Riska

The Eaton Vance Tax-Advantaged Dividend Income Fund (NYSE:EVT) is a closed-end fund, or CEF, that specializes in providing a high level of current income to its shareholders by investing in a portfolio that consists primarily of dividend-paying common stocks. This is something that may prove to be appealing to some investors who want a high level of income, but do not want to just put their money into a fixed-income fund and sacrifice the upside potential of common equities. However, this fund only has an 8.74% yield, which is worse than the best fixed-income funds. In addition, the economy is under much more pressure than the headline media reports would indicate as is evident in the lack of top- and bottom-line growth for many companies. Thus, there may be a reason to expect fixed-income securities to somewhat outperform common equities over the short term, although equities do historically outperform over extended periods.

As regular readers may recall, we last discussed this fund in early July. To say that the overall market environment was very different in early July would be an understatement as the market was still suffering from the delusion that the Federal Reserve would lower interest rates in the second half of 2023 and was bidding up both stocks and bonds in anticipation of that rate cut. However, about halfway through the month, the market came to realize that the rate cuts that it was expecting were not going to happen and investors started to demand higher current yields on their money, which caused the price of both common stock and bonds to decline precipitously. As such, we can probably expect that this fund has delivered a disappointing performance since the last time that we discussed it. This is indeed the case, as the Eaton Vance Tax-Advantaged Dividend Income Fund has seen its price decline by 9.89% since the date that my prior article was published. This is substantially worse than the performance of the S&P 500 Index (SP500) since that date:

Seeking Alpha

This may be a bit of a turn-off to potential investors, but it is important to keep in mind that this fund has a substantially higher yield than the S&P 500 Index. It is important to take this into account when we analyze a fund because the distributions will offset a certain amount of price declines. It may even allow investors to make money even when the share price declines. After all, if the share price declines 5% in a year but the asset has a 10% yield, then the investor who owns it still makes money over the course of a year.

Here is the same chart showing how investors in the Eaton Vance Tax-Advantaged Dividend Income Fund actually fared versus the S&P 500 Index since the date that my previous article was published:

Seeking Alpha

As we can see, investors in this fund still experienced a worse performance than the S&P 500 Index, but they only lost 7.40% when the distribution was included as opposed to the 9.89% loss that we saw just from the fund’s share price decline over the period. That is still disappointing though, and it will probably turn off most investors.

However, we should still revisit our fund and see if the overall thesis is still valid. After all, sometimes a beaten-down asset actually proves to be a very good investment.

About The Fund

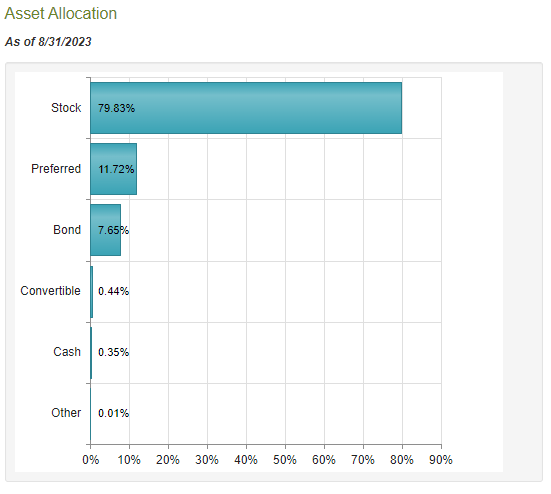

According to the fund’s website, the Eaton Vance Tax-Advantaged Dividend Income Fund has the primary objective of providing its investors with a very high level of after-tax total return. This is not surprising considering that this is a common stock fund. As we can see here, 79.83% of the fund’s assets are invested in common equities alongside much smaller allocations to preferred stock and bonds:

CEF Connect

As I pointed out in my previous article on this fund:

The fact that the fund is focusing on achieving a high level of total return makes sense in this light. After all, common stock is generally considered to be a total return investment. Investors purchase common stocks to receive income in the form of dividends as well as benefit from the capital appreciation that accompanies the growth and prosperity of the issuing company. There are very few people who will buy common stock purely for income today as, other than a few companies in the traditional fossil fuel sector, very few stocks have a yield that beats a money market fund. Thus, fixed-income assets will make much more sense for anyone who is seeking a high level of income.

As the above quote indicates, fixed-income funds are somewhat better at yield right now. For example, let us take a look at the yields on a few of Eaton Vance’s own fixed-income funds:

|

Fund |

Current Yield |

|

Eaton Vance Floating-Rate Income Trust (EFT) |

11.53% |

|

Eaton Vance Limited Duration Income Fund (EVV) |

9.77% |

|

Eaton Vance Senior Floating-Rate Trust (EFR) |

11.60% |

|

Eaton Vance Senior Income Trust (EVF) |

11.14% |

|

Eaton Vance Short Duration Diversified Income Fund (EVG) |

8.87% |

As we can clearly see, all of Eaton Vance’s own fixed-income closed-end funds significantly beat the 8.74% yield of this fund. Thus, we can clearly see that investors today will be more discerning when it comes to taking on the higher risks of common stocks than they were a few years ago when fixed-income yields were lower. The goal of this fund is to generate returns through both capital gains and dividend income, which fits the total return objective as opposed to if the fund said that its primary objective is current income.

With that said, the long-term return of the S&P 500 Index over the 1957 to 2022 period is 10.15% annually. That is lower than what some of Eaton Vance’s own fixed-income funds are offering so it seems that investors of all stripes may be able to get a better total return by just buying a fixed-income fund over a common stock fund in today’s environment. The above floating-rate funds should be able to maintain their performance unless rates fall substantially. It seems unlikely that rates will decline in the near future unless the Federal Reserve is willing to accept inflation and unleashes another round of quantitative easing. After all, right now the Federal Government’s insatiable demand for a growing percentage of a limited and static money supply is the biggest factor that is holding rates up right now. I am somewhat doubtful that the Federal Reserve would be willing to accept inflation at close to 2022’s levels on a permanent basis, and it would be politically infeasible for it to do so. Thus, the environment for fixed-income securities may make those funds more appealing than this one for a while, even for investors who do want the potential returns from appreciating stocks.

As I pointed out in my previous article on this fund, the stocks that the Eaton Vance Tax-Advantaged Dividend Income Fund puts into its portfolio seem a bit strange considering that its fact sheet claims that the fund focuses its efforts on investing in dividend-paying stocks. Here are the largest holdings as of September 30, 2023:

Eaton Vance

This is not as bad as what we saw the last time that we discussed the fund. In particular, the fund’s weighting to Alphabet Inc. (GOOG) (GOOGL) has been substantially decreased since the last time that we discussed it. While that company has been a pretty decent performer so far in the second half of the year when compared to other large technology companies like Apple Inc. (AAPL), its lack of a dividend is still a strike against it when it comes to a fund like this. After all, without a dividend, the only way that the fund can generate any cash from the company that can be paid out to the shareholders is to sell its shares.

The remainder of the companies here generally have fairly attractive yields:

|

Company |

Dividend Yield |

|

JPMorgan Chase & Co. (JPM) |

2.94% |

|

Constellation Brands, Inc. (STZ) |

1.47% |

|

Chevron Corporation (CVX) |

4.09% |

|

ConocoPhillips (COP) |

1.94% |

|

The Charles Schwab Corporation (SCHW) |

1.79% |

|

Bristol Myers Squibb Company (BMY) |

4.32% |

|

American International Group, Inc. (AIG) |

2.26% |

|

Linde plc (LIN) |

1.30% |

|

Micron Technology, Inc. (MU) |

0.63% |

Curiously, we do not see any of the utilities or telecommunications companies that have very high yields. However, it is nice to see that this fund is not completely neglecting the energy industry, as some other funds do. As shown above, both Chevron and ConocoPhillips are among the fund’s largest positions, and the energy sector has been performing very well lately. In fact, the iShares U.S. Energy ETF (IYE) has substantially outperformed both this fund and the S&P 500 Index since we last discussed this fund:

Seeking Alpha

This could be one reason why the weightings of both Chevron and ConocoPhillips have increased since the last time that we discussed this fund. After all, they outperformed some of the other companies here and that would naturally increase their proportional representation in the fund’s overall portfolio.

In fact, this fund engages in very minimal trading for a closed-end equity fund. The fund had an annual turnover of 31.00% in its most recent year, which is much lower than most other equity funds. This is a good sign as it implies that the fund is not incurring a substantial level of expenses due to trading costs. These costs create a drag on the fund’s performance and are one of the reasons why many active funds tend to underperform comparable index funds. The fact that this one is very reasonable with respect to its trading activity is thus something that investors should be able to appreciate.

Leverage

As is the case with most closed-end funds, the Eaton Vance Tax-Advantaged Dividend Income Fund employs leverage as a method of boosting its returns beyond that delivered by the underlying assets in the portfolio. I explained how this works in my previous article on this fund:

In short, the fund borrows money and then uses that borrowed money to purchase dividend-paying common stocks. As long as the purchased securities are able to deliver a higher total return than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio.

This fund is capable of borrowing money at institutional rates, which are considerably lower than retail rates. As such, it will normally be the case that the strategy works properly. With that said though, the interest rate on borrowed money today is going to be much higher than the yield of just about anything except for certain energy partnerships so the strategy is not nearly as effective as it was two years ago.

Unfortunately, the use of debt in this fashion is a double-edged sword. This is because leverage boosts both gains and losses. As such, we want to ensure that the fund is not employing too much leverage since that would expose us to too much risk. I generally do not like to see a fund’s leverage exceed a third as a percentage of its assets for this reason.

As of the time of writing, the Eaton Vance Tax-Advantaged Dividend Income Fund has levered assets comprising 21.08% of its overall portfolio. This is a much higher ratio than the 20.10% that the fund had the last time that we discussed it. This is concerning as the use of leverage is a bigger risk today than it was two years ago when the Federal Reserve was still deep into its “free money” policy. However, it is understandable that the fund’s leverage would increase since its net asset value is down 4.87% since we last discussed it:

Seeking Alpha

Thus, if the fund’s borrowings remained stable, it would now account for a larger percentage of the portfolio than it used to just because the portfolio is smaller. The fund’s leverage is still not really too bad though, so it does not appear that we need to worry about the debt very much right now.

Distribution Analysis

As mentioned earlier in this article, the primary objective of the Eaton Vance Tax-Advantaged Dividend Income Fund is to provide its investors with a very high level of total return. In order to achieve this objective, the fund invests in a portfolio that primarily consists of dividend-paying common stocks. While these stocks do not have ridiculously high yields, they do still provide a certain amount of income to the fund that is artificially boosted with leverage. However, this fund does not stop there as it also seeks to realize capital gains, which provide it with more cash. The fund takes the money that it receives from these sources and pays it out to the shareholders, net of its own investments. While the dividends alone are insufficient to give the fund a very high yield, the addition of capital gains should be sufficient to make its yield very respectable in most market environments.

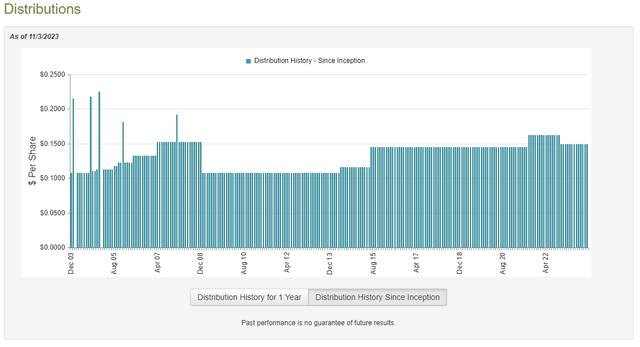

It is certainly the case that the Eaton Vance Tax-Advantaged Dividend Income Fund boasts a respectable yield, but it is not competitive with most fixed-income closed-end funds as we discussed earlier. The fund pays a monthly distribution of $0.1488 per share ($1.7856 per share annually), which gives it an 8.74% yield at the current price. This fund has been reasonable with its distribution consistency, although it still had to cut it in response to the events of 2022:

CEF Connect

This is one of the few Eaton Vance funds that has had much success at growing its distribution over time. Many of the funds that we see from this fund house have tried to maintain a stable distribution over the past decade but this one was able to increase it. That will undoubtedly appeal to those investors who are seeking a source of income to use to pay their bills or finance their lifestyles, but the recent distribution cut is certainly going to reduce the fund’s appeal somewhat. In addition, the fund was quite stingy about distribution increases after 2015, which is rather irritating during inflationary periods because the income that you receive from the fund declines over time.

However, a static distribution can at least be overcome by reinvesting some of the money that you receive from the fund. In addition, new investors will not be impacted by the distribution cut last year. These investors will receive the current distribution at the current yield. Thus, the most important thing is how well the fund can sustain its current distribution. Let us investigate this.

Unfortunately, we do not have an especially recent document that we can consult for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on April 30, 2023. As such, it will not include any information about the fund’s performance over the past six months. This is rather disappointing since the market turned back in July and almost certainly handed the fund some losses. The first half of the year was generally a very optimistic one, so the fund’s performance was probably better during the reporting period than it has been since it ended. As such, this report may show that the distribution is more sustainable than it actually is.

During the six-month period, the Eaton Vance Tax-Advantaged Dividend Income Fund received $23,186,962 in dividends along with $10,120,231 in interest from the assets in its portfolio. When we combine this with a small amount of income from other sources, the fund reported a total investment income of $35,408,392 during the period. It paid its expenses out of this amount, which left it with $13,866,011 available for shareholders. That was, unfortunately, nowhere close to enough to cover the $66,551,796 that the fund paid out in distributions during the period. At first glance, this is almost certainly going to be concerning, as the fund did not have sufficient net investment income to cover the money that it is paying out to its shareholders.

However, the fund does have other methods through which it can obtain the money that it needs to cover the distributions. For example, it might have been able to earn some capital gains that could be distributed. After all, capital gains are not considered to be investment income, but they clearly represent money coming into the fund. The fund did manage to deliver a reasonably decent performance at this task during the period. It reported net realized gains of $74,295,526, which were partially offset by $34,402,775 net unrealized gains over the six-month period. While this was decent, it was still not enough to cover the distributions and the fund’s net assets declined by $12,793,034 after accounting for all inflows and outflows during the period.

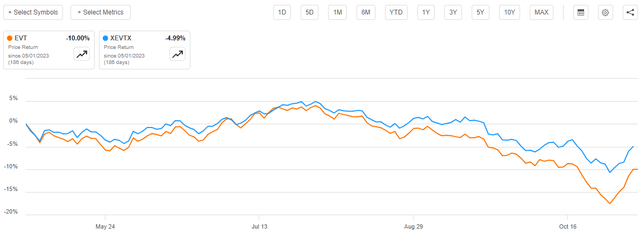

Thus, the fund failed to cover its distributions during the most recent period. Unfortunately, it appears that this continues to be the case. As we can see here, the fund’s net asset value per share is down 4.99% since May 1, 2023:

Seeking Alpha

That would not be happening unless the fund is paying out more than it takes in. As such, the fund appears to be overdistributing right now. That is a very real problem as it may indicate that the fund could have to cut the payout again in the near future to bring its distribution down in line with the actual performance of its investment portfolio.

Valuation

As of November 3, 2023 (the most recent date for which data is currently available), the Eaton Vance Tax-Advantaged Dividend Income Fund has a net asset value of $22.45 per share but the shares currently trade for $20.35 each. This gives the fund’s shares a 9.35% discount on net asset value at today’s price. That is not quite as good as the 10.57% discount that the shares have had on average over the past month, but it is not an unreasonable price to pay for the shares. However, it may still be possible to obtain a better entry price by waiting a bit.

Conclusion

In conclusion, the Eaton Vance Tax-Advantaged Dividend Income Fund is a closed-end fund that employs an equity-focused strategy to earn a high level of total return for its shareholders. This is not a bad strategy, although it could underperform fixed income for a while considering where rates are at.

The Eaton Vance Tax-Advantaged Dividend Income Fund appears to be relatively conservative with its strategy as it does not engage in a substantial amount of trading and seems to be primarily employing a buy-and-hold strategy. It also does not engage in aggressive leveraged trading and has a very reasonable valuation. The biggest problem here could be that the fund may be overdistributing and be unable to sustain its current distribution going forward.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Credit: Source link

![Full Cevallos: ‘The DOJ Has Super Powers Compared To The [January 6th] Committee’](https://i.ytimg.com/vi/vQqZgw5gxZ0/maxresdefault.jpg)