nopparit

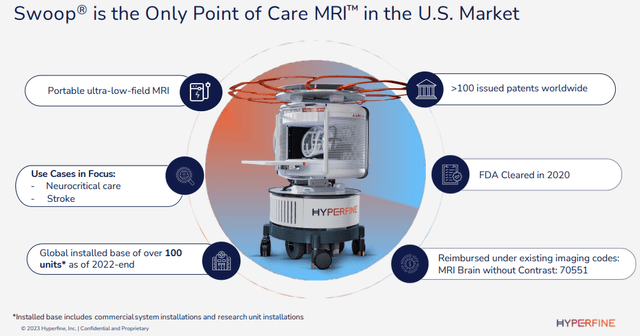

Hyperfine (NASDAQ:HYPR) is aiming to ‘democratize’ access to MRIs with the help of selling a bedside, low-energy MRI scanner called the Swoop. This is an invention of serial inventor and company founder Dr. Jonathan Rothberg.

The Swoop has the potential to make MRI scans, a critical diagnostic tool, available to a much wider patient population, given the cost attached to conventional scanners.

In rich countries, it is not marketing the Swoop as an alternative to conventional scanners, but as a complement, given the large number of advantages attached to the device.

HYPR IR presentation

The company already has 100+ devices placed, a quarter of which with the help of the BMGF (Bill and Melinda Gates) Foundation, which also:

- Provides a global network of specialists working with their development team.

- After the close of Q1 they offered a new $3M grant, the third one, for improvements in the Swoop and funding for clinical research on the neural effects of malnutrition of infants and young children in developing countries.

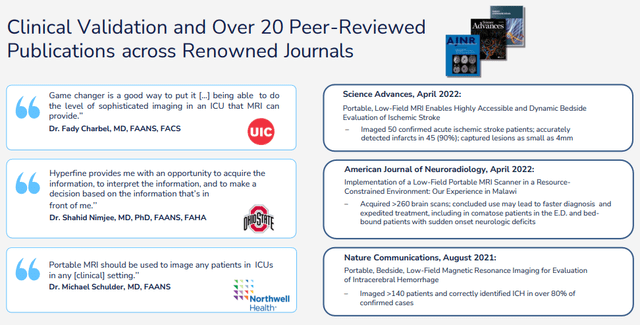

There is a wealth of clinical validation:

HYPR IR presentation

And the company is still adding to this as it’s one of their three pillars that guides their action (the others are innovation and commercial success). The company is working with leading US and international institutions on multiple studies, for example:

- The next important one is the ACTION PMR study which is enrolling patients already to evaluate the Swoop in acute stroke patients.

- Enrollment is already completed in the HOPE PMR study, “a 150-patient observational multicenter study imaging pediatric hydrocephalus patients with a Swoop System. Hydrocephalus is the accumulation of too much fluid in the brain, and children with this neurological disorder need to be scanned frequently over many years. MRI is a very desirable gating modality to prevent frequent exposure to radiation using CT.” (Q2CC).

- The SAFE MRI ECMO study evaluates the Swoop for patients on extracorporeal membrane oxygenation or advanced life support where it’s likely the Swoop offers brain imaging which would otherwise not be available.

- A large new opportunity is AD (Alzheimer’s Disease) with recent drugs requiring frequent MRI scans which the Swoop could be able to perform at a fraction of the cost.

Advantages

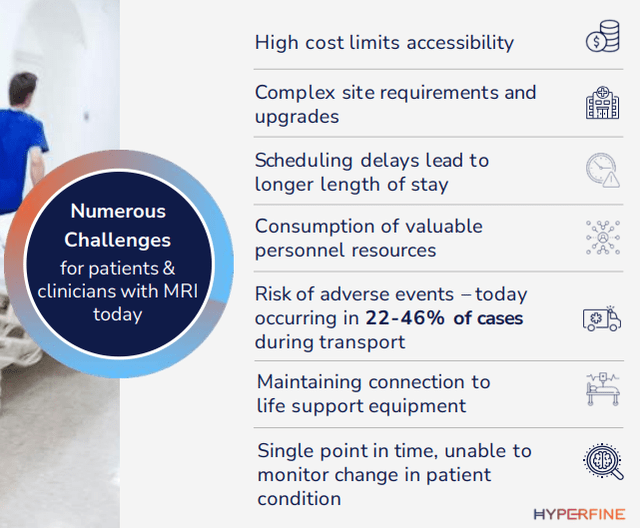

While conventional MRI scanners are great diagnostic tools, they also come with a number of downsides:

HYPR IR presentation

Many of these can be addressed by the Swoop. Below is a quick list of the main advantages, and there is a wealth of additional detail in the 10-K and the March/23 IR presentation. We’ll just summarize the most important ones:

- Cost; the Swoop is an order of magnitude cheaper than a conventional MRI scanner and doesn’t need a specialist facility or specialist people operating the device.

- Ease of use; no specialized operators necessary, control via tablet or smartphone producing standardized imaging feeding directly into hospital systems.

- Ultra-low magnetic force field significantly reduces safety concerns and the length of necessary pre-safety checks.

- Bedside; 37% of patients are anxious while others are in too critical a state to be moved. The Swoop enables earlier treatment and faster discharge.

- Free up capacity for full-scale MRI scanners.

- No harmful radiation (like PET, X-ray) so multiple uses are possible, enabling the monitoring progress of conditions and treatment.

- Better soft tissue contrast compared to PET scans.

- 55%+ workflow reduction, reducing the average 11.7-hour conventional MRI process to 0.5-5.3 hours (per 10-K and see the IR presentation for detailed steps).

- Motion correction software; see below

- Attractive ROI.

- AI, diagnostics system

- Standardization of images

On the motion correction, here is the 10-K:

Conventional MRI scans regularly suffer from quality problems due to patient motion, with approximately 30% of all scans from inpatient or emergency department exams having moderate or severe image quality issues. We have developed motion compensation technology to improve image quality in the most challenging, and often most in need, patients that received FDA clearance for clinical use. We believe that with continued development, our technology can produce diagnostic scans without requiring the operator to make expert adjustments to the scanning procedure due to typical patient movements.

90% of the world population doesn’t have access to MRI, simply a matter of cost. For starters, there are the MRI devices themselves, which can cost up to $3M a piece (and additional service contracts on top).

Then, there are the dedicated facilities and personnel necessary to operate it, consider for instance this, from the 10-K:

Conventional MRI scanners are permanently installed in a special room where the walls, floor, and ceiling are encased in copper or aluminum to provide an environment for conventional MRI machines to operate, in which all man-made and natural electromagnetic interference is prevented from entering. Installation of these shielded rooms typically costs more than $100,000.

Hyperfine has solved that issue. Their Swoop portable MRI scanner works on proprietary, patented noise-cancellation technology.

Market opportunity

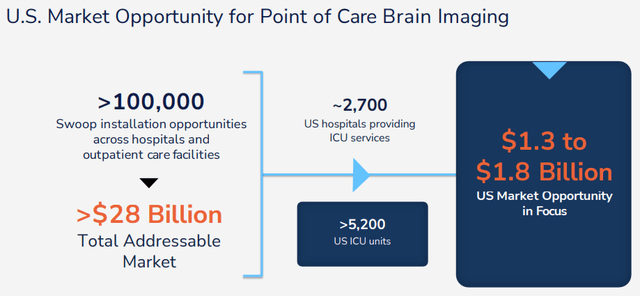

Per their excellent March 2023 IR presentation, the company has a TAM of $28B while their more immediate ambitions are smaller, but still considerable:

HYPR IR presentation

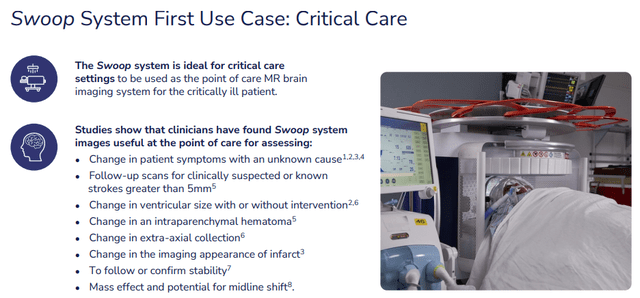

While the Swoop is FDA-Cleared for MRI of the brain and head in patients of all ages, its first use is critical care:

HYPR IR presentation

But use cases will be added, it’s one of the growth avenues.

The company is selling through three channels:

- US direct commercial sales

- International distributors

- Units that are part of the KCL Kings College London (an order for 20 systems last fall) which has been completed in Q2/23.

Growth

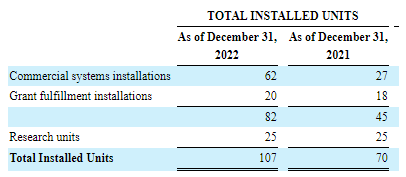

There was a tremendous increase in commercial installations last year, from the 10-K:

HYPR 10-K

There were another 14 Swoop sales in Q2/24 with all of the systems delivered with regards to the 2022 order from King’s College London (with the help of a BMGF grant).

We see multiple growth vectors:

- Complement existing MRI scanners

- Broadening the market

- International

- Additional conditions

The Swoop complements existing conventional MRI scanners, which according to the 10-K results in an average of 20% increased usage of existing MRI usage for outpatient procedures as caseload is taken off by bedside use of the Swoop.

Given the much lower price point and absence of requirements of specialist facilities and personnel, it’s no surprise that the Swoop will be able to significantly broaden the market, in the developed world but certainly also in the developing world.

While the focus of management will be squarely on the US market, the Swoop has already been approved in other markets, most notably the EU but also the UK, Canada, Australia, New Zealand and Pakistan. Management is also exploring the potential to enter the regulatory process in China.

The company also achieved two grants from the BMGF (Bill and Melinda Gates Foundation), from the 10-K:

to assess the clinical feasibility of our Swoop® system in providing immediate point-of-care brain imaging to infants between the ages of 0 to 24 months in low to medium income countries. We were awarded a $1.6 million grant from the BMGF for providing and equipping twenty sites with our Swoop® system to enable the performance of a multi-site study focused on optimizing diagnostic image quality (the “Project”). During the third quarter of 2021, we were awarded an additional $3.3 million grant, of which $2.5 million was received from the BMGF in September 2021, with the remainder received in April 2022. Both of these grants are designed to support the deployment of a total of 25 Swoop® systems and other services to investigators, which commenced in the spring of 2021 and is expected to fund the program for approximately two years. The ongoing investigation is designed to provide data to validate the use of our Swoop® system in measuring the impact of maternal anemia, malnutrition, infection, and birth-related injury.

To which a third $3M grant was added in Q2/23.

Improvements and use case expansion

Here is what the Swoop is able to be used for today (10-K):

point-of-care MRI in acute mental change assessment and follow-up in an ICU setting; stroke workflow; and pediatric and adult point-of-care assessment of hydrocephalus, an abnormal buildup of fluid within the brain.

But further enhancements and improvements will likely expand the use cases.

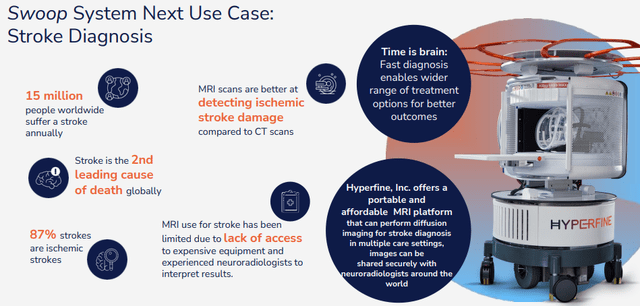

The company is working on improvements that will enable the Swoop for dealing with stroke patients:

HYPR IR presentation

This is close at hand, from the Q4CC:

to improve our DWI, also because we have that appetite to get into stroke, and that’s going to be critical. There’s some other things that we can do to continue to strengthen the robustness to motion, the correction for noise through more DL and then some other features around usability. We’re looking at software helping with the patient position, which is also important and other things like that. What I would say is that these improvements are getting us closer and closer to feeling really ready to take on the ischemic stroke setting and as such is probably going to be after the next software release, probably when we feel ready to start that Action PMR study that we have discussed.

That Action PMR trial can deliver instant results as it’s really about scans of acute stroke situations, but there are two bottlenecks in the form of enrollment (starting mid-year) and another software update (Q1CC):

So our first order of business with that evaluation is to make sure that our latest software, which is going to be one more than the one that is commercially available, is able to detect as clinicians want the stroke in the acute setting. We have to do a little bit more work to shorten the time that it takes to gather those sequences, those images. So we need to shorten the length of the sequences. So we will be continuing on that development work and want to actually include faster sequences at some point in time also in the Action PMR. There really is no follow up to the study, all of it is really in the acute setting.

There is research on aspects, for instance from Yale (here and here)

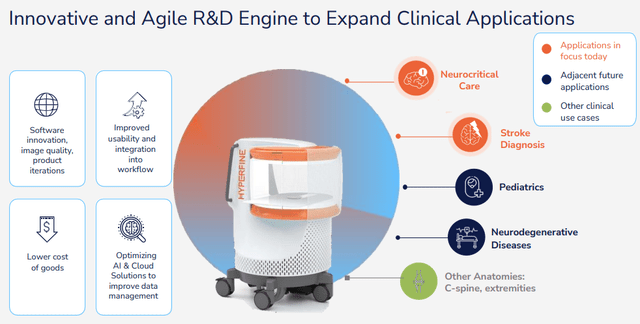

But the increase in use cases isn’t going to stop at stroke patients:

HYPR IR presentation

Perhaps the most promising avenue for improvement is in AI, which has the capability to transform the Swoop into a full diagnostic system with the FDA clearing their software in February 2022.

The company entered into a partnership with Viz.ai, a leading AI-powered disease detection and intelligent care coordination platform in July 2022 and together they will produce pilot evaluations in a few key sites in 2023.

The Viz.ai software already produced a new version in Q1 which already received FDA approval.

There are additional opportunities, for instance in AD (Alzheimer’s Disease) where new drugs are coming online that require multiple MRIs a year.

This obviously isn’t an immediate opportunity, it isn’t even clear whether their Swoop can accommodate that or it has to be a traditional MRI, but management is already establishing contacts with possible partners.

In terms of improvements, the company regularly updates both the software and AI algorithms, on the latter (Q2CC):

The Swoop System integrates deep learning, a form of artificial intelligence as a component of its image processing for T1, T2 and FLAIR sequences. Our future product road map also includes development of an AI algorithm for our DWI sequence. The integration of deep learning does not require any additional steps from the user.

Early next year the company will launch another upgrade of its software system (most of this happens remotely), to further improve the sequence.

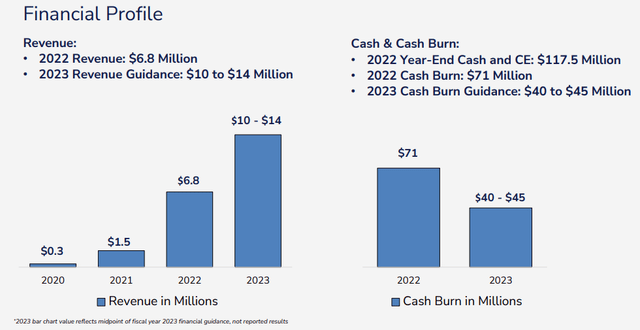

Finances

The company sold 35 commercial Swoop systems in 2022 receiving $6.8M in revenues with Q1/23 revenues at $2.64M and Q2/23 revenues at $3.5M (up from $1.5M in Q2/22). Some additional metrics:

- Gross profit -$1.4M vs -$0.2M Q2/22

- SG&A $7.8M vs $15.7M Q2/22

- Net loss $10.6M (EPS -$0.15) vs $23.1M Q2/22

- Cash burn $10.1M

- Cash $93.9M

FY23 Guidance

HYPR IR presentation

Operational cash outflow was very large in FY22 ($72.3M) but this year management guides for much less; $40M-$45M on cost-cutting (mainly SG&A), increased sales, and higher ASPs.

Management made some cutbacks in order to decrease the cash burn (Q4CC):

we have right-sized our business and implemented spending discipline to extend our cash runway through 2025, including the cessation of the Liminal brain sensing program and associated position.

There was also a signed letter of intent for seven commercial units from BJC Healthcare in St. Louis (per the Q1CC).

Valuation

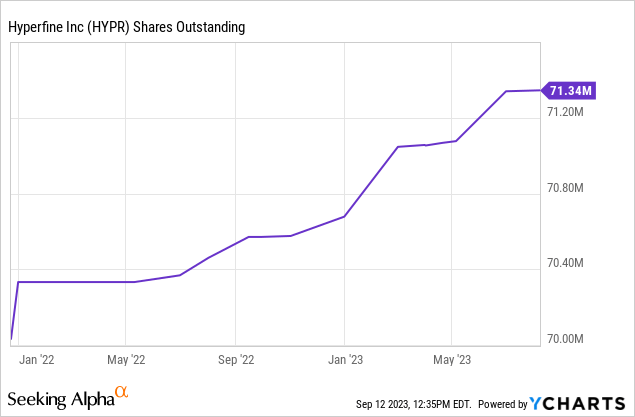

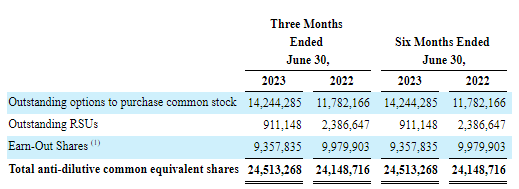

There were 56M class A shares and 15M class B shares outstanding for a total of 71.3M shares.

HYPR Q2/23 10-Q

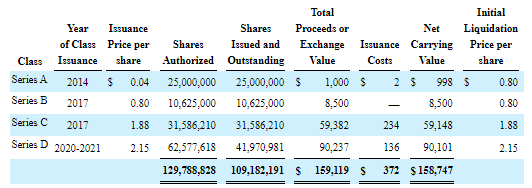

So we’re looking at a fully diluted share count of 95.85M. But then there was this, from the 10-K (F-21):

HYPR 10-K

These are all convertible in shares of ‘legacy’ Hyperfine, which is (since December 2021) a wholly owned subsidiary called Hyperfine Operations.

Quite frankly, we are not 100% sure what the consequences are of the conversion of these convertible preferred shares into legacy Hyperfine shares, of which Hyperfine is the 100% owner. Here is the 10-K on the original Business Combination in 2020 (our emphasis):

each share of Legacy Hyperfine capital stock (other than shares of Legacy Hyperfine Series A preferred stock) that was issued and outstanding as of immediately prior to the Effective Time was automatically cancelled and extinguished and converted into the right to receive a number of shares of the Company’s Class A common stock equal to 0.3275 (the “Hyperfine Exchange Ratio”), rounded down to the nearest whole number of shares;

each share of Legacy Hyperfine Series A preferred stock that was issued and outstanding as of immediately prior to the Effective Time was automatically cancelled and extinguished and converted into the right to receive a number of shares of the Company’s Class B common stock equal to the Hyperfine Exchange Ratio, rounded down to the nearest whole number of shares..

There are similar passages for the Series B to D preferred, apart from these converting into Class A common stock.

This seems to suggest that the series A, B, C, and D can still be converted into 0.3275 shares of Hyperfine (not legacy Hyperfine). This would produce another 35.6M shares and bring the fully diluted share count to 131.6M shares for a market cap (at $2 per share) of $263.2M. The company had $93.9M in cash left and no debt, which would produce an EV of $169.3M.

However, we found one filing that indicates the Series B preferred shares (and 2.5M of the Series A) have been converted into Class A/B common stock, although the number of converted Series B preferred shares (roughly 24M) greatly exceeds the number of issued (10.625M), another puzzle.

Analysts expect sales this year of $12.45M rising to $18.25M in 2024, so the shares sell at 13.6x FY23 EV/S and 9.3x FY24 EV/S. That’s pretty steep, although admittedly we’re not entirely sure about these Series A-D shares (we asked the company but they didn’t reply yet and there was no further info in the 10Q).

Conclusion

We are convinced the Swoop has tremendous commercial potential which it hasn’t even began to scratch the surface of. Investors have to realize that they sell these mostly on a CapEx business with little in the form of an ongoing revenue stream besides the 36-60 month annual service and support agreements.

The margin profile already improved a lot in Q1 and might improve further with scale. At 50% gross margin and an OpEx run-rate of $60M the company will have to produce $120M in revenue to break even, which seems a long way off despite the triple digit growth rate.

Being cash flow positive will likely happen well before that so they might have enough cash, but even that seems a stretch to us.

While we acknowledge that the Swoop can be a winning product and the company could ultimately be worth a multiple of today’s value, for now, we’re staying on the sidelines unless we see a fairly dramatic uptick in growth.

Credit: Source link