paitoonpati

It’s here! After years of handwringing and excuses, the SEC has finally approved the listing of exchange traded funds (“ETF”) that hold bitcoin, instead of bitcoin derivatives like the ProShares Bitcoin Strategy ETF (BITO) that hold bitcoin futures.

More than a year ago, I wrote a cautious article on MicroStrategy (NASDAQ:MSTR), noting even if one was bullish on bitcoin, there were better alternatives. Using a sum-of-the-parts analysis, I estimated MSTR was overvalued by 60%, while alternatives like BITO and the Grayscale Bitcoin Trust (GBTC) traded at NAV and a steep discount to NAV.

However, some pushback I got from readers was that as European investors, they cannot access GBTC as it trades in the OTC markets. They felt that MSTR, being available on an equity exchange, essentially acts like a bitcoin ETF.

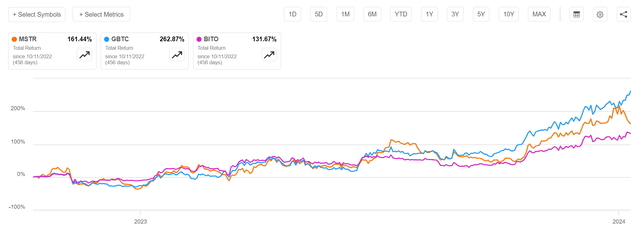

Since my article, MSTR has massively underperformed GBTC, returning 161% compared to 263% (Figure 1). However, it has outperformed BITO.

Figure 1 – MSTR vs. GBTC and BITO (Seeking Alpha)

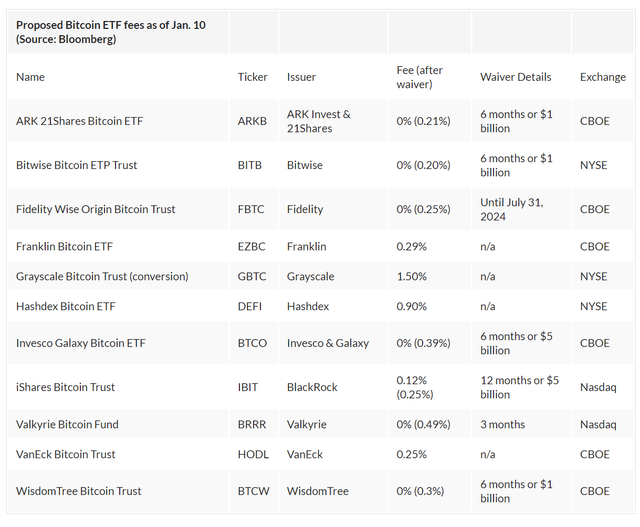

Today, with the stroke of a pen, the SEC has added 10 alternatives to MSTR (note, the 11th, GBTC, is being converted into an ETF), from leading issuers like Fidelity, BlackRock, and Invesco (Figure 2).

Figure 2 – Approved bitcoin ETFs (investing.com)

For investors, I believe there is simply no excuse to own MSTR for its bitcoin holdings. I reiterate my relative sell recommendation on MSTR.

Brief Company Overview

First, for those who aren’t familiar with the company and its Chairman, Michael Saylor, MicroStrategy is a business intelligence software company that hitched its future to bitcoin in 2020 by converting most of its cash reserves into ~21k bitcoins at ~$11,600 / bitcoin. After exhausting its cash reserves, MSTR continued to acquire more bitcoins by issuing debt and shares.

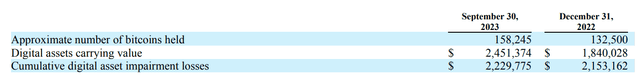

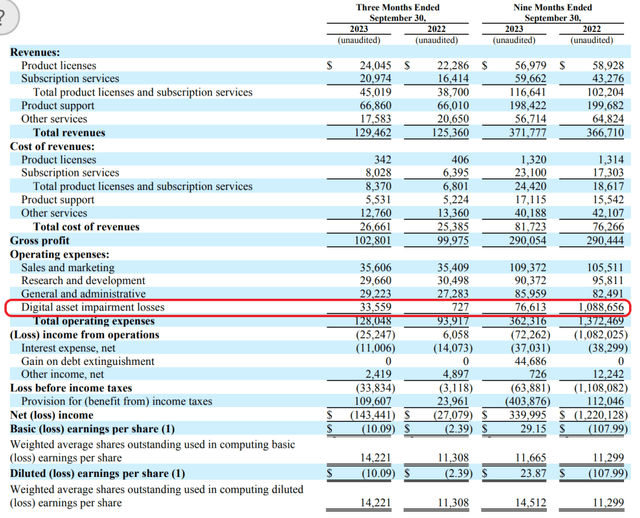

Altogether, as of September 30, 2023, MSTR held 158,245 bitcoins at a cost of $4.69 billion (Figure 3).

Figure 3 – MSTR bitcoin holdings (MSTR Q3/2023 10Q report)

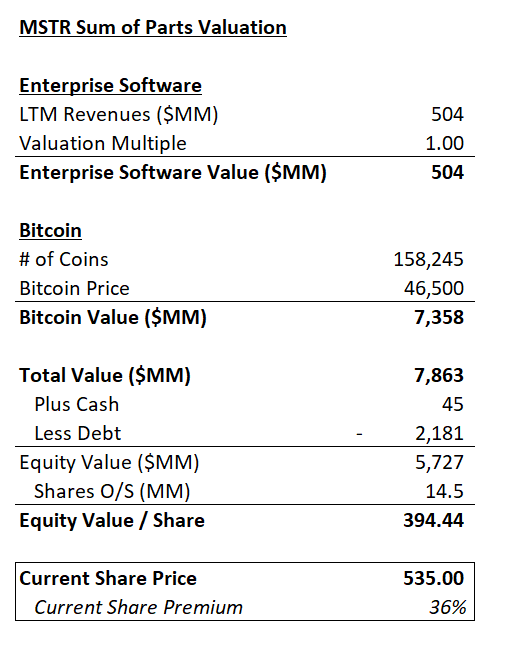

Overvalued Using Sum Of Parts

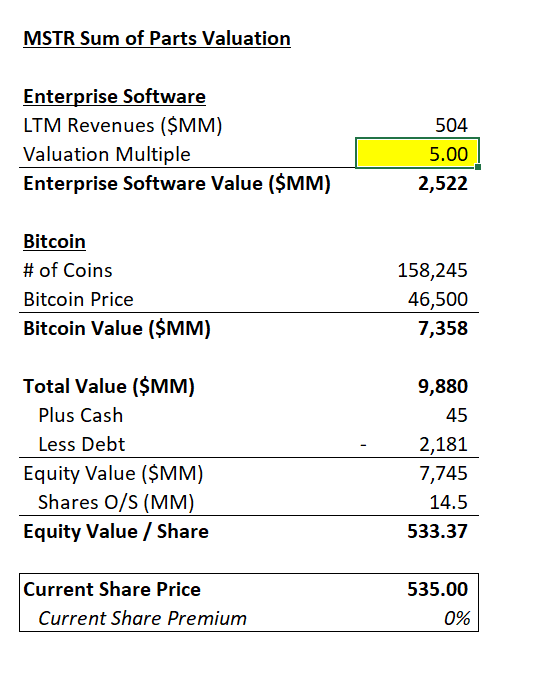

Updating my sum-of-parts model on MSTR using September 30, 2023 financials and today’s bitcoin price of ~$46,500, I believe MSTR’s shares remain overvalued by ~36% (Figure 4).

Figure 4 – Sum of the parts model on MSTR (Author created)

Core Business Is The Wildcard

Of course, part of my valuation model is dependent on the value assigned to the core software business. I have generously assigned a 1x Price-to-Sales multiple to value the business, although I believe this may still be aggressive. For example, if we look at MSTR’s YTD financials to September 30, 2023, the core business is essentially breakeven (operating income of $4.2 million on $371.8 million in revenues) (Figure 5).

Figure 5 – MSTR financials (MSTR Q3/2023 10Q report)

With low single digit (“LSD”) revenue growth and barely breakeven operationally, is this software business even worth the $500 million I have assigned in my model?

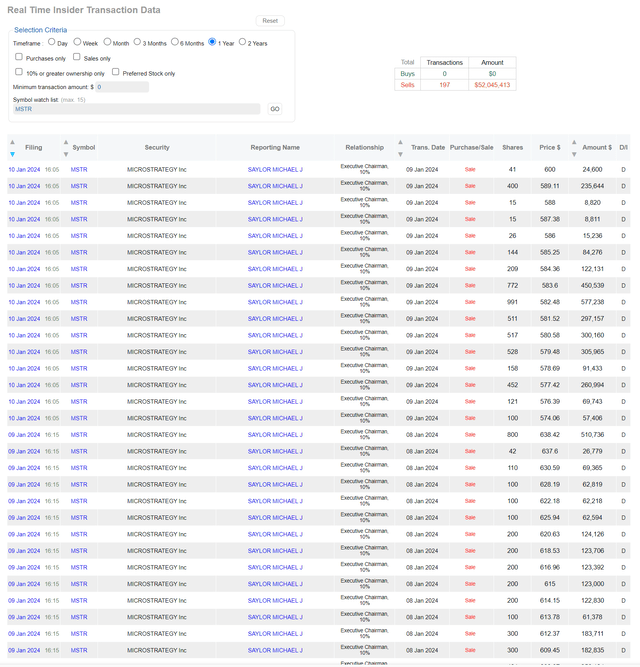

Chairman Is Selling Shares, So Should You

Perhaps Mr. Saylor agrees with my assessment of his company’s valuation, as he has been selling shares aggressively in the last few weeks, coinciding with the impending bitcoin ETF announcements (Figure 6).

Figure 6 – Mr. Saylor has been dumping shares (dataroma.com)

Risk To My Cautious Call

The major risk to my cautious call is obviously the value I have assigned to MicroStrategy’s core software business. For example, if investors assign a 10x P/S multiple to the business, then MSTR shares may even look undervalued. To justify MSTR’s current valuation, investors will have to value the core business at 5x P/S or $2.5 billion (Figure 7). Caveat Emptor!

Figure 7 – MSTR is implying a 5x P/S on core software business (Author created)

Conclusion

I am reiterating my relative sell on MicroStrategy. With the approval of bitcoin ETFs, there is simply no reason investors should hold MSTR for its bitcoin holdings. I believe its premium to underlying asset value will collapse in the coming days.

Credit: Source link