marchmeena29

Gladstone Commercial Corporation (NASDAQ:GOOD) is a leading commercial real estate investment trust that continued to cover its dividend with funds from operations in the fourth quarter.

Gladstone Commercial’s strong position in terms of rent collection (the trust collected 100% of its scheduled rent in 2023) and very decent dividend coverage are reasons why I am reaffirming my Buy Stock recommendation.

Gladstone Commercial also continues to sell at a very moderate FFO multiple which implies a very solid margin of safety for passive income investors.

Based on the trust’s last earnings release, I am not concerned about Gladstone Commercial’s ability to pay a stable dividend in 2024.

My Rating History

Gladstone Commercial’s FFO multiple suffered considerable downward pressure in 2023 which was related to the trust’s association with the U.S. office sector.

Taking into account the central bank’s statement that it would consider slashing short-term interest rates in 2024, my stock classification was Buy. The trust’s fourth quarter earnings proved that the dividend should be sustainable in 2024 and I think we could see growth in the trust’s portfolio footprint once the central bank follows through with rate cuts.

Portfolio Review

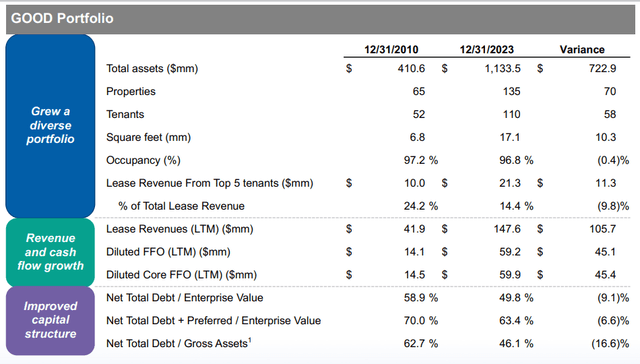

Gladstone Commercial’s main business is the acquisition, ownership and operation of industrial and office properties. At the end of 2023, the commercial real estate investment trust had 135 properties in its portfolio that produced approximately $147.6 million in annual lease revenues.

The trust’s portfolio has grown consistently since 2010 and it has been well-leased: Gladstone Commercial’s real estate portfolio had an occupancy of 96.8%, reflecting an improvement of 0.2 percentage points QoQ.

Portfolio Overview (Gladstone Commercial)

The main reason for Gladstone Commercial’s poor performance in the last year (as well as the dividend cut in 1Q-23) was that the real estate investment trust has considerable exposure to the office market which is seeing pressure related to rising vacancies and higher interest expenses.

About $1.2 trillion in commercial real estate debt is set to mature in the next two years and a lot of this debt will have to be refinanced at higher interest rates which in turn could lead to bankruptcies in the commercial real estate sector.

As a consequence, U.S. offices have experienced severe valuation pressure in 2023 which has created a distaste among passive income investors for real estate investment trusts with office exposure.

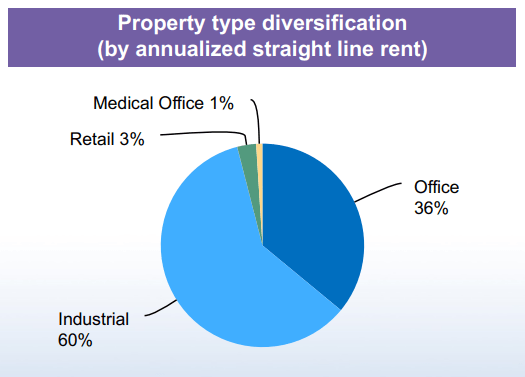

Gladstone Commercial has about 36% of its investments tied up in U.S. offices with another 60% being allocated to the industrial market. Though the U.S. office market is stressed, Gladstone Commercial collected 100% of its scheduled rent in 2023. Smaller investments are allocated to retail (3%) and medical offices (1%).

Property Type Diversification (Gladstone Commercial)

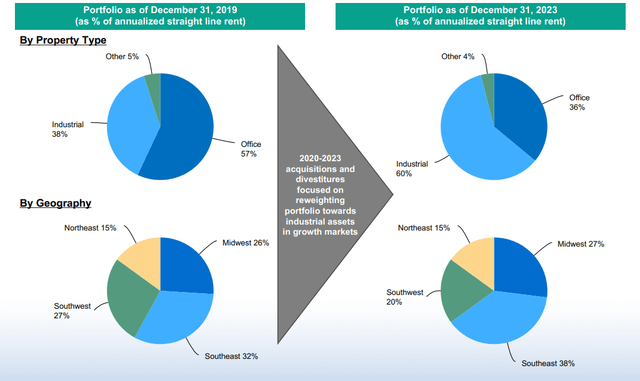

Gladstone Commercial has repositioned its real estate portfolio in the last couple of years, cutting its exposure to office real estate and overweighting industrial properties where market fundamentals are more favorable.

While office properties have suffered from the headwinds discussed, the industrial market is more resilient, primarily due to strong demand from the eCommerce industry.

Portfolio By Type And Geography (Gladstone Commercial)

7% YoY FFO Growth, Dividend Coverage Improved QoQ

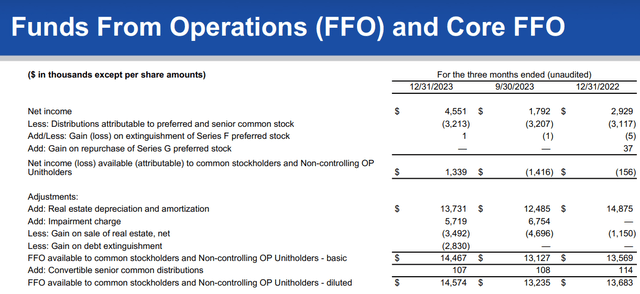

Gladstone Commercial’s fourth quarter showed promise in terms of dividend coverage as well as funds from operations growth. Passive income investors should remember that the real estate investment trust slashed its dividend in 1Q-23 due to the company’s exposure to the embattled U.S. office sector. Since then, however, the trust has consistently covered its dividend with funds from operations, including in 4Q-23.

Gladstone Commercial earned $14.6 million in funds from operations in 4Q-23, up 7% YoY due to strong lease performance even in a weak U.S. office market.

The trust did report an impairment charge of $5.7 million related to three properties in the fourth quarter, but this negative entry was offset by a gain of $3.5 million related to two property sales as well as a $2.8 million gain on a debt transaction. All things considered, it was a pretty boring (that is, stable) quarter for the commercial real estate investment trust.

Funds From Operations (Gladstone Commercial)

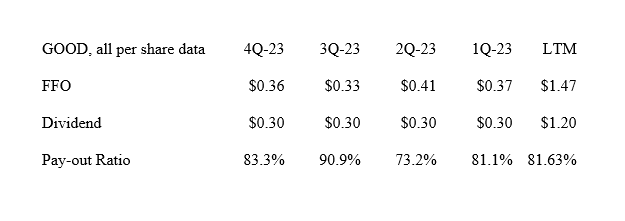

As a consequence, Gladstone Commercial covered its $0.10 per month per share dividend pay-out with funds from operations easily. The dividend pay-out ratio in 4Q-23 was 83%, reflecting an improvement of 7.6 percentage points QoQ. Since the LTM pay-out ratio was just 82%, I think that the commercial trust has a good chance to sustain its monthly dividend throughout 2024.

Dividend (Author Created Table Using Company Supplements)

FFO Multiple And Intrinsic Value

Based on 4Q-23 run-rate funds from operations of $0.36 per share, which about equals the quarterly average in 2023, Gladstone Commercial could be set to earn $1.44 per share in funds from operations in 2024. This estimate would give the industrial and office real estate investment trust an FFO multiple of 8.8x.

The low FFO multiple is mostly explained, in my view, by Gladstone Commercial’s large exposure to the office sector. However, as I explained, the portfolio is well-performing as the trust has no rent collection problems.

STAG Industrial Inc. (STAG) is selling for 16.2x FFO, but the trust owns a purely industrial real estate portfolio that does not experience the same headwinds as the office sector.

W. P. Carey (WPC) recently spun off its office real estate portfolio (to get rid of it, frankly) and the remaining portfolio, including industrial properties, warehouses and retail, is selling for 12.0x (adjusted) funds from operations.

Prologis, Inc. (PLD) is still the most expensive industrial REIT with a FFO multiple of 24.5x.

Taking into account that the trust had full rent collection in 2023 and that dividend coverage looks robust, I think GOOD has re-rating potential. GOOD could sell, in my view, fairly easily for 10x funds from operations which reflects a stock price target of $14.40, and this is basically with any FFO growth. Since the trust already aligned its dividend last year and that funds from operations are growing, I think that the 10x FFO multiple is quite defensible.

Why The Investment Thesis May Turn Sour

Gladstone Commercial should experience relief in case the central bank slashes short-term interest rates. However, January’s inflation data came in higher-than-expected which gives the central bank an incentive to postpone rate cuts. This could delay positive tailwinds associated with lower borrowings costs for the commercial real estate sector.

The dividend, like I stipulated, seems to be well-covered with funds from operations here, but any deterioration in this regard might be a game changer.

My Conclusion

Gladstone Commercial is a well-performing commercial real estate investment trust whose underlying funds from operations results (as well as dividend pay-out statistics) don’t send any major distress signals.

The trust collected 100% of its scheduled rent in 2023 and the dividend has high enough a margin of safety to suggest that it is reasonably safe in 2024.

Gladstone Commercial’s FFO multiple is also quite compelling, in my view, as the real estate investment trust is selling for only 8.8x funds from operations anticipated for the present financial year.

Though Gladstone Commercial has substantial office exposure, I think that passive income investors have become a bit too fearful here.

Buy for passive income and re-rating potential.

Credit: Source link