John Kevin

By Samara Cohen

Three Things To Know From Q3 2023

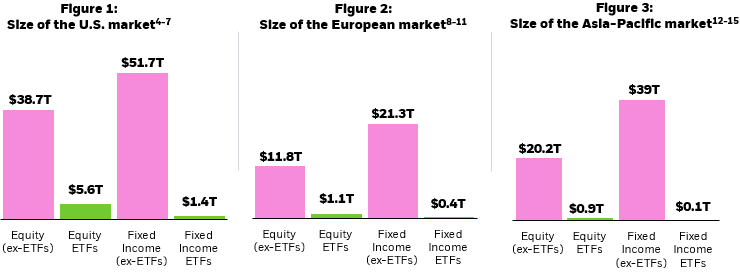

- Exchange traded funds (ETFs) remain a fraction of the total global financial market in both equities and fixed income, ranging from 4.4%-12.7% of equities and 0.4%-2.6% of fixed income assets by region.1

- Global ETF volumes, with the exception of an increase in Asia-Pacific, were roughly in line quarter-over-quarter as a result of continued lower equity market volatility and remain lower year-over-year, while ETF bid-ask spreads continued to tighten in both the U.S. and Europe over the period.2

- U.S. ETF options volumes have grown at a compounded annual growth rate of 53% since 2019 (reaching nearly $100 trillion year-to-date); ETFs with a robust options ecosystem are typically supported by higher average daily volumes and lower bid-ask spreads.3

ETF Market Size

Assets under management in ETFs are only a fraction of the global financial market.

ETFs represent 12.7% of equity assets in the U.S., 8.5% in Europe, and 4.4% in Asia-Pacific. Market share is smaller in fixed income, where ETFs account for 2.6% of fixed income assets in the U.S., 1.8% in Europe, and 0.4% in Asia-Pacific (Figures 1, 2, and 3).

Chart description: Column charts showing the size of equity and fixed incomes ETF assets under management in comparison to the total equity market capitalization and total debt outstanding in the U.S., Europe, and Asia-Pacific. This chart shows that while ETFs represent a large dollar amount of assets, that amount is still small in comparison to both the equity and fixed income markets.

ETF Trading Volumes

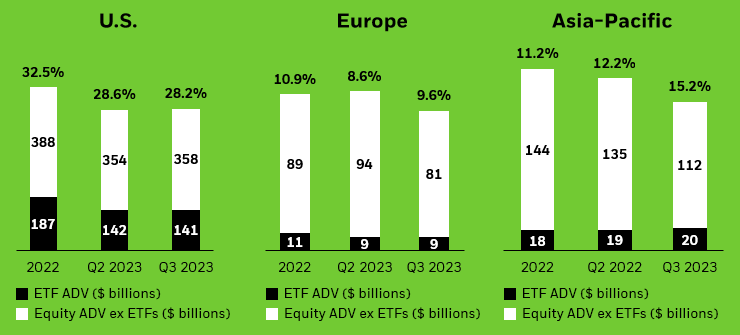

In the third quarter of 2023, average daily trading volumes for U.S. equity market (shares, ETFs, and depository receipts) and U.S. ETFs were $499.6 billion and $141.3 billion, respectively. This means that U.S. ETFs accounted for 28.2% of the total U.S. composite volume in the secondary market over the quarter, slightly lower than Q2 figure.

In Europe, there was an uptick in this percentage. Average daily trading volume in European equities was $89.5 billion, while the average daily trading volume in European ETFs was $8.5 billion, roughly 9.6% of total European equities over the quarter. This was as a result of a decline in European equity volumes in Q3.

In Asia-Pacific, ETFs accounted for 15.2% of the total composite volume in the secondary market in the quarter, with Asia-Pacific equities and ETFs trading $132.9 billion and $20.2 billion, respectively. This was a substantial increase from Q2 led by a pickup in levered and inverse ETP trading as well as a significant decline in Asia-Pacific equity volumes (Figures 4, 5, and 6).

Figures 4–6: ETFs as a percentage of total equity trading volume (% average)16

Chart description: Column charts showing ETF trading as a percentage of overall equity market trading volumes in the U.S., Europe, and Asia-Pacific. Equity ADV includes stock and ETF volumes. This chart shows that ETF trading volume as a percentage of the equity trading volume was lower in the U.S., but higher in Europe and Asia-Pacific than in the previous quarter.

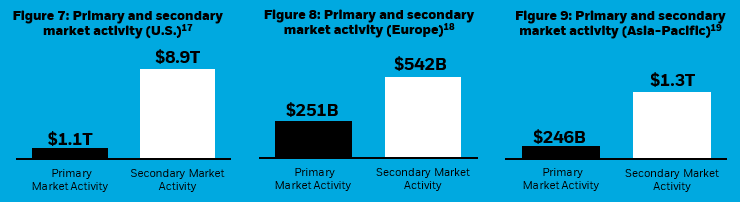

Most Trading Activity Occurs In The Secondary Market

Most ETF trading activity occurs in the secondary market, where ETF shares change hands between buyers and sellers. When demand cannot be met in the secondary market, large institutions (known as “authorized participants”) can transact with ETF issuers to create or redeem ETF shares in a separate, “primary” market.

In the third quarter of 2023, the ratio of secondary market activity to primary market activity in the U.S. was 8:1. This means that for every $8 of ETFs traded, only $1 resulted in trading activity in the underlying securities. In Europe, this ratio was 2:1 and in Asia-Pacific it was 5:1 (Figures 7, 8, and 9).

Chart description: Column chart showing the amount of ETF trading in the secondary market compared to the amount of primary market activity in the U.S., Europe, and Asia-Pacific. The amount of secondary market activity is far greater than primary activity, which means that most ETF trading takes place on an exchange between buyers and sellers and does not impact the underlying securities of the ETF.

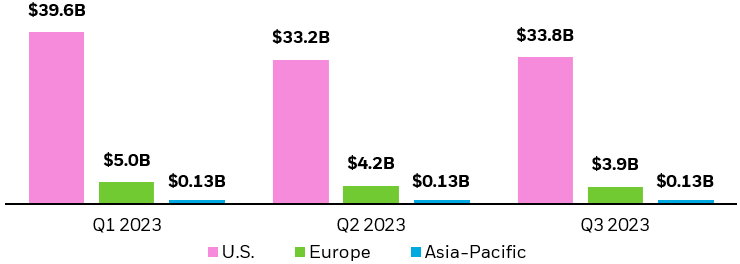

iShares Secondary Market Trading Stats

In the third quarter of 2023, the average daily trading volume in U.S. iShares ETFs was $33.8 billion, slightly up from an average of $33.2 billion in Q2 2023.

In Europe, the average daily trading volume in iShares ETFs was $3.9 billion, down from an average of $4.2 billion in Q2 2023.

In Asia-Pacific, the average daily trading volume in iShares ETFs was $0.13 billion, in line with the Q2 2023 average (Figure 10).

Figure 10: Average daily volumes for iShares ETFs20

Chart description: Column chart showing the average daily volume (ADV) of iShares ETF trading in the U.S., Europe, and Asia-Pacific in Q3 2023. Volumes slightly decreased quarter-over-quarter in Europe and remain roughly in line in the U.S. and Asia-Pacific.

Bid-ask spreads (a component of trading costs for investors), are impacted by factors such as liquidity, volatility, and the efficiency of the ETF ecosystem.

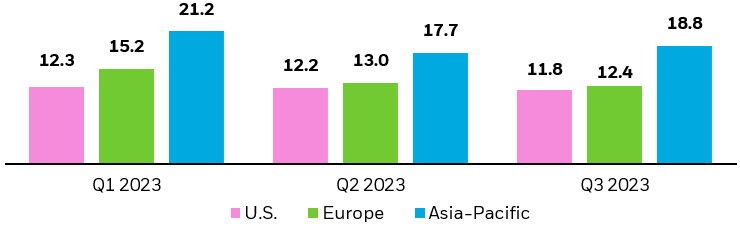

In Q3, bid-ask spreads in U.S. iShares ETFs tightened to 11.8 basis points (bps), on average. In European-listed iShares ETFs, spreads tightened to 12.4 bps on average, and in Asia-Pacific-listed iShares ETFs, spreads widened to 18.8 bps on average (Figure 11).

Figure 11: Average iShares ETF bid-ask spreads (bps)21

Chart description: Column chart showing the average bid-ask spread (a component of an ETF’s trading cost) for iShares ETFs in the U.S., Europe, and Asia-Pacific for Q3 2023. Bid-ask spreads tightened in the U.S. and Europe, and slightly widened in Asia-Pacific, compared with Q2 2023.

ETF Flows Typically Have Minimal Impact On Stocks

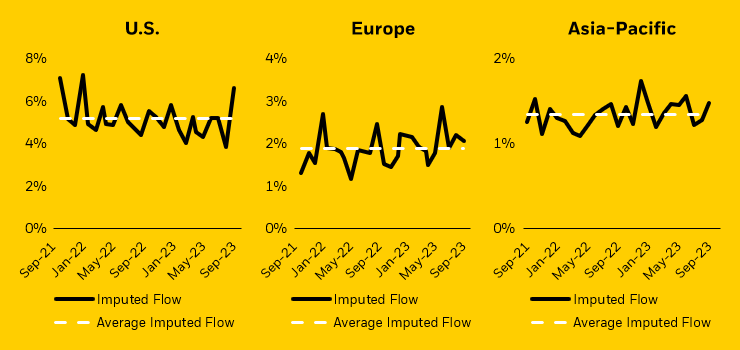

Investors can assess the impact of primary market activity on the prices of underlying stocks through a metric called “imputed flow.” This metric estimates the proportion of all stock trading that results from ETF creations or redemptions; meaning, imputed flow is an approximation for how much stock trading is generated by ETF inflows and outflows.

The impact is typically modest. From September 2021 through September 2023, approximately 5.2% of trading volume in U.S. equities has been attributable to ETF activity, while in Europe, just 1.9% of trading in individual European stocks has been attributable to ETF flows. In Asia-Pacific, this figure is 1.3% (Figures 12, 13, and 14).

Figures 12–14: Percentage of stock trading as a result of ETF flows22

Chart description: Line charts showing both the total and average imputed flow in the U.S., Europe, and Asia-Pacific. Imputed flow is an estimation of how stock trading is generated by ETF inflows and outflows. The charts show that imputed flow is below 5.3%, on average, in all regions.

A Look At The ETF Options Landscape

- ETF options are an increasingly popular tool for both institutional and individual investors to express tactical market views, seek income, and hedge portfolios.

- ETF options volumes have significantly increased since 2019, and ETFs with a robust options ecosystem are typically supported by higher average ADVs and lower bid-ask spreads.23

The Case For ETF Options

ETF options are commonly used by both institutional and individual investors for a variety of purposes, which may include to:

- Express tactical market views through leveraged exposure to a specific segment of the market.

- Seek income by receiving options premium income from certain options-based strategies, like buy-writes.24

- Hedge portfolios and manage market risk.

ETF options are listed on multiple exchanges across regions, including in the U.S., Europe, and most recently, Asia. There are over 1,600 unique ETF options listed on over 5 different exchanges.25

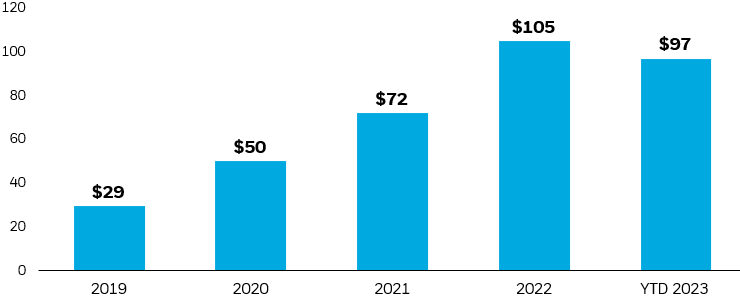

In the U.S., ETF option volumes have grown at a compounded annual growth rate of 53% since 2019, and year-to-date 2023 figures are on track to become the highest on record (Figure 15).

Figure 15: U.S.-listed ETF options volume ($trillions)26

Chart description: Bar chart showing U.S.-listed ETF options volumes since 2019. This chart shows that U.S.-listed ETF options volumes has significantly increased since 2019. Year-to-date figures are as of September 30.

Benefits To The ETF Ecosystem

ETF options can give investors choice by providing them with another way to express their views; they can also contribute to an improved ETF trading experience.

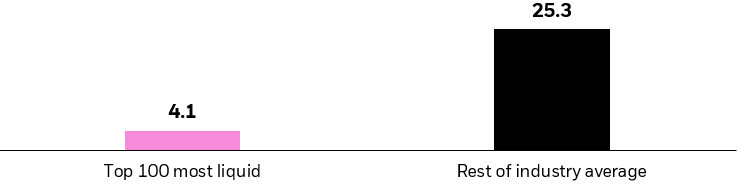

ETFs with a robust options ecosystem are typically supported by higher average daily volumes and lower bid-ask spreads as a result of hedging activity using the ETF.27

As the ETF options landscape expands, liquidity and cost benefits for investors are likely to continue to accrue to the ETFs with the largest options markets.

For example, in the U.S., ETFs with the most liquid options markets had an average bid-ask spread of 4.1 bps versus the rest of industry average of 25.3 bps in Q3 (Figure 16).

Figure 16: Average bid-ask spreads of U.S.-listed ETFs with most liquid options market vs. industry (bps)28

Chart description: Column chart showing the average bid-ask spread (a component of an ETF’s trading cost) for U.S.-listed ETFs with the largest options markets compared with the rest of the industry. Top 100 is defined as ETFs with the largest related number of ETF options contracts traded year-to-date as of September 30.

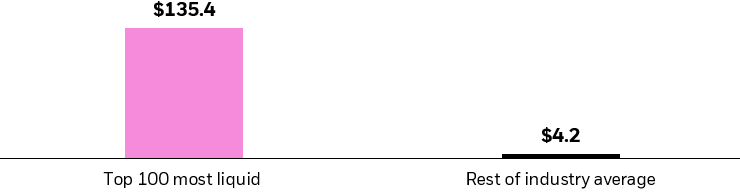

At the same time, U.S. ETFs with the most liquid options market had over $130 billion more in Q3 ADV than the rest of industry average (Figure 17). This can make these ETFs more liquid and cost-efficient to trade for end investors.

Figure 17:Average daily volumes of U.S-listed ETFs with most liquid options market vs. industry ($ billions)29

Chart description: Column chart showing the average daily volume (ADV) of U.S.-listed ETFs with the largest options markets compared with the rest of the industry. Top 100 is defined as ETFs with the largest related number of ETF options contracts traded year-to-date as of September 30.

Disclosure:

iShares unlocks opportunity across markets to meet the evolving needs of investors. With more than twenty years of experience, iShares continues to drive progress for the financial industry. iShares funds are powered by the expert portfolio and risk management of BlackRock.

© 2023 BlackRock, Inc. All rights reserved.

1 See Figures 1, 2 and 3.

2 Market volatility measured by the Cboe Volatility Index (VIX), a real-time index that represents the market’s expectations for the relative strength of near-term price changes of the S&P 500® Index (SPX). Because it is derived from the prices of SPX index options with near-term expiration dates, it generates a 30-day forward projection of volatility. Volatility, or how fast prices change, is often seen as a way to gauge market sentiment, and in particular the degree of fear among market participants. As of September 30, 2023. Source: Bloomberg, BlackRock, big xyt.

3 As of September 30, 2023. Source: Bloomberg, BlackRock, Markit.

4 This reflects the size of the U.S. equity market (ex- ETFs). As of September 30, 2023. Equity (ex-ETFs) represented by the market capitalization of the Russell 3000 Index. Source: Bloomberg.

5 This reflects the size of the U.S.-listed equity ETF market. As of September 30, 2023. Source: BlackRock, Markit.

6 This reflects outstanding debt issued by the residents of the U.S.. As of March 31, 2023. Source: Bank for International Settlements (BIS).

7 This reflects the size of the U.S.-listed fixed income ETF market. As of September 30, 2023. Source: BlackRock, Markit.

8 This reflects the size of the European equity markets (ex- ETFs). As of September 30, 2023. Equity (ex-ETFs) represented by the market capitalization of STOXX Europe 600 Index. Source: Bloomberg.

9 This reflects the size of the Europe-listed equity ETF markets. As of September 30, 2023. Source: BlackRock, Markit.

10 This reflects outstanding debt issued by the residents of the Euro area. As of July 31, 2023. Source: European Central Bank.

11 This reflects the size of the Europe-listed fixed income ETF market. As of September 30, 2023. Source: BlackRock, Markit.

12 This reflects the size of the Asia-Pacific equity markets (ex- ETFs). As of September 30, 2023. Equity (ex-ETFs) represented by the market capitalization of the MSCI Asia Pacific All Country Index. Source: Bloomberg.

13 This reflects the size of the Asia-Pacific-listed equity ETF markets. As of September 30, 2023. Source: BlackRock, Markit.

14 This reflects outstanding debt issued by the residents of Australia, China, Hong Kong, Japan, Malaysia, Philippines, Singapore, and Thailand. As of March 31, 2023. Source: Bank for International Settlements (BIS).

15 This reflects the size of the Asia-Pacific-listed fixed income ETF market. As of September 30, 2023. Source: BlackRock, Markit.

16 As of September 30, 2023. Source: BlackRock, Markit, Cboe Global Markets, big xyt.

17 Information on individual primary market orders may not be available for each ETF, globally. To approximate the scale of primary market activity for ETFs, we have used the absolute value of daily net flow for each ETF and aggregated it over the time period. This is only an approximation of ETFs’ primary market activity. As of September 30, 2023. Source: Bloomberg, BlackRock.

18Information on individual primary market orders may not be available for each ETF, globally. To approximate the scale of primary market activity for ETFs, we have used the absolute value of daily net flow for each ETF and aggregated it over the time period. This is only an approximation of ETFs’ primary market activity. As of September 30, 2023. Source: Bloomberg, BlackRock, Markit, big xyt.

19 Information on individual primary market orders may not be available for each ETF, globally. To approximate the scale of primary market activity for ETFs, we have used the absolute value of daily net flow for each ETF and aggregated it over the time period. This is only an approximation of ETFs’ primary market activity. As of September 30, 2023. Source: Bloomberg, BlackRock.

20 As of September 30, 2023. Source: Bloomberg, BlackRock, Markit, big xyt.

21 A basis point (BP) is one hundredth of one percent. As of September 30, 2023. Source: TAQ Refinitiv.

22 As of September 30, 2023. Source: Bloomberg, BlackRock.

23 As of September 30, 2023. Source: Bloomberg, BlackRock, Markit.

24A buy-write is an options strategy which seeks to generate option premium income by selling at/out of the money call options on underlying holdings, which caps upside returns.

25 As of September 30, 2023. Source: Bloomberg, BlackRock.

26 As of September 30, 2023. Source: Bloomberg, BlackRock, Markit.

27 Market Makers often hedge the exposure they provide liquidity on, by taking the opposite trade as the buyer or seller. For instance, if an investor is shorting U.S equity market exposure, a market maker may hedge this trade by purchasing a comparable U.S. equity ETF. Given this activity may happen frequently, it can lead to increased ETF liquidity and make it cheaper to trade the ETF.

28 Top 100 is defined as ETFs with the largest related number of ETF options contracts traded YTD. As of September 30, 2023. Source: Bloomberg, BlackRock, Markit.

29 Top 100 is defined as ETFs with the largest related number of ETF options contracts traded YTD. As of September 30, 2023. Source: Bloomberg, BlackRock, Markit.

Carefully consider the Funds’ investment objectives, risk factors, and charges and expenses before investing. This and other information can be found in the Funds’ prospectuses or, if available, the summary prospectuses, which may be obtained by visiting the iShares Fund and BlackRock Fund prospectus pages. Read the prospectus carefully before investing.

Investing involves risk, including possible loss of principal.

Fixed income risks include interest-rate and credit risk. Typically, when interest rates rise, there is a corresponding decline in the value of debt securities. Credit risk refers to the possibility that the debt issuer will not be able to make principal and interest payments.

International investing involves risks, including risks related to foreign currency, limited liquidity, less government regulation and the possibility of substantial volatility due to adverse political, economic or other developments. These risks often are heightened for investments in emerging/ developing markets or in concentrations of single countries.

A BuyWrite Strategy ETF’s use of options may reduce returns or increase volatility. During periods of very low or negative interest rates, the Underlying Fund may be unable to maintain positive returns. Very low or negative interest rates may magnify interest rate risk. In a falling interest rate environment, the ETF may underperform the Underlying Fund. By writing covered call options in return for the receipt of premiums, the ETF will give up the opportunity to benefit from increases in the value of the Underlying Fund but will continue to bear the risk of declines in the value of the Underlying Fund. The premiums received from the options may not be sufficient to offset any losses sustained from the volatility of the Underlying Fund over time. The ETF will be subject to capital gain taxes, ordinary income tax and other tax considerations due to its writing covered call options strategy.

Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of “Characteristics and Risks of Standardized Options.” Copies of this document may be obtained from your broker, from any exchange on which options are traded or by contacting The Options Clearing Corporation, One North Wacker Dr., Suite 500, Chicago, IL 60606 (1-888-678-4667). The document contains information on options issued by The Options Clearing Corporation. The document discusses exchange traded options issued by The Options Clearing Corporation and is intended for educational purposes. No statement in the document should be construed as a recommendation to buy or sell a security or to provide investment advice. If you need further information, please feel free to call the Options Industry Council Helpline. They will be able to provide you with balanced options education and tools to assist you with your iShares options questions and trading. The Options Industry Council Helpline phone number is 1-888-Options (1-888-678-4667) and its website is www.888options.com.

This material represents an assessment of the market environment as of the date indicated; is subject to change; and is not intended to be a forecast of future events or a guarantee of future results. This information should not be relied upon by the reader as research or investment advice regarding the funds or any issuer or security in particular.

This material is provided for educational purposes only and is not intended to constitute investment advice or an investment recommendation within the meaning of federal, state or local law. You are solely responsible for evaluating and acting upon the education and information contained in this material. BlackRock will not be liable for direct or incidental loss resulting from applying any of the information obtained from these materials or from any other source mentioned. BlackRock does not render any legal, tax or accounting advice and the education and information contained in this material should not be construed as such. Please consult with a qualified professional for these types of advice.

Shares of ETFs may be bought and sold throughout the day on the exchange through any brokerage account. Shares are not individually redeemable from an ETF, however, shares may be redeemed directly from an ETF by Authorized Participants, in very large creation/redemption units.

There can be no assurance that an active trading market for shares of an ETF will develop or be maintained.

Buying and selling shares of ETFs may result in brokerage commissions.

The Funds are distributed by BlackRock Investments, LLC (together with its affiliates, “BlackRock”).

©2023 BlackRock, Inc or its affiliates. All Rights Reserved. BLACKROCK, iSHARES, iBONDS, LIFEPATH, ALADDIN and the iShares Core Graphic are trademarks of BlackRock, Inc. or its affiliates. All other trademarks are those of their respective owners.

iCRMH1023U/S-3146152

This post originally appeared on the iShares Market Insights.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Credit: Source link