A senior couple walk the beach together.

dmbaker

If you’re at least a somewhat conservative investor as I am, preservation of capital is an important concept. This is because while losing money is part of the game no matter who you are, it can sting quite a bit. How much?

Psychology estimates that losing money is twice as psychologically painful as gaining money is enjoyable. Now, it’s true that this is difficult to quantify. But think back to your experiences of losing money as an investor, and I think we’ll all agree that it is more psychologically distressing than the joy derived from making money.

What’s the reasonable response to reduce your risk of losing money as an investor as much as possible? Though not perfect, I would argue that buying well-established businesses at sensible valuations is the best course of action.

Well, you’ll be hard-pressed to find many businesses that are as qualitatively sound as the leading beverage company, Coca-Cola (NYSE:KO). For the first time in over four years, I will discuss why I am upgrading the stock from a hold rating to a buy rating.

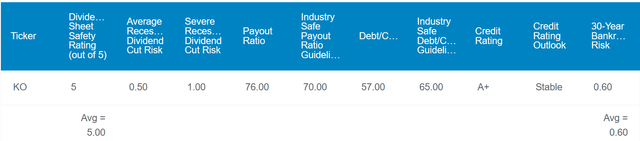

DK Zen Research Terminal

Investors seeking decent starting income versus the market will be pleased to find that Coca-Cola’s 3.2% dividend yield is double the 1.6% yield of the S&P 500 Index (SP500). Better yet, this higher starting income is also quite safe. Coca-Cola’s 76% EPS payout ratio is only marginally above the 70% payout ratio that is considered safe for consumer staples by rating agencies.

The beverage giant makes up for this slightly high payout ratio with an exceptional balance sheet. Coca-Cola’s 57% debt-to-capital ratio is comfortably lower than the 65% that rating agencies view as ideal. Coupled with the considerable brand power of the company’s beverage portfolio, this is why it enjoys an A+ credit rating from S&P on a stable outlook. That implies the chance of Coca-Cola not being around in 2053 is just 0.6% or 1 in 167.

If you avoid overpaying for ownership in a company and there is a very low risk of bankruptcy, the odds of making money over the long haul improve greatly. Fortunately, Coca-Cola is the equivalent of a wonderful business trading at a decent valuation.

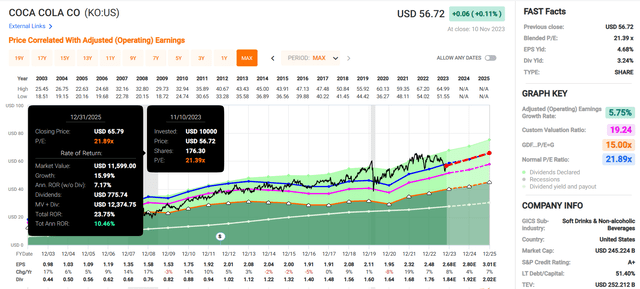

According to Dividend Kings’ historical fair values for metrics including dividend yield and P/E ratio, shares of the beverage maker are worth $60 each. Based on the current $57 share price (as of November 13, 2023), Coca-Cola is priced at a 5% discount to fair value.

If the company meets growth expectations and returns to fair value, here is what total returns could resemble in the next 10 years:

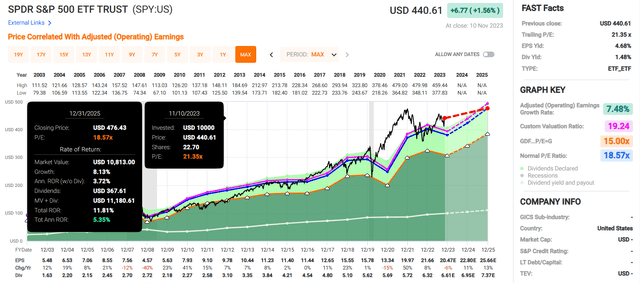

- 3.2% yield + 6% FactSet Research annual earnings growth consensus + a 0.5% annual valuation multiple boost = 9.7% annual total return potential or a 152% cumulative total return versus the 9.9% annual total return prospects of the S&P 500 or a cumulative 157% total return

Coca-Cola Is Flexing Its Pricing Muscles

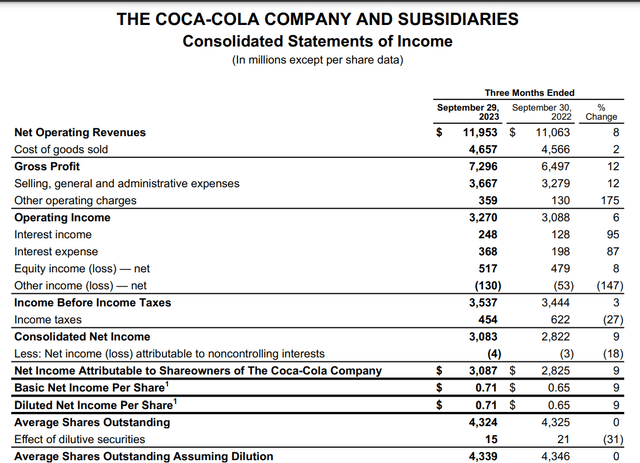

Coca-Cola Q3 2023 Earnings Press Release

The true sign of quality for a consumer staple is the strength of its brands. Coca-Cola’s brand portfolio consists of over legendary 200 brands, including the eponymous Coca-Cola, Powerade sports drink, and Dasani water. Thanks to these leading brands, the company’s products are consumed around the world by over 2.2 billion people each day.

Given that Coca-Cola’s products have become so embedded into the daily routines of so many people, its third-quarter results shouldn’t be surprising. The company’s net operating revenue surged 8% higher over the year-ago period to $12 billion for the third quarter ended September 29.

Coca-Cola’s pricing and mix contributed to a 9% increase in its topline during the third quarter. This was predominantly driven by price hikes that were implemented to protect against rising costs and maintain the company’s strong profit margins. Yet, consumers were unphased by these higher prices. This was proven by a 2% growth rate in Coca-Cola’s global unit case volumes in the quarter.

These positive catalysts were partially offset by a 2% hit to net operating revenue via unfavorable foreign currency translation for the third quarter. This was due to the U.S. dollar’s strength against most other foreign currencies during the period. Divestitures of non-core assets also impacted net operating revenue by 1% in the quarter.

Coca-Cola’s non-GAAP EPS increased by 7.2% during the third quarter to $0.74. Bottomline growth slightly lagged topline growth because of a 40 basis point contraction in non-GAAP profit margin to 26.8% for the quarter. This was the result of faster growth in its selling, general and administrative expenses and other charges categories.

Looking ahead, Coca-Cola’s growth prospects should remain solid. Besides its admirable pricing power and the tendency to execute bolt-on acquisitions, the company is also forming smart strategic partnerships to expand into more large addressable markets. As Yiannis Zourmpanos put it recently, the company’s anticipated launch of the Absolut Vodka and Sprite prepared cocktail with Pernod Ricard next year could move the growth needle. Coca-Cola expects that this emerging category of alcohol ready-to-drink beverages can deliver 8% to 10% annual growth (per slide 7 of 54 of Coca-Cola Third Quarter 2023 Investor Presentation). For these reasons, FactSet Research believes that the company’s earnings will grow by 6% annually over the long run.

Coca-Cola’s financial health is also unquestionably vigorous. This is supported by an interest coverage ratio of 23.1 through the first three quarters of 2023. That has to at least partially factor into on why S&P awards Coca-Cola with an A+ credit rating.

Six Decades Of Dividend Growth And Counting

Having upped its dividend for the 61st consecutive year in February, Coca-Cola is easily a Dividend King. The company’s impeccable dividend growth streak also likely won’t be ending anytime soon.

This is because Coca-Cola’s free cash flow payout ratio is very sustainable. In the first three quarters of this year, the company generated $7.9 billion in free cash flow. Against the $4.1 billion in dividends paid during that time, this equates to a 51.4% free cash flow payout ratio (page 8 of 61 of Coca-Cola 10-Q filing). This should give Coca-Cola the flexibility to keep delivering mid- single-digit annual dividend growth to shareholders.

Risks To Consider

Coca-Cola is an excellent company, but even the best of businesses still have risks.

One risk to the company is that GLP-1 receptor antagonists like Eli Lilly’s (LLY) Zepbound weight loss drug are thought to reduce the appetite and thirst of patients. As obesity rates continue to grow and more patients begin taking this drug, there could be a modest decrease in demand for Coca-Cola’s products.

The company is also more oriented toward away-from-home consumption channels (e.g., restaurants and theme parks). Thus, a recession could at least somewhat weigh on its financial results in the near term.

Another risk to Coca-Cola is that it is a common target for hackers. If the company experienced a major hack, its operations could be disrupted, and sensitive information could be compromised. This could potentially harm its fundamentals.

Summary: Coca-Cola Offers Competitive Total Returns With Lower Volatility

FAST Graphs, FactSet

FAST Graphs, FactSet

Coca-Cola isn’t the best bargain in the investment universe right now, but it is reasonably appealing. The company’s blended P/E ratio of 21.4 is slightly less than its historical P/E ratio of 21.9.

Along with its dividend and 4% and 7% respective earnings growth in 2024 and 2025, Coca-Cola could generate annual total returns of over 10% through 2025. This is about double the total returns of the S&P 500 index for that period. Coca-Cola also can roughly match the index over the long term, which is why I believe it is a buy for conservative investors at this time.

Credit: Source link