skynesher

Thesis

Chubb Limited (NYSE:CB) is a property and casualty insurance company. It offers various types of insurance, including those for businesses and individuals, including coverage accidents, death, etc. I think CB is one of the best P&C brands because of its distinguished commercial lines business, innovative personal lines division, and access to fast-growing international markets. The size of the company, its commitment to disciplined underwriting, and its willingness to be adaptive in terms of product mix should all contribute to the company’s ability to sustainably report high underwriting margins. In addition, I think the company is in a strong position thanks to its diversified product mix if price increases in commercial lines continue to decelerate. More importantly, valuation on a forward earning has come down to slightly above 10x, which is near its all-time-low, excluding Covid period. Although CB’s earnings for 1Q23 fell short of expectations, I believe that the underlying business trends were positive. High catastrophe losses weighed on profits, but other metrics, such as the combined ratio, were in line with expectations. There was also better-than-expected performance from premiums and investment income. In sum, I think this company is worth investing in because of its cheap valuation, solid distribution channels, and well-known brand name.

Results review

CB’s operating EPS of $4.41 was lower than expected. However, the total P&C underlying combined ratio of 83.4% was in line with expectations. In addition, the expense ratio and underlying loss ratio both performed as expected. I would attribute the EPS shortfall to the greater-than-anticipated quarterly Catastrophe losses. Growth wise, total P&C NPW growth of 9.3% compared to 8.4% expectations from the market also exceeded expectations. Additionally, CB saw a quarterly pricing acceleration to 11.2% for NA Commercial P&C, up from 6.5% in the previous quarter.

Margin

Considering CB’s excellent underwriting history and its success in maintaining healthy underwriting margins and expanding its business even as its pricing environment softened in the years leading up to 2018, I am optimistic about the company’s future margins. Importantly, I hold the belief that CB is in a favorable position to endure a decline in commercial lines pricing as it possesses a varied range of insurance businesses that are complementary to each other and have achieved significant market share and influence. For example, when compared to other large commercial carriers like Hartford Financial Services Group (HIG) and Travelers Companies (TRV), CB has more exposure to reinsurance and less exposure to workers’ compensation. I believe that CB’s potential outperformance relative to its peers is primarily attributable to this distinctive mix and focus.

International

I think it’s important to point out that management is optimistic about future growth in Asia and in the legacy Cigna business. The expansion of CB’s agency organization and telemarketing efforts in the region are two key parts of its strategy for organic growth there. The strong growth in Europe during the quarter also bolsters the broader theme of international expansion. Management also highlighted Latin America as a promising market for future growth. I believe the commentary on these regions are helpful in setting the expectations for long-term growth runway.

Valuation

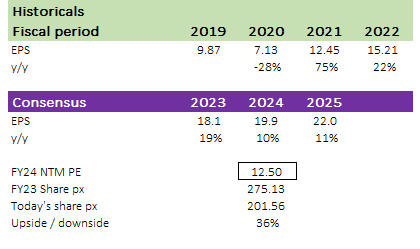

One of the main reasons I recommend a buy rating on CB stock is the relatively low valuation in comparison to the past. CB has a forward earnings ratio of 12.5x on average over the last decade and is currently trading at around 10.7x. I believe that the rising rate environment has lowered the valuation of such interest-sensitive assets, but I also believe that this has created an interesting risk/reward situation. The current high rate environment will eventually normalize, and while I don’t expect it to return to 0%, I believe it will fall significantly. If this occurs and CB valuation returns to its average, I believe the share is worth $275 in FY24 based on the consensus FY25 EPS figure.

Author’s model

Risks

There are 2 key risks I see today. The first is the slowing of premium increases in the commercial lines market which could hurt performance if it slows faster than expected, but as I’ve already mentioned, I think CB is better positioned to weather the storm than its competitors. The second risk to the stock is that CB will make another huge acquisition that is dilutive to shareholders. However, given CB pace of buying back shares, it seems less likely that management will pull off another large acquisition (they would not be buying back shares as they need the capital).

Conclusion

In conclusion, I recommend a buy rating for CB due to its cheap valuation, strong distribution channels, and reputable brand name. Despite falling short of expectations in 1Q23, the underlying business trends were better than initially perceived, with strong growth in total P&C NPW and pricing acceleration for NA Commercial P&C. Furthermore, CB’s diverse product mix and focus on disciplined underwriting should contribute to the company’s ability to sustainably report high underwriting margins, even if commercial lines pricing continues to decelerate. The company’s international expansion efforts, particularly in Asia and the Cigna acquisition, also provide a promising growth runway.

Credit: Source link