the organization owning the schedules in the first place.

Besides representing a significant milestone towards eventual federal decriminalization, the act of rescheduling cannabis to Schedule III may have a direct financial impact to their bottom lines. US cannabis operators have been subject to 280e taxes, in which they are unable to deduct operating expenses for corporate income tax purposes. For example, GTBIF generated $13.4 million in net income in the latest quarter, while paying $25.8 million in corporate income taxes from $39.5 million in taxable income. If 280e taxes were removed, then GTBIF might see net income rise to around $31 million, or $124 million annualized. The stock’s market cap recently came in at around 17x that number.

Take also for instance cannabis operator Verano (OTCQX:VRNOF). VRNOF lost $13 million in net income in the latest quarter, paying $27.7 million in income taxes on $14.6 million in taxable income. Removal of 280e taxes would cause net income to swing to positive $11.5 million. The stock would be trading at 25x that number. What’s more, these names would likely see an improvement in their cost of capital (starting with their equity), potentially enabling them to refinance expensive double-digit yielding debt at lower rates – further improving the bottom line. Yes, the stocks are already up double digits since the news came out, but there is arguably much more upside to be had if the DEA does decide to reschedule the plant.

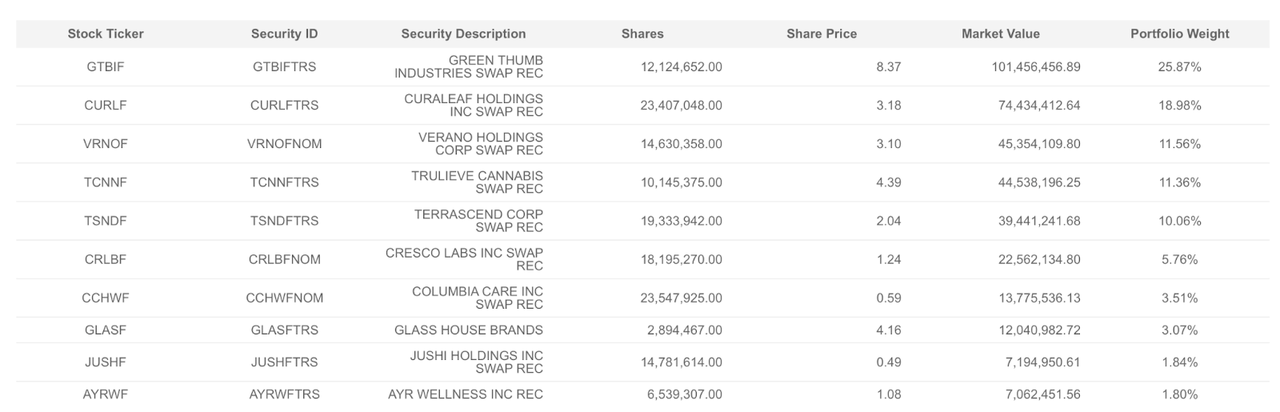

MSOS ETF Stock Holdings

The MSOS ETF offers a convenient way to invest in the sector. With a reasonable 0.75% expense ratio, MSOS trades on the major exchanges, whereas the multi-state operators typically trade over the counter (‘OTC’). MSOS is able to do this due to investing in “total return swaps” of the MSOs.

MSOS ETF

As can be seen above, MSOS offers diversified exposure to all the major multi-state operators (‘MSOs,’ hence its namesake), with significant concentration to the four largest operators. Those looking for easy exposure to MSOs may find this ETF quite attractive, as well as those looking to trade options (perhaps to hedge long equity positions).

Are Cannabis Stocks A Buy?

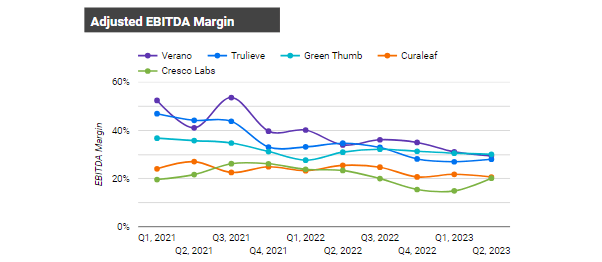

Some readers may be hesitant to buy given the large Wednesday rally. Others might be hesitant due to the poor price action over the last two years. The stocks of the MSOs have slid as price compression swept the sector.

Cannabis Growth Portfolio

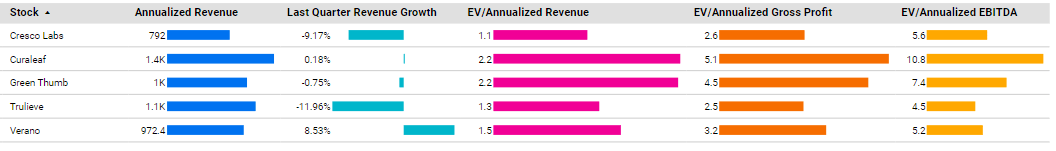

Nonetheless, their stocks are exceedingly cheap, with most of the top operators trading at between 5x and 7.4x adjusted EBITDA.

Cannabis Growth Portfolio

Among the MSOs, I find GTBIF to be the most attractive, as it is the only large MSO to still be generating positive GAAP net income. That is in large part due to the company holding far less leverage than its peers, as it has been more disciplined in its M&A activity.

Outside of the MSOs space, I also like NewLake Capital Partners (OTCQX:NLCP). After Wednesday’s rally, NLCP yielded just over 11%. NLCP is a net lease REIT with a focus on cannabis cultivation facilities, making it a “cannabis Realty Income” (O) of sorts. Due to not directly touching the plant, the company has been immune from 280e taxes and generates 87% free cash flow margins, comfortably covering the dividend. The company’s leases carry 2.7% annual lease escalators, on average, meaning that even while sale-leaseback transactions have come to a standstill, the company can still post solid organic growth. The removal of 280e taxes might not directly benefit NLCP’s financials, but it would eliminate the main bearish overhang by improving the credit quality of its tenants.

Conclusion

It is always shocking to see many stocks in an entire sector soar 15%, 20%, or even 30% in just a couple of hours. That just illustrates how impactful potential legislative reform could be for the US cannabis operators. Even after the run-up, stocks of the largest operators continue to trade at compelling valuations. There remains the risk that the DEA does not react positively to the recommendation from the HHS and that pricing compression continues to negatively impact the sector. But for investors looking for a catalyst-driven entry point into the cannabis sector, this appears to be an opportune moment, given that there may now be a positive headline loop until the DEA issues its decision. Among others, I rate GTBIF and NLCP as strong buys in the US cannabis sector.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Credit: Source link