FG Trade

Humana (NYSE:HUM) is a healthcare giant that generates its revenue through various streams, including insurance premiums, government funding, healthcare services, pharmacy operations, and corporate ventures. Humana has carved out a niche in the Medicare Advantage market, making it a significant player in this space. The company’s focus on creating a chronic care management platform for seniors is considered a key element in driving competitive medical cost advantage.

Humana’s stock is down nearly 30% over the past year, with most of the decrease following Q4 2023 earnings and a significant reduction to 2024 and 2025 guidance.

HUM Price Trend (Seeking Alpha)

While the drop in price was partially deserved as management seemed completely shocked and the guidance change was truly exceptional, I believe the market overreacted to the news, with the stock falling well below fair value.

Even without a full recovery to the Medicare advantage business, there is upside to the price. In addition, Medicare advantage and integrated care still represent solid growth opportunities and upside to the current price.

Normally, this upside would push me to strong buy, I am holding back due to concerns around management as a downside risk. With all of the above in mind, I rate HUM a buy with a price target of $405.

Upside On Price Even Without Full Recovery

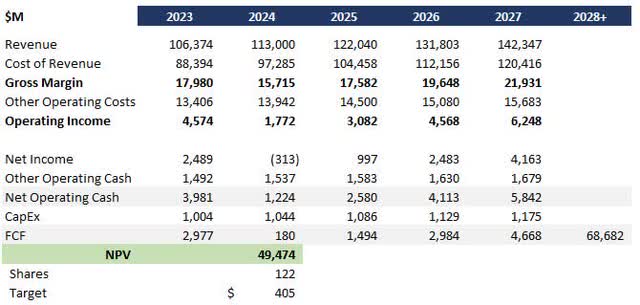

I ran a DCF analysis considering the company’s trajectory coming into 2024, management guidance, and market dynamics. I made the following underlying assumptions:

- The Q4 cost of revenue trend carries forward throughout 2024 based on management commentary during Q&A

- 8% revenue growth, 6% from organic health insurance growth, and 2% from company growth initiatives

- 0.5ppt cost of revenue recovery annually from 2025 through 2027. This is still well below historical performance and does not assume a full recovery

- 4% S,G,&A cost growth slightly ahead of inflation expectations as a conservative estimate

- 10% discount rate based on WACC estimate of 9% plus 1ppt conservative estimate

- 3% long-run growth rate

This DCF analysis yields a price target of $405 or 17% upside to today’s pricing.

HUM DCF (Data: SA; Analysis: Mike Dion)

Wall Street analysts are similarly bullish with a price target of $423.

HUM Wall Street Rating (Seeking Alpha)

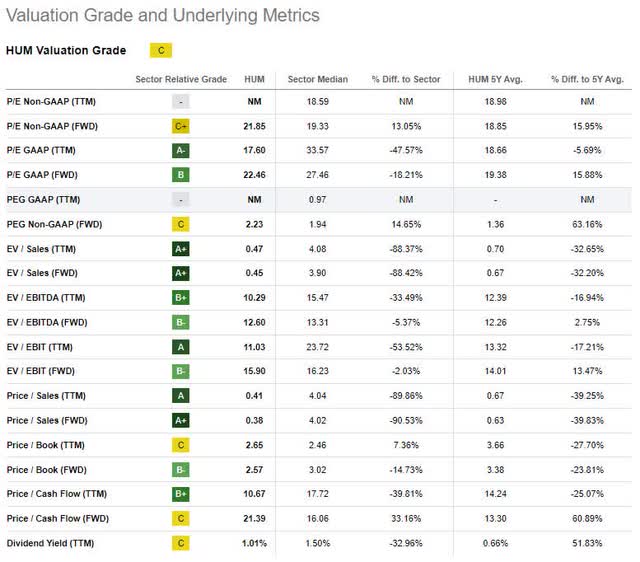

Overall valuation multiples are quite compelling, despite weighting to a hold rating. Nearly across the board, Sales and Profitability multiples are well below the industry and the historical average.

I would expect Humana to be at or slightly below the sector due to less diversification compared to more diversified players like Elevance Health (ELV) and UnitedHealth (UNH), however, it is one of only three dividend payers in its industry and has carved a niche in a rapidly growing space (as I will cover below). Versus its historical average, there is certainly a short-term cost blip, but nothing has fundamentally changed with the long-term growth prospects.

With that in mind, these multiples signal a clear buy opportunity.

Multiples (Seeking Alpha)

Medicare Advantage Is Still Compelling

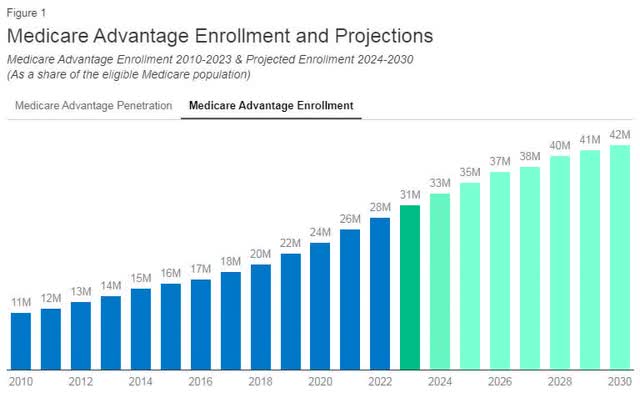

As discussed above, the market should hand Humana 6% organic growth. The remaining 2% (or preferably more) growth is likely to come from either Medicare Advantage or Integrated Care.

Medicare Advantage, despite Humana’s utilization issue, is still a compelling growth opportunity. Enrollment is expected to grow by more than 10 million through 2030, both from increased penetration and from growth in the eligible population.

Medicare Enrollment (KFF)

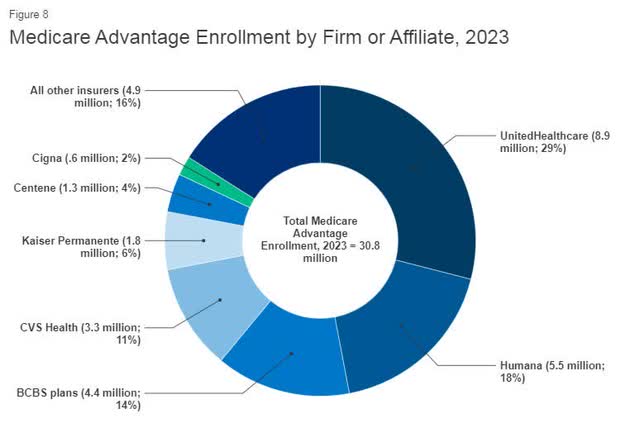

In 2023, Humana held an 18% market share, with only UnitedHealth Care holding a larger position. Assuming annual pricing takes care of inflation, if Humana held on to their market share, the business would grow at a 4.6% CAGR. To deliver 2% growth needed to support the price target, Humana’s market share could fall as low as 15%.

Medicare Advantage Market Share (KFF)

The demographics are on Humana’s side for this business.

Integrated Care Is A Solid Path Forward

Integrated care via CenterWell represents another solid growth opportunity. The business added 12-14 thousand patients in January, and management has committed to opening 30-50 centers annually.

This business model not only brings in payers from outside Humana at a roughly 10% margin, but can help lower the cost of service delivery for Humana itself.

Not only that, but integrated care is expected to grow at an 8.9% CAGR over the next few years. There is also the pharmacy business that is expected to grow at over 18% over the next several years.

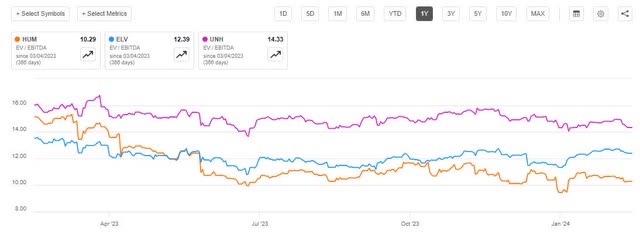

The difference is clear when looking at United Healthcare and Elevance Health, both more aggressively vertically integrated, versus Humana from a valuation standpoint. The competitors have held a higher valuation longer and with less volatility than Humana.

EV/EBITDA Comparison (Seeking Alpha)

Downside Risk

The primary downside risk for Humana is management and execution risk. They seemed completely caught off guard by Q4 earnings, opening by stating “we are disappointed with today’s earnings.”

To consider that neither United Healthcare nor Elevance Health noted issues with cost or utilization in Medicare Advantage during their respective Q4 earnings is especially concerning.

Humana has a chance every year to adjust their program and pricing. The true risk is that they are surprised again in the future. They really need to dial in their actuarial models and prevent this from happening again. The biggest challenge is that we won’t know how well they did until 2025.

Verdict

Humana’s stock was pummeled following Q4 earnings, and they largely deserved it. Management seemed shocked by the results, and Humana was the only insurer to call out utilization challenges in the quarter.

Despite this, the market overly punished Humana, and it is now trading well below what I believe is the fair value of $405. To achieve this value, Humana only needs a partial cost recovery over several years and 8% revenue growth. The 8% revenue growth is achievable through 6% organic growth and the remaining 2% from a combination of Medicare Advantage growth and vertical integration.

The upside potential from such a large company would usually warrant a strong buy, but I am holding back due to my concerns around management’s ability to manage the company. With the above in mind, I rate Humana a solid buy. I will be closely monitoring for a rebound (or further downturn) in profitability as 2024 progresses.

Credit: Source link