GoodLifeStudio

Investment Thesis

I take the view that Hyatt Hotels (NYSE:H) could see further upside on the basis of continued revenue growth for the Hyatt Regency brand as well as continued RevPAR growth across China.

In a previous article back in May 2023, I made the argument that Hyatt Hotels could see further upside from here on the basis of RevPAR growth for the Park Hyatt brand and the expansion of the Regency brand into China.

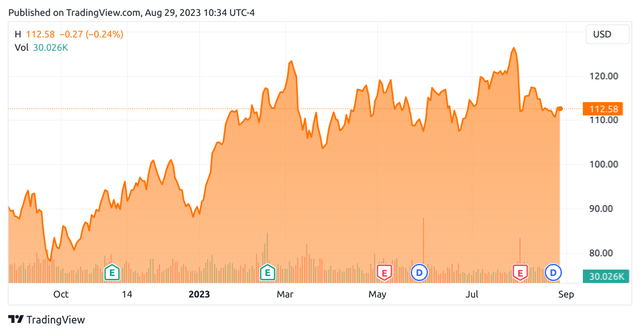

Since then, the stock has descended to a price of $112.58 at the time of writing:

TradingView.com

The purpose of this article is to assess whether Hyatt Hotels has the ability to see continued growth from here taking recent performance into consideration.

Performance

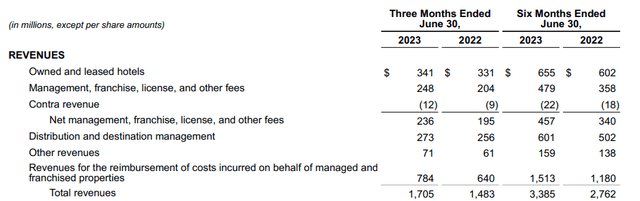

When looking at the most recent earnings results for Hyatt Hotels, we can see that total revenues for the quarter were up by 15% (on a three-month ended basis).

Hyatt Hotels: Q2 2023 Earnings Release

However, we can see that net income is down significantly on that of the last quarter – this was influenced by gains on sales of real estate resulting in a higher net income figure for the same quarter in the previous year.

Hyatt Hotels: Q2 2023 Earnings Release

In the absence of a $251 million gain on sales of real estate in the previous period – net income would have been negative for that quarter.

In this regard, Hyatt Hotels has seen progress in both revenue and real net income growth over the course of the year.

Revenue Analysis

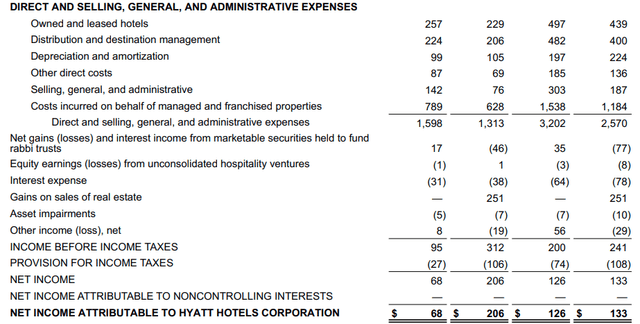

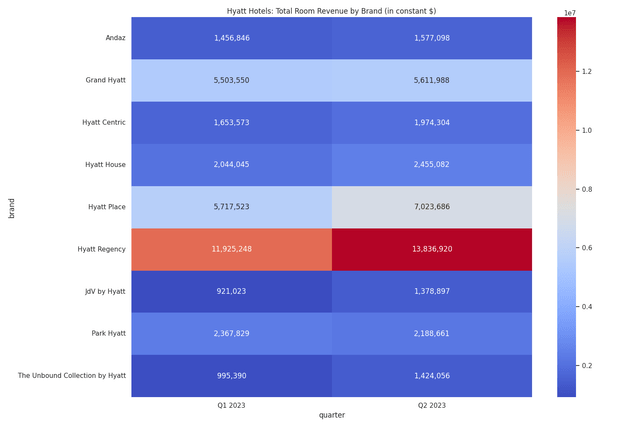

When looking at total room revenue by brand (calculated as the number of rooms * RevPAR), we can see that the Hyatt Regency – the largest brand by number of rooms – saw a significant increase from that of the previous quarter.

On the other hand, we can see that the Park Hyatt (the most expensive brand by ADR – $409.14 as of Q2 2023) saw a decrease in total room revenue over the same period.

Total room revenue figures calculated by author using SQL using data sourced from Q1 and Q2 2023 Hyatt Hotels Corporation Earnings Releases. Heatmap generated by author using Python’s seaborn library.

This indicates that we are continuing to see growth across mainstream brands – the Hyatt Regency (ADR = $201.67 for Q2 2023) being the prominent example – whereas total room revenue growth at the upper end of the price scale is showing signs of slowing.

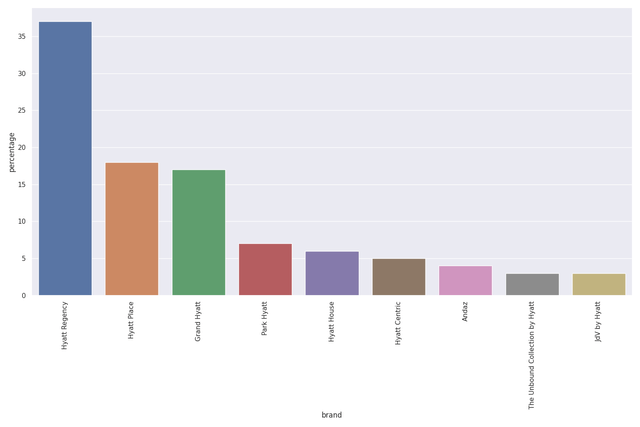

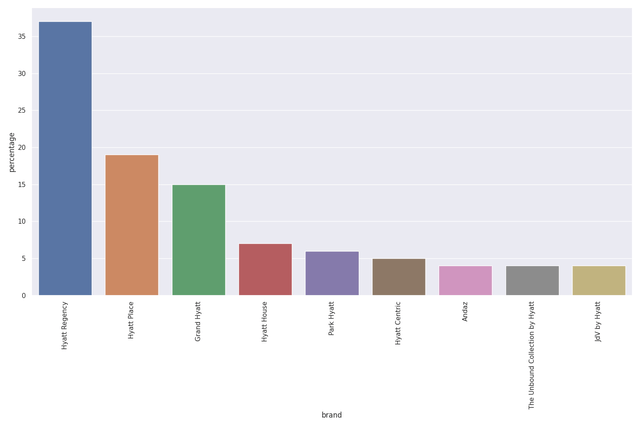

When comparing across both quarters on a percentage basis – we can see that the contribution to total room revenue by the Hyatt Regency stayed constant from that of the last quarter. However, Hyatt Place (ADR = $151.18 for Q2 2023) accounted for a higher portion of total room revenue whereas that of the Grand Hyatt (ADR = $242.32 for Q2 2023) decreased.

Q1 2023: Total room revenue (%) by brand

Percentages calculated by author using SQL using data sourced from Q1 2023 Hyatt Hotels Corporation Earnings Release. Bar chart generated by author using Python.

Q2 2023: Total room revenue (%) by brand

Percentages calculated by author using SQL using data sourced from Q2 2023 Hyatt Hotels Corporation Earnings Release. Bar chart generated by author using Python.

From this standpoint, there have been notable examples of total room revenue across lower-priced brands accounting for a greater share of total room revenue – whereas that of higher-priced brands are seeing a growth plateau.

My Perspective

As regards my take on the above results and the implications for the growth trajectory of the stock going forward, I continue to maintain that Hyatt Hotels has significant growth ahead on the basis of recent performance.

One of my main arguments in my last article was that the Hyatt Regency brand has significant room for further growth on the basis of continued expansion across China. We have seen that the brand has continued to perform well overall – seeing significant revenue growth from that of the last quarter. In spite of sales growth plateauing across more expensive brands by ADR – this has not been the case for Hyatt’s largest brand.

RevPAR across Greater China overall exceeded 2019 levels by 6% over the last quarter. On this basis, I take the view that further revenue growth across the Hyatt Regency brand has the potential to further bolster growth for the region as a whole.

Risks and Looking Forward

Heading into the latter half of the financial year – revenue growth can be expected to see a decline in line with seasonal trends, i.e. the summer months are coming to a close and lower booking demand is expected to place downward pressure on revenue.

With that being said, performance for both the Hyatt Regency brand and the recovery in overall RevPAR across China are encouraging signs, and I take the view that these two elements have the potential to drive revenue growth higher over the longer-term.

In terms of the potential risks to Hyatt Hotels at this time, we could see a risk of downside if further revenue growth is not reflected in net income and earnings. We can see that while net income growth is up from that of the same quarter last year (when excluding the impact of gains on sales of real estate for the previous year), expenses have also been rising. In particular, costs incurred on behalf of managed and franchised properties accounted for half of total expenses (direct and selling, general, and administrative) for the quarter.

With Hyatt Hotels prioritising further growth in the China region for the Hyatt Regency brand – expenses are likely to rise further to accommodate such growth. If we do not see robust revenue growth to accommodate such costs, then the stock could see risk of downside.

Conclusion

To conclude, Hyatt Hotels has seen strong revenue growth for the Hyatt Regency brand and RevPAR growth across China generally has been strong.

Given these two factors, I continue to take a bullish view on Hyatt Hotels.

Credit: Source link