Halina Pinchuk

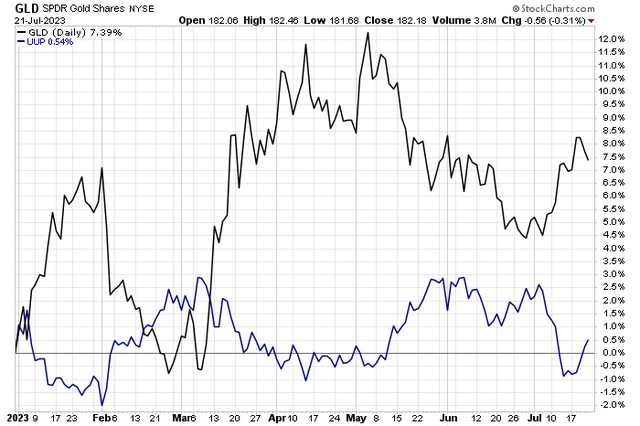

Gold prices put in a stellar first few months of the year. Through early 2023, the SPDR Gold Shares ETF (GLD) was up more than 10% as the US Dollar ETF (UUP) was rangebound. Just recently, the US Dollar Index (DXY) dipped below the psychologically important 100 level, though I view the 100.40 to 101.40 as more technically critical.

In the last two months, though, gold prices have been merely flat amid a generally weaker greenback. That is not an encouraging sign for gold miners, though last week Citi hiked its 2024 gold price forecast as the shiny metal briefly peeked above its six-week range.

I have a hold rating on the VanEck Junior Gold Miners ETF (NYSEARCA:GDXJ) based on unappealing valuations, mixed technicals, and a bearish seasonal setup.

Gold Remains Well Beneath Its YTD Peak As The DXY Wanders

Stockcharts.com

According to the issuer, GDXJ seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the MVIS Global Junior Gold Miners Index, which is intended to track the overall performance of small-capitalization companies that are involved primarily in the mining for gold and/or silver. Its portfolio consists of small gold miners, some of which are in early exploratory stages with upside potential and high risk.

The ETF, which has $4.1 billion assets under management, pays a low 0.5% trailing 12-month dividend yield and carries a moderate 0.52% annual expense ratio. Momentum-wise, GDXJ has underperformed the S&P 500 over the last three months with even more negative alpha on the 6-month performance chart. The ETF is highly liquid, though, with a 3-month average volume of more than five million shares and a 30-day median/bid-ask spread of just three basis points, according to VanEck.

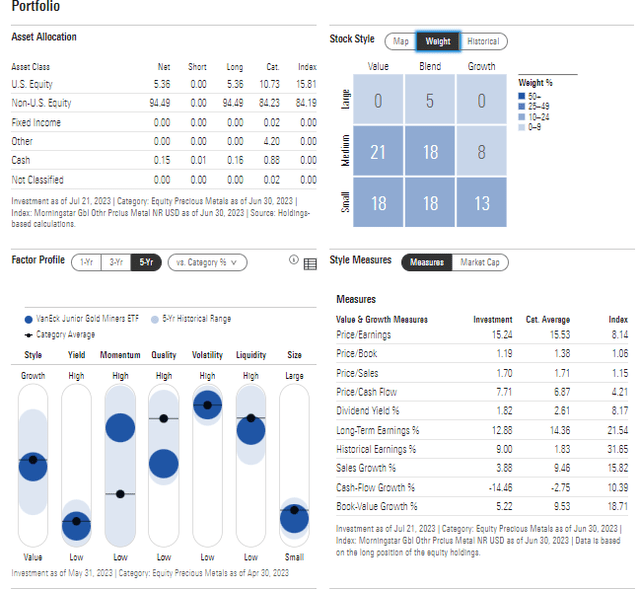

Digging into the portfolio, data from Morningstar show that GDXJ is tilted toward the value style with just 21% allocated to growth. The style box also illustrates that there is a mix of small and mid-cap stocks with just 5% considered large cap. That tells investors that more cyclical risk is possible compared to its larger-cap ETF peer (GDX). As of June 30, 2023, the fund’s trailing 12-month price-to-earnings ratio is high at 23.7 while its price-to-book ratio is moderate at 1.3. Many investors own something like GDXJ for its low correlation to the broader market; the 3-year beta is 0.87 while its moderately positively correlated to the SPX (0.45 on a 3-year basis).

GDXJ: Portfolio & Factor Profiles

Morningstar

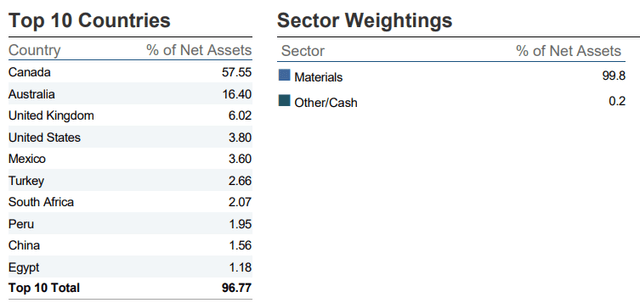

Primarily a foreign stock ETF, it is key to pay attention to price action in the currency markets as well as macro factors that may influence changes in the US Dollar and gold itself. In particular, trends in the Canadian economy should be monitored as more than half of the fund is made up of companies domiciled north of the border.

Oh, Canada! Pay Attention to the Loonie & Canadian Economics with Gold Miners

VanEck

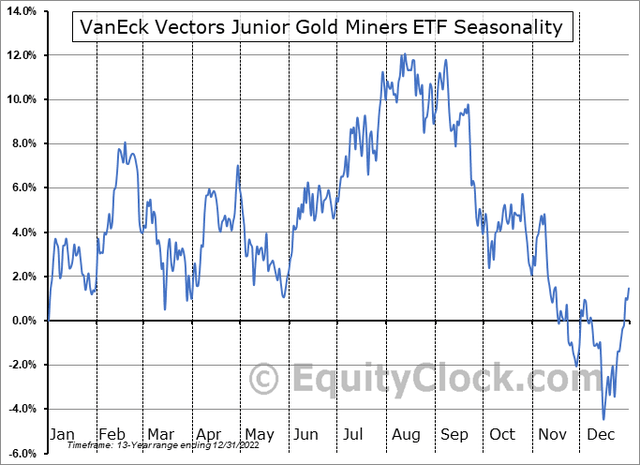

Seasonally, small-sized precious metals equities tend to rally into mid-August but then lose their luster through much of the remainder of the year, according to data from Equity Clock. The back half of Q3 through mid-December has been fraught with volatility and downside price action over the last 13 years, so this is a cautious data point to consider.

GDXJ: Minor Gold Miners Tend To Fall in the Fall

Equity Clock

The Technical Take

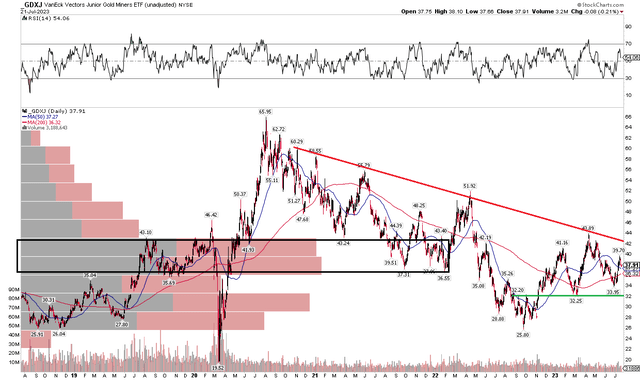

With a moderately high valuation and expense ratio, the chart is likewise unappealing. It is not overly bearish as a decent-looking bottom was notched in September 2022. Since then, a pair of higher lows have been marked, though the 52-week high back in Q2 was not sustained. A subsequent 23% pullback under the rising 200-day moving average attracted some buying interest.

I would like to see the ETF rally above the $42 level – that is where a downtrend resistance line comes into play. Of course, a close above the year-to-date peak of $43.89 would help support the case that the trend has indeed inflected positively. With support at $32, I see the current zone as tough slogging for both the bulls and bears. Notice on the left side of the chart below that there’s high volume by price in the $36 to $43 area – that congestion region may keep GDXJ confined in price action over the short term.

GDXJ: Highly Congested Range, Shares Coiling Under Resistance

Stockcharts.com

The Bottom Line

I have a hold rating on GDXJ. The valuation is not overly cheap, seasonals are weak, and price action is lackluster right now.

Credit: Source link