DavidLeshem

By Blu Putnam

At A Glance

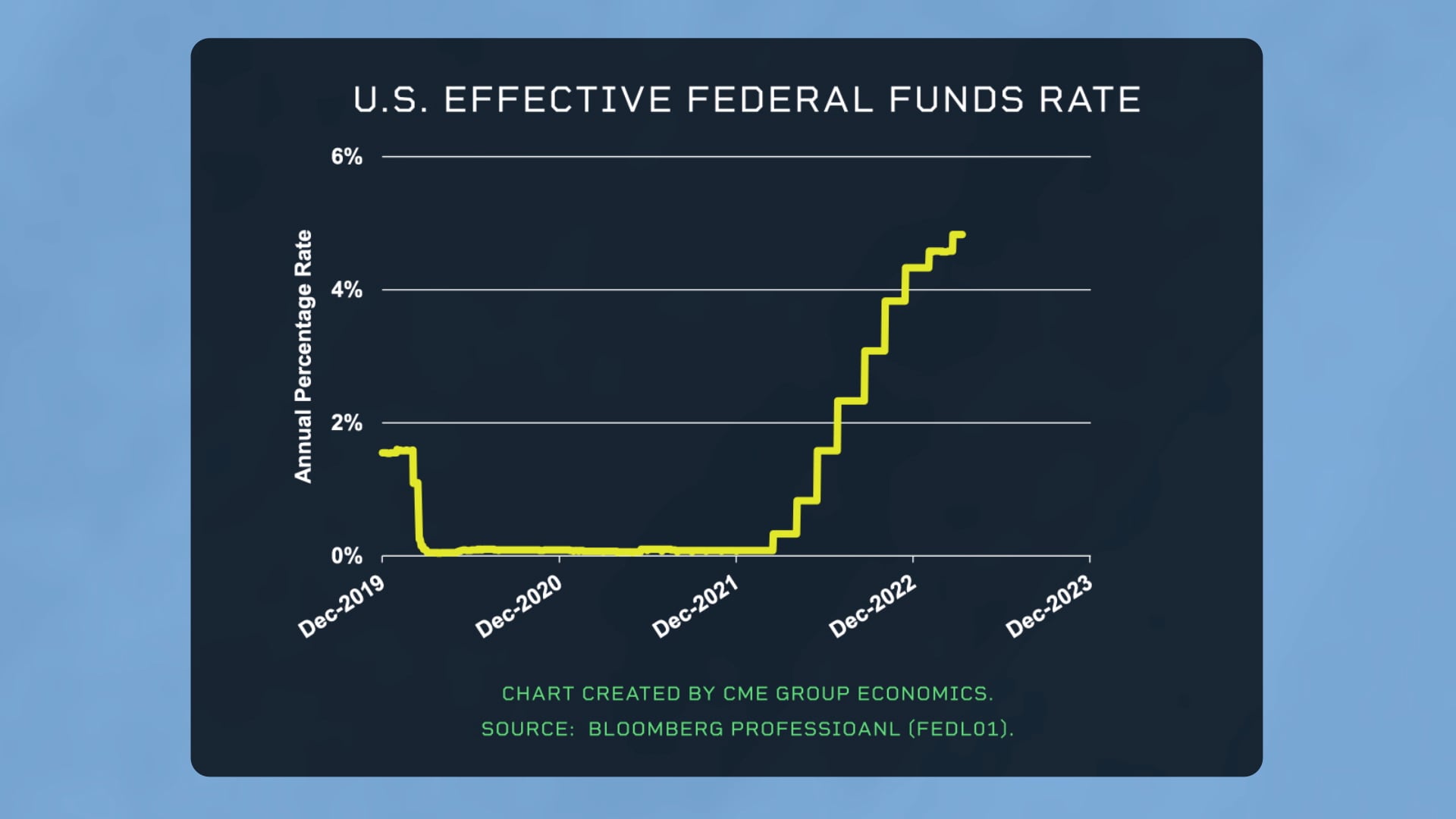

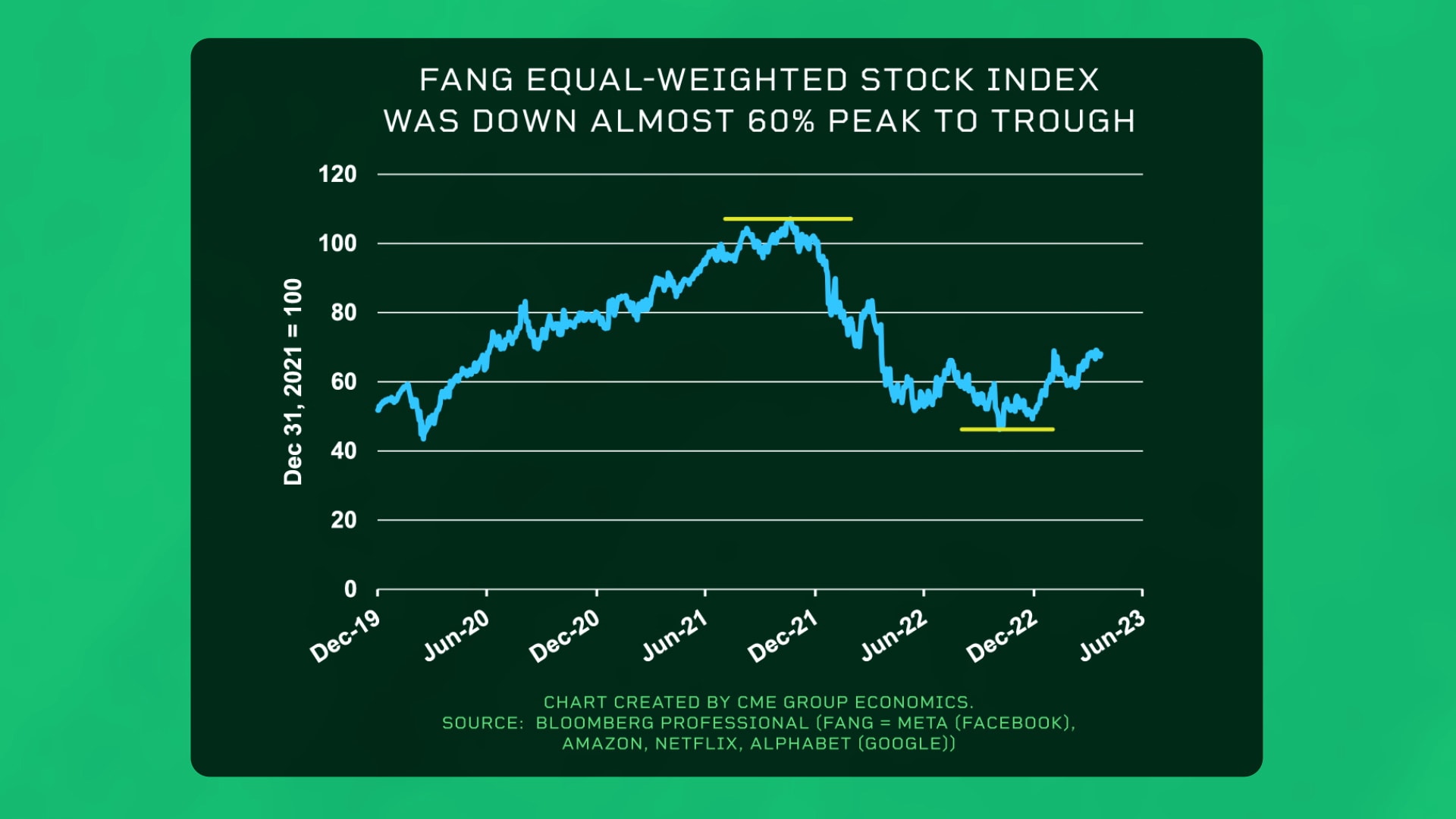

- As Treasury prices fell, yields rose sharply from the pandemic lows of mid-2020, triggering a large revaluation of equities, especially high-growth, rate-sensitive stocks.

- Interest rate hikes can dampen economic growth, but not in the ways outdated economic models might suggest.

The way higher interest rates impact the U.S. economy has dramatically changed over the last six or seven decades. Many economic models are outdated and no longer work. Let’s compare the old process to the new one.

In the first few decades after World War II, the U.S. economy was driven by manufacturing and a housing market dependent on 30-year fixed rate mortgages. Higher interest rates squeezed savings and loan institutions to raise mortgage and auto loan rates. Housing construction dipped into a recession, and automakers cut production and laid off workers.

Fast-forward to today’s service sector economy, with a high concentration of mega-sized technology firms. High interest rates still hurt the housing sector, but not so much as in the past because lenders better manage their interest rate risk, and borrowers have many choices of how to finance a new home. The transmission process has shifted to the equity market. High interest rates cause a revaluation of equities, especially the interest rate sensitive companies with high growth rates in the tech sector.

Some technology stocks dropped over 60% before partly recovering. That kind of stock price move changes the business model. Zero rates and easy money empowered a go-for-the-growth mentality. High interest rates and lower stock prices shift the business model to what CEOs can directly manage – namely, the size of the workforce. Layoffs build and employment growth slows but with significant lags and considerable variability among companies.

Interest rate hikes still dampen economic growth, but not in the ways outdated economic models might suggest.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Credit: Source link