South_agency/E+ via Getty Images

Investment Thesis

inTEST Corporation (NYSE:INTT) serves the defense, aerospace, automotive, security, industrial, and life sciences industries by providing them with process and test solutions. It has reported a strong quarter despite economic downturns which reflects the healthy demand in the industry. I believe the long-term positive demand in its end markets can act as primary catalyst for the company in the coming period.

About INTT

INTT mainly focuses on supplying test & process solutions that are used in testing and manufacturing in various key markets such as defense, aerospace, automotive, security, industrial, and life sciences. It operates its business all around the globe covering major markets in North America, Europe, and Southeast Asia. The company generates 42.02% and 57.98% of revenue from the U.S. markets and foreign markets respectively. The company conducts and reports its business in three operating segments: Electronic Tests, Environmental Technologies, and Process Technologies. The Electronic Test segment mainly deals in manipulator products, docking hardware products, interface products, Acculogic scorpion flying probe test systems, and Acculogic BRiZ automated test and programming services. This segment contributes 34.42% to the company’s total revenue. The Environmental Technology segment deals in ThermoStream products, Thermal chambers, Thermal platforms, Thermonics products, and Ultra-cold storage solutions. This segment generates 25.83% of the company’s total revenue. The Process Technologies segment sells its EKOHEAT(R) and EASYHEAT precise induction heating equipment. Its customer base includes manufacturers in a variety of sectors, including aerospace, automotive, and semiconductor. This segment earns 39.75% of the company’s total revenue.

Financials

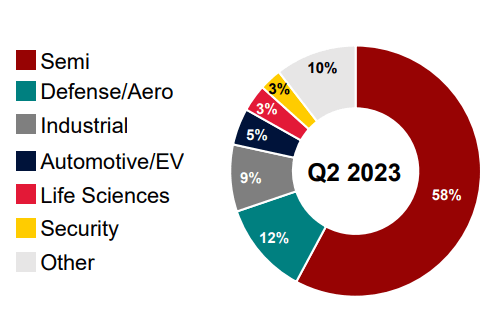

The Global Covid-19 pandemic disrupted the supply chain and led to a significant downturn in the semiconductor industry. The growth was also hampered due to continuing geopolitical issues and labor shortages. However, the demand has gradually rebounded in the industry as a semiconductor is one of the fundamental components used in many industries. According to Semiconductor Industry Association, global sales can be down this year followed by a strong rebound of 11.9% in 2024. I believe this positive long-term outlook can help the company to grow as it derived 58% of its revenue from the semiconductor industry. In addition, the aerospace and defense industry has gained significant momentum after the pandemic due to rising demand for air travel. This growth was also fueled by increasing military orders and new aircraft. Further, this growth is expected to rise in the future due to multiple reasons such as the growing usage of new technologies, changing business models, and the use of digital threads. The company’s orders from the defense/aerospace industry has increased by 70% YoY compared to last year’s same period which reflects the growing demand in the industry. The thermal test chambers and flying probe test tests reported a remarkable increase in sales as they are extensively used in various components to ensure functionality and quality.

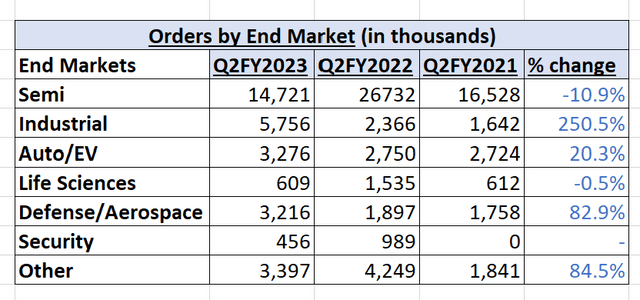

Orders by End Market (Value Quest)

We can observe in above chart that the company is experiencing a significant demand in end markets since last 3 years. INTT has experienced slight demand decline in semiconductors and life sciences market which is offset by demand growth industrial, defense & Aerospace and other markets. After reviewing INTT’s orders, I think the Q2FY23 confirms the demand in the end market is still strong.

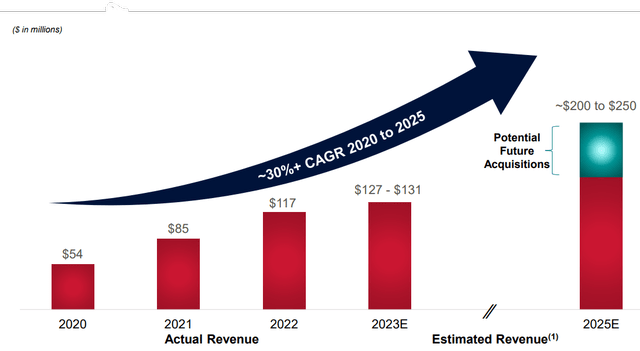

These rising demands in the end-market might act as primary growth catalyst for the company as it will help INTT to implement favorable pricing model which can help it to counter inflation and increase revenue & profit margins. I think the company is well-positioned in the market to cater to the increasing demand as it has a strong geographic presence which makes it competitive in the market. In addition, it is highly focused on strategic acquisitions to expand product portfolio and estimates that FY2025’s revenue to be in the range of $200 million to $250 million mainly driven by strategic acquisitions. It also has a growing customer base, access to diversified end markets, and financial flexibility which I believe can help it to serve large industry participants and further expand its contract margins. The company’s consistent growth is reflected in its strong results.

Revenue Trend of INTT (Investor Presentation: Slide No:11)

The company has recently reported its strong quarterly results. It has reported revenue of $32.55 million, up 10.1% compared to $29.57 million in Q2FY22. This growth was mainly fueled by an increase in sales of thermal test chambers and flying probe test sets. INTT has managed to beat the market’s revenue consensus by $0.53 million or 1.65%. Operating expenses increased by 8% from $10.82 million to $11.68 million due to increased investments in sales, engineering, and marketing. It reported a gross margin of 46.2%. It reported net income of $2.79 million which is rise of 32% YoY compared to $2.11 million in last year’s same period. The increased net income is equivalent to diluted EPS of $0.24. The company has exceeded the market’s EPS expectation by $0.01 or 3.7%. INTT reported $37.4 million in liquidity and total debt stood at $14.1 million.

The company’s growth was healthy in the second quarter. After considering the rising demand in end markets, I believe it can sustain its performance in the coming quarters as well. The company has also updated its third-quarter and full-year FY2023 guidance. For the full-year FY2023, it estimates revenue to be in the range of $127 million to $131 million. The anticipated gross margin is roughly 46%. Operating expenditures might range between $46 million to $47 million. Observing the current positioning and growth prospects of the company, I think the estimates are correct as demand can be strong in the end markets.

Q2 Revenue by Sector (Investor Presentation: Slide No: 4)

What is the Main Risk Faced by INTT?

Risk Associated with Chinese Market:

INTT sells & operates in China, therefore its earnings may be affected by its economic, political, legal, and social factors. Recently, the Chinese economy has grown rapidly and inflation has been high. These considerations have pushed the Chinese government to take remedial steps to limit credit, manage growth, and control inflation. Future factors may force the Chinese government to regulate credit or prices or take other measures, which could slow economic activity in China and hurt the company’s product market.

Dependency on Semiconductor Market:

INTT generates a large portion of its revenues from the semiconductor industry. Its sales volume highly relies on the cyclicity of the semiconductor industry. The demand highly fluctuates depending upon the capital expenditures by the semiconductor manufacturers. These capital expenditures keep changing according to the projected market demand for semiconductors. If capital expenditures are reduced, it can negatively impact the company’s operating results by contracting its profit margins and sales volume. Mostly capital expenditures increase during economic downturns and increase when there is a need for expanded production capabilities due to rising demand.

Valuation

INTT has delivered strong financial results and I believe it can sustain its performance in the coming quarters as a result of positive industry trends and its strategic expansion plans. After observing the Q2FY22 result and rising demand in the end markets, I estimate that the revenue for FY2023 might be $131 million. The company has maintained net income margin of 8.7% in the first half of FY2023. I believe the company can maintain the net income margin of 8.7% in the second half of FY2023 as well because we can observe that despite rising operating expenses, the company’s net income has drastically increased which indicates that it can pass on rising inflation and has favorable pricing. Therefore, I am estimating net income margin of 8.7% for FY2023 which gives net income of 11.4 million or EPS of $1.05.

After dividing a current share price with EPS of $1.05 we get forward P/E ratio of 15.78x. The comparison of the forward P/E ratio of 15.78x with the sector median of 19.57x, indicates that the company is undervalued. I believe INTT might grow in the coming quarters as result of strong demand in end markets and its expansion plans which can help it to trade at its sector median. Therefore, I forecast INTT can trade at P/E ratio of 19.57x in FY2023, giving the target price of $20.55, which is 24.01% upside compared to current share price of $16.57.

Conclusion

INTT is experiencing healthy demand which is reflected in its strong financial results. I believe it can sustain this performance in the coming quarters as the semiconductor and aerospace & defense industry are gaining significant momentum which represents majority of its revenue sources. However, the company is exposed to the risk of cyclicity which can reduce its profit margins. The stock is undervalued and we can expect healthy 24% growth from current price levels as result of favorable industry trends. Considering all these factors, I assign a buy rating to INTT.

Credit: Source link