Steven_Kriemadis/iStock via Getty Images

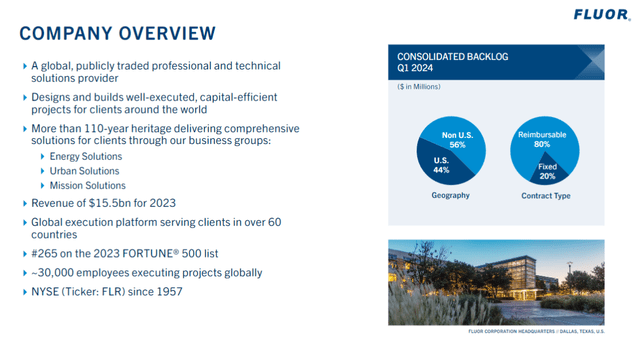

Fluor Corporation (NYSE:FLR) is known for constructing many major and complex facilities which include everything from nuclear power plants, to open pit copper mines, bridges, highways, airports and more. This company has the scale and expertise that is required in order to build these major projects. This is one of the largest engineering and construction companies in the world, and it also offers a number of other services, including construction management. I think it’s a great company, but valuation matters and so does the economic cycle. Let’s take a closer look:

© 2024 Fluor Corporation

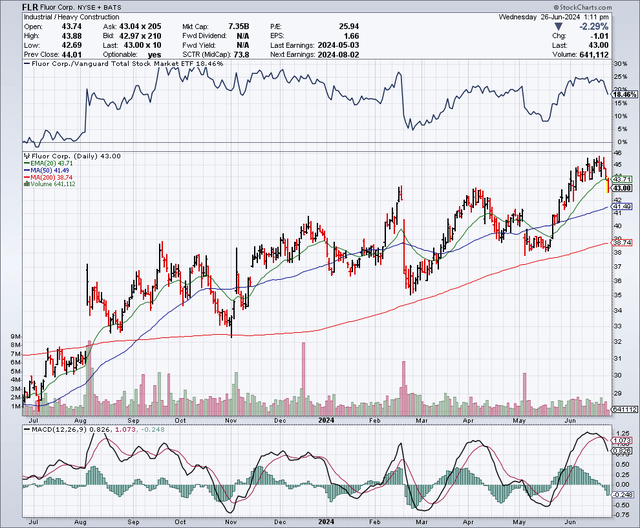

The Chart

As the chart below shows, Fluor shares have been in a solid uptrend for the past year. In June of 2023, this stock was trading at around $28, but now it trades around $45 per share. After yet another recent surge, this stock is now trading well above the 50-day moving average which is $41.44 as well as the 200-day moving average which is $38.70. Based on the chart, this stock looks extended and I think it is ripe for a pullback. A selloff could take it back to around the 200-day moving average which would represent a decline of about 15%. As shown in the chart, this stock has either hit the 200-day moving average or come quite close to it a few times just in the past year, and it could be poised to do so again. But, I would not just sell this stock because of these technical factors, I would also sell it for more fundamental reasons as well, which I will detail below.

StockCharts.com

Earnings Estimates And The Balance Sheet

Analysts expect Fluor to earn $2.82 per share in 2024, with revenues coming in at $17.41 billion. Earnings are expected to grow to $3.20 per share in 2025, on revenues of $19.03 billion. For 2026, this company is expected to earn $3.47 per share, and revenues are expected to rise slightly to around $19.98 billion. Based on the estimates for 2024, this stock is trading for nearly 16 times earnings. I feel this is fully valued at least, and likely even overvalued considering that the quality of earnings from construction and engineering companies can be problematic and at risk of cost overruns, project delays and liabilities from a variety of potential claims.

Fluor has a strong balance sheet with around $1.15 billion in debt and $2.41 billion in cash.

The Dividend

Fluor paid a dividend in the past, but after Covid hit in 2020, the company suspended the dividend. For me, this is a stark reminder of how economically sensitive this industry can be and this is another reason why I would not want to own this stock during the next economic downturn.

Recent Financial Results Missed Expectations

For Q1 2024, Fluor reported non-GAAP earnings per share of $0.47 per share, and this missed estimates by $0.06. In terms of revenues for the quarter, it reported an even bigger miss of about $270 million, when revenues came in at only $3.73 billion. On the positive side, the company has a significant backlog (as of Q1) of about $32.7 billion, but it has had large backlogs in the past as well, and that still did not prevent the stock from plunging during events such as the Covid stock market correction or during the financial crisis in 2008-09.

Finally, it’s worth noting that the company provided guidance for earnings to come in at $2.50 to $3 per share for 2024. This opens the possibility for the company to miss the consensus estimate of around $2.80 per share.

Why I Believe Risks Are Elevated

I believe the Federal Reserve may have already waited too long to start cutting interest rates, and that the apparent desire to keep rates at the current high levels until possibly September or beyond, just increases the chance of a policy error that could lead to recession. There are already signs that the labor market is weakening, and many indicators that show some consumers are cutting back on spending.

Some consumers are already in over their heads with recent data showing rising delinquencies with auto loans as well as record levels of credit card debt. The levels of credit card debt are not just setting records, many consumers are also delinquent in paying these obligations.

There are other recent warning signs of a potential economic slowdown. The Consumer Sentiment Index dropped to 65.6 in June, which was down from 69.1 in May. This is the third monthly decline in a row which seems to be a trend that is pointing to a potential recession. When consumers are not confident, it often leads to a pullback in spending, which leads to businesses cutting back and laying off employees. This in turn leads to consumers cutting back even more creating a negative cycle in the economy that leads to a recession.

I think the stock market might be signalling that a recession is coming because when I look at stocks that have a high level of economic sensitivity, I see stocks that are trading at or near new 52-week lows. Take a look at some of these examples: Whirlpool (WHR), Stanley Black & Decker (SWK), Goodyear Tire (GT), and you will see stocks that have been trending down and are now right around new 52-week lows. These are not the type of stocks that would trade so poorly if the market expected the economy to be robust in the months ahead. This type of very negative price action on these types of stock could be signalling a coming downturn for the economy.

When I look at how this stock traded during the Covid stock market correction in 2020, or how it fared during the 2008-09 financial crisis, it makes me think the current share price is a potentially ideal opportunity to sell this stock, especially as an economic downturn could be looming. For example, Fluor shares plunged to about the $3 per share range in 2020, and in 2008 it also plunged from around $80 per share to $28. It had large backlogs during these plunges as well, so backlogs are not enough.

How I Could Be Wrong

This company has a strong balance sheet and other positive factors going for it, including the backlog. The backlog is a positive factor, but in my opinion not as much as some would believe because backlogs are a part of the construction business since major projects take time. There is still a chance that the Federal Reserve will successfully pull off a “soft landing”. If this is the case, and if the company continues to see large contracts awarded thanks to infrastructure and other projects, this stock could go even higher. A potential boom in AI could boost the economy overall and help offset any policy errors from the Fed.

In Summary

I see Fluor as a best-in-class company that is a leader in this industry. But this industry is economically sensitive and has significant risks that come with longer-term contracts such as cost overruns, project delays caused by external factors such as weather, and it can also be dependent on government spending and business confidence. This stock is at an extended level as shown on the chart and based on the fundamentals. I also see it as potentially fully to even overvalued. Recent financial results and guidance have also not been impressive. But, my biggest concern is that I have seen this stock plummet when economic concerns spook investors more than once in the past. With my belief that a potential recession is becoming more likely, I see the recent rally in this stock as an ideal opportunity to cash in.

No guarantees or representations are made. Hawkinvest is not a registered investment advisor and does not provide specific investment advice. The information is for informational purposes only. You should always consult a financial advisor.

Credit: Source link