Scharfsinn86

Investment Thesis

Mobileye Global Inc. (NASDAQ:MBLY) Q3 results saw much of the same: slowing growth rates and unimpressive free cash flows. However, there are some good aspects to this story, too, such as MBLY commanding significantly more market share than practically any other peer. At close to a third of the total global market share, this company clearly has significant staying power.

However, I find its valuation of 55x forward free cash flows as leaving too little upside for new investors.

In sum, I reaffirm that Mobileye Global Inc. stock isn’t worthwhile chasing higher.

Rapid Recap

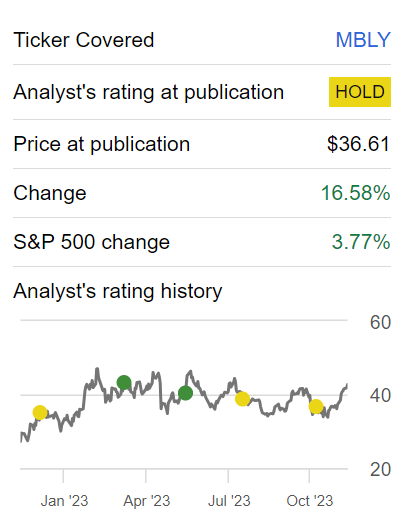

In my previous analysis, back in October, before Mobileye reported its Q3 results, I said:

Mobileye is set to report its Q3 results on next Thursday, 26 October before the market opens. I declare that unless Mobileye finds some way of meaningfully increasing its growth rates, investors will not be overly keen to chase this stock.

And as a consequence, having to pay more than 40x this year’s operating earnings, will leave this stock too stretched and unattractive for new investors.

Author’s work on MBLY

Since that time, its valuation has become even more stretched. And even though I recognize that investors have recently turned ”risk-seeking,” this strong bullish sentiment won’t last. And that investors will return to find this opportunity too richly priced for what it offers investors.

Mobileye’s Near-Term Prospects

In the first instance, I’ll describe Mobileye’s near-term bullish narrative.

Mobileye, a leading player in advanced driver-assistance systems (”ADAS”) and autonomous vehicle technology, is positioned for solid growth.

The company’s recent partnerships and design wins underscore its expanding footprint in the automotive industry. Mobileye’s collaboration with FAW, a major Chinese automaker, exemplifies its traction in the market. With FAW, Mobileye is set to deploy its next-generation domain controller, IQ 6, across more than six FAW brands, commencing in late 2024. This strategic move extends beyond mere software provision, as Mobileye will also supply sensors, including one of its cutting-edge imaging radars, showcasing the company’s holistic approach to vehicle autonomy.

Moreover, Mobileye’s penetration into an impressive list of ten original equipment manufacturers (”OEMs”) solidifies its market presence, these partnerships represent 34% of the auto market share.

Mobileye’s technology agnosticism, catering to both EVs and internal combustion engine vehicles, positions it as a versatile player in the evolving automotive landscape. As legacy OEMs recalibrate their investment strategies, Mobileye is witnessing increased engagement.

Rather than slowing electric vehicle (“EV”) adoption hindering supervision adoption, Mobileye anticipates a reverse trend. Legacy OEMs’ investments are redirected toward Mobileye’s offerings, leveraging the company’s strengths in time-to-market performance and over-the-air updates.

Given this backdrop, I’ll now turn to discuss MBLY’s financials and outlook.

Revenue Growth Rates Should Improve in 2024, But How Much?

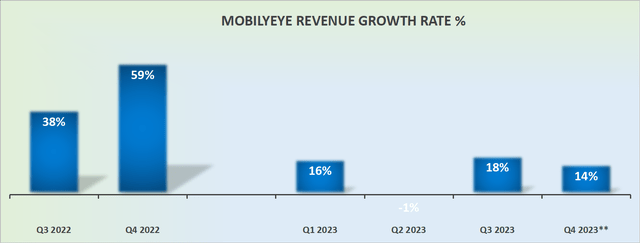

MBLY revenue growth rates

MBLY’s revenues will exit 2023 and start 2024 with much easier comparables. This will allow the company to put forth a new narrative and turn a new chapter.

Indeed, it won’t be difficult for MBLY to report higher than 20% CAGR in H1 2024 and for the company to proactively describe to investors how it is ”reaccelerating” its growth rates.

However, this doesn’t take away from the fact that there’s plenty of competition in this space, also vying for market share.

Case in point, MBLY’s growth plans, especially in the highly competitive Chinese market, introduce challenges. The competitive landscape in China is marked by the presence of both established domestic players and international companies vying for a share in the rapidly evolving autonomous driving sector. Mobileye’s ability to navigate this competitive space and secure a strong foothold amidst local competition will be crucial for its success in the near term.

There’s also the potential for EVs to incorporate other features beyond camera-based systems, such as more sensors and higher computing capabilities.

Naturally, this could impact MBLY’s opportunity to meaningfully grow its revenue growth rates in 2024.

Next, we’ll discuss its valuation.

MBLY Stock Valuation — Not That Cheap For What It Offers

There was a time when all it took for investors to get excited about a company was a good narrative of taking significant market share. But now, in the higher interest rate environment, investors are more sensitive to a company’s underlying profitability and free cash flow potential.

MBLY will probably make approximately $350 million of free cash flow in 2023. However, we know that the bulk of its free cash flow was taken up by a dramatic increase in building inventory throughout 2023.

What’s more, management declares that this inventory build will decrease in the coming quarters, which means that in all likelihood in 2024, there’s the potential for MBLY’s free cash flow to more closely approximate its adjusted operating income line.

Put another way, in 2024, I estimate that MBLY’s free cash flow could reach about $600 million. This would leave MBLY priced at approximately 55x forward free cash flow, a figure that is high and doesn’t leave new investors with enough upside potential.

That being said, on a positive note, MBLY has a rock-solid balance sheet, with virtually no debt, and close to $1.2 billion in cash. This war chest leaves MBLY with ample flexibility and optionality of how it will invest in its growth prospects in 2024 and beyond.

The Bottom Line

Mobileye’s near-term outlook reflects a combination of strengths and challenges.

On the positive side, the company boasts a substantial market share, securing partnerships and design wins. Its technology agnosticism, catering to both EVs and internal combustion engine vehicles, positions it as a versatile player.

However, challenges arise in the competitive landscape, especially in China, where established players and international competitors vie for market share. The potential for other features in EVs, coupled with a forward free cash flow multiple of approximately 55x in 2024, raises concerns about valuation, potentially limiting upside for new investors.

While Mobileye’s balance sheet is robust with no significant debt and ample cash reserves, the company must navigate a competitive space and justify its valuation for new investors considering entry.

Credit: Source link