imaginima

Hess Midstream (NYSE:HESM) is, by design of the backers, never on the bargain table. Yet, the prices of the past clearly were a purchasing opportunity. This is largely because the backers of Hess Midstream want to raise money from time to time by selling their shares in the company. But in order to do so with a reasonable profit, they must do their best to keep the price rising. That makes current prices likely a good thing even if the stock is not “cheap” or a “bargain” by many measures.

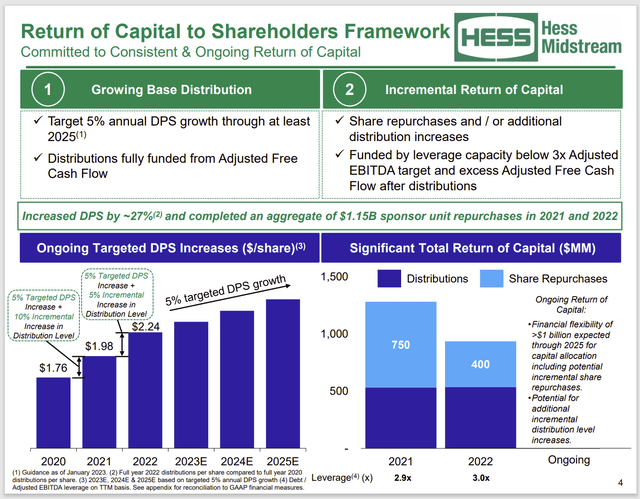

Recently, Hess Midstream announced the purchase of about 3.6 million unconverted units that are part of the noncontrolling interest. The purchase and retirement of those units will mean that there are less units outstanding. There has been a steady announcement of repurchases ever since the midstream went public a few years ago.

Back in fiscal year 2021, the company repurchased $750 million units from the backers at a price of $24 per share. That repurchase led to an immediate 10% increase in the dividend with a still conservative debt ratio. That was one of the larger share retirements in recent years.

Hess Midstream Return Of Capital Framework (Hess Midstream Corporate Presentation March 2023)

Investors are doing fairly well because this management wants a ready cash source. Therefore, it is doing what it can to maintain a decent stock price so there is an avenue to raise money for the backers if that is needed.

Investors benefit from the decreasing share count and the increasing dividend every year. This creates a growth and income play which generally has a little more value than a strictly income play with a flat distribution over the years.

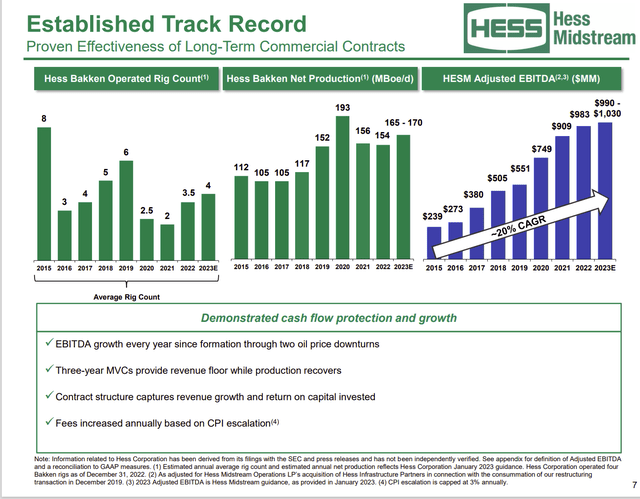

Even though Hess intends to use the Bakken leases as a cash flow source to fund the Guyana project if needed, there is still a fair amount of room for the midstream business to grow. Therefore, it is likely that the Bakken business and the midstream business will grow at different rates for some time to come.

Hess Midstream History Of Business Growth Regardless Of He (Hess Midstream March 2023 Investor Presentation)

As clearly shown above, the rapid growth pace will slow. Hess Midstream may have more Hess (HES) leases to service. But Hess does not have infinite Bakken business to service. So sooner or later Hess Midstream will have an activity pattern to follow. Such a pattern will be limited by some take or pay provisions. But there will be a time when the midstream gets to that mature phase.

At that point, there will have to be a decision about whether to diversify away from Hess somewhat so growth can continue or to maintain the current relationship as a mature service provider. But that time will not be for a while.

The current presentation guides to at least a 5% growth rate in the near future. When that is combined with a robust distribution rate and some share repurchases, the current price remains attractive for those interested in an income and growth vehicle that has a conservative debt midstream ratio.

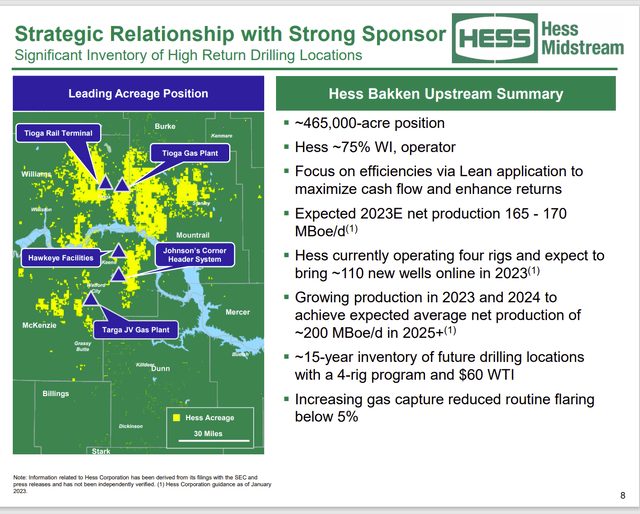

Hess Production Guidance And Lease Map Of Hess Midstream Business (Hess Midstream Corporate Presentation March 2023)

Hess increased the sales stream through the purchase and expansion of the Tioga natural gas plant. The current robust commodity price environment (compared to not too long ago) still enables some slow growth of production.

Older wells often represent increasing business as many times water (among other things) has to be separated from the sales stream and properly disposed or recycled. In that sense the older wells represent a slightly counter-cyclical effect on the business.

But the overall business has benefited through the close cooperation with the midstream subsidiary as well as the increasing gathering abilities of the midstream.

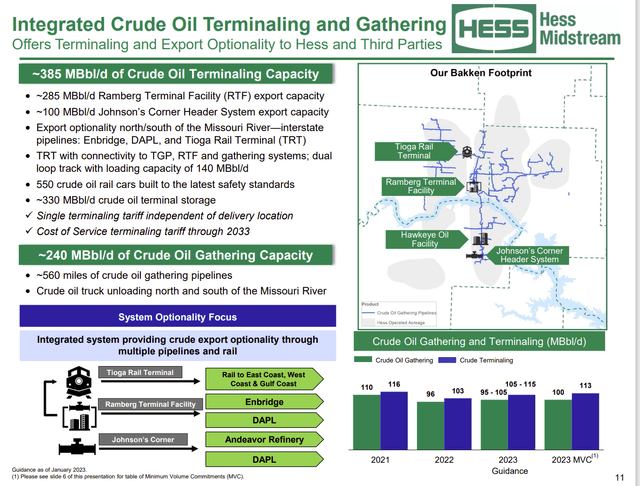

Hess Midstream Connections To Long Haul Transportation (Hess Midstream Corporate Presentation March 2023)

Hess Midstream actually has redundant capabilities in case one option becomes unavailable for whatever reason. But the optionality to pick stronger markets is an advantage that few companies in the industry ever really explore. This often results in a price received advantage that heads straight to the bottom line with only a few minor reductions along the way.

The ability to choose markets and have export ability is important as the United States generally produces more light oil than it needs. We as a country export light oil and important discounted heavy oil to make money on the spread. It helps our balance of payments situation.

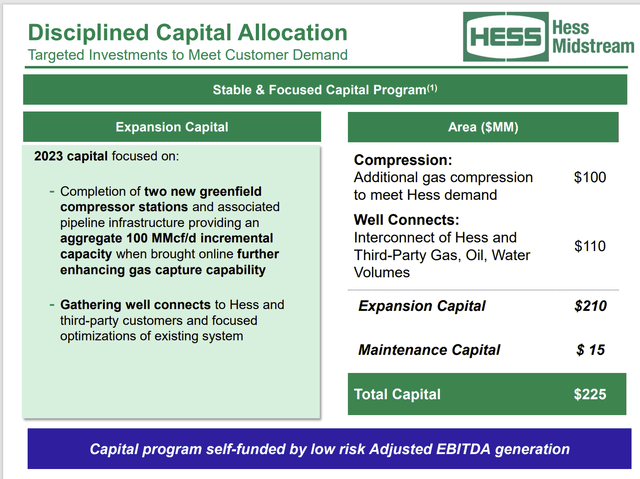

Hess Midstream Capital Budget For 2023 (Hess Midstream Corporate Presentation March 2023)

As the production growth of Hess slows, the capital requirements of the midstream will also decline. This of course will lead to expectations of more free cash flow.

Hess Midstream is likely to repurchase more shares in the future from its sponsors to maintain a relatively robust (for midstream) growth rate per share. That would likely dictate a fair amount of money dedicated to reducing the already low debt load.

Should oil prices fall so that the Guyana joint venture is no longer cash flow positive, then Hess and likely its partner as well would raise cash through a secondary sale of shares. Traditionally Hess Midstream purchases shares from a secondary sale to blunt the effect of more shares in the public market and the resulting pricing weakness after that. But there needs to be room on the bank line (and conservative debt ratios) to do that when the need arises.

This midstream is one of very few that offers a middle teen percentage return for the foreseeable future from a combination of a dividend, dividend raises, and share repurchases. That return is likely to last well into the future from the current price.

The current backers of the midstream have masterfully raised money while keeping the common price in an upward trajectory over time. This is that rare instance of backers needing money but knowing how to do it without cratering the midstream price.

Recently, the dividend was increased yet again with the first quarter report. Those increases appear to be set every quarter for the foreseeable future. The current dividend is still well covered. So future increases are not a problem.

Hess, the parent company, is an investment grade company. That is fairly strong backing for a company like this with one major customer. This stock remains a decent buying opportunity for buy and hold investors looking for an income and growth opportunity that has a relatively high combined return.

Credit: Source link