spawns

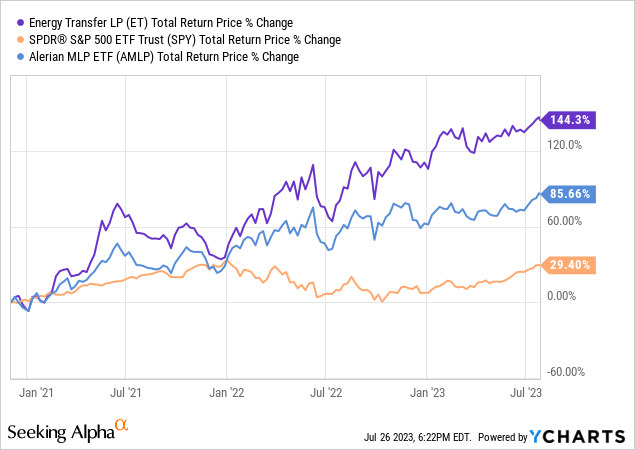

Energy Transfer LP (NYSE:ET) stock has been a big winner for us since we bought it in our Core Portfolio on December 3rd, 2020, crushing the broader MLP sector (AMLP) and stock market (SPY) since then:

Despite this massive outperformance, we believe it still has further upside ahead of it and, therefore, keep it as one of the largest positions in our portfolio today. In this article, we discuss three key items to look for in ET’s earnings release and earnings call that is scheduled for next week (post-market August 2) and then share our latest thoughts on the valuation and total return proposition for the stock.

#1. Capital Allocation Update

The biggest story to look for in the Q2 earnings release is how management is thinking about capital allocation moving forward. Management has provided increased clarity around the distribution in recent months, with what appears to be a plan to slightly increase the distribution each quarter for the foreseeable future in pursuit of achieving a 3-5% CAGR for the distribution for years to come.

Moreover, management has made it clear that they plan to pursue a credit rating upgrade in the near future, stating on the Q1 earnings call:

Our goal is to get to that BBB flat… We think that BBB is a good place to be and that’s what we’re going to continue to target.

With billions of dollars in liquidity and billions of dollars in retained cash flow after paying out the distribution, ET could very easily decide to continue paying down debt and deleverage further. However, management has not explicitly indicated what they plan to do. After all, they are already comfortably within their long-term leverage targets, so there is no pressure to continue paying down debt.

When asked on the earnings call:

Some of your peers have moved lower over time… Do you see the company ever aspiring to go below 4 times eventually?

Management stated:

If [our leverage ratio] goes below four, we’re okay with that. We won’t be upset with that, but I will tell you that’s still the target. But here’s where I’d like to expand on that a bit. Not all these leverage metrics when they come out of the same. As you know, leverage is only one metric. You have to also look at the makeup of the earnings stream, you have to look at the scale of the company and the size. And when you start looking through all those various components like what a rating agency uses, we clearly are strong in all those areas. So, our leverage metric, when we put it out, we think it’s what fits for us.

While they did not explicitly rule out further meaningful deleveraging, it sounds like it is unlikely for them and certainly not in their immediate plans. They seem very comfortable with sitting at around 4x and achieving a credit rating upgrade to BBB and then putting their excess cash beyond that towards higher returning uses.

Does this mean that they could be about to pivot and begin buying back their preferred equity and/or maybe even their common equity instead of redeeming maturing debt in order to earn higher cash returns on that capital? Time will tell.

#2. Acquisition Outlook

Of course, they could also simply allocate all of their excess cash towards growth projects and/or acquisitions, which would not surprise us at all given that Kelcy Warren still lurks in the background as Executive Chairman and the largest unitholder by far.

After all, this year ET expects to spend ~$2 billion on growth projects alone and management has alluded to making a potential acquisition numerous times in the past. Once again, time will tell, but any further hints along this line will be important to listen for on the upcoming earnings call.

#3. Lake Charles Update

Last, but not least, ET’s major Lake Charles project continues to hang in limbo due to facing problems with the Department of Energy. However, ET is not sitting on its hands while waiting for a full resolution of the matter. A few weeks ago it entered into three long-term agreements to sell LNG from the Lake Charles asset pending its full approval and completion. Once again, time will tell what the fate of this project will be, but if successfully completed, ET is increasingly well positioned to see a considerable boost to its growth from this asset.

Investor Takeaway

There remains a lot up in the air about the ET investment thesis: Lake Charles, capital allocation priorities now that the balance sheet has been sufficiently deleveraged and the distribution has been fully restored and is on a growth glidepath, and potential additional acquisitions large and small. However, despite all of these uncertainties, ET is increasingly looking like a low risk investment given that its balance sheet is in great shape, it is poised for a credit rating upgrade, and its existing portfolio is stronger and better diversified than ever.

As a result, even if Lake Charles fails to materialize, ET is still well-positioned to deliver exceptional value to unitholders for years to come between its near 10% forward yield, low to mid single digit expected distribution CAGR, and 1.5 to 2 turns EV/EBITDA discount to fellow investment grade midstream peers. In our view, the Lake Charles project would merely serve as icing on what should already be a delicious cake of total returns for unitholders. Moreover, whether management elects to be more conservative and further deleverage the balance sheet, be aggressive with a big acquisition, or takes a more middle of the road risk profile approach by beginning to repurchase preferred and/or common equity, we think ET has sufficient margin of safety already built in to its valuation that it will generate attractive total returns for unitholders regardless of which path it takes.

Nevertheless, these scenarios will still be important in determining just how good of an investment ET ends up being, so it is still very important to see what management has to say about these items on its next earnings call.

Credit: Source link