jetcityimage

Over the past two years, CVS Health Corporation (NYSE:CVS) investors have experienced ~33% top-to-trough drawdown. A raft of recent commentary from S.A. readers indicate a general aversion to the stock and disdain for the management team.

On the other hand, I’ve owned CVS shares for about five years now. Sure, I would have preferred it if CEO Karen Lynch offered a more comprehensive view of her long-term plans for the company. However, for the most part, she’s kept her promises while overhauling the business. When situations changed, CVS management provided reasoned explanations and offered refreshed guidance.

I plan to play the long game with these shares.

A CVS Health Ownership Thesis

Background

I became bullish on CVS Health stock back in late 2019. My initial article on the company was, “CVS Health: Keen on the Value Proposition.”

Since then, I’ve written two follow-up articles. This one is the third.

The basics of my underlying investment thesis hasn’t changed, but current events have stretched out the timeline.

My most recent CVS update was written in May of this year. It was entitled, “CVS Health: Investors Getting a Bellyache.” In that article, the acquisition of Oak Street and Signify Health had been announced. I challenged investors to decide whether they believe CEO Karen Lynch’s expanded vision of the company was the correct course of action.

Given the benefit of another two quarters of financial results, additional financial results and management commentary, I remain constructive on CVS Health stock. In particular, given the problems old pharmacy store peers Walgreens (WBA) and Rite-Aid are experiencing (in October, Rite-Aid filed for C11 bankruptcy), I am more convinced the CVS pivot was not only advisable but necessary.

A refreshed investment thesis recap and details follow.

Current CVS Health Investment Thesis

Long-term investors may elect to own CVS stock for the following reasons:

-

Good story line: The company is in the midst of transition. Transitions offer uncertainty, but potential rewards.

-

Good fundamentals: The balance sheet is sound, the business generates strong cash flow, returns are acceptable, and CVS pays investors a solid dividend.

-

Attractive valuation: The stock is inexpensive on an historical or relative basis. In time, I expect the stock price to reflect historical valuation multiples.

I believe it will be very difficult to time when CVS will move. At this place and time, I say go long or go home.

However, at the end of this article I offer an associated short call option strategy I believe may offer a profitable hedge.

Let’s break it down.

The Story Line

Big Changes at the Corner Pharmacy

Current CEO Karen Lynch is a legacy Aetna manager. After taking over corporate reins in 2021, her overarching strategy has sought to verticalize the business; centering it upon the consumer. CVS Health has moved from transaction-based primary care to addressing holistic health.

Her predecessor, Larry Merlo, began the transition by engineering the Aetna acquisition. The deal was announced in late 2017 and closed in 2018. The $69 billion transaction saddled CVS with significant debt. In response, management set out to reduce net debt leverage to 3.0x or less. By the end of 2022, they hit the mark: net debt leverage fell to 2.9x.

However, in 2023, management wasted no time before going back to the well.

In February 2023, CVS announced it was acquiring Oak Street for $10.6 billion; the transaction closed May 2023. The Oak Street transaction allows CVS to add primary care to its portfolio. Oak Street owns 169 medical centers in 21 states.

Then, in March 2023, CVS closed on the $8 billion purchase of Signify Health, a tech company that sends providers to patients’ homes.

As of 3Q 2023, these transactions levered up the debt ratio to 3.6x.

Discussion

In 2016-17, ex-CEO Larry Merlo believed the transaction-based pharmacy, PBM, and convenience store retail business model was insufficient to ensure CVS’ future growth and vitality. So, he set out to do something about it; engineered the Aetna acquisition. At the time Aetna was the third-largest health care company in the United States. Concurrently, he championed in-store CVS “Minute Clinics.”

Successor Karen Lynch followed on by creating a top-to-bottom total customer health care organization. This includes pharmacy, PBM, health insurance, and direct primary care. The strategy, if successful, could lead to higher quality of care and lower medical costs.

Indeed, recent travails involving Walgreens (WBA) seem to have reinforced CVS’ first-mover strategy. Walgreens waited to enter the broader health segment until 2021. “Walgreens Health” plans to become a leading provider of local clinical care services via its consumer-focused technology and pharmacy network. The Company seeks to transform its core pharmacy and retail business; announcing majority investments in VillageMD and CareCentrix. WBA management believes these deals will strengthen Walgreens Health capabilities in primary care, post-acute care, and home care.

The Street isn’t so sure. High debt and a tumbling stock called to question the efficacy and timing of these moves.

Meanwhile, the Aetna acquisition has added revenue, margins, and operating income to CVS books. The Oak Street transaction is expected to add $2 billion of adjusted EBITDA by 2026 and has the potential to unlock at least $500 million in synergies. Signify Health is forecast to be accretive to Adjusted EPS and increased management’s confidence in delivering on their 2024 financial targets.

Downside Risks Remain

Meanwhile, various factors continue to pressure CVS’ business model.

These include,

-

competition, particularly from Amazon;

-

the loss of more PBM customers due to competitive forces. In 2024, CVS will lose a large client in Centene;

-

acquisition/integration risk (Oak Street and Signify Health);

-

secular challenges in the pharmacy business, for example, low reimbursement rates/margins;

-

legal/regulatory challenges, particularly in the PBM space.

Summary

I believe the crosscurrents of acquisitive activity and general industry risks create significant investment opportunity.

I contend CVS management is well-aware of the risks, will integrate the new business lines successfully, and has the capacity to fix problems on the fly.

My investment thesis hinges upon the premise that management will come through and investors will be rewarded when an undervalued security attains Fair Value.

Please see the Valuation section of this article for more detail.

CVS Fundamentals

CVS Health’s fundamentals remain solid. In this section, I will focus upon four specifics I believe support this part of the thesis.

The Balance Sheet

Companies in transition require a sound balance sheet. CVS fits the bill.

It has a middle-of-the-fairway BBB investment grade credit rating.

As of 3Q 2023, year-over-year net debt rose as a function of the two most recent acquisitions; nevertheless, the debt burden isn’t overwhelming. This may be evidenced by the 2023 forecast 6.4x interest coverage ratio (based upon management’s 2023 full-year guidance). A ratio greater than 3.0x indicates sufficient coverage.

In addition, the company enjoys $16.1 billion in balance sheet cash and investments. In part, this is an advantage of the “carry” on the insurance business.

Liquidity is adequate. The current ratio is 0.86x. At the end 2022, the ratio was 0.95x.

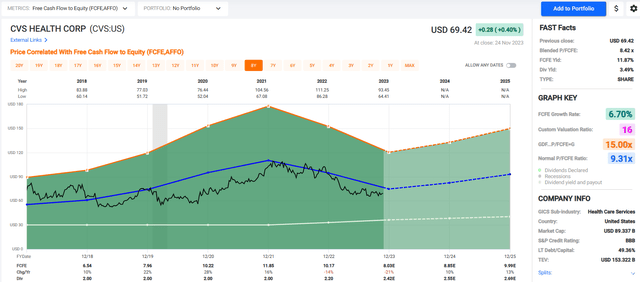

Cash Flow

CVS generates strong and steady cash flows. Free cash flow (cash after capital expenditures) is generous; due to low capex spend. Historically, the capex ratio (capital expenditures as a function of operating cash flow) is in the low-to-mid teens. A figure under 50 percent is good.

In 2023, management expects cash flow yield to be ~4 percent. Last year, it was 6 percent. A company with an OCF yield above 4 percent is acceptable. If the cash flow yield is greater than 7 percent, this is considered a strong performer; particularly for a company that pays a good dividend.

Here’s a post-2017 CVS cash flow chart:

fastgraphs.com

Per management guidance, 2023 full-year cash flow is expected to moderate versus 2022. This is a function of post-C19 one-offs and negative working capital movement.

Returns

CVS exhibits acceptable return-on-equity and return-on-invested-capital. These metrics measure management effectiveness.

Based upon the current 2023 management net income forecast, full-year Return-on-Equity may be expected to be 15 percent. Actual 2022 adjusted RoE was 16 percent.

I like to use 15 percent RoE as a benchmark. Companies that generate returns equal to or greater tend to be good performers.

Using 2023 management guidance, full-year 2023 RoIC is forecast to be 11 percent. Actual 2022 RoIC was 12 percent.

Currently, CVS’ weighted average cost of capital is ~5.4 percent. When corporate RoIC is greater than WACC, it points towards a management team that is creating shareholder value.

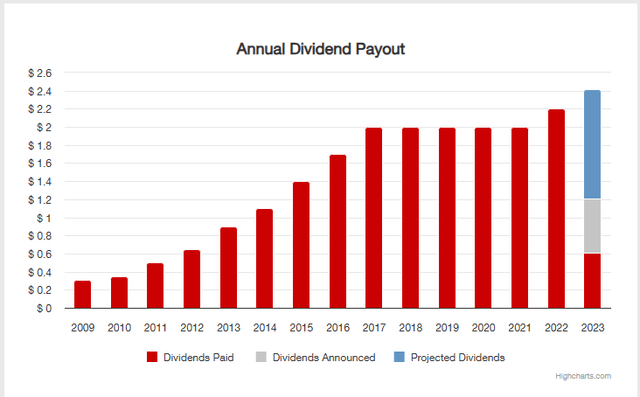

The Cash Dividend

Today, CVS offers investors an annualized $2.42 dividend.

The yield on the closing price is 3.52 percent. This is 87 bps lower than a no-risk 10-year T-note. I find this yield quite acceptable: T-note yields are trending down, interest is taxed as ordinary income, and the ten-year is unlikely to offer comparable capital appreciation versus CVS common equity.

Post-Aetna acquisition, dividend increases were suspended pending debt and debt leverage reduction. In 2022, dividend growth resumed. Looking forward, given the recent Oak Street and Signify Health transactions, I expect the payouts to increase, albeit modestly.

investors.cvshealth.com

The 2023 free cash flow dividend payout ratio is just 17 percent. The distribution is safe.

Valuation: Rubber Hits the Road

CVS stock is inexpensive on an historical or relative basis.

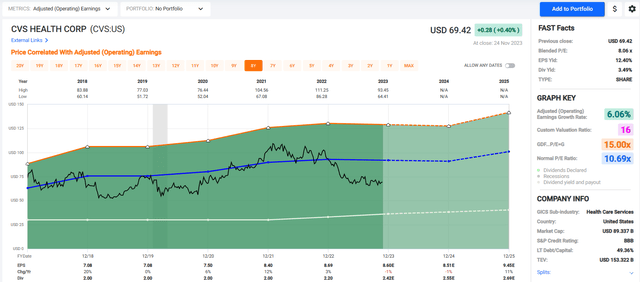

Below there are two Fast Graphs highlighting CVS valuation. I have used charts compiling data from 2017 to date; that’s when the corporate transformation began with the Aetna announcement.

I’ve selected adjusted EPS and Free Cash Flow charts to gauge future Fair Value. When addressing investors, management highlights these metrics.

First, here’s a chart showing the relationship between adjusted EPS and price:

fastgraphs.com

Current Street estimates expect 2024 EPS to ease somewhat from full-year 2023 management guidance. As such, I applied a 10x PE multiple to 2024 estimates for an $85 target price.

I elected to lower the near-term PE ratio since forward earnings growth is expected to be anemic during the corporate transition phase. A 9x PE suggests a company will exhibit a nil terminal growth rate.

Moving on to FCF,

fastgraphs.com

We find CVS generates good free cash flow. FCF is expected to rise through the transition phase. Therefore, I placed a 9.5x FCF multiple on the 2024 forecast (slightly higher than the historic ratio) to arrive at an $84 target price.

Over time, I contend these valuation multiples will expand, pending successful integration of the recent acquisitive activity, a lower debt ratio, and a return to sustained operating, net income, and dividend growth.

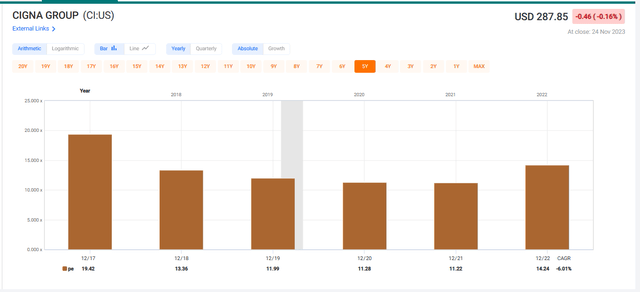

PE ratios between 12x to 14x would be comparable to peer Cigna Group (CI):

fastgraphs.com

Near-term, I do not expect imminent CVS price appreciation; quite the opposite. Nonetheless, I believe a 20 percent price uplift is defensible using the aforementioned valuation estimates. The cash dividend is on top of that.

Longer-term, as aligned with my investment thesis, within the next two or three years I expect CVS stock to reach at least $120 per share. This is predicated upon $9.50 to $10.00 a share EPS, continued strong free cash flow generation, and 12x to 13x PE multiples.

Investors should note there is a CVS Investor Day scheduled for December 5, 2023. Management should provide updated forward guidance and details.

CVS Income / Options Strategy

For investors seeking to hedge a CVS position, you may consider the following options strategy:

-

Go long CVS stock at ~$68.50

-

Sell Jan2025 covered calls on half the position with a $67.50 strike for $8.75 per contract

If the stock moves above $76.25 per share one year out, half your stock will get called and you will have an 11.3% long-term capital gain on it. If all the dividends are collected before assignment, add another $2.42 on those shares for a 15.8% gain, presuming CVS doesn’t increase the dividend. The overall cash-on-cash return on all shares will total 9.2 percent ($7.75 net on the assigned shares, and $2.42 on all shares).

If the stock doesn’t reach $76.25 by January 2025, you can keep the option premium of $8.75 and bank the dividends. In this case, you will enjoy at 9.9% cash-on-cash return on your original investment.

Please do your own careful due diligence before making any investment decision. This article is not a recommendation to buy or sell any stock. Good luck with all your 2024 investments.

Credit: Source link