pcess609/iStock via Getty Images

Dear readers/followers,

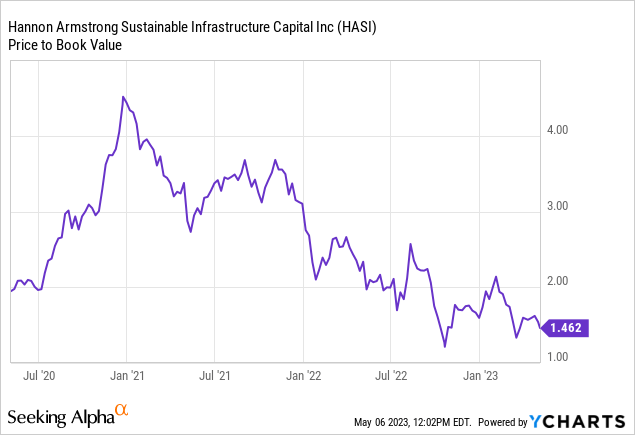

I started coverage of Hannon Armstrong Sustainable Infrastructure Capital (NYSE:HASI) back in February when I published an article called “Hannon Armstrong: Overvalued as Market Continues To Ignore Mortgage REIT Basics”. Despite solid growth prospects I issued a HOLD rating for one simple reason – at the time the REIT was trading at 1.93x book value which I considered overvalued. I encourage you to check out the original article to get my take on why a mortgage REIT should never trade significantly above 1x book value. All I’ll say here is that while I recognize that HASI has some business other than providing loans (i.e. they own some of the projects and generate management fees), the majority of their business does come from loans (62% of all revenues is interest income), which effectively anchor the fair multiple near one times BV. This is what lead me to establish a fair multiple for HASI at which I’m willing buy of 1.5x BV and what stopped me from buying at $33 per share.

Since then, HASI has underperformed quite significantly, dropping by 21.4% while the S&P500 moved sideways. Of course, there were other factors in play beyond simple overvaluation, but staying conservative and waiting for the price to come to a place where I feel the valuation makes sense has proven to be a good decision. Now that we’re here and after Q1 earnings, it’s time for an update.

Now let’s turn to their first quarter results which have been pretty solid on most fronts. First with regards to growing their portfolio, they had their best ever quarter as their portfolio increased by 9% QoQ (and +25% YoY) to $4.7 Billion. The $400 Million increase was financed primarily through credit facilities and commercial paper and when asked about it on the earnings call, management kind of dodged the question and said that going forward they will evaluate different funding options and pick the most attractive one. In any case, the portfolio continues to have a very solid 7.5% yield while new transactions closed in Q1 averaged above 8%.

What’s a bit worrying is that fact that the spread they earn has narrowed for the first time since 2018. This is hardly surprising given a rise interest rates, but definitely something to keep an eye on. Currently the spread stands at 2.7% (vs 3.2% last quarter), but still allows them to earn a ROE of 12% (up from 11.5% in Q4 2022). Going forward the impact of high interest rates is expected to be limited as net interest income [NII] variability is minimized with hedging (87% of debt is hedged) and their fee-based income has no meaningful interest rate exposure. Moreover, their growing portfolio which currently has a pipeline of over $5 Billion should provide a stable basis for their overall results.

HASI Presentation

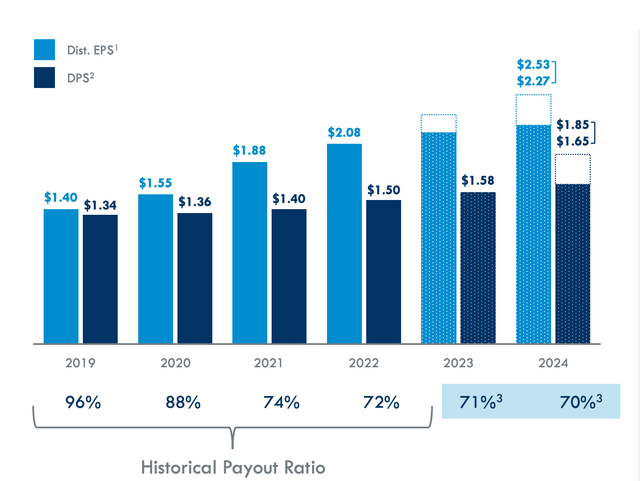

Management has also reiterated their guidance for 2023 and 2024 to grow distributable earnings by 10-13% and dividends by 5-8% per year. That’s fairly impressive growth and one that is quite achievable given their pipeline and the general tailwinds that I expect the renewable energy sector to experience over the rest of the decade. On Investor day, management stated that 75% of distributable NII needed to achieve their 2024 guidance has already been locked in with closed transactions. After their first quarter this number has increased to 80%, meaning that the earnings visibility is high and it’s quite likely that management will deliver on their forecast.

Not only is HASI planning to grow their earnings and dividends, they are also planning to decrease their payout ratio overtime to make the model more sustainable and to retain more cash for redeployment, after all they are able to earn 12% on their equity so it makes sense to retain some of it. The plan is to lower the payout ratio from 72% in 2022 to 70% by 2024 and to 50-60% by 2030. With a current dividend yield of 6.0%, this might be a rare chance to buy a stock that has an already high yield which is also going to grow fairly quickly.

HASI Presentation

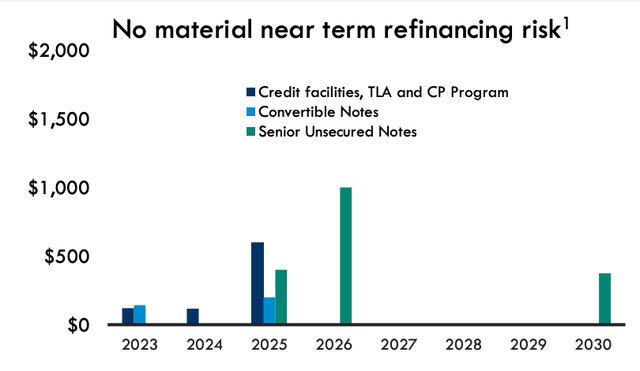

I also like their balance sheet a lot. They are only BB+ rated, which isn’t the greatest, but they do have significant hedges as 87% of their debt is fixed-rate. Moreover, their maturity profile is great with essentially no scheduled debt repayments before 2025.

HASI Presentation

With minimal refinancing risks, there are two main risks that HASI faces. First a rise in interest rates which will further decrease the spread they earn, though the risk is limited to only 13% of variable rate debt. And second loan defaults. To date, however, there has been no indication that investors should worry. As of Q1, 99% of loans were classified as performing with only 1% slightly below metrics (i.e. moderate risk of default).

So once again we get to valuation, but this time with a significantly lower price, HASI doesn’t seem quite as overvalued. It now trades at 1.46x book value which is just under my 1.5x target. Following the same methodology I used in the original article to adjust the book value by adding the value of their off balance sheet fee business (extra $200 Million in off-balance sheet value) and assuming reasonable appreciation on assets that they hold and which are now reported at costs (say 15% appreciation translating into addition $215 Million in value), it’s quite possible to conclude that HASI is fairly valued here at $26 per share and might even be starting to dip into the undervalued territory.

I actually already a started a position in the stock (mostly at $27 per share) and informed everyone in the comment section under the original article. Given solid performance in Q1, confirmed guidance and a reasonable valuation under 1.5x BV I upgrade HASI to a “BUY” here at $26 per share.

Going forward I expect the company to return:

- 6% dividend growing at 5-8% per year

- 10-12% EPS growth

- no return from multiple expansion

- total expected annual return of 15%+ (solid alpha)

Credit: Source link