pidjoe

Hannon Armstrong Sustainable Infrastructure Capital, Inc. (NYSE:HASI) is a REIT that focuses on renewable energy infrastructure projects, mainly solar and wind. In addition to providing loans to such projects, the company also makes equity investments in them. This essentially makes it a combination of a mortgage REIT and a traditional REIT which owns assets and it allows the company to derive unique synergies between a lender and an equity holder. It also has pronounced implications in valuation which I’ll touch on later. In this article, I will present an overview of the company’s operations and comment on the valuation of the company so that you can decide if it makes a good investment for you.

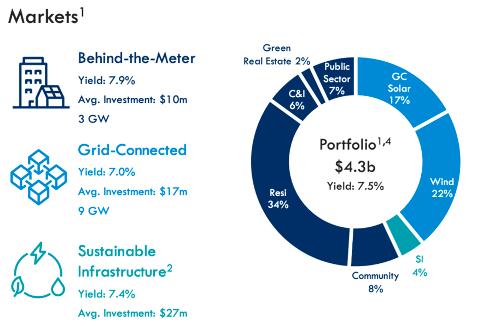

The company currently has a $4.3 billion portfolio which can be broken down into three segments. Over half comes from behind-the-meter projects (projects where energy is produced and consumed on site – solar on roofs etc.), followed by grid-connected projects (large scale projects that are net exporters of energy into the grid – large solar power plants or wind turbines) and sustainable infrastructure which only account for about 4% of the portfolio. With the renewable energy industry expected to grow significantly over the rest of the decade, I like the way HASI is positioned to take advantage of this tailwind.

HASI

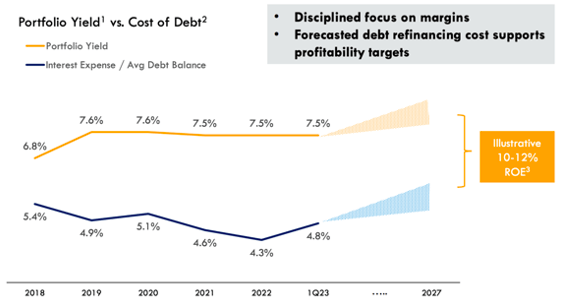

The way in which HASI generates returns is quite simple. It gets money from equity issuance and debt at a relatively lower cost and invests that money into projects that yield 7.5% on average. Since their cost of debt is under 5% (4.8% to be exact) the company earns a solid spread which allows it to generate 10-12% return on equity (ROE). This spread is the single biggest driver of HASI’s business and has been relatively stable through the years regardless of the interest rate level.

HASI

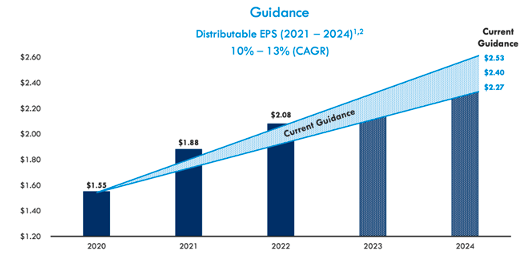

This stable spread has allowed the company to grow its portfolio and earnings at a double-digit rate since 2018. In 2022, EPS totaled $2.08 and first quarter results show that the company is well on its way to achieving its guidance which calls for a 10-13% growth CAGR this and next year. The reason why the company is able to grow its earnings is closely tied to its large pipeline of potential projects. Last year alone, the portfolio increased by 19% YoY and this year will likely be no different as the company sits on a pipeline of $4.5 billion worth of projects. If management delivers on its guidance, 2024 earnings per share could reach $2.40 at midpoint.

HASI

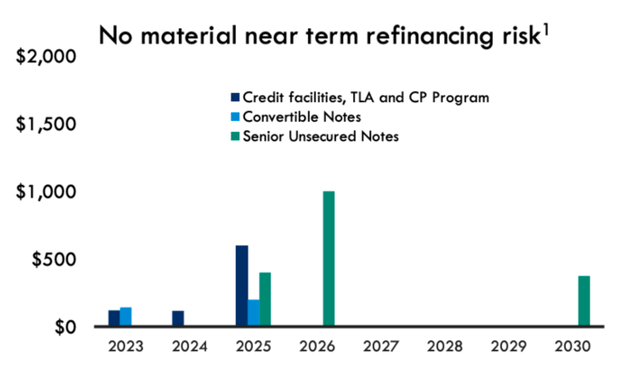

Meanwhile, the company maintains a BB+ rated balance sheet that is 86% hedged against interest rate risk and has no significant debt maturities until 2025 and pays a respectable $1.58 per share dividend which yields about 5.8% and is well covered by distributable earnings.

HASI

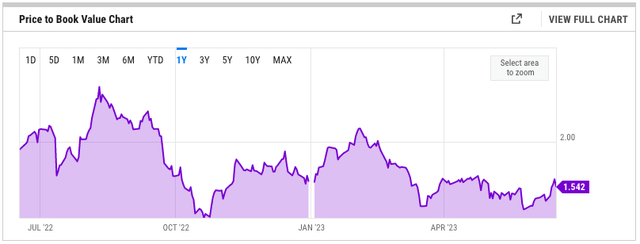

I never invest in companies for their dividend alone but always want meaningful upside and a reasonable margin of safety. A regular mortgage REIT should never trade above 1x book value, but since HASI has almost $2 billion in equity investments and manages some off-balance sheet assets which allow it to earn a fee on top of the interest spread, some premium over 1x book value is justified. Currently the stock trades just under 1.5x book value which I believe to be reasonable.

YCharts

If management delivers on its guidance and EPS grows by 10-13% per year, investors could earn significant market beating dividend even without a need for multiple expansion. With a sizeable pipeline of projects to deploy capital into, it’s quite likely that EPS will grow and the company will continue to pay the dividend at current or higher levels.

Before investing it’s important to consider all risks that could result in a potential decrease in the multiple and consequently a price drop. Since HASI is partly a mortgage REIT, higher rates act as a double-edged sword. They allow the company to charge higher rates on their floating rate loans, but at the same time, they increase the likelihood that borrowers won’t be able to repay their debts. The risk is much lower for HASI compared to say an office mortgage REIT, but is still present nonetheless.

Overall HASI seems like a solid investment that is reasonably priced today for what it is. The downside is always there, as the stock could potentially fall as low as 1.2x BV. Given their equity stake in various projects that are reported at costs, I don’t think the valuation can realistically get to 1x BV, even in the worst-case scenario. On the other hand, the upside is quite intriguing here, especially when the multiple re-rates higher when the economic situation calms down. These reasons lead me to a BUY rating for HASI here.

Credit: Source link