JazzIRT

Medical Properties Trust (NYSE:MPW) does not enough liquidity to cover upcoming maturities over the next couple of years and a dividend cut seems to be just a matter of time, making it a poor income investment.

As I’ve analyzed in previous articles, I’m bearish on Medical Properties Trust over the long term as the business has some issues and controversies, plus its high-dividend yield is not sustainable and, in my opinion, a dividend cut is likely in the near future.

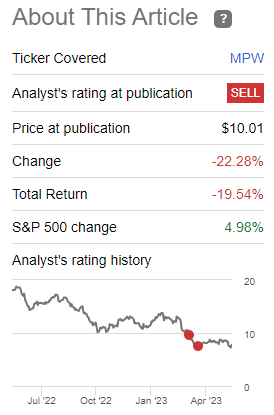

Since my first article on MPW back in March, its total return is negative by close to 20%, being a huge underperformer compared to the overall stock market. This lower share price has led to a dividend yield of close to 15%, which may appear attractive to income investors, but as I’ve analyzed previously its dividend is not covered by cash flows and therefore not sustainable over the long term.

Article performance (Seeking Alpha)

In this article, I analyze the company’s most recent developments and also take a look in more detail into its debt load, to see if its relatively high financial leverage is also a concern regarding MPW’s dividend sustainability or not.

Recent Developments & Debt Load

Since my last article, MPW was able to reach a deal to sell some assets in Australia, which will also enable the company to repay a loan tied to these assets. MPW will sell 11 hospitals in the country for some $800 million, which were purchased by MPW back in 2019 for $840 million, in a competitive process that began in October 2022 and is expected to close during the second half of 2023. Proceeds from this deal will be used to repay MPW’s AUD term loan, which was reflected in MPW’s books at $818 million, thus MPW will ease its refinancing needs for 2024, which can be considered to be a positive move.

On the other hand, the sale of these assets will be done at a small discount to book value and will lose about $54 million of annual rental income, while saving only about $20 million on annual interest expenses. Therefore, MPW’s FFO and cash flow will be negatively impacted by this deal, putting further pressure on its dividend sustainability from 2024 onwards.

It will also increase even further its tenant concentration, even though the impact is not that worrisome, but given that tenant concentration was one of MPW’s key weaknesses, the need to sell assets to manage its debt load is a negative step for MPW’s business profile.

Moreover, more recently, there was more news that two of its largest tenants, namely Steward Health Care and Prospect Medical Holdings, are seeking to refinance their debts as they cannot tap public markets in the current environment, showing that their financial situation is not particularly strong. These two tenants account for some 30% of MPW’s revenues, which so far is not at risk, but MPW may have some issues in the future to collect rent from these tenants.

Given that some 90% of MPW’s revenues comes from rents, a key factor to monitor in the short term is its rent collection rate, as the current economic slowdown and difficult operating trends for hospital operators may lead to delayed rent payments, or ultimately some tenants to stop paying rent altogether.

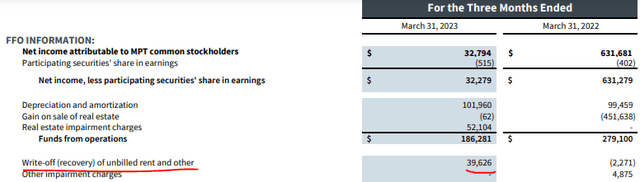

This was already visible in its latest quarterly results, as MPW made a write-off of more than $39 million of unbilled rent, related to Prospect. This tenant has not made any rent or interest payments during Q1 and doesn’t appear likely to restart payments in the coming months.

Rent (MPW)

Considering that MPW’s cash position is not great and has considerable debt coming due in the next few years, more tenants entering into financial distress will put further pressure on the company’s financial situation, and MPW may also enter into financial distress if credit conditions don’t improve over the short to medium term.

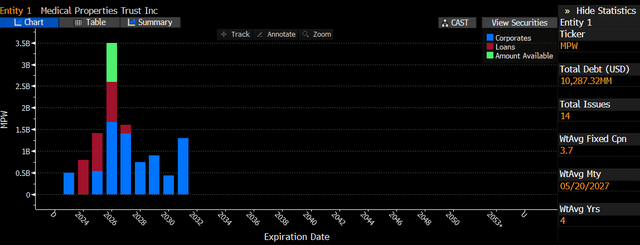

As shown in the next graph, MPW has some $500 million of maturities in 2023, while its 2024 loan will be paid-off with asset sales, thus only by 2025 the company will face significant refinancing needs. This includes both a loan and a corporate bond, totaling more than $1.4 billion. In 2026, its total debt maturities amount to more than $2.6 billion, or about 25% of its total debt. This means that without considering its 2024 loan that will be repaid from proceeds of Australian asset sales, more than 40% of its debt matures in the coming three years, which is worrisome.

Debt schedule (Bloomberg)

Its forthcoming debt maturity is a £bond with some £400 million ($496 million) outstanding, which is currently trading at about 96% of par value. Thus, the market’s perception of a potential default is still relevant, even though I think MPW will be able to repay this bond and avoid a credit event until next December (when the bond comes due).

Indeed, at the end of March, MPW’s cash balance was $302 million plus net asset sales should be enough to cover its December 2023 debt maturity, even though its cash position is likely to become stretched following this payment.

This is happening because MPW’s free cash flow is negative, as the company does not generate enough cash from operating activities to cover its dividend payments, as I’ve analyzed in my previous article.

Despite this strained cash flow profile, during the last quarter, MPW agreed to finance its struggling tenant Prospect, a decision that I don’t think makes sense, and it’s likely to lead to further losses. As said during the last conference call, MPW has invested $50 million in a convertible loan to Prospect:

With respect to Prospect, during the first quarter, we agreed as part of an expected series of additional agreements to invest $50 million in a convertible loan issued by Prospect’s managed care entities.

Given that this tenant is not paying rent currently, the probability of paying this loan back is not great, thus MPW is again financing its tenants to not recognize further losses, which is clearly not sustainable over the long term.

This is more worrisome because MPW’s operating cash flow was $135 million in Q1 2023, while its capex was nearly $80 million, and dividend payments amounted to $176 million. Therefore, MPW is not generating enough free cash flow for its own commitments, and it’s financing its struggling tenant… this is not a good sign from its management.

During the last quarter, MPW was able to increase its cash position by some $63 million because it received more than $95 million from its revolving credit facility with JPMorgan (JPM), thus MPW continues to increase its indebtedness to stay afloat, not a good sign for its long-term business sustainability.

While MPW is not expected to have significant 2024 debt maturities following the sale of its Australian assets, its capacity to refinance 2025/26 debt maturities at reasonable costs seems to be quite low right now. For instance, assuming that MPW would try to raise new debt with a three or four-year maturity, its current senior USD bond maturing in 2027 is currently trading at a yield to maturity of about 10.5% (trading at some 80% of par value), thus the cost of new debt seems to be too high.

This means that MPW’s debt load coming due in 2025/26 is quite high and the prospects of refinancing with new bond or loan issues are low, forcing MPW to sell assets, cut its dividend, and continue to borrow from its revolving credit facility. Indeed, MPW still has some $900 million outstanding from its revolving credit facility, which is enough to pay its upcoming bond maturity and pay two quarterly dividends, but I clearly see MPW being in a tough financial position by the end of this year as its liquidity position will dwindle.

While MPW says it has enough liquidity to operate until 2025, investors should note that its liquidity position will become quite tight by the end of 2023, thus a sizable dividend cut now seems to be just a matter of time, as the company desperately needs to save cash. Investors should note that in Q1, MPW’s net income was only $32 million, while it paid more than $176 million in dividends, thus MPW can easily make a major cut to the dividend and still maintain its REIT status.

Conclusion

Medical Properties Trust has several fundamental issues, and its high-dividend yield is clearly the result of an unsustainable dividend level. Moreover, the company’s debt load will become an issue over the coming months and will put further pressure on its financial profile, not boding well for future earnings as the company will become a forced asset seller. Taking into account this challenging operating backdrop, I think MPW remains a poor income investment, and investors should stay away.

Credit: Source link