Hero Images/iStock via Getty Images

During times of economic uncertainty, you might think that a company that produces and sells boats might not be the best place to park your money. After all, boats are high-priced items focused largely on upper middle class and upper-class individuals. Their high cost and reliance on interest-based financing is not exactly in line with being financially disciplined and contending with a high interest rate environment. In general, however, I feel as though the market has been pushed lower than what it should have been. This is a simple market overreaction. But when it comes to the individual players in the space, perhaps no firm has been punished more harshly than MasterCraft Boat Holdings (NASDAQ:MCFT). To be clear, when I say ‘punished’, I don’t mean that the company’s stock price has been pushed down unreasonably. Rather, what I mean is that shares have been prevented from realizing their full upside potential. Fortunately for investors, management is going to be announcing financial results covering the third quarter of the company’s 2023 fiscal year in the coming days. Assuming that nothing goes terribly wrong, the stock could be due for a bit of additional upside.

Recent performance has been strong

Back in September of last year, I found myself asking whether or not MasterCraft Boat Holdings still made for an attractive prospect for long term, value-oriented investors. Despite robust fundamental performance, shares had experienced downside because of growing market pessimism. But because of how cheap the stock was, I remained confident enough to keep the company rated a ‘buy’. Since then, things have gone quite well. While the S&P 500 is up 5.7%, shares of MasterCraft Boat Holdings have seen upside of 36.7%.

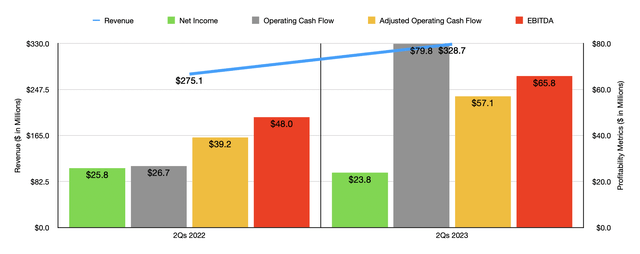

Author – SEC EDGAR Data

At long last, the market seems to finally understand that the company has been trading on the cheap. Of course, some of this upside has also been driven by continued robust performance achieved by management. Consider how the company performed during the first half of its 2023 fiscal year. Revenue for that time came in at $328.7 million. That’s 19.5% higher than the $275.1 million reported one year earlier. Part of this upside was driven by a 4.1% increase in total sales volume. The total number of boats sold grew from 3,117 in the first half of 2022 to 3,245 the same time of the 2023 fiscal year. The greatest growth on a percentage basis came from the Aviara brand. This increased 57.1% year over year. But that resulting in only 66 boats shipped in the first half of this year. The bulk of the increase, then, came from the 15.4% rise associated with the Crest brand name that the company owns. In addition to this, consolidated net sales per unit also increased year over year, climbing 14.8%. This took the weighted average price from $88,000 per unit to $101,000 per unit.

On the bottom line, the picture is mixed but mostly positive. It is true that net profits declined from $25.8 million to $23.8 million. But this drop was only driven by a significant loss associated with discontinued operations. Net income from continuing operations actually expanded from $30.1 million to $44.6 million. Other profitability metrics also came in strong. Operating cash flow, for instance, nearly tripled from $26.7 million to $79.8 million. If we adjust for changes in working capital, we would get a rise from $39.2 million to $57.1 million. And finally, EBITDA during this period rose from $48 million to $65.8 million.

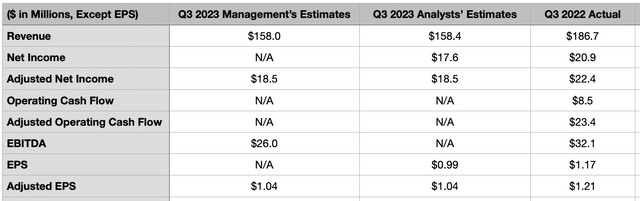

It will be interesting to see what transpires when the company reports financial results. These are expected to come out on May 10th. At present, analysts are forecasting revenue of $158.4 million. This is only marginally higher than the $158 million that management has forecasted. For context, in the third quarter of 2022, the company reported revenue of $186.7 million. Although I fully expect pricing to be higher year over year, the company would likely suffer from a decline in unit volume. During the second quarter of the year, for instance, the company experienced some weakness on this front. But probably the largest driver of this downside will be the sale that the company performed of its NauticStar brand. To put this in perspective, in the third quarter of 2022, this part of the company generated revenue of $17.4 million.

Author – SEC EDGAR Data

On the bottom line, analysts are forecasting profits per share of $0.99. This would represent a decline from the $1.17 per share reported one year earlier. Adjusted earnings per share, meanwhile, should be around $1.04. That matches what management forecasted for the quarter as well. In the table above, you can see precisely the impact that achieving these numbers would have on an absolute dollar basis. It’s unclear what we should expect when it comes to other profitability metrics. But for context, operating cash flow in the third quarter of 2022 was $8.5 million. On an adjusted basis, it was $23.4 million. And finally, EBITDA for the business came in at $32.1 million.

I do have to wonder exactly how much weakness the company will experience during the third quarter. In addition to seeing robust results for the first half of 2023 relative to the same time one year earlier, the company also has the support of industry analysts. According to one source, new powerboat retail unit sales in 2022 were about 17% lower than what they were in 2021. However, that same source indicated that sales should be about 285,900 units this year. That would be about 14.4% above what we saw in 2022. It would also be about 2% higher than what the industry saw in 2019. If this does come to fruition, then the upside potential due to MasterCraft Boat Holdings could be attractive.

Even if the forecast for the industry fails to materialize, the picture for the company does not look all that bad. At present, management believes that revenue for the year as a whole will be between $620 million and $640 million. Earnings per share will be between $4.40 and $4.65, with a midpoint implying net profits on an adjusted basis of $80.5 million. Meanwhile, EBITDA for the company should be between $111 million and $118 million. No guidance was given when it came to other profitability metrics. But if we assume that operating cash flow will decrease at the same rate that EBITDA is forecasted to, then a reading of $91.3 million is not unrealistic.

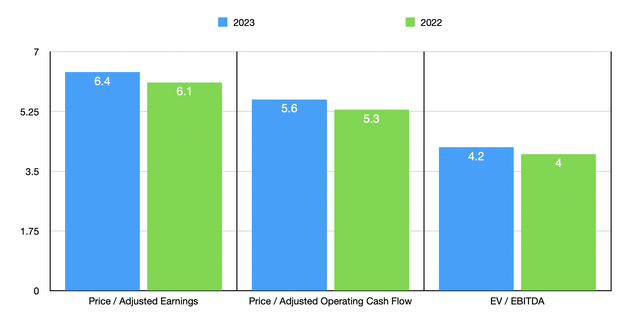

Author – SEC EDGAR Data

In the chart above, you can see exactly how the company is priced on a forward basis, as well as using data from 2022. On an absolute basis, shares look very affordable. Meanwhile, in the table below, you can see how the stock is priced relative to similar firms. Although two of the five companies that I looked at are cheaper than MasterCraft Boat Holdings on a price to earnings basis, our prospect is the cheapest of the group when it comes to the other two profitability metrics.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| MasterCraft Boat Holdings | 6.4 | 5.6 | 4.2 |

| OneWater Marine (ONEW) | 3.2 | 55.0 | 5.6 |

| MarineMax (HZO) | 3.6 | 9.1 | 4.4 |

| Malibu Boats (MBUU) | 6.9 | 7.4 | 4.5 |

| Brunswick Corporation (BC) | 9.4 | 10.9 | 6.7 |

| Marine Products Corporation (MPX) | 10.5 | 8.9 | 7.0 |

Takeaway

Right now, there seems to be some uncertainty regarding the industry more broadly. Regardless of what that picture looks like, there’s no denying that MasterCraft Boat Holdings looks cheap, both on an absolute basis and relative to similar companies. Of course, investors should use the upcoming earnings release to see to what degree that picture might be changing. But assuming nothing significantly negative comes out of the woodwork, I would argue that the company does offer enough upside from here, even in spite of seeing its share price surge in recent months, to warrant a ‘buy’ rating.

Credit: Source link