imaginima

Comstock Resources, Inc. (NYSE:CRK) common stock has withered under predictions of low natural gas prices and a likely coming El Nino winter. The recent heatwave has begun a rally somewhat. In addition, there are others who think that current industry actions will likely outweigh the negatives out there. Antero Resources Corporation (AR) management eliminated the hedges they had in the latest reported quarter because they feel that, by 2024, natural gas prices will be higher. I follow other natural gas companies like EQT Corporation (EQT) that seem to have a similar attitude.

Comstock Resources is a dry natural gas producer. That means that any other products obtained during production are usually not enough to shift the overall price received materially from the reported natural gas price. Therefore, this company is very dependent upon the price of natural gas in order to report decent profits.

That means that the actions of industry insiders in response to what they see the industry doing is important.

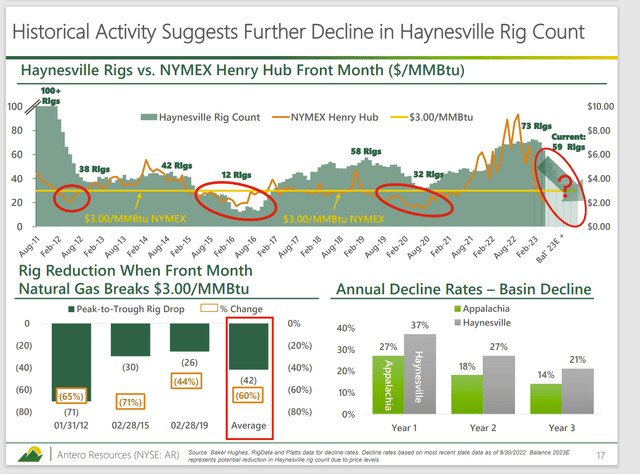

Antero Resources Explanation Of Swing Basin Haynesville Activity (Antero Resources Corporate Presentation May 2023)

The Haynesville, where Comstock has a material presence, has long been the swing producing region. Dry gas producers represent the majority of natural gas production. When prices are low, then this is usually the type of production that declines.

A producer like Antero Resources has a matrix of products that it produces. So, the breakeven point is a weighted average of all the products that it sells. Low natural gas prices can be made up with higher liquids selling prices. Therefore, the decision of a producer like Antero Resources to produce less is more complicated as it depends upon several prices. Since there still appears to be a general industry feeling that liquids prices will be improving the second half of the year, a company like Antero Resources will have a different strategy.

Many remember that the fast growth of unconventional (particularly the Permian) led to steady overproduction of natural gas for a relatively long time. But, by most accounts, that fast growth period is over with. Therefore, the rest of the unconventional business is unlikely to be the source of continued natural gas overproduction. This is an important difference from the last time around when it seemed like the downward price action of natural gas would never end.

Operating Costs

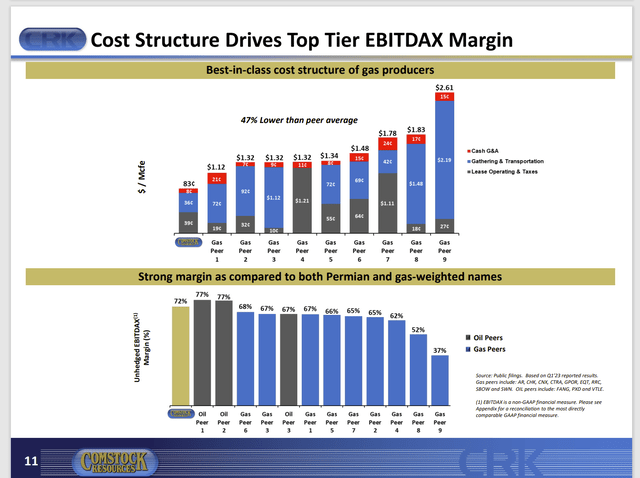

Comstock has some of the lowest operating costs in the business.

Comstock Resources Operating Cost And Margin Comparison (Comstock Resources June 2023, Corporate Presentation)

As a dry gas producer, the operating costs will be low because the company is dealing with primarily one product. So there is not as much of a need to separate out other products and get them for sale. Those other products are value added. But if there is not enough of them in the production stream, then the extra costs of those products will be low. Some producers will even let those other products in the production stream if the relative volume is low enough (as a percentage of total production).

The Comstock margins are wide because of the relatively low key costs. However, wells in this area are relatively large producers and, therefore, expensive compared to other areas. While those wells are profitable the size of the initial investment does influence the ability to increase or decrease production.

The considerations above make the comparison somewhat misleading because extra costs for various production and transportation needs of rich gas producers are offset by a more valuable sales stream. Otherwise, there is no need to drill for rich natural gas.

Now it should be noted that not all strategies win all the time. Sometimes, dry gas production is very profitable while other times the rich gas producers have more profits. Therefore, the key for investors has to be how profitable the company is at various points in the industry cycle. Overall, average profitability throughout the business cycle tends to matter a lot. Any investment has to earn an adequate return regardless of costs. If the company appears to be adequately profitable, then it is probably worth doing that due diligence to see how that adequate return is obtained.

One of the things about commodities in general is that there are usually several ways to make money adequately throughout the business cycle. So the focus on one thing like costs or sales prices (or even free cash flow) can cause an investor to miss good opportunities in the industry.

Cash Flow

It is not unusual for natural gas producers to bring on wells for the important heating season. Therefore, the recent decrease in activity can also be related to the fact that summer can be seasonally slower than winter. Now that can change if the summer is unusually hot.

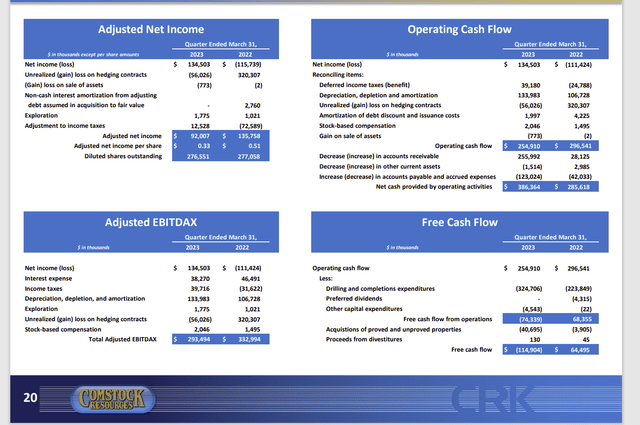

Comstock Resources Summary Of First Quarter Results (Comstock Resources Corporate Presentation June, 2023)

Notice that free cash flow was negative as activity was relatively high in the first quarter. There are managements that will “take a chance” on the fiscal year with the idea that the initial gas prices are high enough to raise the well profitability a couple of percentage points to make that gamble worthwhile.

The heating season when natural gas prices are traditionally strong is generally the time to “gamble” on bringing extra production online. The currently very hot summer is actually aiding the effort to raise ROI’s on wells drilled in the first quarter. It could have easily backfired. But right now, that negative cash flow is looking like a very good strategy.

That is true as long as the summer months are not predicted to be an industry disaster. Even then the profitability of new wells can be protected through hedging. That would allow a financial justification of the capital budget.

The hedging program did hold up profitability progress while natural gas and oil prices were rising back in 2022. Now, it looks as though the hedging program will likely help profits along for at least a quarter or so.

Balance Sheet

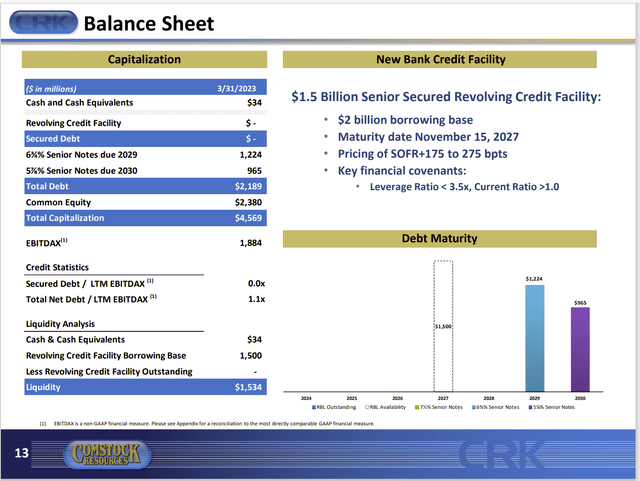

Ever since major shareholder Jerry Jones became involved with the company, the balance sheet has shown steady improvement from “zombie corporation status.”

Comstock Resources Balance Sheet And Key Leverage Ratio Summaries (Comstock Resources Corporate Presentation June 2023)

The debt maturity schedule shown above is very favorable. Notice also that the bank line is very clear. That is extremely important when the credit market is raising interest rates (which results in a perceived tightening of credit). Unlike many comments to the contrary, the credit market never shuts down. But it can become prohibitively expensive because interest rates heavily influence debt servicing needs.

This management clearly took advantage of the low interest rates to float bonds that locked in those low rates. Now, should natural gas prices strengthen as predicted, there could be an opportunity to repurchase some of that debt at discounted prices. That process could potentially save shareholders a lot of money.

The current leverage ratio, based upon last year’s earnings, has improved tremendously from years past. The preferred stock is now gone as well and an initial dividend has begun.

With the low operating costs of current production shown before combined with the current balance sheet, this company is in an excellent position to wait for a natural gas pricing recovery.

Key Ideas

Jerry Jones remains the controlling shareholder of the company. Therefore, finances are likely to remain at least adequate for the foreseeable future. A return to the overleveraged days is highly unlikely.

The time to consider a dry gas producer is when prices are low (not considering the heatwave which the market often overlooks) and the market sours on the industry prospects. That appears to be the case right now. Plus, the market remembers what it took to fix the company finances.

Therefore, the recovery potential of this stock is pretty good. A major shareholder like Jerry Jones usually intends to triple his money within 5 years. This company is in good enough shape to at least accomplish that.

Unlike many investors, Jerry Jones is not leveraging the company financially for that big return. Instead, he is going for low operating costs while waiting for the increasing ability of North America to export natural gas to the stronger world pricing market. When that happens, it is very likely that natural gas will have a cycle of higher prices than is the case right now.

This out-of-favor stock Comstock Resources, Inc. is a good strong buy consideration not only for the recovery potential of natural gas but also the possibilities offered by of all those export facilities (now under construction). A few years from now, this stock is likely to trade much higher than the price levels today.

Credit: Source link