Matteo Colombo

If you take a cursory glance at Interactive Brokers (NASDAQ:IBKR) as a company, it can be a little difficult to tell what’s going on from a high level.

Due to an accounting quirk that has to do with the large chunk of shares that are insider-held, by some measurements, the company either looks incredibly expensive, or incredibly cheap. Is the Market Cap $12 billion, or $48 billion? Do diluted EPS figures mean anything? Finding out the true state of the firm can take some digging.

However, once you cut back the numerical underbrush, an impressive picture emerges. IBKR, which runs a straightforward discount brokerage business in a large number of global markets, is performing well due to its low fixed cost base, strong customer experience, and a wide selection of products.

With an incredibly strong profitability profile, a reasonably priced stock, and a number of avenues for future growth, IBKR appears to be an attractive looking opportunity in the market, even when taking the recent run-up into consideration.

While critics may think that the surge in NIMs that have powered recent earnings could be set to drop in the future when rates go down, we’re less concerned about this eventuality given the broader tailwinds that are behind retail trading on the whole.

Today, we’ll be breaking down the company, its prospects, and the stock itself to explain why we think that IBKR is one of the most under-discussed GARP gems on the market today.

Sound good? Let’s jump in.

The State Of Interactive Brokers

As we just alluded to, depending on what information you’re looking at, it can be tough to get a handle on IBKR’s overall profile due to an accounting quirk that relates to the company’s unique ownership structure.

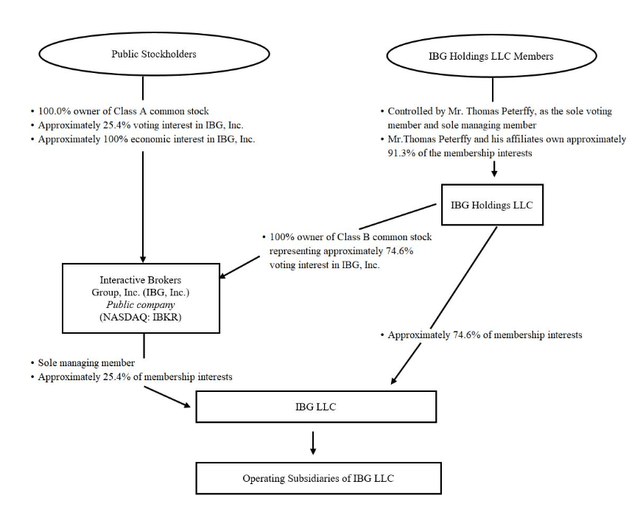

For reference, here’s a diagram that explains the setup:

10K

We think this diagram is actually a bit more complicated than necessary, but what you need to know is that the public company, IBKR, owns and operates IBG LLC, which is what conducts all of Interactive Brokers’ global business.

74.6% of the public IBKR stock is controlled by the founder, Thomas Peterffy, though a dual-class share structure. As a public investor, you have access to the ‘A’ shares, which comprise 25.4% of the total equity, and the founder controls 74.6% of the company through ‘B’ shares, which are 100% owned by his LLC.

Overall, this structure doesn’t have an impact on investors, as the profits and interests of this majority shareholder and you, the public shareholder, are completely aligned. In that way, it’s possible to completely ignore this arrangement when investing in the company.

However, because this arrangement does cause NIA to drop substantially, it can be easy to come to the conclusion that the company is wildly overpriced or underpriced.

Here’s the reality – the company has a Market Cap of $48 billion. ~$12 billion of these shares are publicly traded, and the remaining $36 billion in ‘B’ class shares are not.

In 2023, IBKR did $4.3 billion in revenue. With a market cap of $48 billion, this gives the stock a 2023 Price / Sales of roughly 11.1x, which is quite expensive for a financial firm.

Much of this can be explained away by IBKR’s high level of profitability, though.

In 2023, IBKR was able to keep $2.8 billion of the $4.3 billion in revenue as net income, which is very impressive. This gives the firm 2023 price/earnings of 17.1x, which is more in line with what you might expect from a brokerage company of this size.

Earnings Growth

Now that we’ve got a handle on where the company is, let’s take a closer look at the underlying profitability profile.

For its part, the company consistently boasts about the low cost, automated trade execution platform that it has built for multiple asset classes across numerous global geographies:

Since our inception in 1977, we have focused on developing proprietary software to automate broker-dealer functions. The proliferation of electronic exchanges and market centers has allowed us to integrate our software with an increasing number of trading venues, creating one automatically functioning, computerized platform that requires minimal human intervention.

We specialize in routing orders and executing and processing trades in stocks, options, futures, forex, bonds, mutual funds, ETFs and precious metals on more than 150 electronic exchanges and market centers in 34 countries and 27 currencies seamlessly around the world. The ever-growing complexity of multiple market centers across diverse geographies provides us with ongoing opportunities to build and continuously adapt our order routing software to secure excellent execution prices.

To their credit, this does appear to be a massive competitive advantage for the company.

In an era where other brokerages have had to slash prices to zero to compete, and many have been acquired to avoid a slow decline into chapter 11 (including TD Ameritrade and E*TRADE), IBKR has been able to thrive. Why? Because many clients still pay commissions at IBKR in order to access the company’s exclusive routes, which actually save money, net, per order, due to execution quality.

Looking at IBKR’s income statement, in 2023, the company made $1.5 billion in commission revenue, and only spent $383 million to clear and execute those trades. This is a far cry from other brokerage companies, that have very thin margins.

For example, U.S. competitor Robinhood (HOOD) did $785 million in commission revenue in 2023, but spent $1.5 billion on ‘cost of services provided’, which is rather negative on a unit basis.

Net of everything, including NIMs, the company makes 65% net margins, which is very good, given the landscape for brokerage these days.

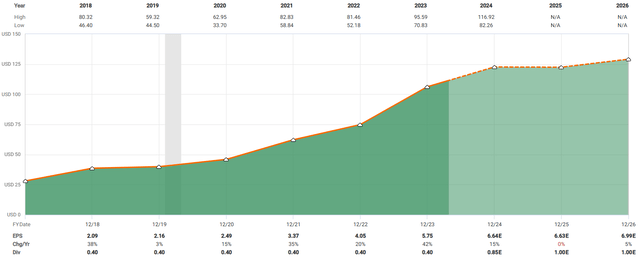

Looking ahead, earnings are expected to grow more modestly than they have in the past, at around 5% over the next three years, which is in line with our expectations:

FAST Graphs

Some think that NIMs will head back down as rates rise, but we expect that the impact will be muted. Many of the new clients the company has brought on in the last several years are likely to remain with the firm, and as rates head down, we expect that the markets will stay ebullient, which should drive more trading and higher commissions for IBKR. This is the benefit of a self-hedging, multipronged business model.

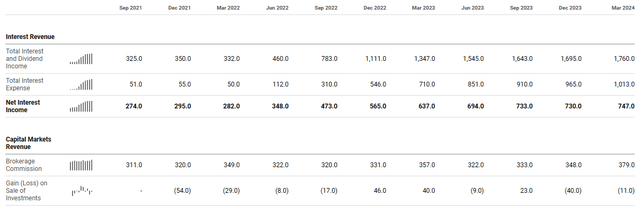

The company’s recent Q1 earnings report showcased this dynamic, as NIMs remained mostly flat, but commission revenue increased significantly towards $380 million:

Seeking Alpha

We expect this situation to continue in future reports.

The Valuation

But how much is the company worth?

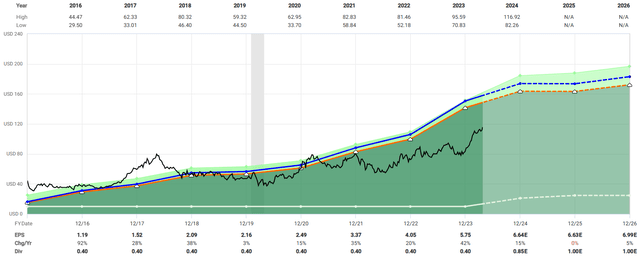

Right now, IBKR as a whole is worth $48 billion, as we mentioned earlier. This represents a P/E in the 19x range, which may appear expensive. However, when looking back over the last few years, we find this valuation very historically reasonable, given that the company’s typical multiple has been in the 17x – 25x range:

TradingView

This would appear to give shares considerable room for margin expansion back to the mean as EPS continues to grow, which could produce sizeable returns over the coming years.

If this dynamic plays out, we think shares could see upside towards $160 and beyond:

FAST Graphs

This would represent a solid annualized RoR of 16% through the end of 2026 for investors.

Risks

How could this go wrong?

In our eyes, some of the risk here is in the cyclicality of rates. If NIMs do end up dropping more than expected, or more quickly than expected, as rates decrease, that could dent revenue, which would hurt net margins and the overall profitability picture.

Additionally, the stock has performed well, which leads to questions around technical sustainability. If the market sees shares as overbought, then no matter the future earnings potential, there could be pullback risk inherent to investing in IBKR at this precise point in time.

Finally, all of the operational risks inherent in brokerage could also disrupt things, if they flare up. An outage, erroneous orders, or other glitches in the system could cause the firm to lose reputation, which would hurt the bottom line significantly.

Summary

That said, we like the profile of IBKR in the market right now. Shares appear reasonably priced, and EPS is expected to continue to grow for the foreseeable future on a low fixed cost base.

Sure, there’s some risk here when it comes to rate cyclicality, but the valuation, at the lower end of the historical range, ameliorates this concern considerably.

We think the stock could see $160 per share over the next few years, which has ultimately led us to rate the stock a ‘Buy’.

Cheers!

Credit: Source link