Wasan Tita

There is no question that current dynamics have been favorable for insurers. With the world experiencing increased uncertainty, including inflationary pressures, geopolitical instability and extreme weather conditions, demand for risk protection has been on the rise, leading to higher premiums across the insurance market.

While we have seen many insurers benefiting from this backdrop, one name that stands out for me is International General Insurance Holdings (NASDAQ:IGIC), a specialty insurance company where we can find a combination of strong growth and profitability, but still trading at low valuation multiples.

Although there are challenges ahead, I see IGIC as a compelling alternative for investors as the outlook remains overall positive for the insurance industry for the foreseeable future.

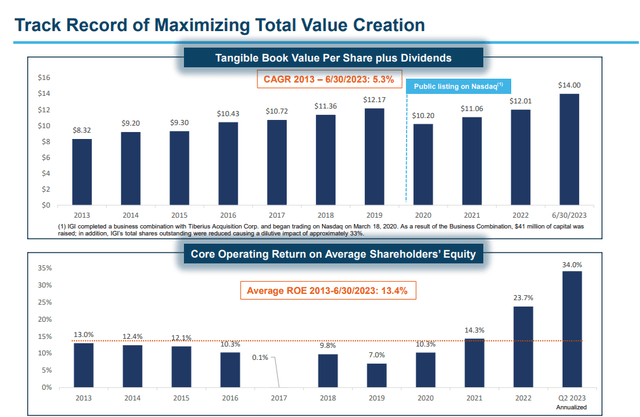

Book Value Growth, Strong ROE

Over the last ten years, IGIC has generated consistent book value growth, a key measure to gauge shareholder value creation by an insurance company. The figure below just illustrates that, where we see tangible book value per share plus dividends increasing by a compounding annual growth rate of 5.3% since 2013.

IGI Investor Presentation Q2 2023

During the same timeframe, IGIC’s profitability has also been quite good, with ROE at nearly double digits in 8 out of 10 years. It is also noticeable that since 2022 ROE has increased sharply, as the company has benefited from higher premiums in the insurance industry.

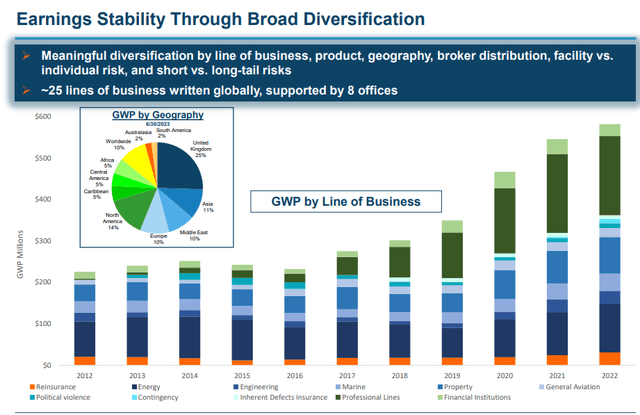

Another positive here is that IGIC has been able to maintain a fairly diversified portfolio across a handful of lines of business and geographies, limiting risk exposure in each business segment, as we can see below by the broad distribution of gross written premium.

IGI Investor Presentation Q2 2023

Q2 2023: A Stellar Quarter

It was a strong quarter for IGIC, the company delivered gross written premium growth of more than 10% over a year ago, totaling $199.6 million in the quarter, and accumulated an increase of over 21% in the first-half of 2023, driven by higher rates on renewal business. Another positive contribution came from the reinsurance treaty business, which expanded nearly 40% over a year ago.

These elevated premiums gave a boost in the profitability, leading to a combined ratio of 73.5% in the second quarter and 75.7% for the first-half of the year, levels substantially lower compared to the historical average of 87% over the past 10 years.

High interest rates have also benefited IGIC’s investment performance, as net investments income came at $ 14.4 million, with an annualized yield of 3.9% in the quarter and 3.7% in the first-half, up 1.7 points from a year ago.

These improvements, combined to slightly higher G&A expenses, led to core operating income of $40.5 million in Q2, up 84% compared to $22.0 million last year, and $89.8 million in the first-half, up 68% over a year ago.

As a result, annualized return on equity improved 12.6 bps in the quarter to 36.1%, and for the first-half, return on equity was 33.9%, up 10.5 bps from a year ago, while book value per share improved over 20% to $10.91.

In summary, IGIC delivered strong profitability in the quarter, leading to metrics, such as combined ratio and ROE, at considerably better levels than historical patterns for the company.

Healthy Outlook, But Long Term Remains Mixed

To be sure, fundamentals in the insurance industry have been constructive and are likely to remain unchanged for the most part in the foreseeable future, as forces behind this hardening insurance market, in my view, seem not transitory.

Therefore, IGIC’s overall optimistic view appears well grounded. The company continues to see healthy submission flow, which provides an opportunity to be more selective in the risk analysis for new business.

Net rates in the short tail segment have increased in most business lines. In the treaty reinsurance business, cumulative net rate has improved by as much as 27% in the second quarter, led by the increased rate environment. While the reinsurance business accounts for just 13% of total IGIC’s portfolio, it is a segment that IGI intends to scale up over time as long as favorable conditions remains in place.

On the flip side, the backdrop for the long tail segment remains mixed, as we have seen in previous quarters, reflecting competitive and pricing pressures in several business lines and geographies. For context, the company reported margin compression in DNO and financial institutions, while professional indemnity in UK saw net rate increases above 3%.

That said, it seems plausible to me that we continue to see gross written premium growth at high-single digits, driven by the strong momentum in the short tail segment. On the bottom line however, we may see ROE at more reasonable levels below 20%, while still above the historical average of 13%, as rates may pullback a bit after increasing sharply over recent quarters.

IGIC Is A Quite Undervalued Stock

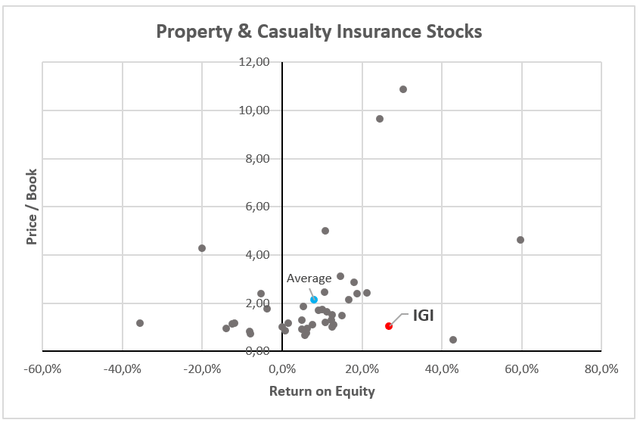

Even after climbing nearly 40% this year, handily outperforming most insurance stocks, that rose 11% on average, shares of IGI are trading at lower valuation multiples, taking as reference Price/Book ratio, a very common multiple to gauge the valuation of financial stocks, such as banks and insurers.

Currently trading at a Price/Book of 1.03, shares of IGIC are well below the average of property & casualty insurance stocks of 2.12. Such valuation gap seems even more pronounced when we include a profitability metric like ROE in the analysis.

As we can see below, IGIC appears at the bottom of the Price/Book versus Return on Equity chart, as its Price/Book is relatively lower relative to the peer group. Besides, IGIC is also dislocated in terms of ROE, as its TTM ROE in the neighborhood of 25% is much higher than the peer group average of nearly 8%, which suggests a sizable upside to shares of IGIC.

Seeking Alpha, consolidated by the author

IGIC’s dividend yield of only 0.35% may have some influence on company’s valuation, as many insurers have dividend yield above 2% or 3%. However, in my view, this alone should not justify such a large discount on current prices.

Therefore, while IGIC is still a largely underfollowed name, I believe that its financial performance will be gradually factored in the stock prices over time, as the company continues to show consistent results, even with ROE at more reasonable levels.

In summary, I see IGIC as a good name to hold in the long run. However, I would take a more cautious view in the short term, as investors with shorter time horizon may be subject to a sharp selloff in a more risk-off environment, given the sharp rally seen this year, or due to adverse events involving catastrophe insurance claims, for instance.

Credit: Source link