Victoriia Kovalchuk/iStock via Getty Images

Introduction And Thesis

Lovesac (NASDAQ:LOVE) is a specialty furniture company headquartered in Stamford, Connecticut. It designs, manufactures, and sells innovative, modular furniture solutions primarily centered around its flagship product, the “Sactional” modular sectional sofa. The company also offers other complementary products such as bean bags, pillows, and blankets.

LOVE has a strong value proposition in our view, even if this does not materialize into a long-term competitive advantage/moat. We believe its current position can be utilized to build a lasting brand and compelling offering for consumers.

The financial results appear primed to follow suit, even if we are not convinced by its margin development thus far. As economic conditions improve and further scale is achieved, we believe it is likely Management will deliver the prior promised development.

Irrespective of how the future develops, so long as growth remains positive, we believe LOVE is attractively priced given how oversold it is relative to its 2022 level. An FCF yield of ~5% for any stock that is outgrowing its industry/gaining market is crazy in our view (outsized of a few unique cases). For these reasons, we rate the stock a buy.

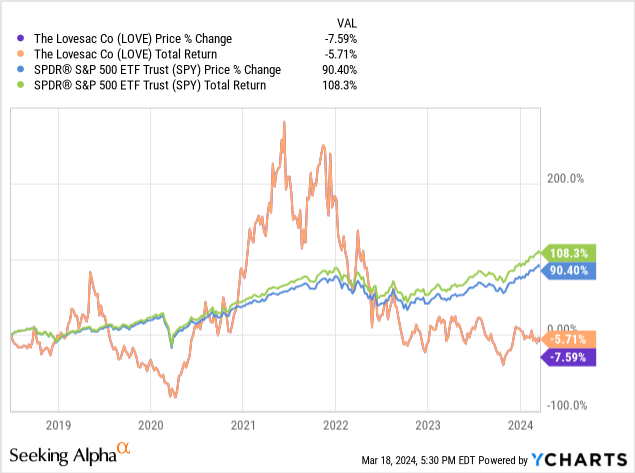

Share Price

LOVE’s share price performance has been disappointing since the stock was listed, reflecting underwhelming financial development following an initial period of expansion, alongside concerns around its long-term commercial trajectory.

Commercial Analysis

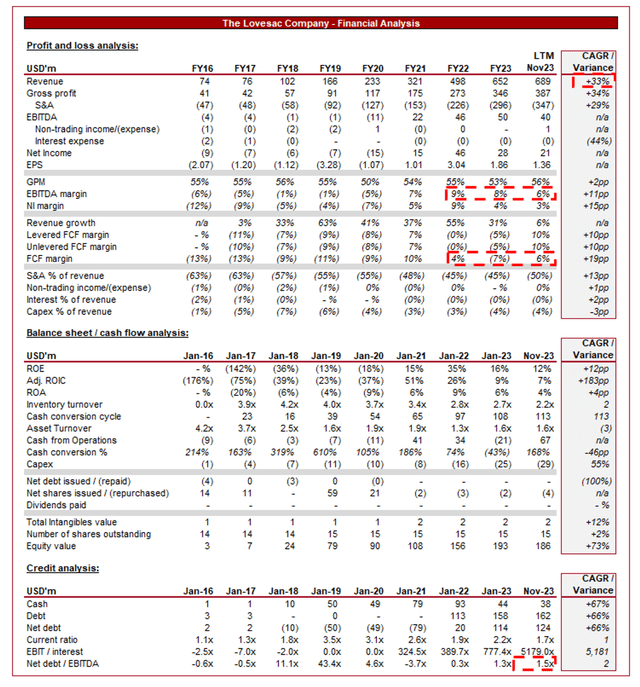

Capital IQ

Presented above are LOVE’s financial results.

LOVE’s revenue growth has been impressive, with a CAGR of +33% into LTM23. Alongside this, the company has transitioned to consistent profitability with scale.

Business Model

Lovesac

LOVE specializes in modular furniture, notably its flagship product, Sactionals. Sactionals are versatile and customizable sofas made up of individual seats and sides that can be rearranged to fit any space. This modular design appeals to consumers seeking adaptability.

LOVE has generated impressive consumer interest with its Sactionals. The products have benefited from organic marketing and an acceleration from social media buzz. With consumers seeking to be more expressive and unique, and changing living arrangements contributing to the need for flexibility, the Sactionals are addressing a clear need in the market. We believe this is the primary reason for its strong growth trajectory since FY18.

With this in mind, LOVE may be a victim of its own success. The company has generated considerable success from a handful of products, with the risk being that as hype softens, revenue growth reverses. Currently, 46% of LOVE’s transactions are from repeat customers, which shows loyalty but a high weighting toward acquired customers. Whilst we are not in the business of speculating on a company’s demise, it is worth highlighting that interest in the LOVE brand has been broadly flat since 2019, albeit the lack of continued upward trajectory aligns with the slowdown in revenue growth during LTM23.

Google

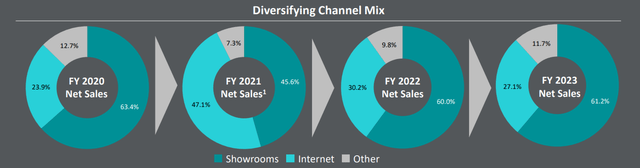

LOVE primarily sells its products through a direct-to-consumer model via its website, showrooms, and pop-up shops (such as in Costco and BestBuy). This omnichannel approach allows the company to maintain control over its brand development and maximize its unit economics. Management frequently references this omnichannel approach as being a primary success driver. Significant investment has been made into the customer experience, such as to ease the purchase process, both in-store and at home, as well as to easily access touchpoints.

Lovesac

We believe LOVE has a reasonable competitive position. The company has innovated in the furniture space, an industry that is highly mature and sees limited genuine innovation. This is not to say LOVE has created something never seen before but that it has combined marketing with customization to grab the interest of the public. This said we are not convinced its competitive position will be maintainable on product alone, even with its 74 patents. Beyond its Sactionals products, its DTC model is referenced. We look at this similarly to the Sactionals advantage. LOVE is ahead of its peers but not with something tangible enough to protect. For this reason, we believe it is critical for LOVE to brand build and broaden its customer reach at a rapid pace to establish its position before its competitive position subsides.

Strategy

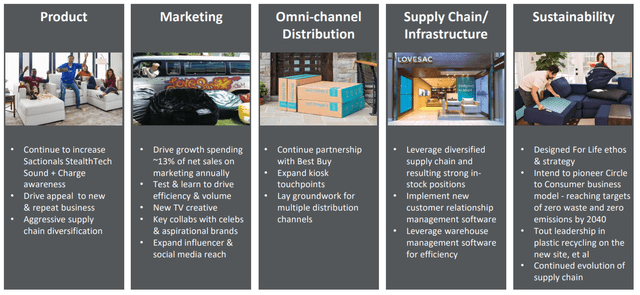

Lovesac

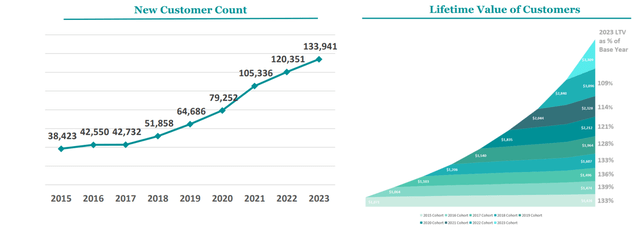

Management’s strategy going forward is broadly centered around product and operations. The company is seeking to carefully expand its SKUs, albeit while maintaining the tight offering that it sees as “focused”. We believe this is extremely important to the development of its brand. The company must ensure its brand is not synonymous with any single product and must continue to push development forward to create a “lifestyle” perception. As the following illustrates, its customer count has gradually improved, suggesting its appeal is growing. The beauty of product development is that it appeals to more customers while also growing the lifetime value of all customers.

Lovesac

Secondly is its operational capabilities. Whilst margins have turned positive, EBITDA-M has been flat for over 36 months. At its existing levels, we believe cyclicality could be a major problem for the sustainability of its cash flows over time. This will involve more efficient marketing spending, which we believe should be deliverable, alongside improvements to its supply chain. The latter may be more difficult due to its impact on commercial; factors, as LOVE offers generous concessions to customers, such as next-day shipping.

Finally comes LOVE’s physical expansion. The company remains committed to expanding its showrooms, as well as its shop-in-shops. The latter have shown themselves to be quite successful and is a departure from the strategy of its peers. Given its tight product line, this is a shrewd approach in our view and the success speaks for itself. This helps minimize overhead costs and again maximizes its brand.

Financials

LOVE’s recent trajectory has been strong, with top-line growth of +21.7%, +9.1%, +4.0%, and +14.3%. Alongside this, margins have slipped. Whilst the company continues to grow, its deceleration is a reflection of macroeconomic conditions.

With elevated rates (primarily) and the impact of inflation, activity in the housing market has ground to a halt. Further, consumer spending on large ticket items has softened in response to rising living costs. This has contributed to a housing and furniture bear market. For this reason, we are broadly impressed by LOVE’s performance, as it reflects clear market share growth.

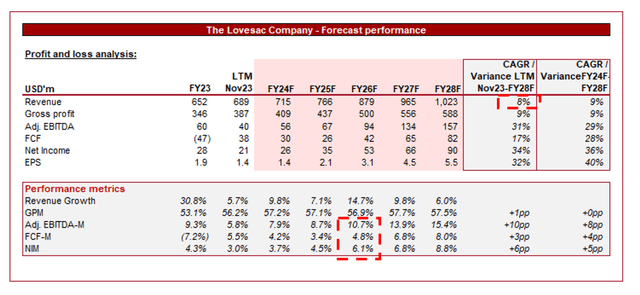

Looking ahead, analysts are forecasting strong growth in the next 5 years, with a CAGR of +8%. Alongside this, margins are expected to sequentially improve, reaching an EBITDA-M of ~15% by FY28F.

We are broadly supportive of the revenue assumptions, although believe there to be elevated risks of missing forecasts. The reason for this is highlighted above, namely the softening interest in its brand which has clearly translated to growth (which we concede is also macro-influenced). This could just be a speed bump from which LOVE can accelerate or it could be a fundamental slowdown in its trajectory, which could force the business into the lower single-digits.

Regarding margins, we see even greater risk. On paper, analyst forecasts appear completely reasonable. With scale and brand building (as a manufacturer and retailer), LOVE will benefit extensively from economies of scale and can ladder down its marketing spend. This said, we have seen almost no evidence to suggest this can be delivered since FY21, particularly as analysts expect it almost immediately vs. LTM23.

Capital IQ

Industry Analysis

Seeking Alpha

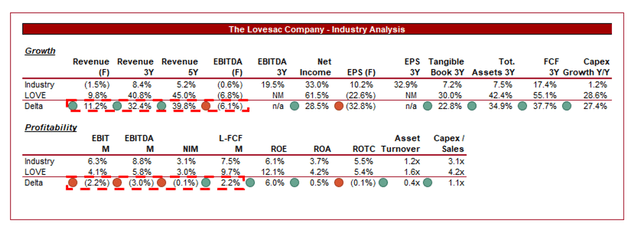

Presented above is a comparison of LOVE’s growth and profitability to the average of its industry, as defined by Seeking Alpha (8 companies).

LOVE’s financial performance relative to its peers is as we would expect. The company’s is outgrowing its peers, with this delta expected to continue in the forward period. From a margin perspective, LOVE is currently lacking, albeit boasting an FCF and ROE advantage.

This margin performance is impressive given its lack of scale and current investment in growth. This suggests if it can continue to scale successfully, its margins will normalize above its peers’ level, making it a leader in its industry.

Valuation

Capital IQ

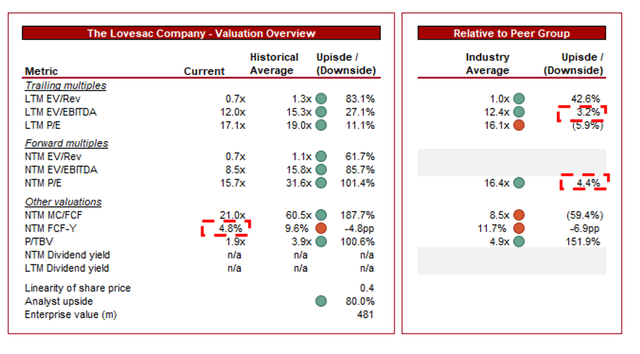

LOVE is currently trading at 12x LTM EBITDA and 9x NTM EBITDA. This is a discount to its historical average.

LOVE is currently trading at an FCF yield of ~5% and a small discount to its peers. Given its superior growth and scope for margin improvement, a premium could easily be argued. The discount appears to reflect clear hesitancy about its long-term trajectory and interest in its brand. The lack of a tangible moat is something we keep returning to and is fundamentally an issue. The important factor here, however, is that this appears to be priced in.

If we were to assume growth immediately decelerates, the logical step for Management would be to slow expansion and focus on efficiencies. This would theoretically lift margins and FCF, while growth investment would come through capex spending on new locations. Based on this, investors could expect an FCF yield of ~5-6% and a growth rate of ~3% (in line with long-term inflation). This is a pretty good downside if you ask us. The alternative base case is decelerating growth but still in the MSD/HSD range with margin improvement, rapidly compounding that 5% yield.

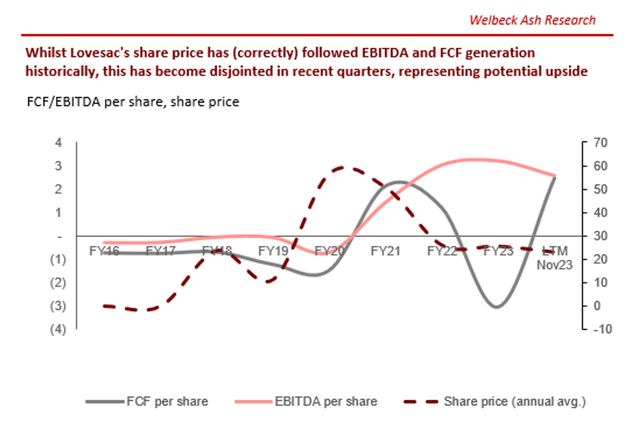

Further supporting its attractive valuation is the below, which suggests a misalignment of earnings and its share price. This usually occurs in very rare cases where the current or near-term situation is dire, which is not the case with LOVE. Its share price cannot consistently lag behind earnings.

Capital IQ

Finally, Seeking Alpha’s quant rates LOVE’s valuation an A- and analysts have a consensus upside target of +80%.

Key Risks With Our Thesis

The biggest risk, which we have repeated several times is the ability to execute brand development. Hype is short-lived but a brand should last a lifetime.

Final Thoughts

LOVE is a solid business in our view. The company has taken a fresh approach to a saturated and mature industry, allowing it to gain market share rapidly and establish itself within the industry.

We do not expect this trajectory to last forever but Management is taking the necessary steps to ensure a lucrative future. Importantly, we believe LOVE is attractively priced in its current position, even if growth was to immediately fall to LSDs. For this reason, we rate the stock a buy.

Credit: Source link