Roman Tiraspolsky

I recently published a Tesla, Inc. (NASDAQ:TSLA) article illustrating how it could beat Q4 sales and earnings forecasts. However, Tesla missed top and bottom line estimates. The primary reason for the miss was lower average selling prices (“ASPs”) in its wildly popular Model 3 and Y vehicles. Tesla lowered prices more than anticipated to protect its market share in the electric vehicle (“EV”) segment during the challenging time of high-interest rates and a relatively slow economic environment.

However, the dynamic of lower ASPs may be transitory, as prices could increase as economic growth returns and interest rates fall in future quarters. Additionally, Tesla announced the introduction of a new, cheaper mass-market vehicle for 2025 and may be plagued temporarily by the “Osborne Effect.” Despite the transitory nature of Tesla’s slowdown, estimates have been lowered considerably for future years. Intermediate and longer-term forecasts may be too pessimistic, and Tesla could outperform as we advance.

Meanwhile, Tesla’s stock has gotten battered, dropping to about $180 post the earnings report. At $180, Tesla’s stock was down by 40% from its recent high, around $300, and nearly 60% from its ATH, around the $420 range. Tesla has immense revenue and profitability potential due to its popular S/3/X/Y vehicle lineup and its new vehicles (Cybertruck, Semi, Next Generation vehicle) coming online in 2024 and 2025.

Therefore, despite some near-term volatility and sideways price action, Tesla’s stock price should rise considerably as sentiment improves and earnings estimates increase in future quarters. Tesla’s margins should also improve as economic growth returns and the Fed lowers interest rates this year. I recently increased my Tesla position by 50% and will add to my Tesla holdings if the stock drops again.

The Downside May be Minimal – Upside is Immense

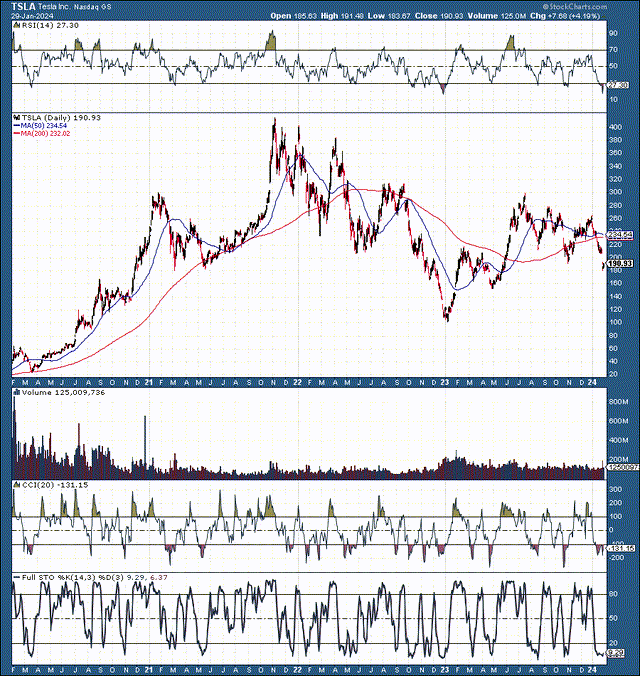

TSLA (StockCharts.com)

Tesla’s stock made a blowoff top in 2021, and it’s been downhill since. Tesla’s share price is about 55% below its 2021 $420 peak. Yet, Tesla’s 2021 revenues were only $53.8 billion compared to 2023’s $96.8 billion. Also, Tesla’s net income was only about $5.6 billion in 2021, compared to the $15 billion last year. Therefore, while its stock is much lower, Tesla is in a much better financial place and has excellent prospects.

Technically, Tesla’s stock hit a panic-induced generational low of around $100 (75% below its ATH) during the height of the tech selloff/bear market around late 2022/early 2023. Unless something drastic happens to the company, I don’t think the stock will be heading near $100 again. However, some minimal downside is possible, and we may have another opportunity to pick up Tesla shares in the $150-160 range if poor sentiment persists.

Tesla’s stock recently became very oversold as the RSI crashed to 20. We also see the full stochastic and other technical indicators suggesting that momentum could improve soon. Moreover, the 200-day MA should soon surpass the 50-day MA, a positive technical dynamic for the stock. In the long term, Tesla’s stock has tremendous potential and could achieve new ATHs in 2025.

Model 3/Y ASPs Dropped More Than Expected

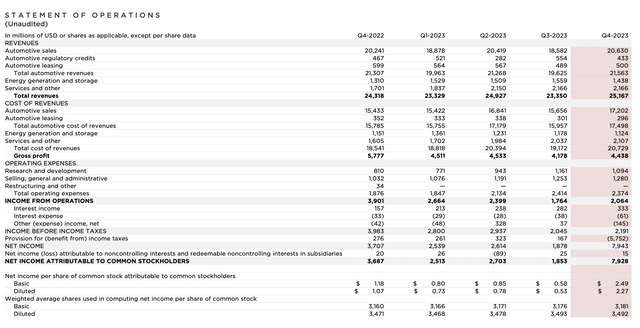

I expected an ASP of $42,250 for the Model 3/Y segment, similar to the ASP I deduced in Q3 2023. My automotive sales estimate was $21.6 billion. Yet Tesla’s automotive sales came in at just $20.63 billion instead. Tesla’s services, energy generation, and storage revenues were slightly lighter than anticipated. As a result, Tesla reported total sales of about $25.17 billion vs. my estimate of $26.8 billion for Q4.

Tesla’s Income Statement

Income statement (static.seekingalpha.com)

Tesla’s ASPs declined more than expected in Q4 as it continued lowering prices on Model 3/Y vehicles to maintain market share during these challenging times for the EV industry. Using an ASP of $110,000 for Tesla’s premium “other” segment (primarily Model S/X vehicles), roughly 22,280 (adjusted for lease accounting) vehicle sales in Q4 likely provided about $2.5 billion in revenues.

Therefore, the Model 3/Y segment could have contributed about $18.13 billion in revenues last quarter. Provided that Tesla sold approximately 452,307 (adjusted for lease accounting) Model 3/Y vehicles in the previous quarter, the ASP was likely $40K. This decrease represents another drop in ASPs from the prior quarter. However, $40K may represent a low point for the Model 3/Y segment.

While it may appear low, the $40K ASP makes sense, as much of Tesla’s sales come from China. Due to the ultra-competitive EV market in China, a new Model 3 started at below $36K in Q4, and a new Model Y started below $37K. Many consumers (not only in China) likely opted for base models due to the challenging economy and the ultra-high interest rate environment.

Margins Are Already Improving

Due to the price drops, high rates, slow growth, and a challenging macroeconomic environment, Tesla’s margins remained under pressure in Q4. However, we saw an improvement in margins over Q3, implying the worst may be behind Tesla. Automotive sales gross margin (excluding leasing and regulatory credits) came in at 16.6%. However, this was higher than the previous quarter’s (Q3 2023) gross margin of 15.7%.

Also, the total automotive sales gross margin was 18.85% in Q4. The total automotive sales gross margin in the previous quarter was 18.7%. There was also $121 million more in regulatory credits in Q3 than in Q4. Once adjusted for the extra regulatory credits, Q3’s total automotive sales gross margin would have been 18.1%.

Tesla’s operating margin improved to 8.2% in Q4 vs. 7.55% in the previous quarter. Thus, we’re seeing improved profitability despite a lower ASP in the Model 3/Y segment, illustrating improved efficiency and higher profitability, a highly constructive dynamic for Tesla in the long term.

Higher Profitability Likely Ahead For Tesla

Despite Tesla’s margin improvement over the previous quarter, its total automotive sales gross margin was 25.9% in Q4 last year. Tesla’s operating margin was also much higher at 16% in the same time frame. Nonetheless, we see improvements, and Tesla’s decline in profitability is likely a transitory phenomenon associated with sluggish growth, temporary high saturation in the EV market, high-interest rates, and other factors that could improve in the near term.

As interest rates moderate and economic growth improves, Tesla’s profitability metrics should increase, leading to improved sentiment and a much higher stock price in future years. We should consider that Tesla has new vehicles like the Cybertruck, Semi, and its next-generation mass-market vehicle that should translate into much higher revenues as we advance.

The Osborne Effect

In 2023, Tesla’s deliveries grew by 38% to 1.81 million YoY. Tesla may sell about 2.2 million vehicles this year, demonstrating a 21% YoY growth rate. Of these 2.2 million vehicles, Tesla may deliver around 75K Cybertrucks and roughly 75K Model S/X vehicles. Tesla could also deliver about 50,000 Semis this year, leaving approximately 2 million cars as Model 3/Y sales.

Note: While some projections point to around 50,000 units in Semi sales this year, we could see fewer Semi sales (in my view) in the 20,000-30,000 range.

In 2023, Tesla delivered 1,739,707 Model 3/Y vehicles. Thus, an increase to 2 million this year will only result in a growth rate of about 15%. Still, this dynamic should equate to significant sales growth for Tesla, and we can’t forget about the “Osborne Effect.”

“The Osborne Effect is roughly defined as a social phenomenon of customers canceling or deferring orders for the current products due to the announcement, official or unofficial buzz over a future product that may compare favorably. The Osborne effect is considered a form of sales cannibalization by a company as it sets its product strategy.”

We can expect lower Model 3/Y sales before Tesla’s next-generation vehicle launches, likely in the mid or second half of 2025. Tesla informed suppliers it would like to start producing a new mass-market vehicle codenamed “Redwood” in mid-2025. The car could start around $25K and should compete exceptionally well with cheaper EVs from BYD and other “cheap” mass-EV manufacturers.

It’s natural to see a slowdown in demand in the Model 3/Y segment, as many consumers will opt to wait to get the newer and cheaper vehicle in future years. Also, we should consider the massive market penetration potential Tesla offers with a $25-30K vehicle, as volume sales could eventually be higher than its Model 3/Y segment.

We witnessed a similar slowdown in sales dynamic with Tesla’s transition from primarily Model S/X vehicles to the Model 3. The Model S sales, in particular, softened going into the Model 3 launch. Therefore, this time, we may see some softness in Model 3 sales before the cheaper EV. Nonetheless, a 15% growth rate in the Model 3/Y segment is solid, and Tesla’s revenues should increase significantly this year.

Tesla 2024 Revenue Projections

- Two million Model 3/Y cars, $40K ASP, equates to $80 billion in sales.

- 75K Cybertrucks, $90K ASP, equates to $6.75 billion in revenues.

- 75K Model S/X vehicles, $110K ASP, equates to $8.25 billion.

- 25K Tesla Semis, $175K ASP, equals $4.5 billion.

- Regulatory credit revenues: $2 billion.

- Automotive leasing revenues: $2 billion.

- Energy generation and storage sales: $7 billion.

- Services and other revenues: $8.5 billion.

2024 Revenue Estimate: $119 billion

- 19.7% gross margin equates to a gross profit of $23.44 billion.

- Estimated operating costs: $8.8 billion.

- Estimated tax/other: $1.2B.

- 2024 estimated net income: $13.44 billion.

2024 EPS estimate: $4.20.

Note: All estimates are based on prior results and publicly available information.

The Bottom Line: Estimates May Be Too Low Now

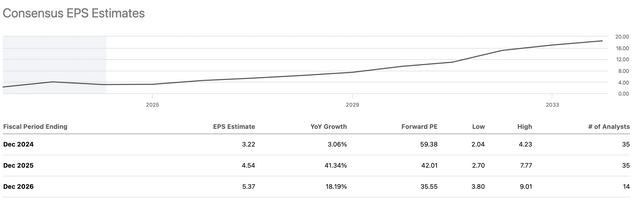

There is significant pessimism surrounding Tesla, and the sentiment is at a low point. This depressed valuation dynamic is typically the time to go long. Consensus EPS estimates are for just $3.22 this year, which seems incredibly low.

Tesla Now Set Up To Beat EPS Estimates

EPS estimates (SeekingAlpha.com)

I used a sub-20 % gross margin, achieving $4.20 in EPS. However, the Model 3/Y ASP could rise this year, enabling margins to improve more than expected (potentially increasing above 20%). Moreover, we see Tesla’s production efficiency improving, and we may see further margin expansion as productivity strengthens. Likewise, EPS estimates look lowballed for future years, and we could see significant upward EPS revisions as we advance.

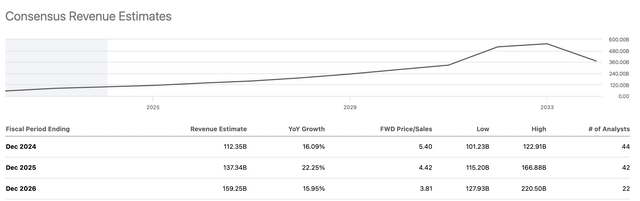

Also, Tesla’s average revenue estimate is only around $112 billion now, with a higher-end forecast at around $123 billion. We could see the economic recovery strengthen this year. Moreover, lower interest rates should increase demand in the EV industry. We may also see higher oil prices, leading to more robust EV sales this year.

Revenue Estimates May Be Too Low

Revenue estimates (SeekingAlpha.com)

This dynamic could enable Tesla to easily beat the consensus figures, potentially selling toward the high end of estimates and achieving revenues of $120 billion or more this year. My estimates are relatively modest but are still higher than many on the street. Tesla’s guidance toward future Cybertruck, Semi, and the Next Generation Tesla vehicle sales should also impact sentiment and future EPS and revenue estimates.

- My 2024 year-end Tesla price target: $250-300.

- My 2025 Tesla price target range: $400-500.

Risks to Tesla

Despite my bullish outlook, Tesla faces many risks. Tesla faces the continuous threat of increased competition. As the leader in the EV industry, Tesla must remain ahead of the pack. There are Chinese EV automakers like BYD Company Limited (OTCPK:BYDDF), NIO Inc. (NIO), and others. Tesla also faces competition from traditional automakers now making solid EVs.

Furthermore, Tesla may experience worse-than-expected growth in its crucial Model 3/Y segment due to a sluggish global economy, high-interest rates, and other factors. Additionally, Tesla faces ramp-up and additional cost risks associated with the Cybertruck production ramp-up, the Semi, and the Next Generation Model ramp-up next year. There is the risk of margin compression and lower-than-anticipated profitability. Investors should examine these and other risks before investing in Tesla.

Credit: Source link