Galeanu Mihai

Article Thesis

Meta Platforms, Inc. (NASDAQ:META) has reported its most recent quarterly earnings results on Wednesday afternoon. The company destroyed estimates on both lines, showcasing excellent growth and tight cost controls. While the valuation is not as low as it once was, I am a very happy holder of Meta stock, which has delivered excellent results for the third quarter.

What Happened?

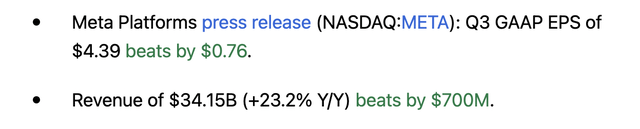

Social media giant Meta Platforms announced its most recent quarterly earnings results, for its fiscal third quarter, on Wednesday after the market had closed. The company’s headline numbers for the period can be seen in the following screenshot:

Seeking Alpha

We see that Meta Platforms was able to generate revenue growth of 23%, which was a lot better than expected. Looking at the bottom line number, we see an earnings per share result of almost $4.40, which beat estimates very easily — profits were around 20% higher than what was expected, which is an excellent result, I believe.

The market reacted very positively to these results in early after-hours trading, sending shares higher by 4% at the time of writing. It is possible that this changes over time, as trading outside of regular market hours can be very volatile. We saw this yesterday as well when Alphabet (GOOG, GOOGL) reported its quarterly earnings results.

Meta: The Recovery Continues

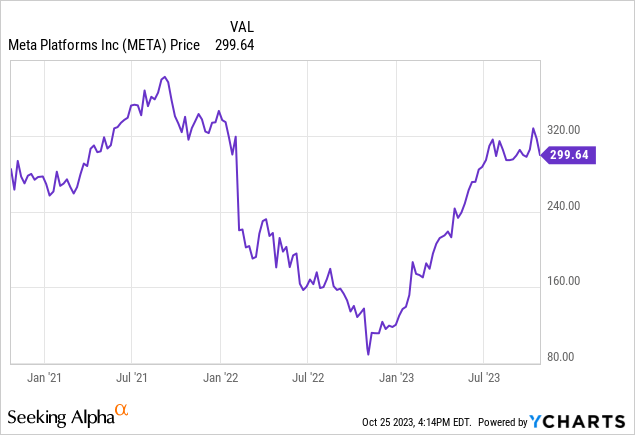

Over the last couple of years, Meta has been a very volatile stock, as we can easily see in the following graph:

This was driven by worries about a decline in Meta’s business growth rate, while margin declines, partially due to heavy Metaverse investments, played a role as well.

However, management has learned its lesson and has started to focus more on profitability following the steep share price plunge in 2022. Cost-cutting efforts began, which included massive layoffs to reduce the headcount that had been too high due to a hiring spree during the pandemic. As these cost-cutting measures increasingly took hold, Meta began to recover.

During the third quarter of 2023, we saw more of the same, which is why Meta was able to grow its profits quite a lot compared to one year earlier: On a year-over-year basis, Meta Platforms’ earnings per share soared by around 170%, which was possible thanks to a combination of two factors: First, profits in Q3 of 2022 had been pretty low, as this was the nadir, which made for an easy comparison. Second, Meta’s results during the most recent quarter were excellent in absolute terms, which can be seen by the fact that earnings per share were never this high before — which could be a pretty big surprise for those that had been ultra bearish Meta one year ago.

Let’s delve into the numbers. The first contributor to Meta’s much higher-than-expected profits was the hefty revenue growth rate of more than 20%. Not only is this pretty strong compared to the company’s growth in recent quarters, but it also is an excellent achievement considering the large size of Meta: In general, growing at a high relative rate is pretty hard for large companies, and yet, META managed to see its revenues soar.

Revenue growth depends on several contributing factors, the first one of these is user count growth. Family daily active people jumped 7% compared to one year earlier, which is, I believe, pretty impressive, considering the very large size of Meta. The company now has more than 3 billion daily active users, and yet, the company manages to add users at a sizeable pace. It is possible that Meta benefitted from one-time tailwinds, as 2022 was a year where people were more eager to go out following the pandemic, which might have caused below-average signups to social media. If that is true, then 2023 was a year of relatively easy comparables. But no matter what, it is pretty clear that Meta is and remains the king of social media, with a massive and steadily growing user count.

Meta generates higher revenues per user in some quarters and lower revenues per user in others. Seasonality plays a role here, due to the holiday effect in the fourth quarter, but factors such as the strength of the economy play a role as well. Last year, many investors, consumers, and businesses were worried about a potential recession. That explains why some companies cut their marketing and advertising budgets, which was a headwind for companies such as Meta. But it turns out that recession predictions were premature, as the economy remains in solid shape for now — with no recession materializing, companies have begun to be more aggressive with marketing and advertising once again, which naturally is very positive for platforms such as the ones owned by Meta, while peers such as Alphabet benefit as well.

During the third quarter, ad impressions soared by more than 30% compared to one year earlier, which is a great sign and shows that the combination of high user growth and higher advertising demand is very beneficial for Meta. While there is no guarantee that this trend remains in place, momentum is on Meta’s side, and with the advertising-heavy holiday season upon us, it would not be surprising to see Meta do even better during the fourth quarter — I believe there is a good likelihood that the current quarter will turn out to be a new record quarter for the company.

Higher revenue generation was an important profit driver for Meta in Q3, but tight cost controls were very important as well. Meta Platforms’ costs and expenses totaled $20.4 billion during the quarter — while that undoubtedly is a large sum in absolute terms, it actually was 7% less than what Meta spent one year earlier. Being able to grow revenues by more than 20% while lowering costs by close to 10% is a great feat, and shows that Meta’s management is doing a good job in positioning the company for improved profitability. When we consider that inflation remains high, the 7% cost reduction is even more impressive. That was made possible via a combination of reducing the headcount, using office buildings more efficiently, and reducing unnecessary spending on non-core products that do not generate a lot of value for the company.

I hope management sticks with this strategy going forward, as this is highly beneficial for shareholders due to the high profits and cash flows that can be generated when Meta is focused on creating shareholder value — which arguably had not been the case one year ago when overspending and over-hiring resulted in a profit slump.

There are many other things to like on top of the strong business growth rate and the tight cost controls, such as the balance sheet strength: Meta ended the third quarter with a cash position of $61 billion, or around 8% of the company’s market capitalization, which is a pretty strong number. Add hefty free cash generation of $14 billion during the third quarter alone (more than $50 billion annualized), and Meta is well-positioned to spend cash for shareholder returns while opportunistic acquisitions are an option as well. Buybacks totaled $4 billion during the third quarter, which is well below what would have been possible thanks to Meta’s strong free cash flows, but I can understand that buying back shares following the steep run-up in META’s share price is not as attractive as buying back shares when they were much cheaper earlier this year.

It will be interesting to see what Meta will do with its rising cash hoard going forward — amping up buybacks is possible, but management may shy away from that due to the steep share price increase in 2023.

Is Meta Stock A Buy?

Meta has a strong market position, being the dominant social media company around the world. Meta has compelling fundamentals with nice margins and returns on capital and a very strong balance sheet. During the third quarter, Meta destroyed estimates, showing strong revenue growth and even better profit growth. Does that mean Meta is a buy today? I doubt that investors who buy here will do badly, but following a run-up of several hundred percentage points, Meta Platforms, Inc. also is not as much of a value play as it was earlier this year.

I thus am a very happy shareholder following these results, but with META jumping to an even higher share price following the release of these results, I will likely not add to my position in the very near term. Waiting for a better buying opportunity for this very strong company could pay off — depending on what the broad market will do over the coming months, we may get one.

Credit: Source link