adventtr

Is Pan American Silver Still A Buy? Earnings Breakdown

YCharts

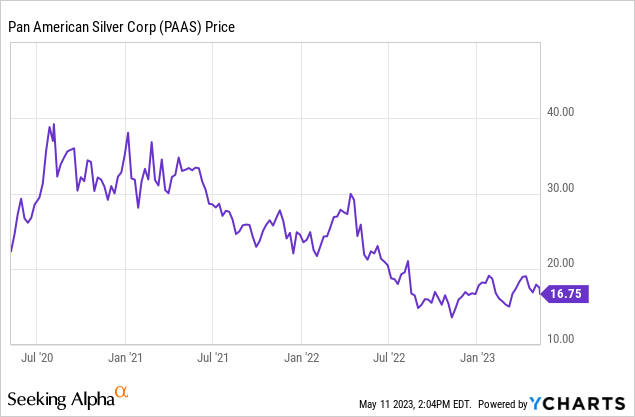

This is an update on Pan American Silver Corp. (NYSE:PAAS), whose stock I previously called a BUY on Feb. 28 at $14.71 per share. Since that coverage, the stock has had a nice rebound, with a 15.45% total return compared to the S&P 500’s (SP500) 3.8% gain. But is the stock still worth buying after that run-up?

Pan American just reported first quarter earnings that have been received as poor by the market, as indicated by the stock price’s 3% decline on Thursday. The headlines on Seeking Alpha read that its earnings and revenues both dipped from a year ago.

For example, its Q1 net income fell to $16.5 million, or $0.08/share, down from $76.8M, or $0.36/share, in the prior year’s quarter, while its revenues plummeted 11% to $390.3 million.

But did Pan American Silver really have that poor of a quarter, and is the stock worth selling? I actually think the market has gotten this one wrong, as earnings weren’t nearly as bad as they seemed. In addition, earnings and cash flow should improve substantially in the coming quarters following its acquisition of 4 producing mines from Yamana Gold Inc. (YRI:CA).

Pan American Silver Earnings Breakdown

It wasn’t a great quarter from Pan American, but it wasn’t nearly as bad as the numbers show. Yes, revenue and net income were down compared to last year. But there are a few good reasons for this.

First, its average realized prices of its metals produced were mostly lower. In particular, silver prices fell by 5.63%, while zinc prices collapsed 21.05%, lead was down 8.38%, and copper fell by 9.70%. Prices are looking better here in Q2, so earnings should naturally improve.

Second, its Manantial Espejo mine was placed on care and maintenance following the completion of mining at the end of 2022, and this was not an unexpected development. This led to lower production compared to the prior year.

Finally, its net earnings of $16.5 million, or $.08 per share, did include $18.9 million in transaction and integration costs related to the Yamana transaction and $12.7 million in severance provisions.

The positives from Q1

Here are what I think are the biggest positive results to come from the news release:

-

For one, while silver all-in sustaining costs rose slightly (5.09%) compared to the prior year’s quarter, its gold AISC fell by 25.59% to $1,196/oz.

-

Pan American’s financial position is looking pretty robust, ending the quarter with working capital of $827 million, and $425 million available under its $750 million revolving sustainability-linked credit facility.

-

While the company has $1.18 billion in debt, this was added as a result of the Yamana Gold transaction. And the rates and terms are very favorable: $500 million is due with a coupon of 2.63% maturing in 2031, and $283 million with a coupon of 4.625% maturing in 2027.

-

Pan American is one of the few silver miners that continues to pay shareholders a dividend, which I feel is sustainable. The company paid a quarterly dividend of $.10 per share, which gives its stock a current yield of 2.37%, among the highest in the industry.

Finally, and perhaps most importantly, Pan American’s results reported here only include its existing mines: La Colorada, Huaron, San Vicente, Manantial Espejo, Timmins, Shahuindo, La Arena and Dolores. They do not include the soon-to-be included Jacobina, El Peñón, Minera Florida & Cerro Moro mines in South America.

These mines add 111M ozs of silver and 13.7M ozs of gold to Pan American’s reserves, and, if included in this quarterly result, would have led to a 50% boost in silver production and a 100% gain in gold production, based on Yamana’s prior guidance. In total, the mines should increase annual silver production by approximately 9.5 million ounces and annual gold production by approximately 550,000 ounces.

Additionally, these mines are lower-cost assets compared to Pan American’s current mines. Last year, for example, the Yamana assets produced gold at a combined AISC of $981/oz, or ~$200 less than its current cost profile.

And, Pan American has also stated that the potential synergies from the deal are estimated to be US$40 million to US$60 million per year.

Keep an Eye on Escobal

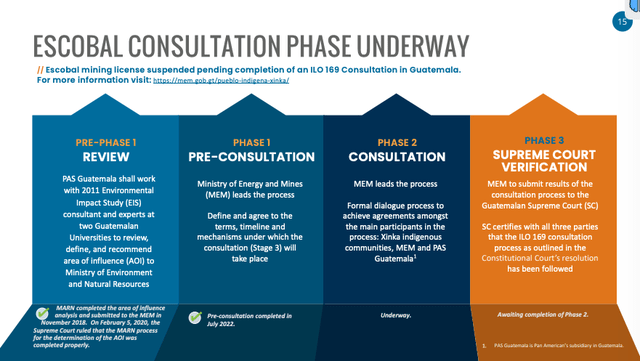

Pan American Silver

Pan American gave an update on its Escobal mine, which is a past-producing silver mine that had its production suspended years ago.

The company says that in Q1, it held two consultation meetings with

Guatemala’s Ministry of Energy and Mines and Xinka Indigenous community representatives, as part of its process, to advance the project back into production.

At this time, the company advises that no date has been set for a potential restart of operations at Escobal. But any positive updates on this asset in the future will likely have a big impact on its business.

Remember that Escobal’s prior operator, Tahoe Resources, invested well over $500 million to construct the mine. This is one of the world’s biggest silver deposits, with current reserves of 264 million ounces.

Prior to shutting down operations in 2017, the mine was extremely profitable, producing 20 million ounces of silver per year at all-in costs below $10 per ounce.

Pan American Silver: Things Will Get Better

This was not a great quarter, but not as bad as it seems, and I believe there are reasons to be optimistic about the company’s future. Although Pan American did see its net income and cash flow fall, that had more to do with metals prices and the shuddering of one of its mines – not its operational performance.

Finally, its financial and operating results do not yet factor in the acquisition of four producing mines from Yamana Gold, which I think will boost its results.

Also, potential future operations at the Escobal mine, one of the world’s largest silver deposits, could significantly impact the company’s profitability. While there’s no timeline for a re-start of operations, I think it’s a positive sign that the company is engaged in discussions with key stakeholders.

Therefore, while Q1 may not have been stellar, the future prospects for Pan American Silver Corp. remain bright, and the current market reaction may be short-sighted.

Credit: Source link