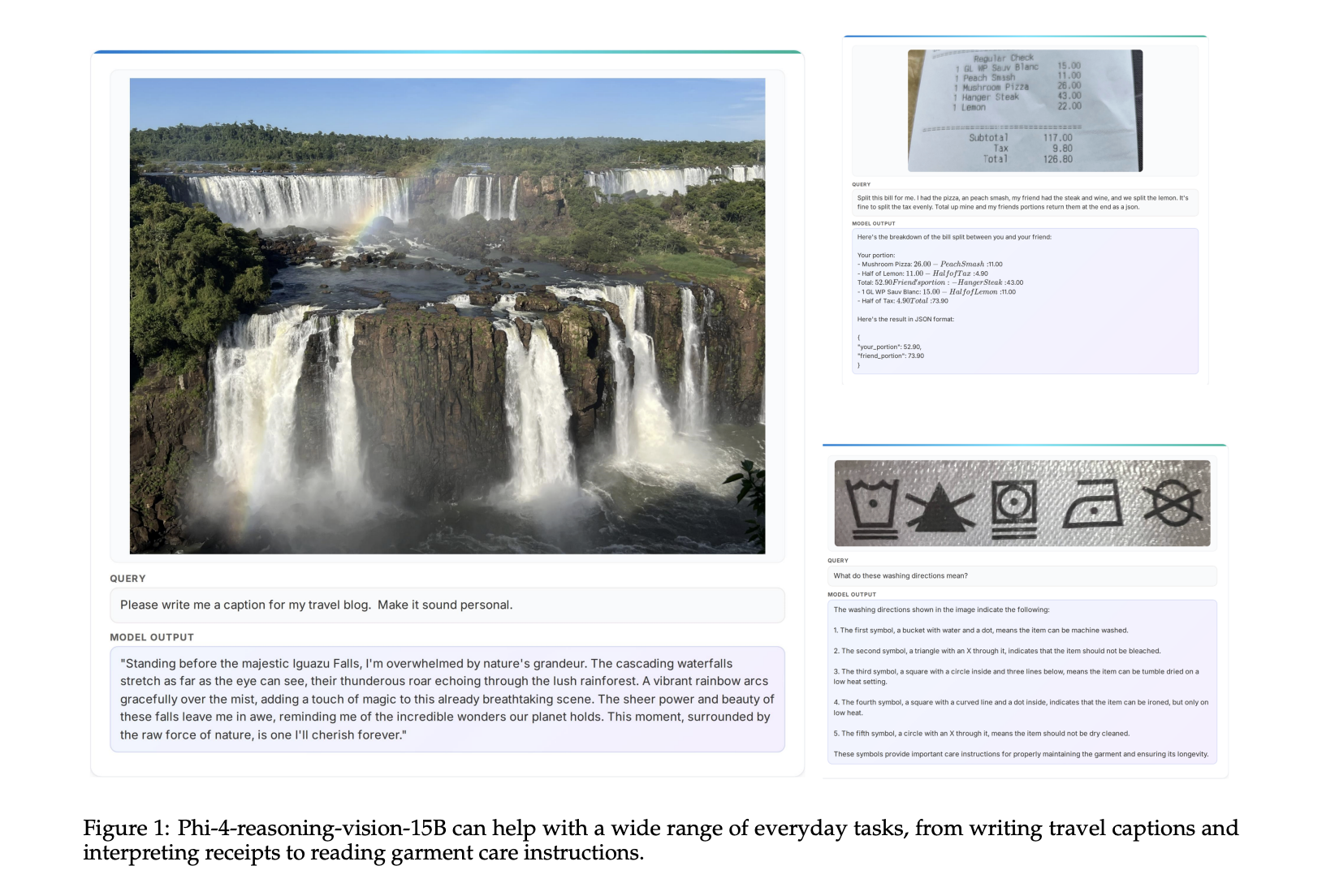

Presented by Envestnet

Personalization-at-scale is a key strategy for fintechs to deliver hyper-relevant products and services to meet customer demands. Learn how top companies leverage AI-enabled tech to deliver experiences that delight clients and build lasting relationships in this VB Spotlight.

Watch free on-demand!

A wealth of data has long been available to fintech companies in the past — but the ability to process it at speed and structure it in usable ways has unlocked a tremendous amount of potential. Structured, tagged and enriched data has changed the game, taking product development and marketing to the next level of personalization and engagement.

“Being able to use and apply machine learning and AI logic on top of transactional data, and combining that with other experience or information that we know about a customer, has transformed how companies can relate to individual customers in a way that they never have been able to before,” says Eric Jamison, head of D&A product — banking & tech product & design, Envestnet. “The ability to better use this data and target consumers based on that information is accelerating on a daily basis.”

Banks are still using cookie sessions, email and banner campaigns because they’ve been effective in the past in drumming up new client sign-ups. But issues persist — the same product marketing campaigns appear in front of current customers and potential leads alike, resulting in a waste of resources and the potential to irritate a customer who is tired of being pushed to buy products they already have, or don’t apply to them.

But new technology isn’t pushing those strategies out of the spotlight, they’re enhancing them with data intelligence, making them much more targeted, personalized and effective. Data processing technology, combined with the ability to interpret it in more depth and detail than ever before, helps companies identify opportunities, analyze consumer behavior patterns and compare consumers across segments in ways that haven’t been possible before, pushing up the success rates of campaigns.

Creating truly personalized experiences

Of course, FIs are providing a business and a service, but companies that personalize experiences that are relevant, emotionally resonant, and truly helpful to consumers, cut through the confusion. This is especially true for the generations that are now early in their careers or just entering the workforce. They have a more transactional view of their data and are actively looking to companies to better understand and interpret their personal information. Whether that’s proactively looking for investment insight, or raising alerts that draw attention to financial matters that should be investigated — like a higher than normal amount of spending.

“Being able to interpret and raise that information to an individual in a very personalized way is how those service providers, whether they’re banks or technologies or wealth management firms, endear themselves to that customer,” Jamison says. “Customers will work with the financial services company that seems to understand them best, and has the greatest depth of insight gleaned from its own client base.”

It’s about best leveraging the information they have about their customers to become that primary source of financial management, he adds.

And when it comes to cutting through the noise, especially for a self-directed banking relationship or technology provider, it’s about bubbling up the most relevant issues that are important, getting them in front of the consumer and getting feedback in return. The relationship evolves as the technology learns about what’s most important to clients, adapting the experience to suit what the client wants, but perhaps most importantly, bringing up new areas of potential interest, or needs the customer didn’t realize they had.

“One of the fears we’ve always had is that if you bombard a consumer with alerts, it can be overwhelming, and they start to ignore them,” Jamison says. “Relevant types of insights though really start to engage the consumer.”

AI, machine learning and scale

AI’s ability to leverage and interpret standardized data is driving the types of insights and information that make experiences with self-banking products and advisor relationships more powerful. It can help advisors optimize portfolios and strategies for their clients, develop short- and long-term plans and visualize scenarios to help make timely, intelligent decisions.

Generative AI will help this scale even further, driving the ability to draw data from a variety of very disparate sources, synthesize and process that information. But the human element will always be crucial to ensuring these tools are tuned correctly, from ensuring data is unbiased and as clean as possible, to fine-tuning algorithms and catching inevitable AI model drift as an algorithm continues to run.

“There’s going to be that need for our data scientists to ensure that it’s focused on the right scenarios for us, tuned to the right types of experiences that we or our clients are looking to drive,” Jamison says. “To me, it’s only a matter of time before it starts to impact the financial services industry.”

For more on the power of hyper personalization-at-scale, a look under the hood at the AI driving the platforms that financial services industries are leveraging and how to launch your own strategy, don’t miss this VB Spotlight!

Watch free on-demand!

Agenda

- How fintechs are using personalization-at-scale to gain a competitive advantage

- Various AI-enabled technologies to securely collect, enrich and analyze financial data

- How advanced analytics and transactional data can deliver valuable customer insights

- Ways to identify customer acquisition, cross-selling and upselling opportunities

- How to create personalized experiences that are relevant and emotionally “sticky”

Presenters

- Bala Chandrasekharan, VP of Product Management, Chime

- David Goodgame, Chief Operating Officer, Tricolor

- Eric Jamison, Head of D&A Product — Tech & Bank Product & Design, Envestnet

- Mark Kolakowski, Moderator, VentureBeat

Credit: Source link