Marina113

Why Invest in the Caribbean Basin?

Most investors are already conscious that the tourism economy is a hotspot, with banner earnings and guidance from cruise operators. The expansion of the Panama Canal coupled with post-Covid trends of US companies near-shoring their supply chains for proximity and China avoidance have huge effects on the Caribbean’s trade economy. Both of these factors are before even considering the exponential upside of the long term “Holy Grail” (a rebuilding of Cuba). That holy grail is certainly not priced into any of the holdings as it remains stymied by a decades-long US embargo that is grossly unpopular worldwide.

As an economy poised for tremendous growth after an initially slow post Covid reopening, the Caribbean Basin probably warrants a thematic ETF. At this time, the only option is a Closed End Fund (“CEF”) providing access to Royal Caribbean (RCL) and (NCLH) cruise stock at far better discounts than I can find on either of their cruises anymore. To pay for their cruises, I best generate some investing alpha.

How do I seek alpha in the Caribbean Basin?

The Herzfeld Caribbean Basin Fund (NASDAQ:CUBA) has a mostly impressive 30 year history, and is managed by Thomas J. Herzfeld Advisors, Inc. That name may be familiar to folks. Barrons features the Herzfeld Closed End Fund Average in their website and print copy. In my 25+ year focus on Closed End Funds (“CEF”s), the Herzfeld premium newsletter, The Investors Guide to Closed End Funds was the best content I have ever seen available to retail CEF investors.

The Investors Guide to Closed End Funds (Herzfeld)

If you do not recall the name from the newsletter or average above, do an eBay or Amazon search for “Thomas Herzfeld Closed End Funds.” You will find books which are starting to look like collectors’ items. One, you may have even read yourself.

During my due diligence into Herzfeld’s one and only self-managed fund focused fund, I learned the company has a unique expertise in the Caribbean Basin. And it is the one and only fund they manage. I found great favor, in their strategy to benefit from the levers in the Caribbean Basin economy, while owning US businesses and ADRs without taking undue political risk. Let me be clear. While rebuilding and modernizing Cuba within the Caribbean is an investing Holy Grail which could unleash exponential profitability for the right banks and infrastructure companies, investing in Cuban-domiciled businesses could be disastrous due to a political control of capital issue. That is a risk I choose to avoid. So, I’ll go with Herzfeld’s “CUBA” approach – the ticker symbol does not reflect where the investing capital of the companies is domiciled.

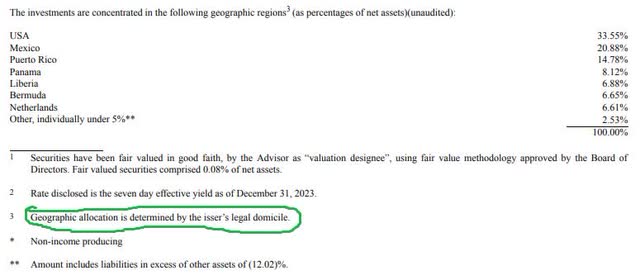

Portfolio by Domiciled Location (Herzfeld Semi Annual Report)

What does it own?

I previously mentioned Carnival and Norwegian lines, each of which are seeing tremendous demand and related improvement in pricing power. Their improved health may let them replace Covid era debt, which would be a boon for the equity. Separate from the Cruise operators, let me get into some of the large holdings, each already strong businesses but with potential exponential upside if the economic Holy Grail is ever found by politicians:

- Puerto Rican bank’s First BanCorp. (FBP) and Popular, Inc. (BPOP) are already major beneficiaries of the region’s improving economy. But trade finance is exceptionally attractive. Panama’s Banco Latinoamericano (BLX) is the leader in all things trade finance during a time when nearshoring trends have made daily auctions necessary to see who goes through the expanding Panama Canal first. If politicians find the Holy Grail and Cuban businesses can be financed by a banking system rather than Western Union remittances, BLX could prove a ten bagger.

- MasTec (MTZ) did infrastructure reconstruction in Puerto Rico after Hurricane Maria, hooking up to New Fortress Energy (NFE). New Fortress has made tremendous inroads in Jamaica and Puerto Rico, where they are generating power. And the economics of its natural gas would now give Cuba the opportunity to move away from burning diesel and coal.

- Vulcan Materials (VMC), Martin Marietta Materials (MLM), and Mexico’s CEMEX (CX) have access to the most locally sourced materials and would be poised to provide the materials to replace crumbling cement buildings. Each are already sector leaders in the Western Hemisphere, and the prospect of rebuilding Cuba would be new information to their investment thesis.

- If Cuba ever rebuilds, Lennar’s (LEN) leadership in Florida’s similar terrain, subject to similar hurricane risk, makes them the obvious leader putting up homes.

Some of the above holdings which had already caught my eye are also mentioned in the Annual shareholder letter released Thursday on Edgar. The same can more easily be downloaded from their website. The portion discussing holdings begins on page 5 of the PDF version with discussion of Consolidated Water (CWCO). Suffice to say, I have begun learning there of several other holdings. What became clear to me, especially in the discussion of details, is Herzfeld’s focused expertise in these companies and related benefit to portfolio construction, time period by time period.

In all these cases, the current business fundamentals and thus market pricing of these constituent holdings reflect the US’ forever unending impugnment onto Cuba the country.

Historically, now is the time buying CUBA’s CEF structure should contribute alpha.

I could certainly argue Herzfeld should be running a thematic ETF or an interval fund offering continuous access at NAV, now is a time where buying (but definitely not selling) the portfolio at market in a CEF structure appears ideal to create alpha. Arguably, the CEF structure offers investors the unique possibility of exiting above NAV, and historically many CUBA shareholders have done so.

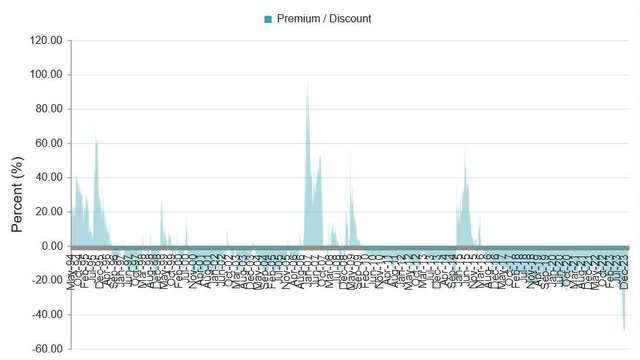

premium discount history (cefconnect.com)

In the fund’s 30-year history, truly substantial premiums have been far more common than similar magnitude discounts. Stretches with 40%+ premiums above net asset value (“NAV”) repeated in the 1990s, 2000s, and 2010s. These premiums approached or surpassed 60% at their apex each time, and once passed 90%. After an absolutely horrific 2023, the same unique regional investment access, generous distribution policies, and NAV accretive tender offers that contributed to the recurring history of premiums are present today.

The upside vs. downside based on premium discount is overwhelmingly positive right now. Similar discounts to CUBA’s today are always scarce among those CEFs (like CUBA) dominated by liquid Level 1 assets, as shown on page 21 of the Fund’s Semiannual report released Thursday. Unlike the known August-December stretch last year, there is absolutely nothing subjective or concerning about the NAV Herzfeld is publishing daily.

The recent illusory high magnitude discount

We cannot understand today’s CEF specific mispricing opportunity without understanding why such opportunity exists. Herzfeld’s Caribbean basin fund traded at an outlier, but very well anticipated, discount to published NAV during Q4 2023. The market was reflecting what the published NAV could not, a major and absolutely anticipated December 20, 2023 drop in NAV. The daily change is shown in the NAV column moving from 12/18/2023 to 12/20/2023 below:

NAV finally reflects anticipated accounting drop (cefconnect.com)

This drop was by virtue of a rights exercise, available to all shareholders and not transferable outside of each CUBA shareholder. It is discussed in greater detail on page 8 of the SemiAnnual Report released Thursday. Ultimately, the amount of NAV reduction similar to what the market pricing move anticipated, $1.60. This amount can be verified as “Dilutive effect due to rights offering” on page 18 of the Semiannual report.

Inappropriate short-term Premium/Discount “stickiness”

In the short term, CEFs tend to trade at discounts near their most recent calculated discount. But, until the anticipated $1.60 accounting reduction was finally reflected as a 31.2% NAV decline on December 20, 2023 the discount calculation was not reflective of market knowledge of the coming NAV drop. In practice, the high magnitude daily NAV discount from August through December 19th is best seen as an illusion.

So, the most recent daily NAV track record that today’s market is using for market premium/discount stickiness appears in all numerical calculations and charts but more accurately should reflect “non-applicable.” Long story short, today’s absurd discount is not well-founded by last year’s formulaic calculation during a period awaiting NAV to reflect the high magnitude NAV decline everyone knew was coming.

Inflection point

The forward-looking prospects for the fund changed dramatically for the better on December 21. The prior night’s published NAV was relevant. The forward-looking expense ratio which had been a concern in recent years was now much lower due to the fund’s larger size. And both the distribution policy and tender offer policy had been restored. That tender offer policy has provided for NAV accretive events nearly annually, and also has provided recurring liquidity near NAV. One such tender is underway now, and its NAV accretion is an anticipated NAV positive event for all shareholders.

Today’s price represents tremendous market inefficiency. And yes, markets can sometimes be that inefficient. Evidence in CUBA trading itself, today’s sellers are taking a much lower price than the tender buyback that is currently underway! This week’s accretive tender offer buys back stock at a discount, thus benefiting all forward-looking shareholders (NAV accretion), while also giving all shareholders the option to monetize a portion of their investment at a better price than selling at market. To make a cruising analogy, I believe we are looking at much smoother seas ahead!

Fixing the fixed expense drain: the Board’s dilemma leading to 2023 NAV issue

The purpose of this writing is to address the investment prospects of CUBA today. And no, I did not see the fund as appropriate for my investment dollar at this time last year. But the following information may lend perspective to the Board’s long-term purposes.

By this time last year, the fund’s total asset value had shrunk such that fixed expenses became truly problematic to a forward-looking investment profile. From a governance perspective, it would appear that either pursuing a liquidation vote, interval fund conversion vote, ETF conversion vote, or raising capital to regain economies of scale was necessary to stop a worsening fixed expense bleed.

That may not sound like the dilemma it probably was. I am skeptical that any needed vote could have been successful in 2023. November 2022 tender results show a 3x proration, meaning only about one-third of shareholders were willing to sell significantly above market price. There are times such reflects a disinterest to realize a gain, or even a loss, where the shares can’t be replaced at a similar price before wash sale rules would apply. In my view, neither was the case. Last year’s CUBA shareholder base was likely an impossible circumstance to achieve the necessary votes for structural change.

So in late August, the fund announced taking drastic and painful steps which would substantially mitigate the fixed expense issues as well as the shareholder indifference. CUBA delayed its 2023 tender offer until now, suspended the distribution policy (which has since been restored), and filed for a rights offering with terms that lacked any basement purchase price. Because any price for newly issued shares would be at a substantial discount to the prevailing market price, many rational shareholders chose to sell the shares they already owned at almost any price at all. I cannot argue with the logic of selling under the circumstance.

The discount was around 50% at worst because The Board of Directors had the option (but not the obligation) to create three newly issued shares for every one previously existing share. If such occurred it would have been a disaster for all shareholders, including those who participated. The issuance itself was not nearly as bad as feared as the Board exercised restraint and did not fulfill subscriber over-subscription requests in full.

Concluding thoughts

Looking forward, the proportional reallocation of stock to “hands on” investors does open up several options. Perhaps CUBA will again find a premium as a CEF in yet another consecutive decade by virtue of the same tenants that made such possible in the 1990s, 2000s, and 2010s: unique regional investment access, generous distribution policies, and NAV accretive tender offers. If so, they can further reduce the expense ratio while accreting NAV rather than diluting NAV with more opportunistic rights offerings. They have done so in the past. My investment thesis does not hinge on ever achieving a premium though.

An affirmative value unlocking vote is now far more achievable if and when the Board desires, if necessary. Since the majority of what are now the total existing shares were recently issued to more active and hands-on investors, the Board has more viability to convert CUBA to an interval structure or ETF structure if and when it chooses. If needed, such would unlock a lot of value from here and forever smooth out market returns from year to year going forward.

Whatever courses CUBA trading and CUBA’s Board of Director’s take, I hope for Herzfeld’s legacy to be vindicated from 2023. Few if any then-shareholders were conscious how limited the Board’s practicable options appeared to have been. I do feel confident that myself having bought these cruise lines and much more of the portfolio constituents thereafter around 80 cents on the dollar could pay for me to cruise the Caribbean at full price on a full ship.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Credit: Source link