Kaan Uluer/iStock via Getty Images

Note: All amounts discussed are in Canadian Dollars. Stock Prices refer to those on the TSX and not the OTC symbol.

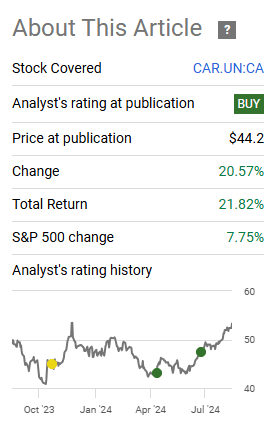

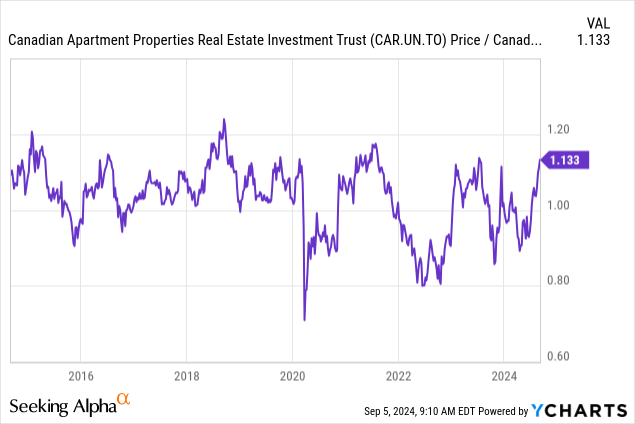

In May of this year, we switched to a Buy on Canadian Apartment Properties Real Estate Investment Trust (TSX:CAR.UN:CA) (“CAPREIT”) and acquired a chunk of shares. The REIT was hit with the same malaise that infected the entire Canadian sector. But unlike some distressed names, this one had no real issues, apart from a lack of investor patience. That patience was required, as the REIT needed time to capture all the high rents in the market. It could not pass it on immediately as its properties were primarily in rent controlled jurisdictions. We reiterated a buy in July as we saw nothing to derail the argument. The stock has done phenomenally well since our first buy, and handily outperformed the AI-bubble as well.

Seeking Alpha

We go over Q2 2024 results, the dividend hike in place, and tell you why we are changing our tune just a bit.

Q2 2024

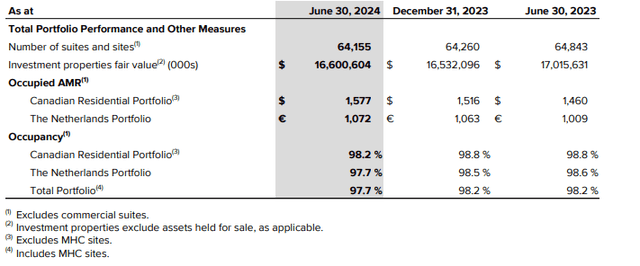

CAPREIT had a small dip in occupancy in both its Canadian and European portfolios. These were primarily from suite turnover and upgrades.

CAPREIT Q2-2024

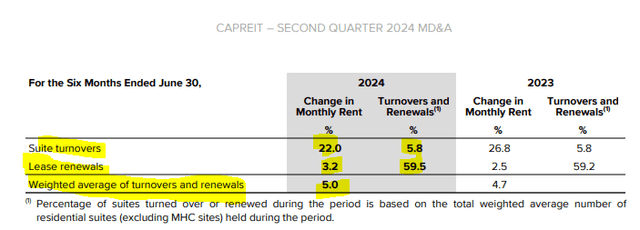

Overall rents rose once again as CAPREIT benefitted from exceptionally strong markets across its portfolio. Suite turnovers unfortunately remain low but wound up driving total change in monthly rent all the way up to 5%.

CAPREIT Q2-2024

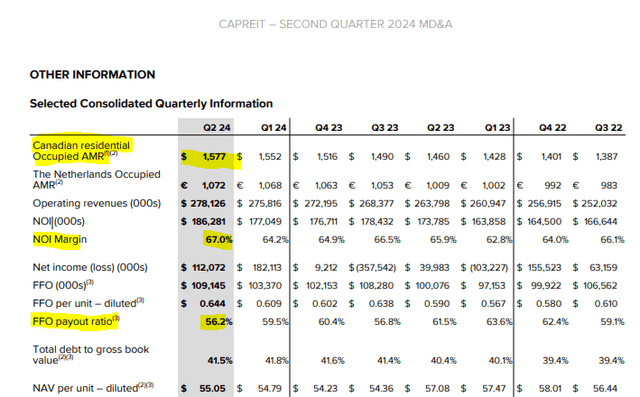

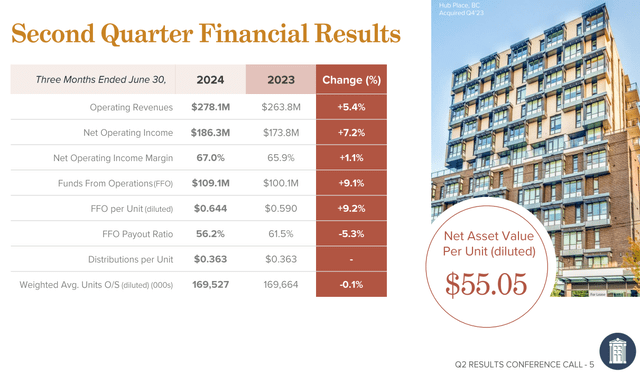

With a huge mark-to-market opportunity in rents, there is a lot of embedded value in the portfolio. This will likely be captured slowly, over the next 5–9 years. The rent increases we did see were enough to drive the highest monthly rent per suite, the highest net operating income (NOI) margins and another drop in the funds from operations (FFO) payout ratio.

CAPREIT Q2-2024

CAPREIT reported its net asset value or NAV at $55.05, and we continue to appreciate the conservative cap rates which are used to reach this number.

CAPREIT Q2-2024

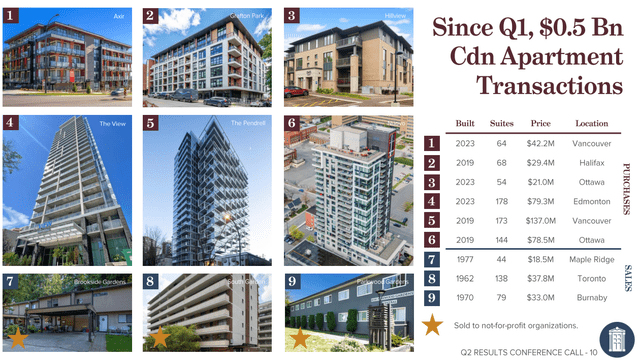

The focus on upgrading the portfolio and making it relative younger continued for the REIT. Just look at the “built” column in the slide below and compare the difference between sales and purchases.

CAPREIT Q2-2024

All in all, it was another step in the right direction.

Outlook

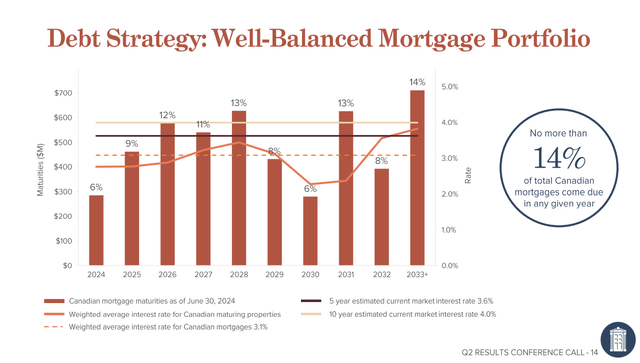

The rent growth side has been well known, and the key question remains as to how long it will take to capture the spread in rent controlled markets. We gave our view on that, but regardless of where you stand on it, you have to know that there is a deep embedded value in some of these apartment REITs. On the debt side of the equation, the interest rate cuts are coming in like the 10th instalment of “The Fast & The Furious” and everyone is trying to run to the front of the line to be the most aggressive forecaster. CAPREIT has always been conservative with its strategy, and there is no front loading of the debt burden. Hence, it will benefit only modestly from all these cuts. But there is some room here for improvement in the rate structure. So far in 2024, the weighted average refinance has been near 4.50%.

To date, CAPREIT completed or committed mortgage financings totaling $409.9 million, with a weighted average term to maturity of 7.5 years and a weighted average interest rate of 4.51%.

Source: CAPREIT Q2 2024.

But the weighted average rate, when it announced its results, had fallen to 3.6% on the 5 year CMHC insured mortgage.

CAPREIT Q2-2024

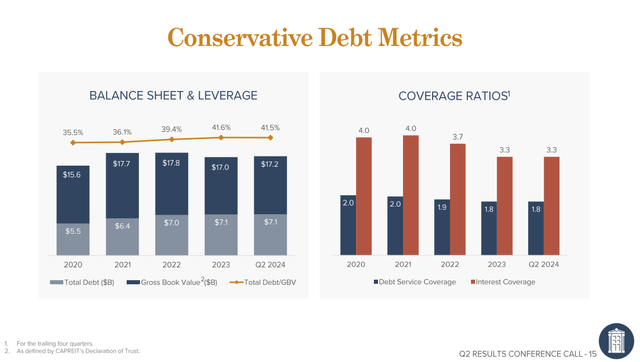

Even this 3.6% is well above all CAPREIT mortgages until you reach 2028. So refinancing will be a drag here, although it will be way less impactful than what 2023 produced at the peak of the cycle. CAPREIT’s rising NOI should be more than enough to offset this and then some, and its interest coverage ratios should bottom out soon.

CAPREIT Q2-2024

The company delivered a long overdue 3% distribution hike (From $1.45 to $1.50 annually). It also exited the Manufactured Housing Portfolio for $740 million. We did not view this as a positive, as the MHC remains underdeveloped and offered a good longer-term opportunity for CAPREIT. The management view was that it allowed focus on the primary portfolio and accelerated the repositioning into newer buildings. At this point, there is little doubt that the company will meet or exceed the 2024 estimates. The only key question is what you are ready to pay it.

CAPREIT trades at close to 19.6X 2025 FFO. That is quite an expansion from where we made our initial thrust for a buy rating in May. It also now trades right around the consensus NAV estimate of $54.95. There is some potential here for it to move higher as NAV estimates likely move up by 3%-5% over the next 12 months, and it can always trade at a premium to this number. Do keep in mind that even during ZIRP (Zero Interest Rate Policy), 1.15X for a price to NAV ratio was the general absolute ceiling.

TIKR

So there is room for upside, but the upside and downside risks are more balanced at this point. On a technical basis, the euphoria in interest rates has definitely begun to show up, as the stock now trades 13.3% over its 200-day moving average.

If all that information told you that it was time to buy, then you really need to follow a different set of authors. Yes, we still like the REIT and are holding on to some of our positions. But it is hardly the screaming buy it was lower down. You are never going to make 100% in any year in REITs (outside a post GFC or post COVID-19 setup). 20% in a year is fantastic. 21.82% in 4 months is probably a Jack Nicholson & Helen Hunt movie. We are downgrading this to a “hold.” There are very few attractive opportunities left among Canadian REITs, and this is certainly not one of them.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Credit: Source link