AOosthuizen/iStock via Getty Images

Grab Holdings Limited (NASDAQ:GRAB), the once widely acclaimed super-app of Southeast Asia, is beginning to look like an overhyped stock that is turning out to be a lemon. While GRAB has achieved admirable success in attracting support and funding from respectable institutional investors, we suspect that the company’s business model was perhaps fundamentally flawed from the beginning.

TradingView.com

For GRAB to realize its vision of becoming a super-app, the company has little choice but to continue to grow its user base aggressively. Perhaps more importantly, GRAB must retain its existing users while fending off competitors as the company expands its ecosystem of applications. But to achieve all that, GRAB will need to navigate a minefield of challenges.

In this article, we present the challenges that GRAB is struggling to overcome from a strategic perspective of GRAB’s business model, and why we think we could potentially be looking at a non-starter.

We initiate coverage of GRAB with a “Sell” rating.

The Grand Vision

GRAB’s vision of building a super-app that could cater to the everyday needs of smartphone users, by disrupting traditional ways of providing goods and services through the use of software technology, is fundamental to GRAB’s future prospects and attractiveness as an investment. By transforming industries (retail, postal, transport, and banking, etc.) and aggregating these services into a streamlined and integrated platform, GRAB has the potential to achieve great economies of scale and create powerful network effects. That is a great business pitch, and it is no wonder GRAB has won the hearts and financial backing of institutional investors.

Grab Investor Day 2022 Presentation

The Promise Of Network Effects

Network effects have often been identified as one of the most important factors explaining the tremendous success of businesses that dominate their respective industries including Microsoft, Apple, and Google, just to name a few. Network effects refer to the phenomenon whereby the greater the number of people using a product or platform, the more attractive it is for existing users to stick with it and for new users to adopt it.

Just like how it is beneficial for users to choose Microsoft’s software over other brands if the vast majority are using it. Similarly, YouTube is the first that comes to mind when we are looking for videos of a particular topic or event. Because that is where you will find the widest variety of video content, nicely sorted by popularity or date. And because YouTube attracts the largest number of viewers, it is also the most attractive platform for video content producers to upload their content onto the platform. In short, scaling a network could enhance the quality and attractiveness of the network itself.

Network effects essentially allow businesses to increase switching costs for existing customers, build on the competitive advantage of their platforms, and increase the barriers to entry for new competitors. So if GRAB could scale rapidly and strengthen the network effects of its platform, the company could effectively monopolize its market. Network effects don’t just seem promising in theory, but have been studied and applied extensively in real-world case studies.

But one of the most challenging problems with any good business strategy is that competent competitors could employ the same strategy. Thus, understanding network effects and knowing how to build them is not enough. Successful businesses tend to employ multiple strategies that are complementary, allowing them to gain and extend their competitive advantages.

The First-Mover Advantage

Another well-understood strategy is the first-mover advantage, whereby businesses that are first to offer a product or service in a new market, or innovators that are first to offer a substantially improved product or service within an existing market, will gain a strategic advantage over later entrants. In the case of GRAB, being the first to offer a streamlined and integrated platform of services, means it could grow rapidly and gain market share before a potential competitor catches on. The quicker GRAB can increase the number of users, the quicker it could strengthen the network effects of its platform.

To scale rapidly, GRAB has chosen a familiar playbook that has helped turn many tech startups into multi-billion tech giants overnight. By spending aggressively on marketing, offering generous incentives for gig workers and attractive discounts for customers, GRAB’s plan is to burn cash to rapidly gain users and grow transactional volumes. Profitability can come later. Investors who bought shares of GRAB during its IPO in December 2021 were keen to participate in the boom. Investors embraced the strategy, even if it meant incurring millions of dollars in losses in the short run.

The Curse Of Competition

Extending GRAB’s first-mover advantage by aggressively growing its user base may seem like a great strategy, but the high costs associated with developing the market and introducing new users to adopt any innovative technology is in essence a risky business.

Competition has always been part and parcel of doing business. And countless books have been written to educate business leaders about the threat of competition and various strategies to manage it. Serial entrepreneurs also understand that competition is always just around the corner, ready to pounce at the opportunity to foil their ambitious plans. The biggest threat to GRAB’s first-mover advantage is competition, specifically new entrants that are capable of offering an equally attractive service with equally generous incentives and discounts.

Because the dynamics of each industry are unique and the areas in which competitors compete may vary, whether being a first-mover is an advantage or not depends on several factors. A few examples include the cost and complexity associated with research and development (R&D), the speed at which a product or service can be introduced to the market, and how challenging it is for competitors to copy or mimic the incumbent.

For GRAB, its existing platform of services does not require any real technological breakthroughs to develop. Any experienced software developer would agree that GRAB’s user app, driver/rider app, payment systems, ride-hail GPS and maps, restaurant ordering system, driver/rider app, after-sales and reward systems etc., mostly involve weaving together existing technologies.

The fact that smartphone users today could install an application, fill in credit card details, and begin using a service with minimal instructions, just shows how easy it is for GRAB’s users and gig workers to switch to a competitor that could offer better incentives or rewards for GRAB’s users and gig workers. This is where we see GRAB’s greatest weakness and risk as a first-mover. Having already spent billions in incentives and rewards to build up its user base and market share over the years, GRAB will have to keep spending to fend off new competitors that are equally well-backed by venture capitalists and institutional investors.

The Business Times

The competition may not even be another well-capitalised giant that would challenge GRAB’s platform head-on. It could very well be smaller competitors that have chosen to focus on providing a single service and excelling at it. In fact, it is already evident that GRAB will have to face several competitors, potentially losing market share in every area. This begs the question of whether GRAB will ever be able to turn a profit and deliver the returns that its shareholders are hoping to see.

Cost Cutting Likely To Dampen Growth

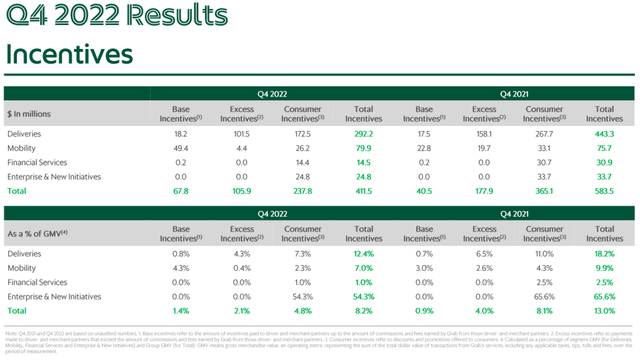

GRAB’s Q4 2022 earnings release provided hints of how management is planning to address concerns surrounding its gigantic quarterly losses, especially at a time when sentiment has shifted against fast-growing tech companies with no earnings. Management announced that incentives have been cut by 29% from US$583.5 million in Q4 2021 to US$411.5 million in Q4 2022. GRAB has also frozen hiring across several regional functions and pleasantly surprised its shareholders with a shortened projected timeline to profitability by the end of 2023.

GRAB Q4 2022 Earnings Presentation

Of course, veteran investors understand that there is rarely such thing as a free meal in the financial markets and in business. By shortening the timeline to profitability through slashing incentives and freezing hiring, GRAB is essentially making a trade-off by sacrificing some growth in exchange for better short-term earnings performance. However, by doing so, GRAB risks losing market share. Because offering generous incentives and rewards to its gig workers and customers was so crucial to GRAB’s growth strategy over the years, taking some of that away could mean encouraging its gig workers and customers to switch to a competing platform.

The pressure to grow and retain users on its platform amid intense competition means GRAB is likely to end up chasing every tech fad that comes along. From digital wallets, cryptocurrencies, and digital banking services, to logistics, telehealth and AI. But trying to do everything usually means that a company is unlikely to do anything exceptionally well. The “all-in-one, every day, everything app” which GRAB calls itself, could end up struggling to compete effectively with many of its smaller and highly focused competitors that specialise in doing one thing really well.

GRAB May Have Already Lost The Plot

The odds of GRAB realizing its vision to become the dominant super-app of Southeast Asia are heavily stacked against the company in our view. If GRAB’s original strategy was to grow aggressively and quickly establish a dominating market share, before eventually reducing incentives to improve profit margins, then that strategy seems to have been poorly conceived.

Not only do we think GRAB’s grand vision of becoming the super-app of Southeast Asia will turn out to be a house of cards, but we also see risks that GRAB’s long-term profitability will turn out to be quite mediocre. Given that GRAB’s competitive environment looks likely to become increasingly cutthroat, and that the company has yet to achieve the network effects needed to dissuade users from switching, GRAB may have already lost the plot.

In Conclusion

We are sceptical of seeing any meaningful improvement in GRAB’s businesses for the foreseeable future, as management seems to lack a viable strategy for fending off competition and securing a dominating market share, which we think is necessary for achieving and sustaining long-term profitability.

Thus, current valuations are unattractive even with its shares trading at around 75% below its December 2021 IPO debut price of $13.05. Should management fail to readjust its strategy, we could be looking at a non-starter.

We initiate coverage of GRAB with a “Sell” rating.

Credit: Source link