PM Images/DigitalVision via Getty Images

Introduction

Over the past few years, I have increasingly focused on one major issue: the looming retirement crisis.

Although every time I use the word “crisis” in a title, I feel guilty of clickbait, there’s no denying that it’s an appropriate use of the word, as we’re increasingly moving to a situation that could see significant retirement funding shortages.

The Guardian headline below is a good example of this:

The Guardian

My most recent article on this subject was written in March, titled “5 Stocks Yielding 5% To Beat The Looming Retirement Crisis.”

In this article, I’ll elaborate on this, add new details, and give you four stocks that provide safety, income, and growth – the perfect mix to build wealth for when it matters most.

So, let’s get to it!

We Need To Take Action Quickly

A few days ago, I read an interesting article on Bloomberg, which highlighted the urge to provide income for people not working.

This sentence from the first paragraph stood out:

As a senior executive at a large asset-management firm recently said to me, with surprising candor: “We don’t know how to solve the retirement problem.”

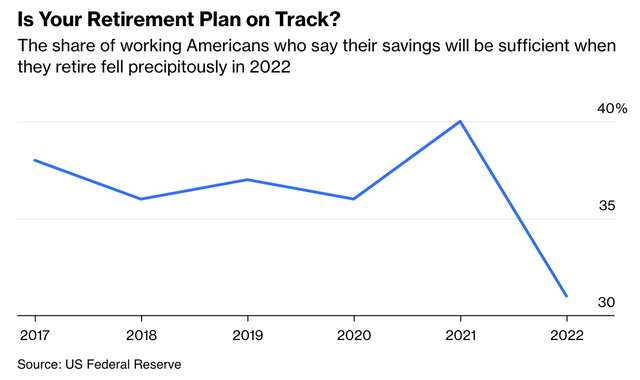

In this case, the problem is the decline in the number of Americans who believe their retirement plans are on track. By “we,” he means the financial industry.

Although the financial industry has created countless products that should (technically) help people achieve their goals, they are not getting the job done.

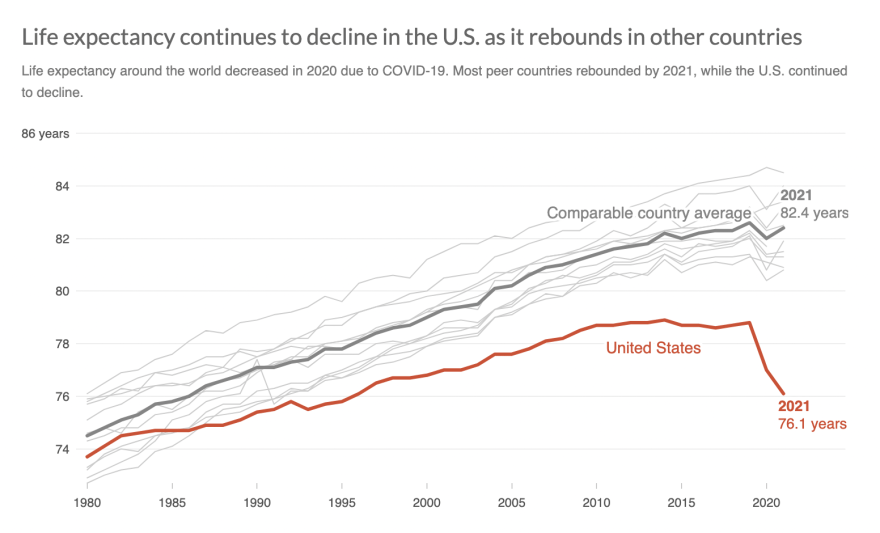

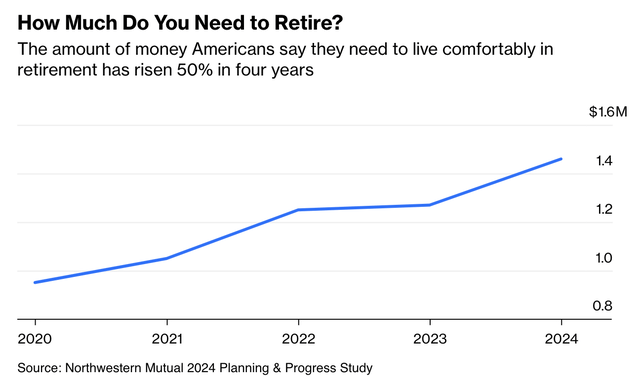

There are a few problems, including the expected cost of retirement has increased by 50% in the last four years. During this period, life expectancy barely changed. In fact, as of 2021, life expectancy has dropped a bit.

World Bank

In 2022, close to 30% of Americans believed they would have sufficient funds to retire. In this case, it needs to be said that 2022 was not a great year for stocks. However, rates soared, which is a tailwind for income-focused investments.

Bloomberg

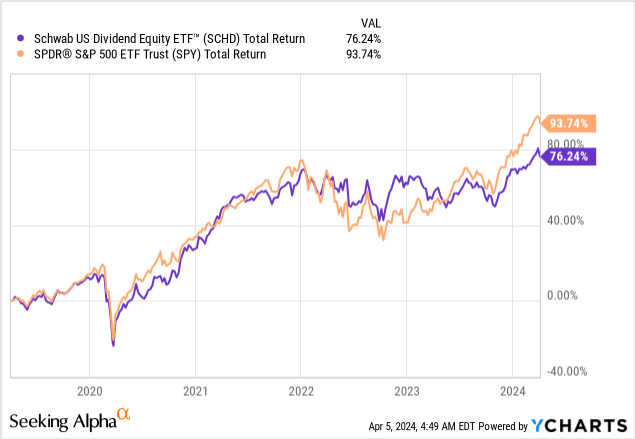

In general, dividend stocks held up quite well in 2022, as the Schwab U.S. Dividend Equity ETF™ (SCHD) ended the year roughly unchanged.

The aforementioned Bloomberg article makes the case that this shows that the financial industry has done a poor job of educating people on what retirement costs and what kind of assets they need. I agree with that.

I’m also very worried about the chart below.

As I just briefly mentioned, the expected amount to retire comfortably in the United States has risen by 50% over the past four years. It’s now north of $1.4 million!

Bloomberg

Obviously, as this is an average number, there are many differences between people:

- Health (costs).

- General living expenses.

- Family situation.

- Location.

- Inheritances.

- Income.

- Countless random events we’re subject to every single day.

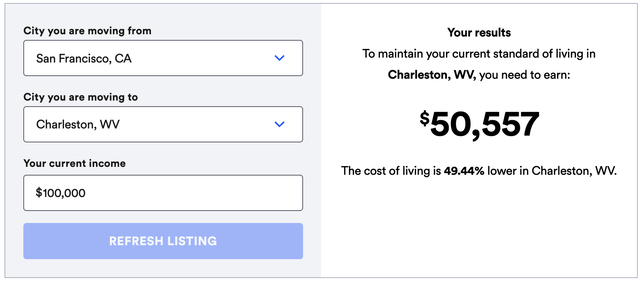

To give you a very extreme example, people moving from San Francisco, California, to Charleston, West Virginia, see an average cost of living drop of roughly 50%. If you make $100,000 in San Francisco (which isn’t even that much in that area), you need just $51,000 in Charleston.

Bankrate

Rent, for example, is 74% lower in Charleston. Home prices are 81% lower!

That said, generating $1.4 million is not impossible.

In fact, there are many ways that lead to Rome:

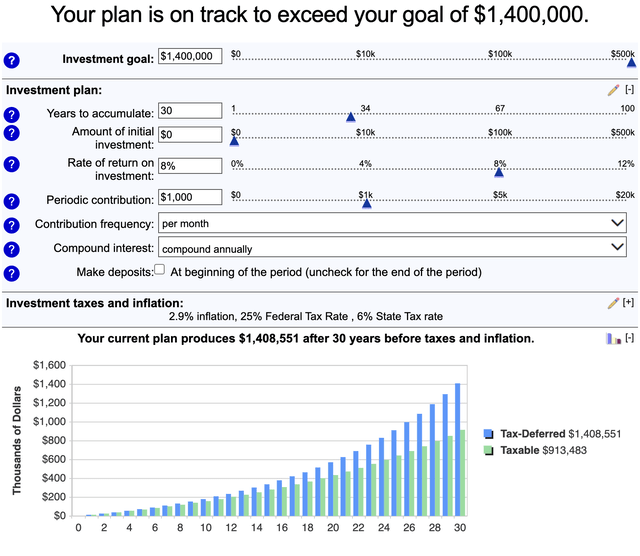

- Investors with a 30-year time horizon investing $1,000 per month with an annual return of 8% end up with $1.41 million before tax and inflation.

Bankrate

- If your time horizon is 20 years instead of 30, you’ll have to invest $2,500 per month to get the same result (all else equal).

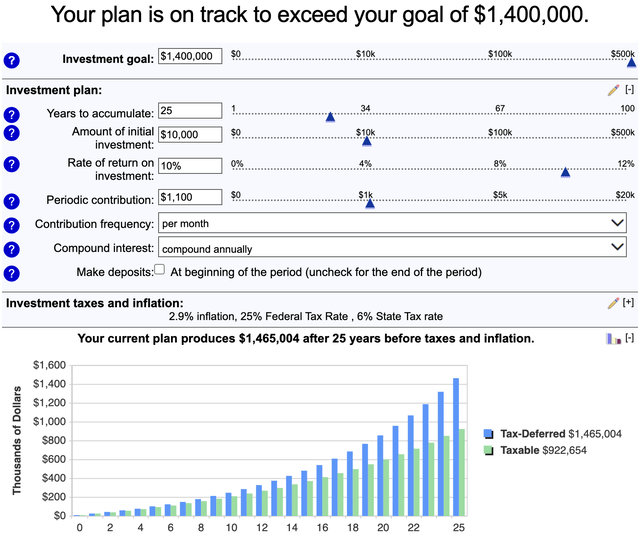

- Investors starting with $10,000, investing $1,100 per month for 25 years, with a return of 10%, end up with $1.5 million (pre-tax and before inflation).

Bankrate

- Wealthier investors who invest $100,000 at the start, add $3,000 each month, and return 10% each year only need 14 years to achieve their goal.

- If you start with $200,000, invest $4,000 each month, and see a 10% return on your money, you need just 11 years to get the job done.

Needless to say, the longer it takes to reach $1.4 million, the more irrelevant that number becomes. After all, the $1.4 million target is 50% higher compared to just four years ago!

Even “mild” inflation on a long-term basis significantly moves this goalpost.

Picks To Get The Job Done

My personal strategy is very straightforward. I have a very variable income, I’m preparing to move to a different country, and many plans for the future.

Hence, I focus on what I can control:

- I invest as much as possible each month (volume). I turn 29 in June. God willing, I have many decades left to invest.

- I focus on finding the best dividend-growth stocks. As most readers know, my favorite holding period is forever. Most stocks that I bought when I started my portfolio are still core holdings of my portfolio.

- I try to understand the market and find the best places to put my money. Right now, I’m value-focused, as the general market valuation hints at subdued total returns in the years ahead. I discussed this in articles like this one.

- I don’t take retirement too seriously. As I love my job and benefit from the fact that it doesn’t take a lot of physical power to do what I do, I have no plans to ever stop working. While my goal is to become financially free as soon as possible, it will likely turn into a “game” after that and benefit the next generations.

With that said, there are four stocks that I want to discuss in this article.

- All four stocks trade at great valuations.

- All stocks come with consistently rising income.

- All stocks have healthy balance sheets.

- All companies have business models that make it likely that they will be around for many decades.

- Combined, they have a powerful risk/reward with a spectacular volatility profile.

I will briefly discuss each stock. However, because I cannot provide an in-depth discussion of each pick, I will add links to articles that can help you research these picks – if you desire to do so. You just need to click on the company name in the sub-title.

Realty Income Corporation (O) – “The Monthly Dividend Company”

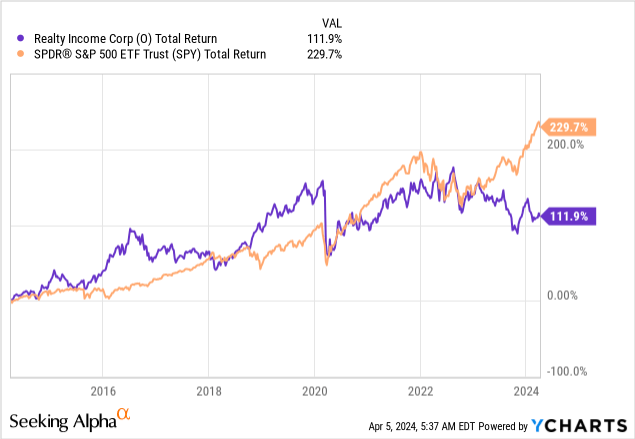

I hesitated for a long time about adding Realty Income. That’s based on its somewhat subdued long-term performance. Over the past ten years, O has returned just 112%.

However, this company yields 5.8%. It pays a monthly dividend and has hiked its dividend for 29 consecutive years, making it a Dividend Aristocrat.

In fact, I believe Realty Income is one of the best income stocks on the market.

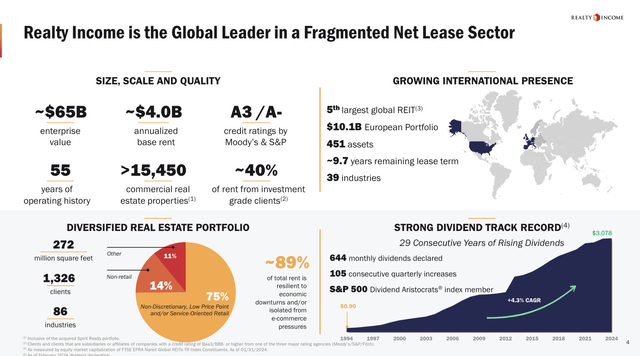

Realty Income is the 5th-largest real estate investment trust, or REIT, in the world, managing more than 15,400 properties. It also has a credit rating of A-, one of the safest in its sector.

Realty Income

The company benefits from the fact that most of its tenants are investment-grade operators in anti-cyclical industries (like convenience stores), sale-leaseback opportunities in a high-rate environment, its healthy balance sheet, and an expansion into Europe, a highly underappreciated real estate market.

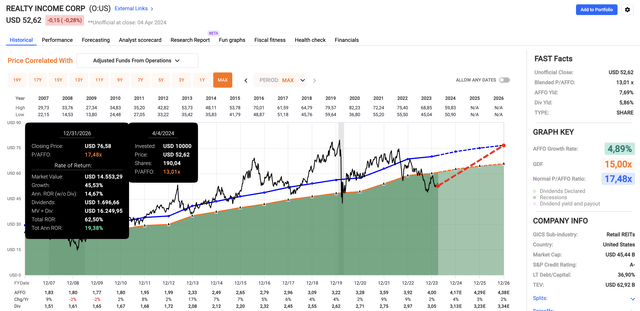

Moreover, as the company trades at a blended P/AFFO (adjusted funds from operations) ratio of just 13.0x (below its normalized 17.5x multiple), I expect up to 45% in capital gains once rates come down, making REITs more attractive.

FAST Graphs

Stock number two is also beaten down by higher rates and sticky inflation.

NextEra Energy, Inc. (NEE) – The Beaten-Down Renewables Giant

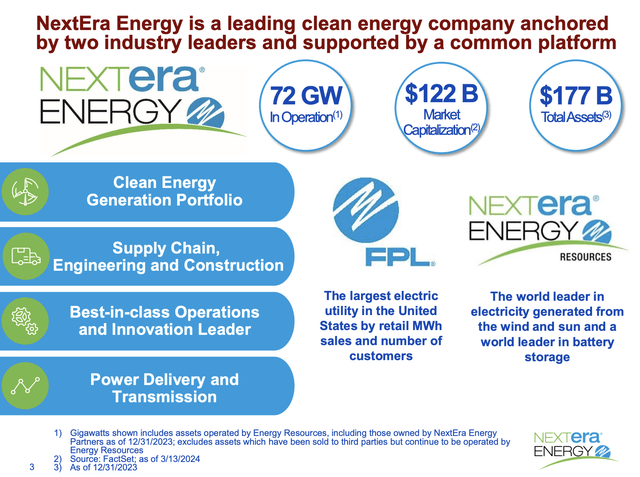

NextEra is a Florida-based utility giant. It owns FPL, the largest electric utility in the United States. It also is a world leader in renewable energy, including wind and solar.

NextEra Energy

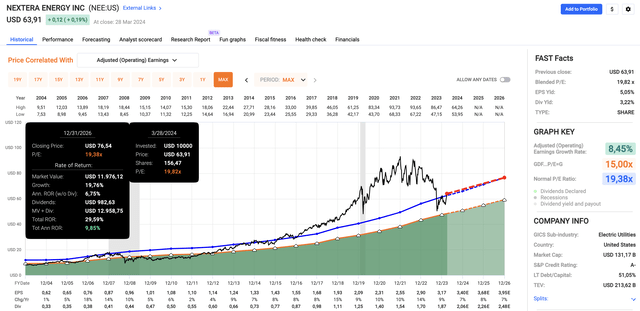

Historically speaking, this company has beaten the market by a mile. Currently, it struggles a bit, as elevated rates and sticky inflation have made utility stocks highly unfavorable.

With a 3.2% yield, this company has plans to maintain 10% annual dividend growth, backed by a healthy balance sheet and improving fundamentals.

As a result, the company could return close to 10% annually through 2026 (theoretically).

FAST Graphs

The next stock has been one of the first five holdings of my portfolio.

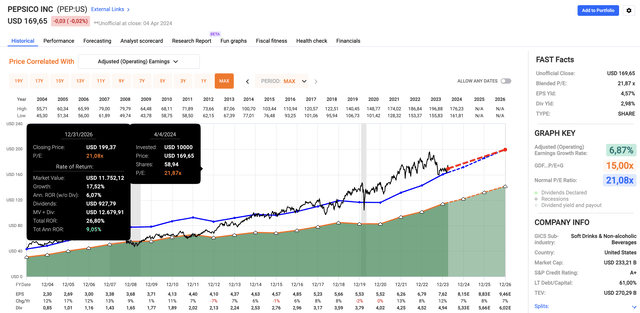

PepsiCo, Inc. (PEP) – Consistency & Income

I have been a huge PEP fan for many years.

The company has a well-diversified business model of snacks and drinks, strong pricing power due to brand recognition, a loyal customer base, and a well-protected 3% dividend yield.

In fact, it has hiked its dividend for more than 50 consecutive years, making it one of the few Dividend Kings on the market!

Moreover, trading at 21.9x earnings, the company is expected to grow EPS by 7-8% per year. When adding its dividend, we get a theoretical annual return outlook of 9-10%.

FAST Graphs

The last one is a healthcare giant I had on my list for a while.

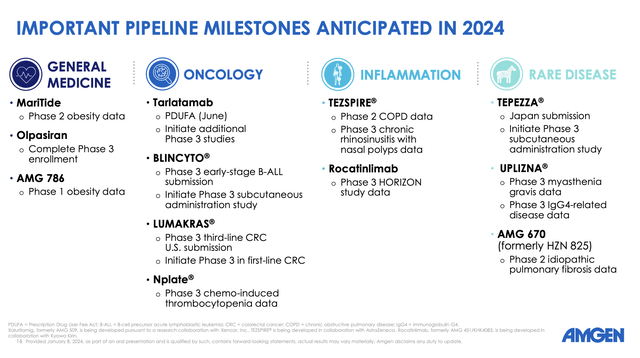

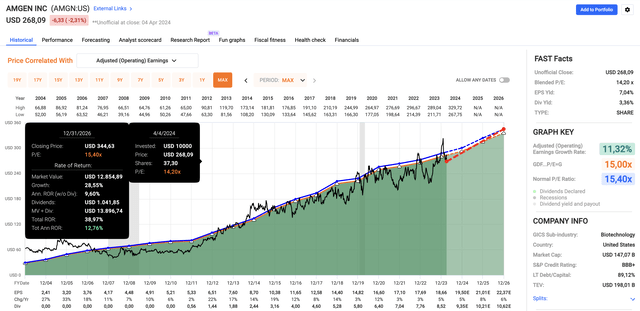

Amgen Inc. (AMGN) – Income & Growth

With a 3.3% yield and a five-year dividend CAGR of 10.0%, AMGN is a cornerstone of many dividend portfolios.

The company is a complex biotech/healthcare giant with a wide range of products, including advanced drugs to treat rare diseases, inflammation, and various cancers.

Amgen

After buying Horizon Therapeutics, the company has future-proofed its portfolio, benefitting high growth expectations and lower patent-loss risks.

Analysts expect annual EPS growth to rise from 5% in 2024 to 8% in 2025, paving the road for >12% annual returns, supported by a P/E ratio of 14.5x, which is one point below its normalized long-term multiple.

FAST Graphs

Even better, all of these stocks have a great total return profile.

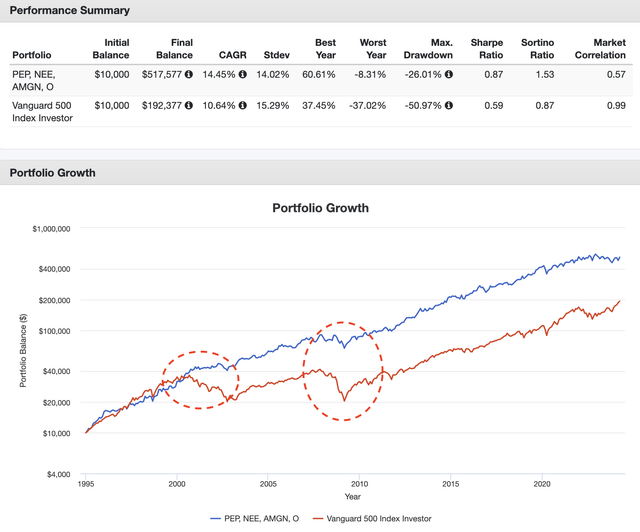

Combining The Four Picks

An equal-weight portfolio of these four stocks has returned 14.5% per year since 1995, turning $10,000 into roughly $518,000.

A $10,000 investment in the S&P 500 would have resulted in $192,400.

If you had invested $500 per month into these four stocks on top of an initial $10,000 investment, you would have ended up with $2.4 million in pre-tax wealth! That’s a million above the average “target.”

Even better, during this period, the four-stock portfolio had a 14.0% standard deviation. That’s below the S&P 500’s standard deviation of 15.3%.

As we can clearly see below, the outperformance was supported by a lot of safety during the 2000 crash and the Great Financial Crisis.

During bull markets, it is harder for this portfolio to beat the market. After all, all stocks discussed in this article are defensive investments.

Portfolio Visualizer

Over the past ten years, these four stocks have returned 11.5% per year, lagging slightly behind the 12.8% annual return of the S&P 500 (SP500).

Obviously, past returns are NO GUARANTEE of future returns.

However, I trust these companies to continue what they have done in the past, which is consistently growing earnings and dividends, defending investors against recessions, and delivering consistent returns.

Hence, the main takeaway here isn’t to buy these exact companies and nothing else.

The takeaway is to focus on what matters most: putting as much money to work as possible in high-quality dividend growers. Also, I want readers to know that we do not need to take excessive risks. These four defensive stocks have turned many people into millionaires without exposing them to horrible sell-offs during recessions.

While none of this will make us rich quickly, it’s a strategy that I expect will help many of us reach our financial goals.

Takeaway

In the face of a looming retirement crisis, it’s crucial to take proactive steps towards securing financial stability.

Despite uncertainties, focusing on high-quality dividend growth stocks can offer a pathway to building wealth.

By investing consistently in companies like Realty Income, NextEra Energy, PepsiCo, and Amgen, investors can benefit from stable income, capital appreciation, and resilience during market downturns.

While past performance doesn’t guarantee future results, prioritizing safe investments in defensive stocks can relatively reduce risks and pave the way for long-term financial success.

Needless to say, I will continue to focus on this topic and work on an article that presents a highly-diversified retirement portfolio for retired investors and investors close to retirement.

Credit: Source link