adempercem

Happy May!

One of my favorite months, and I suppose you know why?

I’ll give you one hint…May 10th sunsigns.org horoscope reads:

“IF YOU ARE BORN ON MAY 10, you are a Taurus who wants to make a mark on the world. The final resume is essential to them in their image. You always want to know how the world perceives you.

The May 10th astrology analysis predicts that those born on this day require a quiet time to reflect and to make decisions. It is typically unusual for this Taurean to be alone. But it is hard to hear the inner workings of progress in a crowded room or a noisy environment.”

That’s right, May 10th is my birthday.

Just another day, yet they seem to come around faster than ever…

Especially these days, as I’m soon publishing my new book, REITs For Dummies, later this summer. I’ve been working diligently on the book, and I’m pleased to say that I’ve finished the manuscript before my deadline, May 10th.

This month I’ll be crazy busy, traveling to New York City and Chicago this week and South Florida next week. I’m tentatively scheduled to be in Las Vegas around May 21st for ReCon, ICSC’s annual retail conference.

As it turns out, I’ll be getting a few birthday presents in May, in the form of dividend checks. Hopefully you have some of the same monthly dividends as me. As I explain in my new book, there are a few good reasons to own monthly paying stocks:

- Automatically reinvesting dividends is a benefit of dollar cost averaging.

- They also allow more opportunities for compounding to work its magic.

- They minimize market risk – specifically, the risk of reinvesting at peak prices – and opportunities for second guessing.

- If you have to sell one, it’s an easier decision (you don’t need to wonder if you should wait a month or two for the next dividend to be paid).

I reinvest all of my monthly dividends, but for some retirees and others who count on the checks to pay bills and cover regular expenses, these monthly payments are a must.

So, with further ado, let me tell you about these monthly-paying REITs that I own…

Realty Income (O): Yielding 4.9%

I know, I promised not to write on O until earnings (May 3rd), but this is not a deep dive, just a listicle.

For the newbies, O is the largest Net Leas REIT (invests in free-standing properties) and is the only REIT in the peer group with an A rating. That’s relevant because O has an extremely defensive balance sheet that has allowed the company to navigate multiple recessions and a global pandemic.

Looking back in time, O has generated positive earnings (AFFO per share) in 26 out of 27 years (the only year the company generated negative earnings was in 2009). Of course, we know that any company that calls itself the “monthly dividend company” is serious about dividends – O has generated dividend growth for 28 years in a row.

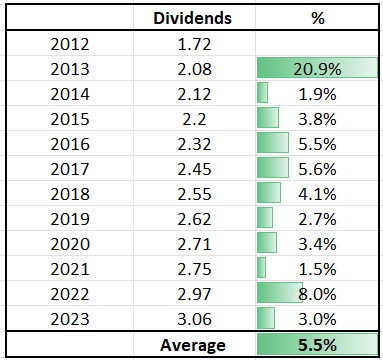

This means that O is also the only “Dividend Aristocrat” on the list of monthly payers and as a result O ranks high on our quality scoring model at iREIT with a score of 97 out of 100. O has grown its dividend by around 5.5% CAGR since 2012.

iREIT

In terms of value, O is worthy of capital allocation, shares are now trading at $62.84 with a P/AFFO of 15.9x. That’s cheap compared to the normal multiple of 18.4x and the pre-Covid multiple of 18.5x. Coming out of the Great Recession from 2010-2016, O traded at an average of 18.5x.

Remember that O is a much stronger REIT today than that period (2010-2016) when the company did not enjoy an A-rating and had a smaller portfolio of properties. O has become a dominant REIT – consider the fact that A-rated Prologis (PLD) now trades at 27.1x.

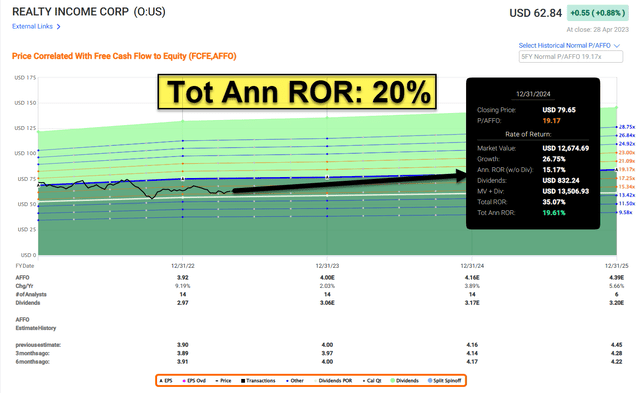

I’m a dividend dripper, so I’m excited to reinvest in O at these levels. Analysts are forecasting growth of 4% in 2024 and 6% in 2025. Factoring in the 4.9% dividend yield, 5% growth, and mispricing (potential price appreciation), we forecast 15% annually.

FAST Graphs

Agree Realty (ADC): Yielding 4.3%

While ADC doesn’t enjoy the same impressive dividend aristocrat status as O, the Michigan-based REIT has done an excellent job creating shareholder value over the years.

Similar to O, ADC is also a Net Lease REIT that invests in high-quality properties leased to investment grade tenants (68%). More recently the company has expanded its ground lease portfolio. The company now owns 206 ground leases representing 12.4% of total annualized base rents.

ADC also has an impressive balance sheet, rated BBB, with $1.5 billion of liquidity (at year-end), that included $557 million of forward equity, $900 million of revolver availability, and $29 million of cash on hand.

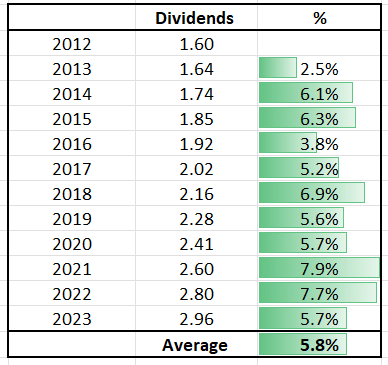

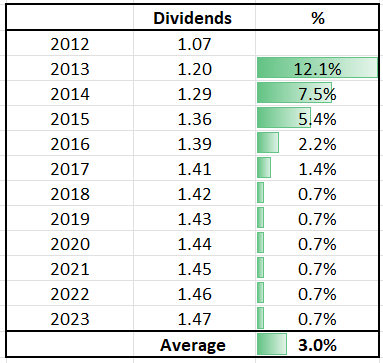

ADC is not as cheap as O, but we consider the shares attractive at these levels. Shares are trading at $67.99 with a P/AFFO multiple of 17.6x (in-line with normal levels). The Pre-Covid multiple was 15.4x. The dividend yield is 4.3% and we find the growth impressive at 5.8% (CAGR from 2012-2023).

iREIT

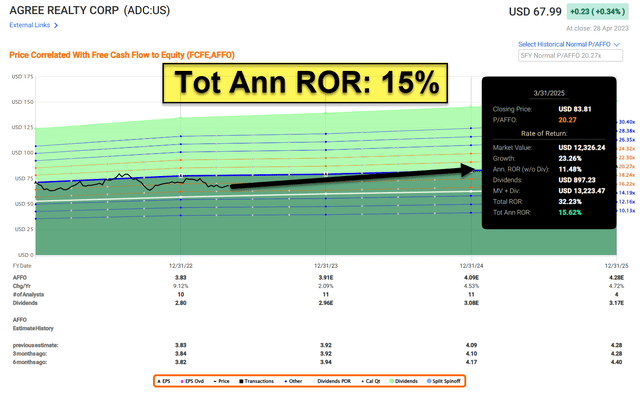

Analysts are forecasting (on average) 5% growth in 2025 and 2025, which translates into a similar forward-looking total request forecast as O, of around 13% annually. ADC reports earnings on May 4th.

Fast Graphs

LTC Properties (LTC): Yielding 6.8%

LTC is a healthcare REIT that focuses on seniors housing (50%) and skilled nursing (50%) properties. In Q1-23, the company disclosed that top tenant (15.7% of rents) Prestige will receive deferrals equating to ~13% of its monthly rents for a period. Also, Brookdale (8.7% of rents) assets will now be sold and transitioned after not renewing its lease.

LTC agreed to defer $1.5M ($300K/mos) in interest due by Prestige from May-Sept and also agreed to defer $467K of April and May rents to an operator who’d previously received assistance with a plan to transition the 8-asset portfolio.

As of Q1-23, LTC has $5.5 million of cash on hand, approximately $136 million available on the line of credit with approximately $264 million outstanding and approximately $129 million available under the ATM. LTC has no significant long-term debt maturities over the next 5 years.

The company has always maintained a conservative balance sheet: debt to annualized adjusted EBITDA was 5.8x and the annualized adjusted fixed charge coverage ratio was 3.6x.

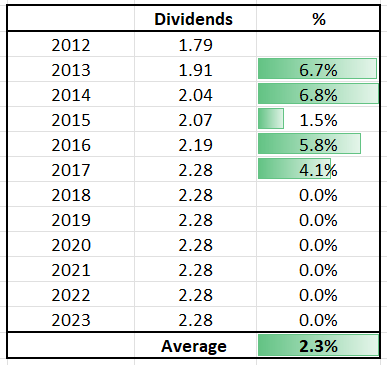

FAD payout ratio in Q1-23 (excluding nonrecurring items) increased to 82% due to not having the benefit of the non-run rate items and the company’s long-term historical goal remains at 80%. As seen below, LTC did not cut the dividend throughout the pandemic, although the company has not grown its dividend since 2017:

iREIT

LTC shares are trading at $33.45 with a P/AFFO multiple of 12.3x. The normal multiple is 15.2x and the pre-Covid average is 15.6x. The dividend yield is 6.8% and analysts forecast growth of 5% in 2023 and 3% in 2024.

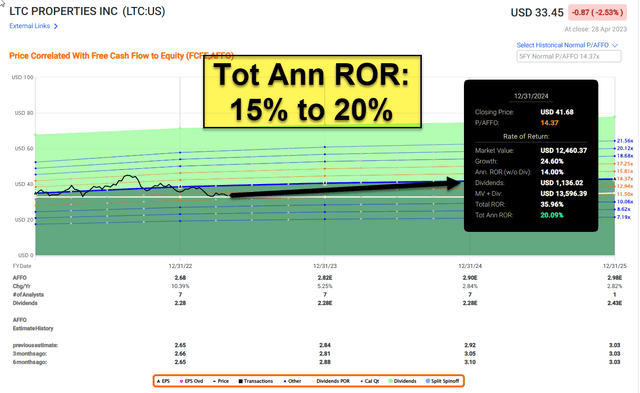

Given the substantial challenges within the skilled sector over the last 3 years, we’re much more cautious, given the fact that the sector should not see a fast recovery. iREIT’s quality score for LTC is 75 and we’ve modeled annual returns at 15% to 20% as show below:

FAST Graphs

Phillips Edison (PECO): Yielding 3.6%

PECO is a shopping center REIT that owns 271 properties in 31 states. Around 71% of PECO’s ABR is from necessity-based goods and services retailers and 97% of rents come from Grocery-Anchored centers (U.S. consumers visit grocery stores 1.6 times per week).

PECO is new to the publicly traded sector as the company listed shares in July 2021, previously the company was a non-traded REIT. The balance sheet is in good shape, with low leverage including net debt to adjusted EBITDAR of 5.3x and a weighted average interest rate of 3.6% and a weighted average maturity of 4.4 years.

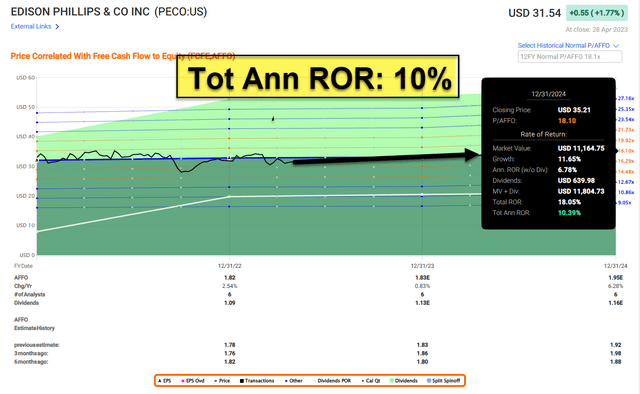

While PECO has a short history of dividend growth (4% YoY) we expect the company to continue growing its dividend thanks to its low payout ratio (61% based on AFFO per share). Analysts are forecasting AFFO to grow by 1% in 2023 and 6% in 2024.

PECO trades at $31.54 per share with a P/AFFO multiple of 17.3x which compares to 16x for the broader Shopping Center sector. As noted earlier, the dividend yield is 3.6% and iREIT forecasts shares to return 10% over the next 12 months.

FAST Graphs

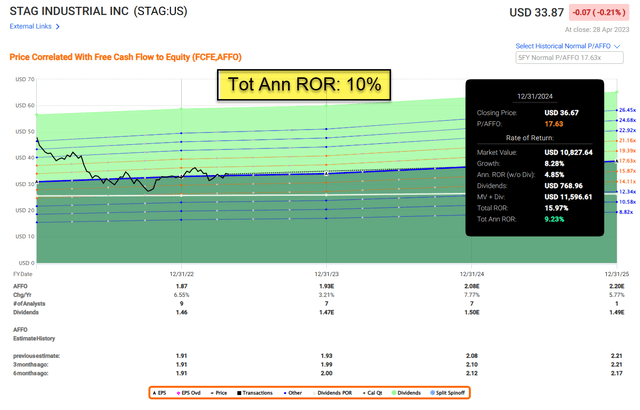

STAG Industrial (STAG): Yielding 4.3%

STAG is an Industrial REIT that 562 properties in 41 states. The company had a respectable quarter (Q1-23) and said that its “current 2023 leasing results have surpassed initial expectations.” The CEO, William Crocker, said,

“As of this week, we have leased 10 million square feet or 78% of the new and renewal leasing we expect to commence in 2023, achieving cash leasing spreads of 30.6%. The progress in lease volume addresses in line with historical cadence at this time in previous years.”

STAG is building a new 715,000 square foot facility around ten minutes away from my home and development is proceeding on schedule with expected delivery in early July. STAG has funded $54 million of the $68 million project and has seen strong leasing interest from tenants in the market.

I can attest to the strength of the market (Greenville-Spartanburg) and investments like this one is a reason I’m a large shareholder in STAG.

STAG also increased same-store guidance for 2023 to be between 4.75% and 5.25%, an increase to the midpoint of 25 basis points. This increase is driven by accelerating leasing spreads and a modest reduction in expected credit loss. The core FFO per share guidance has increased to a range of $2.23 to $2.27 per share, an increase of midpoint of $.01 penny.

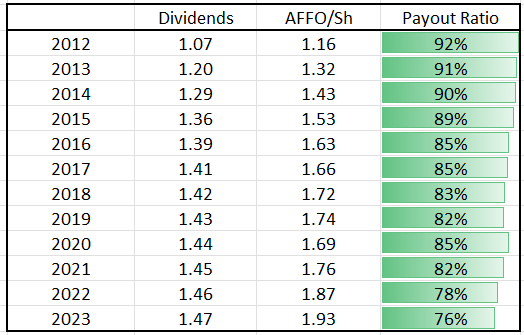

As seen below, STAG has grown its dividend by an average of 3% per year:

iREIT

While that’s modest growth compared to peers like Prologis Inc. (PLD) and Terreno Realty (TRNO), I admire STAG for its ability to reduce its payout ratio, which suggests the dividend is safer and the management team is disciplined.

iREIT

I’ve owned it for a number of years (August 2015) and shares have returned an impressive 15% annually since that time. At $33.87, I find shares a tad rich today, with a P/AFFO multiple of 17.9x versus the normal multiple of 16.4x. Prior to Covid, shares traded at around 15.7x.

STAG deserves a premium valuation, given the impressive efforts to maintain a disciplined capital structure while achieving scale. I’m happy to own shares and DRIP the divvies. iREIT models 10%+ annual returns at the current price point (4.3% yield + 7% growth).

FAST Graphs

What’s Next…

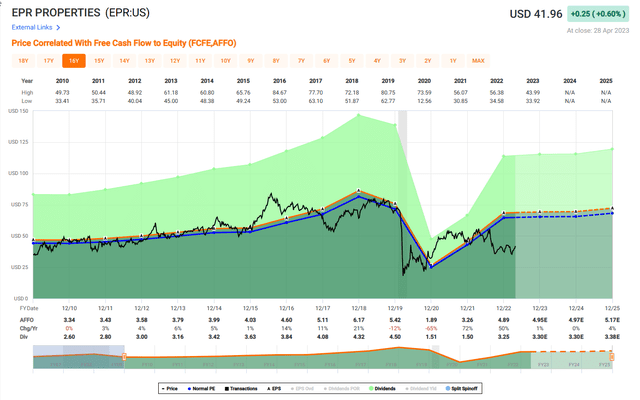

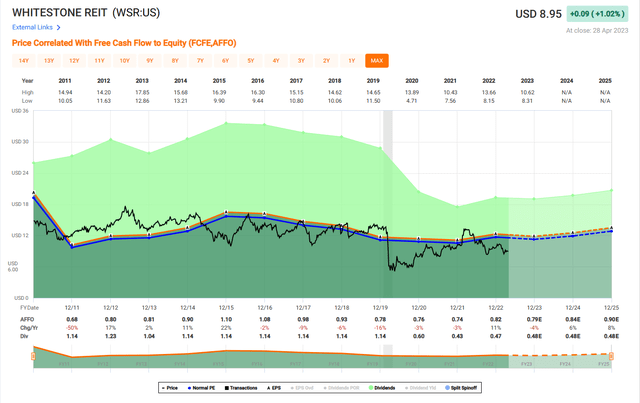

I’ve decided to add EPR Properties (EPR) and Whitestone REIT (WSR) to my research list. Both are monthly-paying REITs and our subscribers have requested a deep dive on both.

EPR had a strong Q1-23 with FFO as adjusted of $1.26 per share versus $1.10 in the prior year, up 15%, and AFFO of $1.30 per share compared to $1.16 in the prior year, up 12%. EPR’s common dividend is well covered with an AFFO payout ratio of 63%.

Of course, there are well-known risks related to EPR’s business model in which theaters are struggling and EPR’s cost of capital is a concern. Also, as cap rates continue to climb, other net lease peers like VICI Properties (VICI) and Realty Income are competing in the same sandbox.

FAST Graphs

WSR is set to release earnings on May 2nd, but I’ll warn you now, I have not been impressed with the company’s dividend history: CAGR is -6.4% from 2012 to 2023. We’ll be watching this one closely.

FAST Graphs

I’ll be attending the Nareit conference (REITWeek) in a few weeks and I look forward to meeting the management teams for these REITs as well as others. I’ll highlight a few REITs that I would like to see paying monthly dividends:

- Alpine Income (PINE)

- Arbor Realty (ABR)

- Chicago Atlantic (REFI)

- CTO Realty (CTO)

- Essential Properties (EPRT)

- Global Medical (GMRE)

- Innovative Industrial (IIPR)

- Iron Mountain (IRM)

- Ladder Capital (LADR)

- Medical Properties (MPW)

- NETSREIT (NTST)

- NewLake Capital (OTCQX:NLCP)

- Postal Realty (PSTL)

- Sachem Capital (SACH)

- Spirit Realty (SRC)

- VICI Properties (VICI)

- W. P. Carey (WPC)

Thanks for reading and have a great May!

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Credit: Source link