LeoPatrizi/E+ via Getty Images

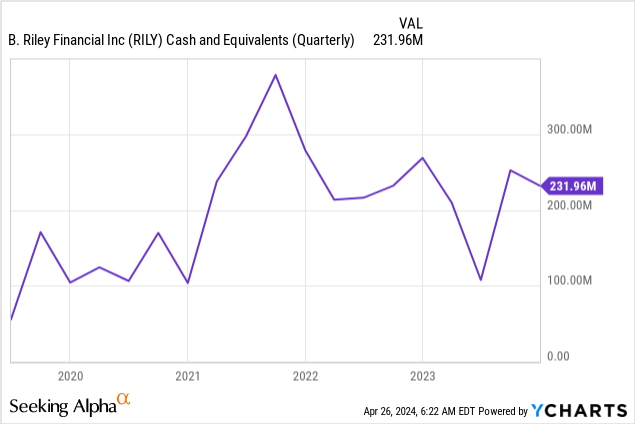

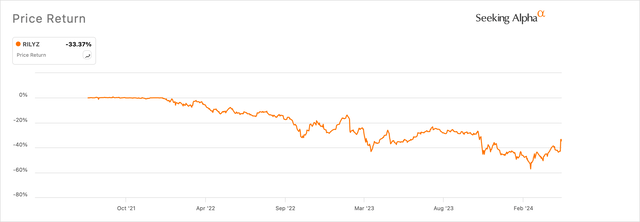

The short interest in B. Riley Financial (NASDAQ:RILY) was never sustainable as it was fully hinged on a single flawed point that RILY would never file its 2023 annual report on Form 10-K. The Los Angeles-based investment bank filed its 10-K before the market opened on April 24, sparking a remarkable and dramatic end to months of drama focused on a single point by bears that the company wouldn’t file and would subsequently face delisting from the SEC. The bearish thesis now sits confidently in the realm of a eulogy for their positions, with the material short position in RILY set to be unwound over the coming weeks and months. I’ve been buying RILY’s 2028 baby bonds (NASDAQ:RILYZ) since the non-10-K filing narrative came to briefly cause them to trade at a nearly 60% discount to its $25 per share liquidation value. For some context, RILY held $232 million in unencumbered cash and cash equivalents at the end of its fiscal 2023 fourth quarter and faces no material debt maturities in 2024 and 2025.

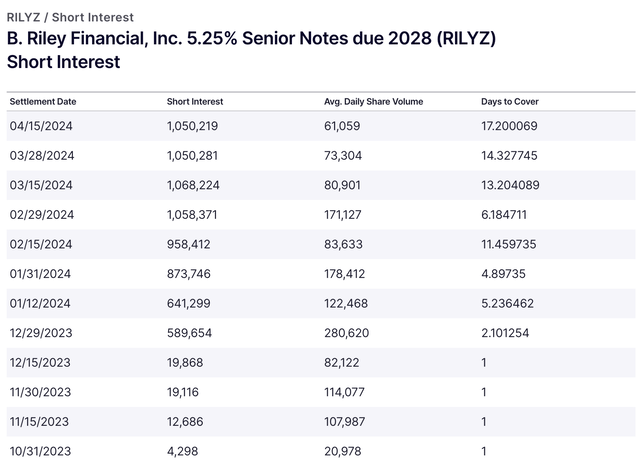

Against this new zeitgeist for RILY, the company will likely see significant share price strength as it decamps from being one of the most shorted stocks on the NASDAQ. Critically, the short thesis that had come to pose the 10-K delay as an existential risk for the company and its outstanding fixed securities is now dead, but bears could still try to steer towards an about-face pivot as their positions get unwound. RILYZ’s rally is set to continue with a view of returning to its level before the critically flawed bearish thesis was published in November. This is especially because of the short interest in RILYZ of 1,050,219 a few days before the 10-K release. The days to cover this stood at 17.2, up from 14.3 in the prior update at the end of March to imply sustained near-term buying pressure until the short interest normalizes closer to RILYZ’s pre-10K bearish fracas average of fewer than 50,000 shares short.

Short Interest, Upcoming Catalysts, And Liquidity

Nasdaq

Why the focus on RILYZ? It’s the bond with one of the deepest discounts to liquidation value in RILY’s bond series. The company is set to redeem its 6.75% Senior Notes Due 5/31/2024 (NASDAQ:RILYO) in less than five weeks and the 2025 bonds are trading on moderate single-digit discounts to their liquidation value. The short interest in RILYZ was actually up since I last covered the ticker, a remarkable show of just how much the shorts believed in their entirely binary thesis. What’s left in this thesis? Not much due to is singular nature, the beginning of a short squeeze, and upcoming RILY catalysts that place the entire disintegrating arguments of the shorts at risk.

Seeking Alpha

It’s important to note that none of the short arguments focused on potential bankruptcy risk from RILY’s financial performance. The selloff of the bonds was driven by anticipation of a non-10K filing and its now absence and what had always been nearly zero focus on the actual ability of RILY to meet interest payments places a RILYZ return to its prior peak of $18 back into play. RILY faces another upcoming positive catalyst from the outcome of its announced strategic review for its Great American Group business. A sale could take place later this year and should bolster RILY’s balance sheet. Management will likely provide an update at its first-quarter earnings call.

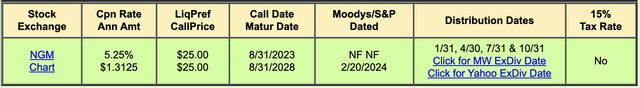

QuantumOnline

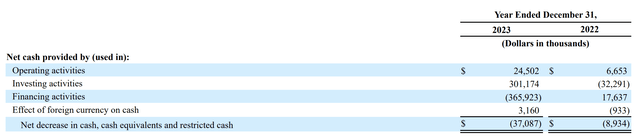

The focus should now turn to RILY’s liquidity. The company held $1.09 billion of securities and other investments at fair value at the end of its fourth quarter. There is also $532.4 million of loans receivable at fair value. RILY generated $24.5 million in cash from its operating activities in 2023, up from the prior year with the bank facing a healthier macro backdrop in 2024 and with activity across its Capital Markets segment set for recovery as the market looks to recover from the slump induced by base interest rates being hiked to 22-year highs in 2023.

B. Riley Financial Annual Report On Form 10-K

RILY also has a $200 million asset based credit facility with Wells Fargo Bank (WFC) that had no outstanding borrowing as of the end of the fourth quarter and does not mature until 2027. Hence, with RILY’s ability to meet its bond payments from its operations really never in question, pending Fed rates cuts later this year, and a pick up of capital market activity, RILYZ looks set to move back to its fundamental value closer to liquidation. This would mean the only discounting it is subject to would be from the positive duration impact of higher base interest rates. With the core bearish arguments dead, the company now faces a sustained recovery to pre-10K fears highs. I remain long.

Credit: Source link