Stock87/iStock via Getty Images

Golden Ocean Group logo (GOGL)

Investment Thesis

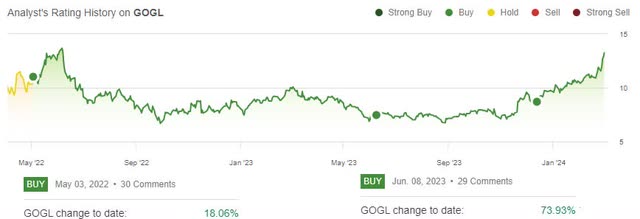

We have been bullish on Golden Ocean Group Limited (NASDAQ:GOGL) since May 2022 when their ex-CEO stated that “the stars seem to be aligning”.

In hindsight, we were early in upgrading GOGL at that time since it is “only” up 18% since then. If you had the fortune, and the luck, to wait until our second Buy stance of the 8th of June last year, investors would now have a gain of 74% plus the return from the dividend.

Tudor Invest’s stance on GOGL (SA)

But timing the market is perfectly a fool’s errand.

GOGL has just published its last quarter and FY 2023 results, so it is a good time to revisit the thesis.

FY 2023 Financial Results

GOGL had a very good Q4 result with adjusted net income up from $22 million Q-o-Q to $64.6 million. The adjusted EPS was $0.32

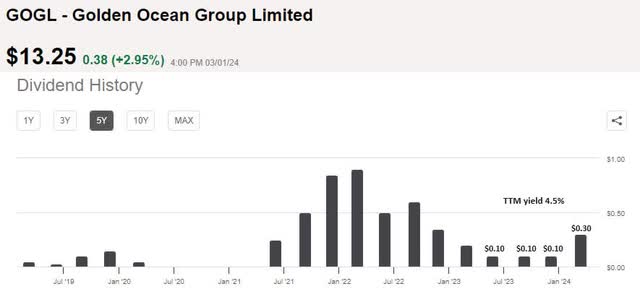

From this, they declared a dividend of $0.30, which was an improvement of 200% from the previous quarter.

That will certainly excite many investors chasing growing dividends. Many other shipping companies are now adopting this kind of dividend policy. It is, in our opinion, perhaps not sustainable in the long run, as it is a capital-intensive business with a high degree of depreciation. One cannot escape this.

To smoothen out earnings and dividends we shall examine the FY 2023 results.

GOGL’s FY 2023 adjusted net profit was $117.4 million. It is interesting to note that half of this came in the last quarter. This pales in comparison to the adjusted net profit of 2022 which was $388 million.

EPS for 2023 was $0.56 compared to $2.29 in 2022.

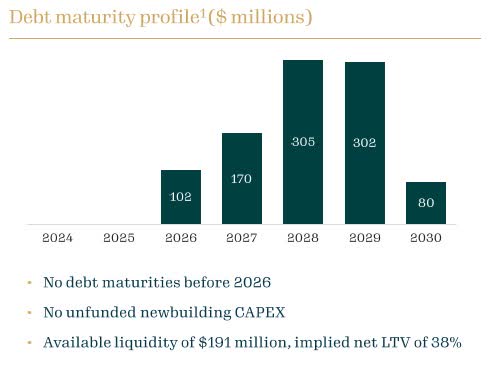

When a company distributes nearly 100% of its earnings, we want to keep a close eye on its financial leverage. More on this later.

Cash generation is larger than the earnings, as the depreciation does not come from cash.

Operating cash flow in 2023 was $266.3 million.

So how good has the dividend yield been if we look at this on a TTM basis?

GOGL dividend history on a TTM basis (SA with comments by author)

The obvious answer is “not very good”.

The current share price is telling us that the expectation for 2024 is for earnings and dividends to rise to levels seen in 2022. The total dividend for that year was $2.35 which would yield 17.7% based on the current share price.

It is not farfetched to believe that this could be happening. Nevertheless, we do want to warn our readers that markets can also disappoint investors. Demand could be below expectations.

Back to the balance sheet because we do want to keep a close eye on the level of debt the company has. GOGL’s average loan-to-value as of the end of 2024 was at a comfortable level at 43.8%. That is especially so when we bear in mind that their fleet is young at an average age of 7.5 years.

Long-term debt, as of the 31st of December 2023 stood at $1.26 billion which was down $51 million Y-o-Y. Their present high dividend pay-out ratio is strengthened by the fact that GOGL has no debt maturing before 2026.

GOGL’s debt maturity profile (GOGL 4th Quarter 223 Presentation )

Market development

Recently, the share price for GOGL, and other dry bulk operators, has moved in anticipation of higher TCE rates for dry bulk in 2024 than what we had last year.

With an increasing number of owners now refusing to send their ships through the Suez Canal, the ton-miles will increase. GOGL reported an increase in longer voyages with coal exports to Asia from Colombia and the U.S. East Coast. More bauxite is also coming out of West Africa for shipments to China. Much of this came from Australia in the past, so we see longer voyages, which means you need more vessels to cater to the demand.

In Star Bulk’s last quarterly report, they used research from Clarkson, which had a negative ton-miles development expected in 2024. The reduction of shipment of iron ore is estimated to be -0.4% and for coal -1.4% compared to last year. Agricultural products are estimated to grow ton-miles by 2.9%.

We are not sure if Clarkson Research at the time of issuing this report had updated information about the present situation in the Red Sea.

With China’s economic engine sputtering, there has been a lot of hope about India picking up the slack. After all, India is now the world’s most populated country and they have quite a lot of “catching up to do” in terms of their economy.

GOGL reported that India is planning to double their steel capacity by the end of this decade. They recorded a growth of 12.5% in 2023. Although India sources some of their iron ore domestically, it is of quite poor quality, so they are also importing some high-quality iron ore.

Last year, India produced 257 million tons of iron ore, of which they exported 21.6 million tons. Importation, of higher-grade iron ore, was small in comparison at just 1.8 million tons. The Indian steel industry is putting pressure on the government to curtail exports so they can use the ore domestically.

However, let us not lose focus. China imported 1.2 billion tons. India’s 1.8 million tons import is small. India can grow – but it will be a long time before they will challenge the importance of China for dry bulk volumes.

At the end of February 2024, Allied Shipbroker had estimated spot earnings for Capesize at $26.079/day, and Panamax at $14,357/day

That is not fantastic.

However, these markets can move very fast – both ways.

Conclusion

A risk to the thesis is that the stock market participants might be too optimistic about the dry bulk market for 2024. If so, then GOGL’s share price will go lower. It is still a good company, but at what price do you want to buy it?

As we have pointed out earlier, longer voyages will increase to demand for vessels. Since GOGL is very dependent upon the Capesize market, iron ore import to China is going to be important. The market will get a boost from more bauxite from West Africa and the potential rerouting of some coal cargoes.

Our concern is that the good news is already priced in at this moment. Hence, we choose to downgrade our bullish call from a Buy to a Hold stance. Some of our readers might wonder why we had a Buy stance in our recent analysis on Star Bulk Carriers Corp. (SBLK). Why not downgrade them to a Hold?

We could be biased as we are long SBLK and not GOGL.

However, to our defense, we would state that SBLK is more diversified in size. Their merger with Eagle Bulk Shipping Inc. (EGLE) will also make them even larger in the mid-size bulk carrier market. That market is not dependent upon just two to three types of commodities. Sometimes the TCE rates for Supramax vessels even outshines that of the larger vessels.

As usual, we look forward to reader’s constructive comments as to what they think about the thesis.

Credit: Source link