Bill Pugliano

Apart from Tesla, Inc. (TSLA), many auto manufacturers have failed to beat the market this year amid a strong comeback of tech stocks. When it comes to the automotive sector, investor focus usually concentrates on vehicle manufacturers, but this sector also is home to several other companies that play an important role in designing vehicles.

Lear Corporation (NYSE:LEA) is a global automotive technology leader that provides seating and electrical systems for vehicles. The company was founded in 1917 as American Metal Products and has grown through several acquisitions and expansions. Lear Corporation’s products include seats, seat covers, seat structures, seat tracks, seat mechanisms, seat foam, seat trim, wiring harnesses, terminals, connectors, junction boxes, modules, switches, sensors, and software.

Lear stock has gained close to 9% this year, outperforming Detroit automakers such as Ford Motor Company (F) and General Motors Company (GM). Lear is a small company with a market capitalization of $8 billion, and this caught my attention as I focus on small companies that are continuing to grow amid challenging macroeconomic conditions.

The Changing Automotive Landscape

Despite the global auto parts and accessories manufacturing industry experiencing a five-year decline in revenue, including stagnation in 2023 when it is expected to reach a total revenue of $1.9 trillion, Lear Corporation remains a standout performer. The company has exhibited remarkable financial resilience in recent years, overcoming significant challenges including semiconductor shortages and labor strikes.

In the second quarter of 2023, Lear reported an impressive $6 billion in sales, an increase of 18% year-over-year with core operating earnings surging by 61% YoY to reach $302 million. A deeper look into the numbers reveals further evidence of Lear’s resilience and forward momentum. The seating segment, a key component of the company’s business, recorded net sales of $4.4 billion, reflecting a substantial 15% YoY increase.

As illustrated below, the company has reported steady revenue growth in each of the last five quarters, which is a testament to how Lear Corporation is bucking industry trends.

Table 1: Lear Corporation’s quarterly revenue growth

|

Reporting Period |

YoY revenue growth |

|

Q2’23 |

18% |

|

Q1’23 |

12% |

|

Q4’22 |

10% |

|

Q3’22 |

23% |

|

Q2’22 |

7% |

Source: Seeking Alpha

The automotive industry finds itself at a crossroads, undergoing profound transformations that demand a strategic reevaluation of its traditional operational paradigms. These disruptions, driven by a convergence of factors such as supply chain challenges, digital connectivity, and the electrification of vehicles, compel automakers to adapt quickly to remain competitive in this evolving landscape. However, amidst these challenges lies opportunity – the digital transformation made possible by technology. The automotive sector’s rapid growth in software and electronics is a testament to this evolution. McKinsey forecasts that by 2030, the global automotive software and electronics market will grow to an impressive $462 billion, growing at a 5.5% CAGR through 2030.

Additionally, the acceleration toward electric vehicles, or EVs, remains a defining trend, propelled by environmental concerns, regulatory incentives, technological advancements, and shifting consumer preferences. Nevertheless, EVs still face formidable obstacles such as high costs, limited range, and inadequate charging infrastructure. In response, automakers are making substantial investments to enhance battery performance, expand charging networks, and explore alternative solutions like hydrogen fuel cells and battery swapping.

Although the automotive industry confronts multiple global headwinds, including energy crises, trade tensions, and labor shortages, digital transformation is reshaping the sector. These are facilitated by technologies such as artificial intelligence, cloud computing, big data, the Internet of Things (IoT), and 5G connectivity to enhance operational efficiency, elevate product quality, enrich customer experiences, and foster innovation. Furthermore, the automotive industry’s future lies in a customer-centric approach, delivering personalized, convenient, and engaging experiences.

In light of evolving consumer preferences, the adoption of driver assistance systems and advanced driver assistance systems (ADAS) is poised for substantial growth. McKinsey anticipates robust annual growth reaching 30% for Level 2 ADAS systems through 2025, largely driven by regulatory mandates. By 2030, an estimated 12% of vehicles are expected to be equipped with Level 3 and 4 AD capabilities, a significant increase from the mere 1% in 2025. Additionally, the automotive software and electronics market is set to flourish at nearly four times that rate over the same period.

Electronic control units (ECUs) and domain control units (DCUs) are projected to account for the largest share of this growing market, with sales expected to reach $144 billion by 2030. Software development, encompassing integration, verification, and validation, follows closely with a revenue potential of $83 billion by 2030. The automotive software market, which was valued at $31 billion in 2019, is projected to more than double in size, surging to approximately $80 billion by 2030. ADAS and AD software will be at the forefront of this growth, representing nearly half of the software market by 2030.

Additionally, the automotive sensor market is poised to witness significant growth, climbing from $23 billion in 2019 to $46 billion in 2030, driven primarily by the increased demand for ADAS and AD sensors, specifically LiDAR, cameras, and radars.

Lear’s Strategic Adaptation To New Market Dynamics

Lear Corporation is well-poised to capitalize on the profound shifts happening across the automotive industry. As the sector transforms, embracing the transition to EVs, the rise of autonomous driving, and the proliferation of connected cars, Lear has displayed proactive agility in adapting to this evolving landscape.

A cornerstone of Lear’s strategy has been substantial investments in expanding its product portfolio to align with the dynamic needs and preferences of customers. At the forefront of these efforts is the E-Systems segment, which provides a wide range of products and services. These include essential elements such as wiring harnesses, terminals, connectors, charging solutions, battery management systems, high-voltage distribution systems, wireless communication modules, software, and cybersecurity solutions. Lear’s cloud-based fleet management services further strengthen its position in automotive excellence.

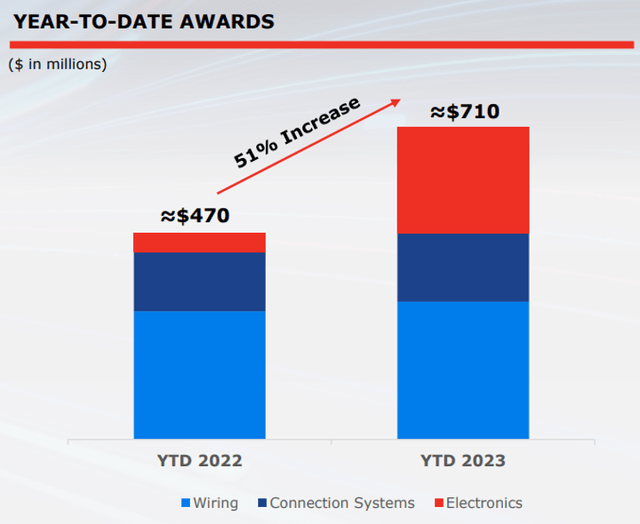

Notably, Lear’s exceptional performance in Q2 outpaced the broader global industry production, primarily underpinned by an 11% market outperformance of the E-Systems segment. The E-Systems segment’s revenue surged by 28% YoY to $1.5 billion. Lear’s year-to-date awards in the E-Systems segment have surpassed 50% compared to the previous year, reflecting the industry’s recognition of Lear’s leadership in this domain.

Exhibit 1: YTD awards

Earnings presentation

The company’s proactive stance extends beyond product diversification; Lear has been actively forging strategic partnerships and pursuing strategic acquisitions to augment its capabilities and enhance its market presence. A noteworthy example of this is the recent acquisition of I.G. Bauerhin, a German supplier of automotive seat heating, ventilation, active cooling, steering wheel heating, seat sensors, and electronic control modules.

Lear’s endeavors in electrification are particularly noteworthy, with awards for high-voltage and low-voltage wiring for multiple EV platforms, including a significant wiring award with BMW. Additionally, the company secured the Battery Distribution Unit for a new Stellantis (STLA) electric vehicle, further solidifying its presence in the EV market. Lear has also embarked on shipping pre-production parts for the Integrated Center Console to support multiple models on General Motors’ Ultium battery platform, indicative of its growing presence within the EV sector.

Furthermore, Lear’s commitment to building a robust sales backlog, with the company on track for its third consecutive year of maintaining a $1 billion 3-year sales backlog, deserves attention. This highlights the steady path toward growth. In terms of clientele, Lear’s E-Systems segment serves industry giants such as Ford, Renault (OTCPK:RNSDF), Jaguar, Volkswagen AG (OTCPK:VWAGY), and Volvo. These partnerships signify Lear’s reputation for delivering quality and innovative solutions to automotive leaders, further cementing its status as a formidable player in the automotive sector.

Additionally, Lear Corporation maintains a robust balance sheet with no significant debt maturities until the year 2027 and a substantial total available liquidity of $2.9 billion. In terms of cash generation, Lear is making commendable progress, primarily driven by the effective execution of its Lear Forward Plan. The company is steadfastly working toward achieving an ambitious target of 80% free cash flow conversion, reflecting its commitment to optimizing operational efficiency and financial performance. This proactive approach positions Lear for sustained cash generation and financial strength in the competitive automotive industry landscape.

The Valuation Seems Reasonable

Lear Corporation focuses on vehicle seating and the electrical architecture of vehicles. The increasing demand for premium seating and high-quality vehicle interiors coupled with Lear’s strategic partnerships with top automakers in the world will help the company outpace the growth of passenger vehicle production in the next few years, in my opinion. The proliferation of EVs will also play a key role in helping Lear’s growth as most of these vehicles come with premium seating, a category where Lear is the global leader. Pure electrical vehicles, on the other hand, require high-quality electrical architecture as well, and Lear is among the market leaders in this segment. Overall, the dynamic shifts that we are seeing in the global automotive sector should bode well for Lear’s growth in the next few years.

Going by the above observations, it is reasonable to conclude that Lear’s growth will accelerate in the foreseeable future. The company, however, is valued at a forward GAAP P/E of just over 12 compared to the 5-year average of 11.2. Lear’s TTM revenue of $22.45 billion is almost three times its current market value, which I believe is an anomaly that can be exploited. In the next phase of the business cycle where auto manufacturers will boost their production of EVs and premium passenger vehicles, I believe the investor sentiment toward Lear will improve meaningfully, pushing its stock higher in the market.

Takeaway

The automotive industry is undergoing a profound transformation, driven by technological advancements, sustainability requirements, and evolving consumer preferences. Lear Corporation, as a proactive leader, is strategically positioned to thrive in this changing landscape. With a robust financial performance and a forward-thinking product portfolio tailored to the future of mobility, Lear exhibits resilience and readiness to excel in the era of EVs, connected vehicles, and autonomous driving.

Credit: Source link