Johannes Simon/Getty Images News

Introduction

There’s something special about a company with a one-letter stock ticker.

The Wall Street Journal wrote an interesting article about the popularity of one-letter stock tickers; for whatever reason, the management of many companies gravitate towards them.

Some of the best businesses have one-letter-long stock tickers; companies like Agilent (A), Realty Income (O), and Visa (V) all come to mind. So, as superficial as it might sound, when I saw Jacobs Solutions (NYSE:J), it immediately sparked my interest.

Regardless of the ticker, and regardless of the name, today I’m here to talk to you about Jacobs Solutions, an engineering and professional services firm, noteworthy for much more than its ticker.

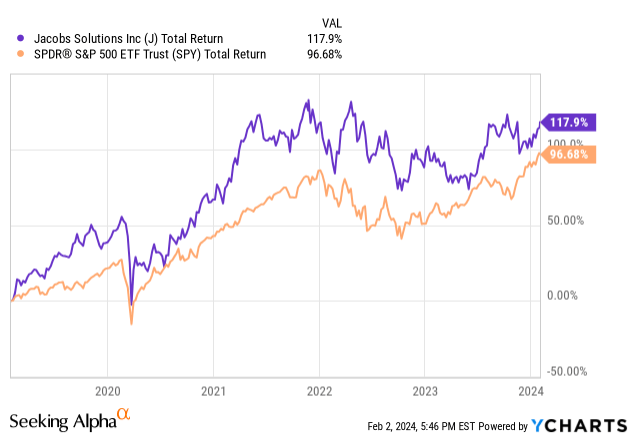

Beyond the short stock ticker, the company managed to outperform the S&P over the past 5 years by about 20%; at that point, I knew this was a firm I wanted to gain a better understanding of.

Context

Jacobs Solutions Inc., based in the US of A, is dominant in the technical professional services industry. Established in 1947 by Joseph “J.” Jacobs, the firm has solidified its standing by consistently delivering in the fields of engineering, professional consultancy, construction, and scientific and specialty consulting. Serving an extensive global clientele, Jacobs addresses the technical needs of corporations, institutions, and government entities across many fields.

The company’s evolution is characterized by its periodic acquisitions, effectively broadening its operational scope and enhancing its market influence. Significant acquisitions have seen the incorporation of global entities like Sir Alexander Gibb & Partners and Carter and Burgess, coupled with impactful mergers such as the amalgamation with Sinclair Knight Merz in 2014. The procurement of CH2M Hill in 2017 and Wood Nuclear in 2020 further underscores Jacobs’ strategic approach to capital investment, aimed at augmenting its proficiency and footprint, especially within infrastructure, governmental service sectors, and nuclear service industries.

Moreover, Jacobs’ investments, exemplified by acquiring a substantial share in PA Consulting and initiating a joint venture with the Qatar-based Locus Engineering Management and Services Co. in 2022, showcase the company’s approach to entering new markets aggressively.

Financial Results

As a result of its strategy of delivering top-tier technical services combined with expansion through acquisition into new regions and verticals, the company has scaled up massively over the past years.

Revenue and EPS

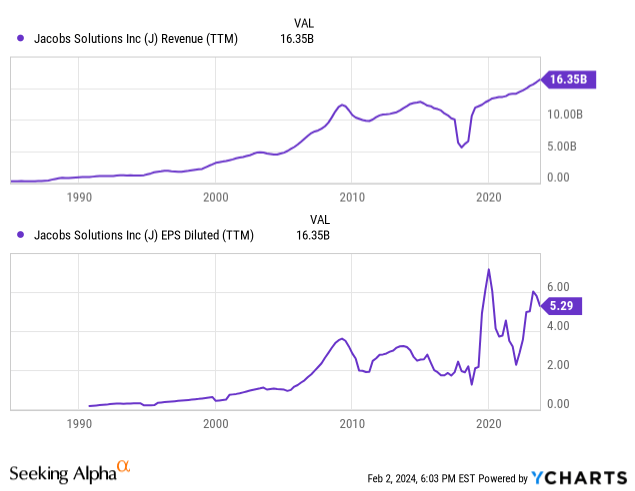

Those investments, both internal and external, have yielded massive improvements to revenues and EPS since its founding. Over the past 12 months, management delivered an EPS of $5.29, which is more than double what the company achieved in the years before the coronavirus.

While the company has experienced years of low growth (2010-2019) and some years with massive drops in earnings and revenues, for the most part, the general trajectory of this business is upward. Perhaps even more impressive is that revenues and EPS growth appear to be accelerating as it scales, not slowing down.

Capital Deployment Efficiency

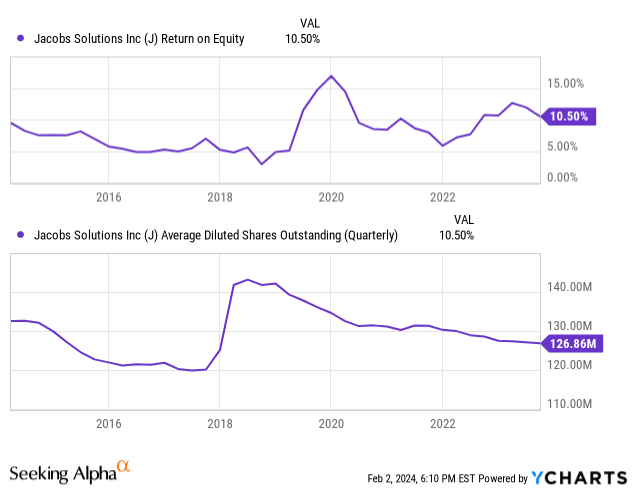

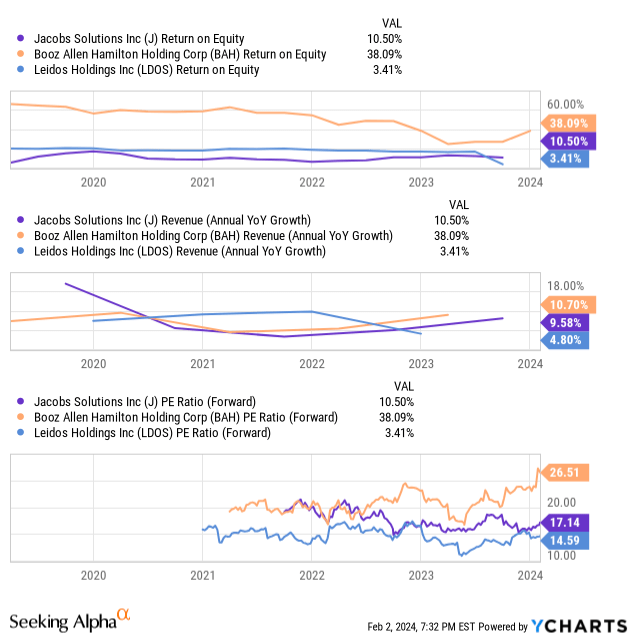

Looking at the management’s track record of deploying capital, we can see that over the past year, they delivered a 10.5% return on equity, which has been more or less steady over the past decade, osculating between 5-15%. I’d consider that level to be roughly average within the space, commendable, sure, but not particularly outstanding.

On the positive side, alongside a ~1% dividend yield, the company returns capital to shareholders through buybacks. These buybacks have let the company use equity to acquire other companies from time to time, which they then can buy back with future earnings. This increases the pool of potential targets, some of which may demand equity to sell their business.

Balance Sheet

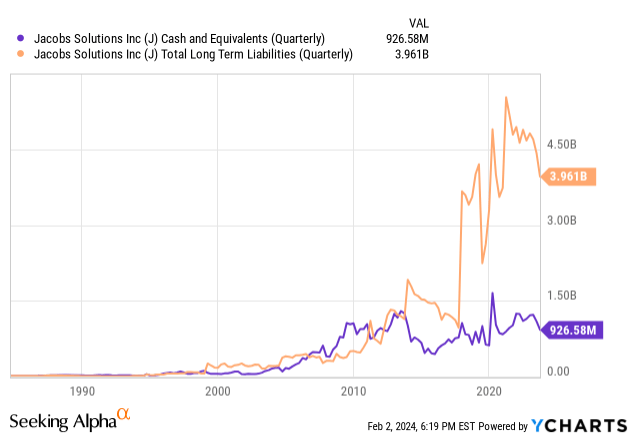

One area of concern is the company’s increasing appetite for debt. In years past, the company ran its business at a roughly debt/cash neutral level; since the late 2010s, it has taken out much more debt. While these levels have decreased over the past year, they are still markedly above their historical levels at a time when interest rates are much higher than they were over the last decade. As the company pays back this debt and/or refinances at higher interest rates, this will eat away at the cash flow that can be used for acquisitions, buybacks, and dividends.

Catalysts for Growth in 2024

Looking forward, I believe 2024 is likely to be a big year of growth for Jacobs. Here’s why… Jacobs is positioned to capitalize as global threats escalate, driven by its exposure to defense and nuclear sectors. The geopolitical climate, marked by a resurgent Russia, a more assertive Iran, and broader international tensions, is prompting nations to prioritize defense spending and energy security.

The increased focus on collective defense and the heightened risk in key trade regions like the Red Sea have underscored the need for enhanced military capabilities in the defense sector. Recent incidents, such as attacks on American-owned ships and Iranian missile strikes, have prompted calls from global defense leaders, including the UK Defense Secretary Grant Shapps, for allied nations to bolster their defense expenditure. This shift, away from the era of the peace dividend, as discussed in a recent SA new article, highlights the urgency of preparing for potential conflicts involving major global powers.

With its expertise and services catering to the defense industry, Jacobs is well-positioned to benefit from the increased defense budgets and the corresponding demand for its services.

On the energy front, the push towards nuclear energy to combat inflationary pressures on electricity is gaining momentum. Jacobs’ recent partnership with the French start-up Naarea to develop a new nuclear power reactor is a testament to the company’s commitment to and capabilities in the nuclear sector.

This collaboration, aimed at promoting energy security by providing safe, clean, and sustainable nuclear energy, aligns perfectly with the global pivot towards atomic power as a reliable and efficient energy source. As countries consider greater investment in atomic energy as a strategic solution to their energy needs, Jacobs’ expertise and ongoing projects in this domain will likely be a significant catalyst for its growth in 2024.

Valuation and Performance vs. Peers

Comparing Jacobs to other peers, Booz Allen Hamilton (BAH) and Leidos (LDOS), we can see that Jacobs’ is more or less in the middle of the pack, both in terms of performance and in terms of valuation at 10% revenue growth with a 17x forward PE ratio.

That said, Jacobs may have the worst combination of growth and value of these three companies. Sure, you have Booz Allen with sky-high returns on equity and a lofty PE ratio, but the more interesting comparison is actually Leidos. Compared to Jacobs, Leidos has historically had marginally faster revenue growth and higher returns on equity apart from its performance last year, despite trading at a lower PE ratio (14.6X) compared to Jacobs’s 17.1X.

Conclusion

In summary, I believe Jacobs Solutions is a solid “Hold.” While its growth rates and capital returns are commendable, they don’t quite reach exceptional levels, especially when juxtaposed with counterparts like Leidos, which presents a comparable growth story at a more compelling valuation. Nevertheless, Jacobs stands at the cusp of potential tailwinds, particularly in the defense and nuclear arenas, as 2024 unfolds. These catalysts may offer the leverage needed for Jacobs to outpace its current projections and achieve a performance that distinguishes it from the pack.

Credit: Source link