Andrii Yalanskyi

A couple months ago I wrote an article about the iShares Interest Rate Hedged Corporate Bond ETF (NYSEARCA:LQDH). LQDH invests in investment-grade bonds, and hedges its rate risk through interest rate swaps. The iShares Interest Rate Hedged Long-Term Corporate Bond ETF (NYSEARCA:IGBH) does the same but focusing on longer-term bonds. Doing so results in marginally higher yields and returns for IGBH, an important benefit for shareholders. Doing so should result in higher rate risk too, but the swaps hedge out all the risk. IGBH seems like a marginally stronger investment opportunity than LQDH and is a buy.

IGBH – Overview and Analysis

Index and Portfolio

IGBH is an interest rate hedged long-term corporate bond ETF.

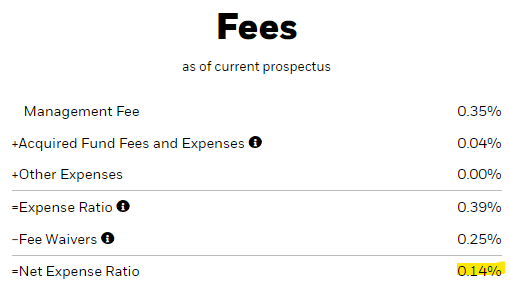

IGBH’s long-term corporate bond exposure is gained through an investment in the iShares 10+ Year Investment Grade Corporate Bond ETF (NYSEARCA: IGLB). IGLB is administered by BlackRock too, with the company waiving a significant portion of IGBH’s fees. This results in a 0.14% expense ratio for the fund, below-average for a niche index ETF. As such, investors do not have to worry about excessive fees, which are quite common for fund of funds.

IGBH

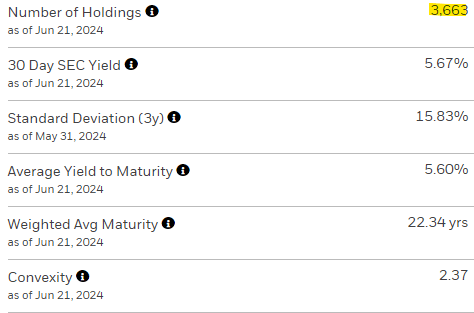

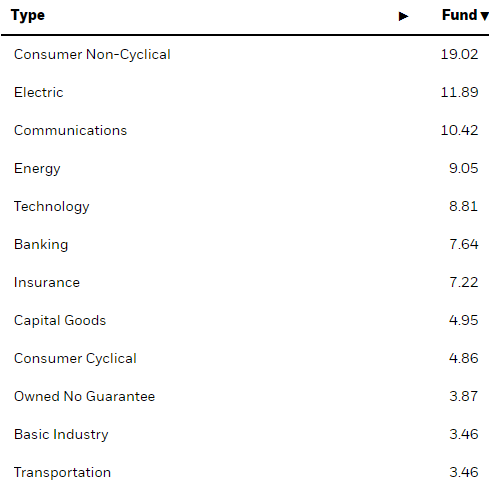

IGLB is an incredibly well-diversified fund, with investments in 3,663 different bonds from most relevant sectors. IGBH provides indirect exposure to these same securities, and so is as diversified as IGLB.

IGBL IGBL

Diversification reduces risk, volatility, and the magnitude of losses from the default of any individual issuer. IGBH is less diversified than the largest, broadest bond ETFs, including the benchmark Vanguard Total Bond Market Index Fund ETF (BND). Focusing on long-term bonds somewhat increases risks, insofar as these could plausibly underperform broader bond indexes. No real catalyst for this to occur right now.

Dividend Analysis

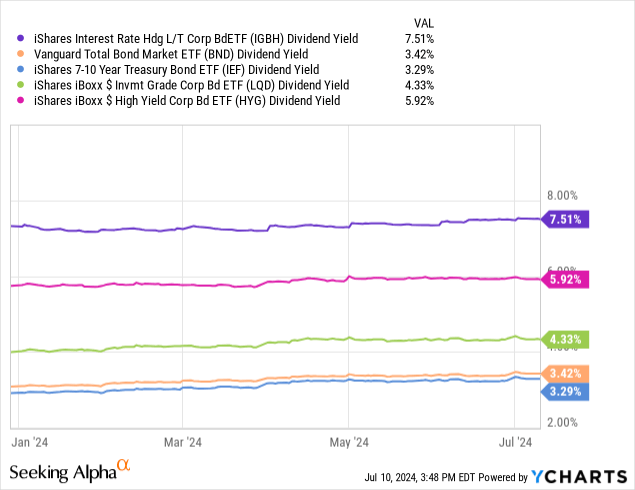

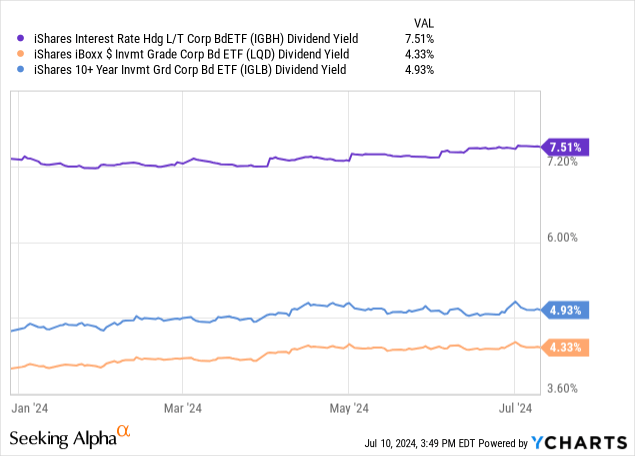

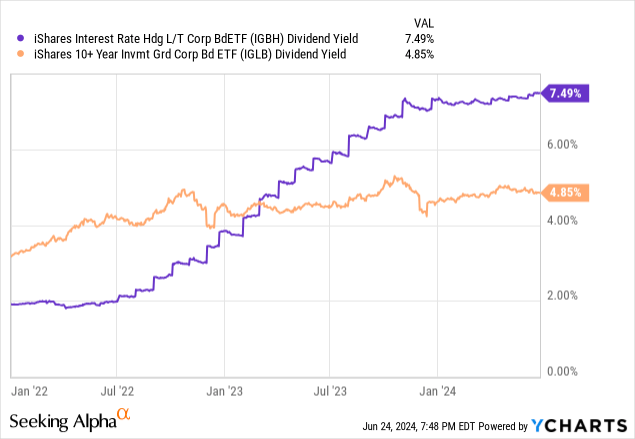

IGBH sports a 7.5% dividend yield, quite strong on an absolute basis, and higher than that of most bonds and bond sub-asset classes.

IGBH also sports a higher dividend yield than most investment-grade bond ETFs, including LQD, the largest, and IGLB, its unhedged counterparty.

IGBH’s investment-grade bonds and interest rate swaps both generate income.

IGBH’s investment-grade bonds generate around 4.5% – 5.2% in income, as per IGLB’s dividend yield and SEC yield, and accounting for current portfolio weights.

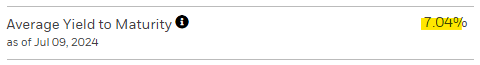

IGBH’s interest rate swaps generate somewhere around 2.0%, from subtracting the above from the fund’s yield to maturity. Said metric should include both sources of income above, so the subtraction should give us the income from its swaps.

IGBH

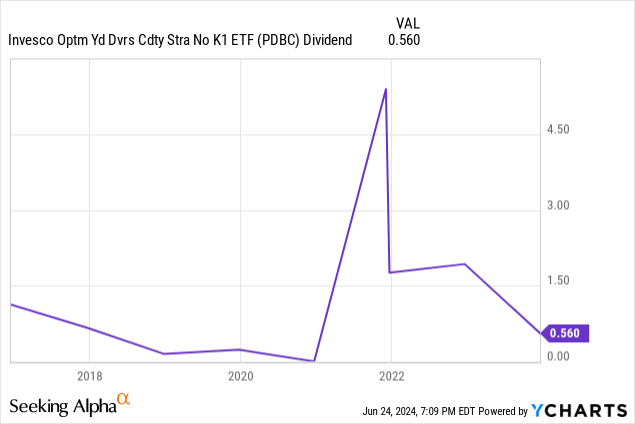

Considering the above, it seems that the fund’s dividends are mostly, but not fully, covered by underlying generation of income. It generates somewhere around 7.0%, as per its yield to maturity, but pays out 7.5%. The shortfall is not massive and could have been caused by normal ETF dividend volatility. ETFs are generally required to distribute gains from derivatives to shareholders. Interest rate swaps might be included, which might explain the (slightly) excess distributions.

As an example of the above, commodity ETFs sometimes have massive distributions, with these coinciding with periods of higher commodity prices. The same might be happening with interest rate swap ETFs, although to a much lesser extent.

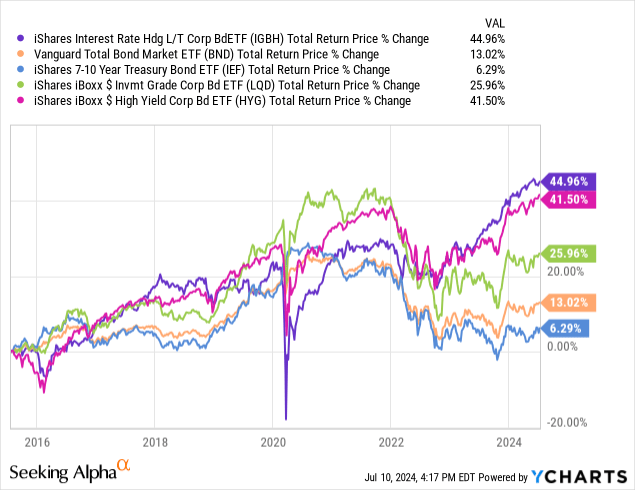

Data by YCharts

In any case, IGBH sports a 7.5% dividend yield, and a 7.0% yield to maturity. In my opinion, the 7.0% figure is more pertinent, and more indicative of the returns that investors should expect moving forward.

Credit Risk Analysis

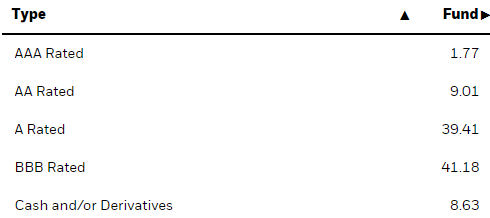

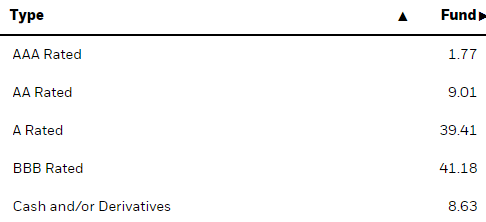

IGBH focuses on investment-grade corporate bonds, issued by comparatively safe companies with solid balance sheets and financials. Right now, the fund seems evenly split between A-BBB bonds, with some investments in higher-quality bonds.

IGBH

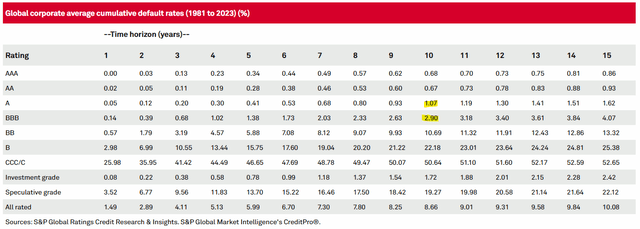

Default rates for the bonds above are quite low, with 10y cumulative default rates of 1.1% for A-rated bonds, 2.9% for those rated BBB. Annual default rates would be in the 0.1% – 0.3% range. Defaults rates do increase when economic conditions worse but remain low throughout the cycle.

S&P

IGBH’s strong credit quality is an important benefit for shareholders, especially considering rising default rates and tighter credit spreads. Conditions seem particularly bullish for investment-grade bonds right now, and that means IGBH and similar funds.

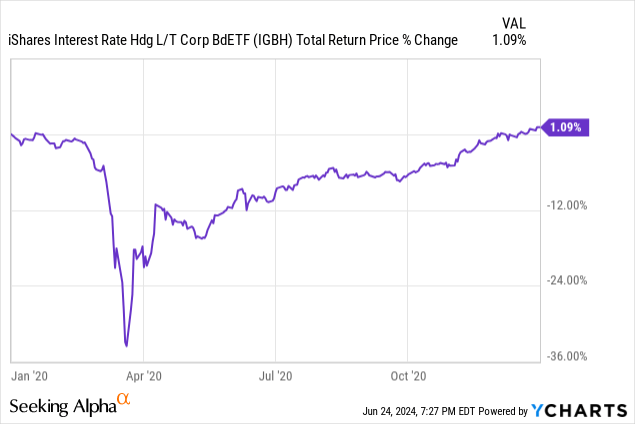

Besides the above, IGBH’s strong credit quality should decrease losses during downturns and recessions. Losses were quite brutal during early 2020, the onset of the coronavirus pandemic, and the most recent recession. IGBH significantly underperformed expectations, at least relative to its credit quality.

Data by YCharts

The above is due to the fund’s interest rate swaps, which brings me to my next point.

Interest Rate Risk

IGBH’s interest rate swaps effectively eliminate the fund’s interest rate risk or duration, as previously mentioned.

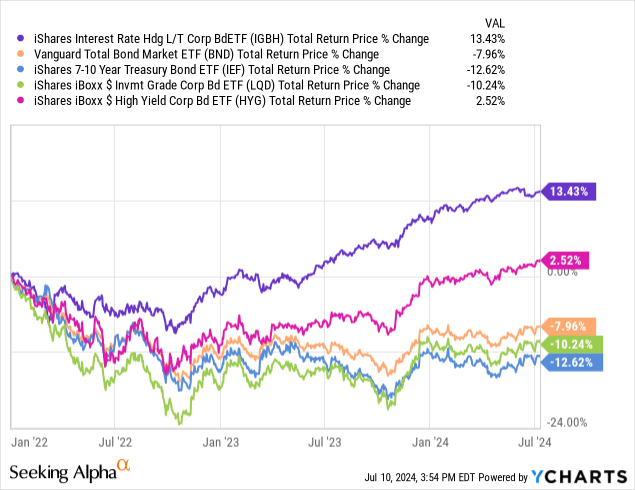

Due to the above, the fund should outperform when rates rise, as has been the case since early 2022.

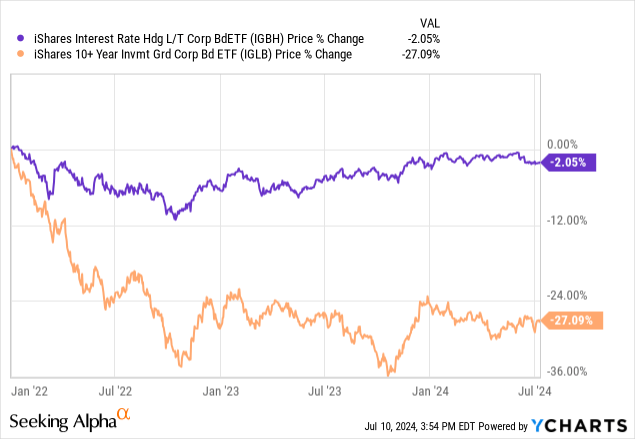

Outperformance is partly due to fewer capital losses, as the swaps see capital gains when rates rise. IGBH’s share price is down 2.1% since early 2022, compared to 27.1% for IGLB. Losses were much lower, as expected.

Outperformance is partly due to dividend growth, as the swaps generate more in income as rates rise. IGBH’s dividends have seen much faster growth since early 2022, as expected.

Data by YCharts

Flipside of the above is that IGBH’s swaps should post losses (or lower gains) as rates decrease, which should lead to underperformance. The Federal Reserve tends to cut rates during downturns and recessions, hence the fund’s underperformance during the pandemic. These losses were not due to excessive credit risk. Although this is little consolation to investors, it is still an important fact to consider.

IGBH’s low duration should lead to outperformance when rates increase, underperformance when these decrease, but this is not a certainty. Bond prices and interest rates are impacted by many factors and are not simply or fully a function of Fed policy. Expectations matter, as does investor sentiment, inflows and outflows, and broader economic conditions.

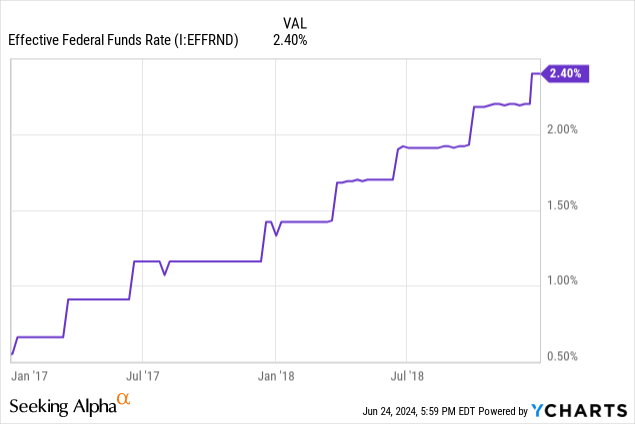

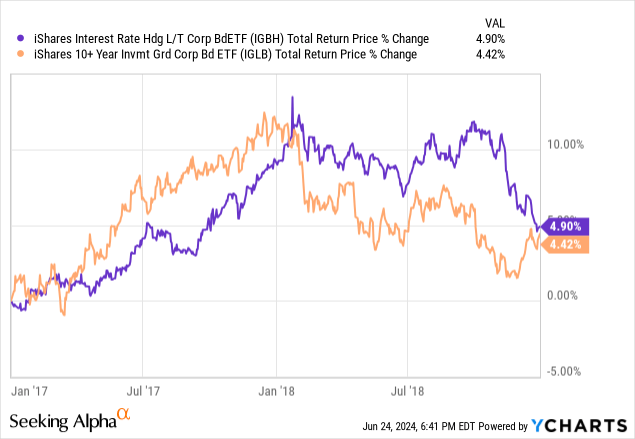

As an example, the Fed last hiked rates from early 2017 to late 2018:

Data by YCharts

During which IGBH marginally outperformed, contrary to expectations.

Data by YCharts

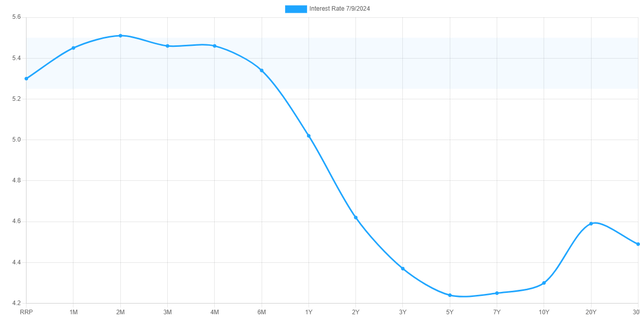

The above was almost certainly due to investor expectations / hikes being priced-in. In my opinion, current conditions are such that IGBH could outperform during this next hiking cycle, as was the case during the prior one. The market already expects several rate cuts and is pricing bonds accordingly, as evidenced by the futures market, and the inverted yield curve. Much will depend on Federal Reserve policy and investor sentiment, however.

U.S. Treasury Yield Curve

The issues above somewhat complicated and, perhaps, hard to parse. I would summarize the situation thus. IGBH outperforms when rates rise, underperforms when these decrease. Right now, the breakeven point is isn’t at zero, but at around 2.0% – 2.5% in Fed cuts. This is my reading of the situation, although off course the market has the final say.

Performance Track-Record

IGBH’s performance track-record is quite strong, with the fund outperforming most bonds and bond sub-asset classes since inception. Returns seem somewhat consistent, with the fund somewhat outperforming pre-pandemic, significantly outperforming since 2022. In my experience, some hedged or variable rate ETFs performed much worse pre-pandemic, but IGBH performed fine.

IGBH’s returns moving forward are strongly dependent on Fed policy. Right now, returns should average 7.0% – 7.5% per year, as per the fund’s dividend yield and yield to maturity. Federal Reserve cuts will almost certainly decrease returns in the coming months / years. Under current Fed guidance, returns in the 3.0% -5.5% range seems reasonable.

IGBH versus LQDH – Quick Comparison

IGBH is quite similar to LQDH, so thought a quick comparison was in order.

Both ETFs focus on investment-grade bonds and hedge their interest rate risk.

IGBH focuses on long-term bonds, LQDH on medium-term bonds. As both funds hedge their rate risk, this has no effect on their duration or rate risk.

IGBH is a bit cheaper, with a 0.14% expense ratio versus 0.23% for LQDH.

IGBH has a lower yield, of 7.5% compared to 8.6% for LQDH. IGBH has a higher yield to maturity, of 7.0% versus 6.7%. In my opinion, and based on my understanding of these ETFs, the yield to maturity metric is more informative, with LQDH’s higher dividend yield being due to vagaries in ETF distribution requirements and realization of gains.

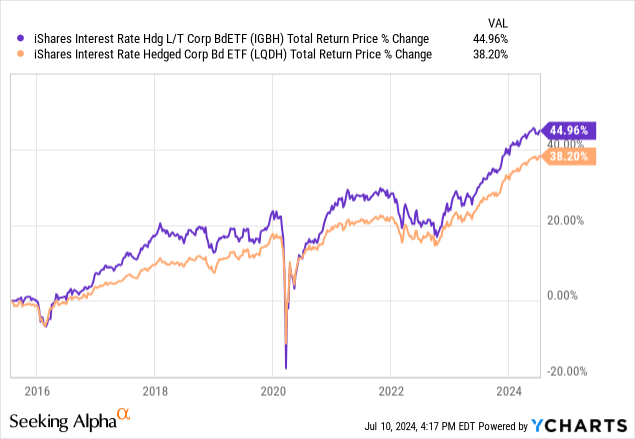

IGBH’s higher yield to maturity should lead to slightly higher long-term returns, as has been the case since inception.

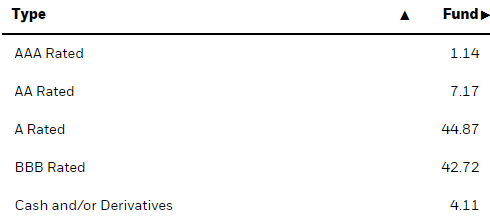

Credit risk seems about the same. Compare IGBH:

IGBH

with LQDH:

LQDH

Long-term bonds arguably have a bit more credit risk than investment-grade bonds, as quality issuers rarely go bankrupt in a short amount of time. As an example, Apple (AAPL) could not plausibly go bankrupt in 12 months, not with a $162 billion cash pile. It could, perhaps, go bankrupt in 12 years, if revenues crater and it starts hemorrhaging cash.

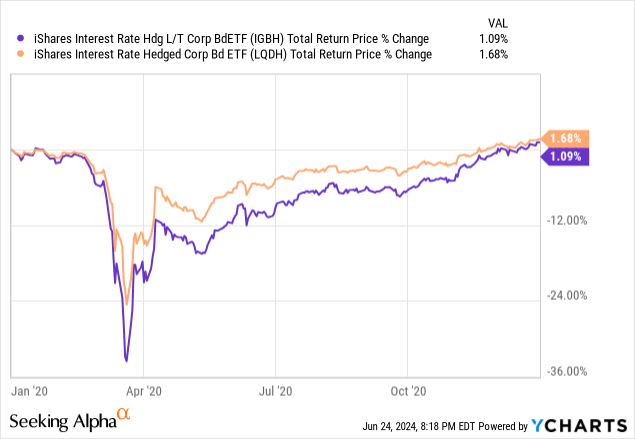

Due to the above, IGBH might see somewhat higher losses during downturns and recessions. IGBH saw double-digit underperformance during the pandemic, somewhat underperforming expectations (I certainly do not expect these issues to be that impactful). Underperformance was short-lived, with the fund almost completely recovering by late 2020.

Data by YCharts

In my opinion, IGBH’s slightly higher yield to maturity make it a superior investment opportunity than LQDH. Both remain similar choices, however.

Conclusion

IGBH’s strong 7.5% dividend yield, good performance track-record, and low rate risk, make the fund a buy.

Credit: Source link