Riska

One of the more interesting banks that I have come across this year is Dime Community Bancshares (NASDAQ:DCOM). After the bottom fell out earlier this year in response to the banking crisis, shares fell as much as 49.2%. But even today, the stock is still down 35.6% compared to where it was at the end of February. The absence of a significant recovery is likely due to the fact that the bank’s deposits recently declined. A drop in profitability also seems to be a factor. Naturally, these are not great things for the institution to experience. But when you look at just how cheap the bank is and when you look at other fundamental data, it does stand out as an appealing prospect that offers upside potential from here. Because of that, I’ve decided to rate it a ‘buy’ for now.

The good and the bad

Before I get into the financial assessment portion of this article, we should first touch on exactly what Dime Community Bancshares is and what it does. According to the management team at the firm, Dime Community Bancshares operates as a bank holding company that engages in a wide variety of financial services. Its original wholly owned subsidiary, Dime Community Bank, was founded back in 1910 in New York. And from that point, it has grown into a rather sizable operation. By the end of 2022, for instance, the bank boasted 59 branch locations throughout various parts of New York, including Long Island and four different boroughs of New York City.

It is from these locations that the company provides customers with typical deposit services. But it also originates loans, including commercial loans, commercial real estate loans, residential mortgages, and more. Using the deposits that come on to its books, it even works with more exotic opportunities like mortgage-backed securities, collateralized mortgage obligations, and other similar assets. Its investments have also included government securities and corporate bonds. On the customer side of things, the company can also provide credit and debit card processing, ATMs, lock box processing services, and it even operates and investment services company through which it provides certain investment products that are given to it by a third-party broker dealer. And lastly, the firm also has a title insurance subsidiary that allows it to act as a broker for title insurance services.

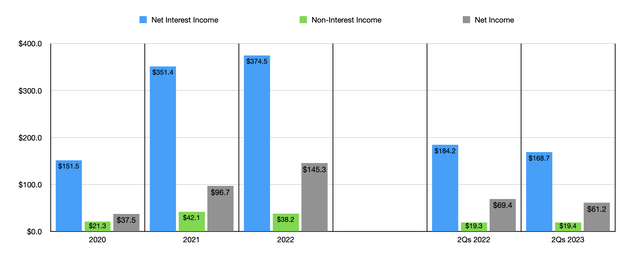

Author – SEC EDGAR Data

In the three years leading up to the current fiscal year, Dime Community Bancshares has done a really great job growing both its top and bottom lines. Net interest income, for instance, more than doubled from $151.5 million in 2020 to $374.5 million last year. At the same time that this occurred, the non-interest income at the bank grew from $21.3 million to $38.2 million. Net profits, meanwhile, skyrocketed from $37.5 million to $145.3 million. This is not to say that everything has been great. This year, for instance, is looking to be a bit painful. For the first half of the year, net interest income came in at only $168.7 million. That’s down from the $184.2 million generated the same time last year. While non-interest income inched up from $19.3 million to $19.4 million, net profits took a dip from $69.4 million to $61.2 million.

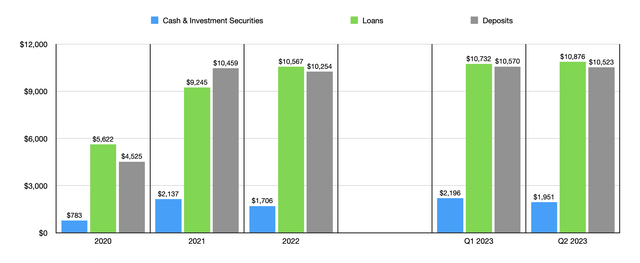

The general increase in the company’s financial performance between 2020 and 2022 was only made possible by a surge in deposits. At the beginning of that period, deposits totaled only $4.53 billion. By the end of 2022, they had expanded to $10.25 billion. Although some of this growth was organic, a big portion of it was driven by a merger that the company completed in 2021. That merger was with a company called Bridge Bancorp. The value of deposits at the bank continued to grow into the first quarter of this year, hitting $10.57 billion. However, deposits did dip slightly to $10.52 billion by the end of the second quarter. That slight decline could be a source of some of its weakness. One positive thing, however, is that uninsured deposit exposure is not all that high. It currently stands at 28% of total deposits. That is just below the 30% figure that I prefer when looking for attractive prospects.

Author – SEC EDGAR Data

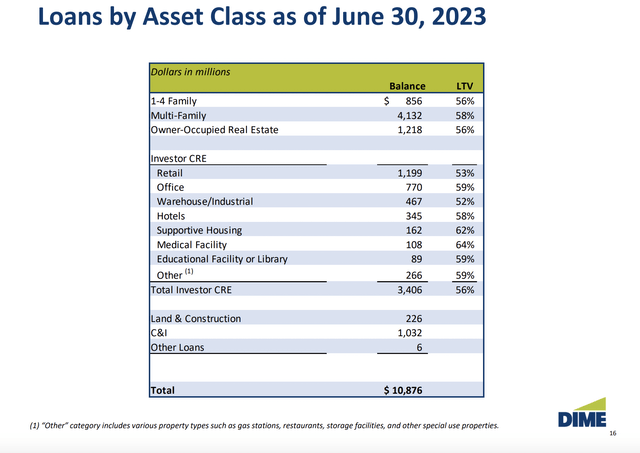

An increase in deposits empowers the company to make various investments. For instance, thanks to the growth in deposits, it was able to grow its loan portfolio from $5.62 billion to $10.57 billion over the past three years. By the end of the second quarter of this year, loans had grown further to $10.88 billion. A big part of the company’s strategy in recent years has been to shift its focus from commercial loans toward business loans. From the end of 2016 through the end of the most recent quarter, for instance, Dime Community Bancshares grew its commercial and industrial loan portfolio from $526 million to $1.03 billion. Over that same window of time, owner occupied commercial real estate loans jumped from $550 million to $1.22 billion. This does not mean that the company is done with its transition. While its multifamily loans have gone from representing 68%of its loan portfolio to only 38%, management is targeting 30% exposure in the long run. I do know that one area that investors are worried about when it comes to loans is exposure to office properties. But the good news is that the company is not overly focused on that space. As of the end of the most recent quarter, only about $770 million, or 7.1%, of its total loan portfolio was dedicated to those types of assets.

Dime Community Bancshares

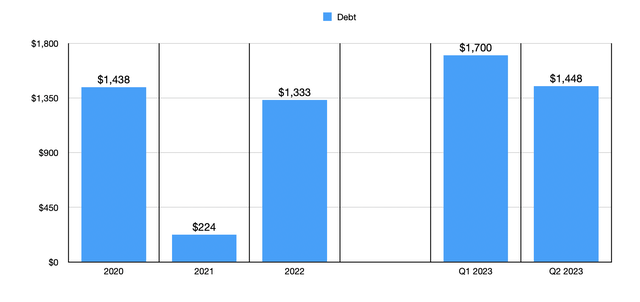

It is important to note that a big part of the company’s strategy has been to utilize quite a bit of leverage in order to capture attractive returns. As of the end of the most recent quarter, it had $1.45 billion in debt on its books. If you glanced at that number and didn’t read any further into it, you might think that it was in response to borrowings aimed at shoring up the company’s balance sheet because of the banking crisis earlier this year. However, debt levels have often been elevated. Gross debt as of the end of 2022, for instance, came in at $1.33 billion. This strategy of accepting leverage also allows the firm to allocate significant amounts of capital toward holding cash and investing in different securities. The combination of these two things totaled $1.95 billion as of the end of the second quarter. But even as of the end of 2022, they totaled $1.71 billion.

Author – SEC EDGAR Data

The high levels of debt that the company has, combined with rising interest rates on it, were partially responsible for some of the weakness this year. For instance, weighted average borrowings throughout the most recent quarter totaled $1.53 billion. That compares to the $406.9 million reported the same time last year. On top of this, the average interest rate on these borrowings grew from 3.52% to 4.66%. In addition to that, however, a general rise in interest rates and the desire from depositors to seek out higher yields at this time, result in a greater amount of interest expense being paid out by the company on deposits. Money market funds, for instance, went from costing the company 0.16% per annum to 2.70%. Savings accounts went from 0.23% to 3.06%. Interest bearing checking accounts went from 0.28% to 1.30%. And finally, certificates of deposit went from 0.50% to 3.60%.

Author – SEC EDGAR Data

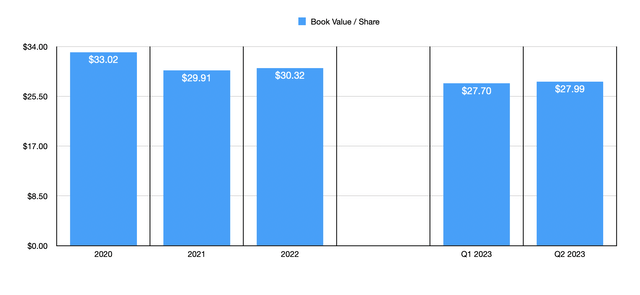

When it comes to valuing the company, there are a couple of ways that we can do it. The easy way is to compare its share price to its book value. Right now, shares are trading at $19.81. The book value per share as of the end of the most recent quarter was $27.99. This means that the company is trading at less than 71% of its book value. Another way is through the price to earnings approach. Using data from last year, the company is trading at a price to earnings multiple of 5.3. Even if we annualize results experienced so far for 2023, we would get a really low reading of 6. The average right now in the banking sector seems to be around 10.4. So on that basis, shares are trading on the cheap.

Takeaway

All things considered, I would say that Dime Community Bancshares is an interesting prospect that investors should be aware of. Recent weakness and the slight decline in deposits are both cause for concern. The good news, however, is that uninsured deposit exposure is not extreme and that, very likely, next year will see interest rates fall. In the meantime, financial performance might remain on the weak side. But given how cheap shares are, I would argue that some nice upside does exist. And because of that, I’ve decided to rate it a ‘buy’.

Credit: Source link