mysticenergy

With its recent acquisition of mineral right assets in the Permian, I believe Kimbell Royalty Partners (NYSE:KRP) looks well positioned to increase its dividend in 2024, assuming energy prices hold up.

Company Profile

KRP is a mineral interest holder that owns the commodities under tracts of land that it leases to producers in exchange for a royalty interest. It receives an upfront cash payment, known as a lease bonus, and also gets a royalty interest giving it a cost-free percentage of production or revenue from production, typically 20-25%. In addition to mineral interests, KRP also owns overriding royalty interests (ORRIs).

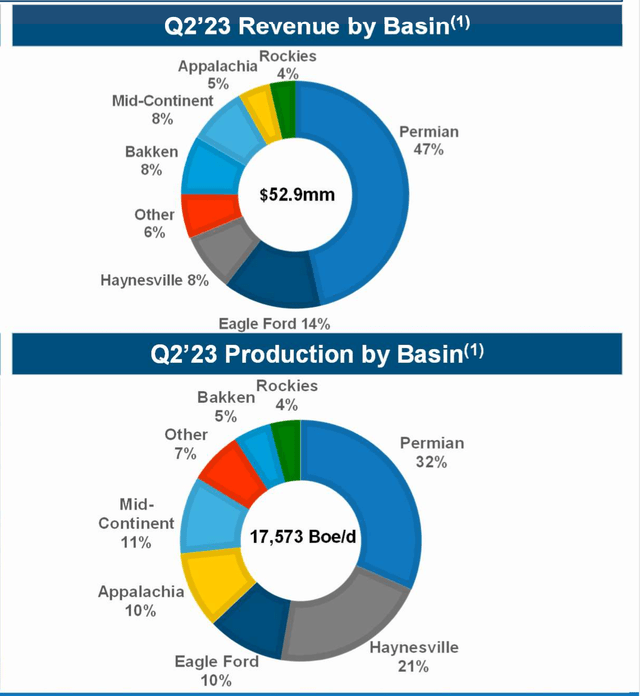

KRP owns mineral interests across most major oil and natural gas basins in the U.S. By production, the Permian is KRP’s most prolific basin, representing nearly a third of its Q2 production, followed by the Haynesville at 21%, the Mid-Continent at 11%, the Eagle Ford and Appalachia both at 10%, the Bakken at 5%, the Rockies at 4%, and others basins at 7%.

Company Presentation

Opportunities & Risks

As with any company involved in the production of oil and natural gas, the price of the underlying commodities will play a big role in its results. The reason for this is twofold. On the one hand, prices directly impact the revenue that KRP receives, so the higher prices are, the better the results the company generates. The company does use hedges, but only 15% of its production was hedged at the end of June, so it uses pretty minimal hedging.

At the same time, oil and natural gas prices can impact the drilling activity of the E&Ps on its land. As a mineral owner, KRP does not have a say in the drilling activity of the operators who lease its lands, so this is always a risk.

One area of particular risk on this front would be the Haynesville, where overall rig activity in the basin has fallen substantially as natural gas prices have weakened. Unlike in Appalachia, the Haynesville tends to have higher breakeven costs, even though it is ideally situated for LNG exports.

However, KRP has seen the rigs on its Haynesville land hold pretty steady, with its acreage up 6 rigs in Q1 and then down 4 rigs in Q2. Given the overall drop in rig activity in the basin, this is a big positive for the company.

Discussing the Haynesville on its Q2 earnings call, CFO Davis Ravnaas said:

“I wouldn’t use the word surprise, but we’re pleased to see that just given the fact that everybody else that seems to be reporting is seeing a lot of disappointing production declines in the basin. I would attribute it to, frankly, I think you kind of hit on it with your first point. That legacy position that we picked up from Haymaker back in 2018 is just an incredible core Haynesville asset. And we would probably argue that our production should and will continue to be more resilient than other folks. I think we have a lower PDP decline rate on our Haynesville position relative to a lot of other people, too. So it doesn’t require quite as much. Well, we will outperform, I should say, on balance, the more hyper drilling folks that have newer flush production with higher decline rates. So we’re kind of in a nice balance spot with a lower PDP decline, right, but still a healthy amount of activity. We got asked that question yesterday on a call, and the mix between privates and publics continues to kind of shift up and down, I’m not sure I would directly attribute our resilience to our specific mix between public and privates, except in so far to say as we have a healthy mix. They’re all, for the most part, very good operators, and it’s just a great asset. I mean it’s just an asset that’s kind of corridors business that just continues to perform.”

Outside of energy prices, acquisitions is another area of opportunity for the company. KRP views itself as a natural consolidator of mineral rights, noting that the market in about $660 billion in size, but there is only a limited number of public companies operating at scale. It thinks with the weak IPO market that it should be able to make acquisitions as private sponsors look for avenues to exit their past mineral investments.

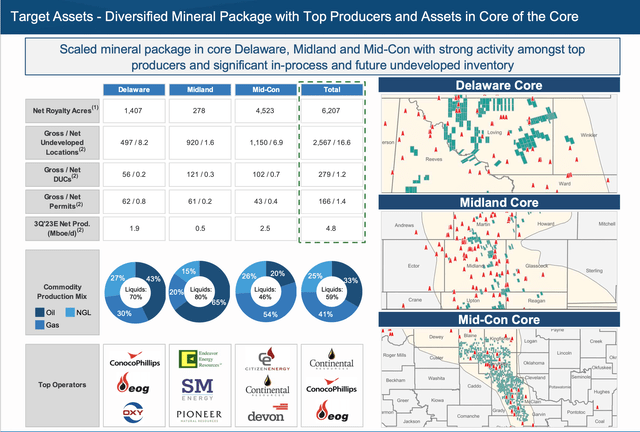

Since its IPO, KRP has closed on 10 major M&A transactions, investing over $1.7 billion in the process. Its latest transaction closed last month, when it acquired oil and gas mineral and royalty assets in the Permian and Mid-Continent for $455 million from a private seller.

Company Presentation

The company said in terms of total proved value, 64% of the value is from the Permian and the rest is from the Mid-Con. It expects next-twelve-month production of about 4,765 Boe/d, with the cut 33% oil, 26% NGLs, and 41% natural gas. It projects the assets to generate $64.3 million in cash flow at current strip pricing as of the end of July, representing just over a 7x multiple.

KRP financed the deal through the sale of $325 million 6% convertible notes it sold to Apollo. It also sold 8.3 million units in a secondary offering for gross proceeds of $116.7 million.

As a result of the deal, its daily production will increase 28% to 22.4 Mboe/d, while its rig count will rise 11%. It expects the deal to reduce G&A per barrel by -22%. Over 40% of its total net locations will now be in the Permian.

KRP does carry debt, but its pro-forma leverage was only 1.0x after the acquisition. Any type of debt when looking at companies involved in energy production is a risk, but right now it looks minimal, and KRP has been able to fund acquisitions through other methods, including equity and convertible securities that carry lower interest rates.

Valuation

BSM currently trades at about 8.7x the 2023 EBITDA consensus of $238 million. Based on 2024 EBITDA it trades at 6.1x given that the EBITDA consensus for that year is $338 million and reflects a full year of its recent acquisition. These valuations reflect its current share count and convertible issuance.

The stock currently has a free cash flow yield of about 14.4% based on my estimate for 2024.

The stock pays out a variable dividend, but is currently yielding about 9.6% based on its last payout of 39 cents per share. Given the difference in its current yield and the FCF yield I project for 2024, it should have some nice room to increase its dividend next year.

Conclusion

KRP is a solid mineral rights owner that is becoming more tied to the Permian with its recent acquisition. Given that the Permian is the most prolific basin in the U.S. with the best growth prospects, I’d view that as a positive. Its Haynesville exposure carries some risk but has been holding up well, and gives it some natural gas price potential upside.

I continue to think natural gas prices should rebound over the medium term, as demand continues to naturally increase while higher-cost production is cut back on. However, a warmer winter in parts of the country due to an El Nino could keep prices in check in the near term, but we’ll have to wait and see how the weather plays out. Southern states, though, will usually be colder during an El Nino, which could help with regional prices in places like Texas and the Gulf Coast.

Overall, I like KRP and think it is currently a “Buy.” My price target is $20, which a 7x multiple on its 2025 EBITDA, to go along with about $1.60+ in dividends.

Credit: Source link