In a world where explosive investment gains are profiled on major news outlets on a daily basis, many investors are tempted to shoot for the moon. Three decades and even more stock market cycles have taught us at 2nd Market Capital that it is the singles and doubles that drive long-term performance. With that in mind, we would like to discuss a particularly reliable investment: Avista Corporation (NYSE:AVA).

Avista is a small electric and gas utility operating in the northwestern U.S. Like most utilities, it collects a regulated profit margin on continuously providing its constituents with electricity and natural gas. While utilities are historically reasonably strong investments, there are 3 aspects that, we believe, make AVA a little bit better than normal and position it to outperform the market:

- Load growth leading to rate base growth

- Rate case timing setting up for higher earnings

- Valuation

Let us begin with a quick review of AVA’s track record and follow with the forward outlook.

A history of reliability

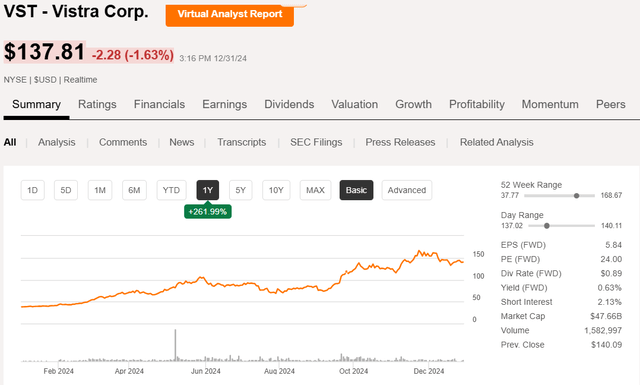

Given the explosive demand for power concurrent with the data center boom, the market seems to be viewing the regulatory framework of regulated utilities as shackles. Avista is trading basically flat on the year.

SA

In contrast, the more freelance-style energy producers, such as Vistra (VST) or Constellation (CEG) are viewed as unfettered by regulation which has allowed them to more fully take advantage of the surge in demand. The market has rewarded these IPPs (independent power producers) with impressive share price gains.

SA

In comparison, the steadier regulated utilities have been left in the dust.

I think this viewpoint of the regulatory framework as a hindrance is myopic in nature.

During boom times it may limit the growth rate, but it also preserves growth through tougher times.

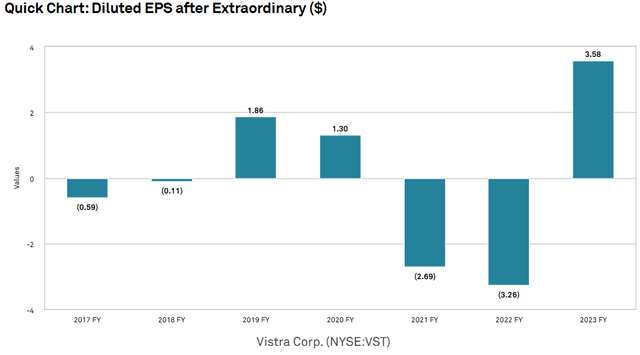

Note that while Vistra is enjoying the currently surging prices for contracted power, it has also suffered when power demand was lower. Vistra’s earnings per share have bounced around rather erratically.

S&P Global Market Intelligence

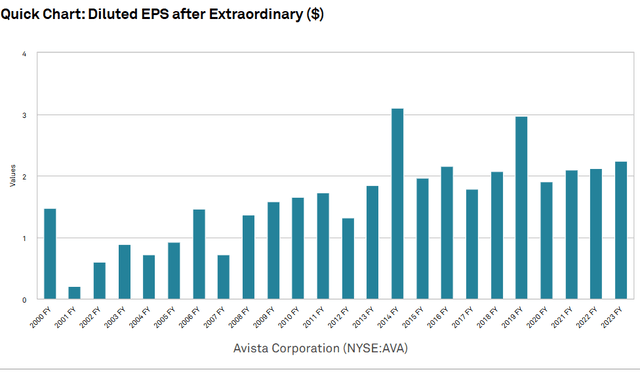

In contrast, AVA has a very clear trendline up and to the right.

S&P Global Market Intelligence

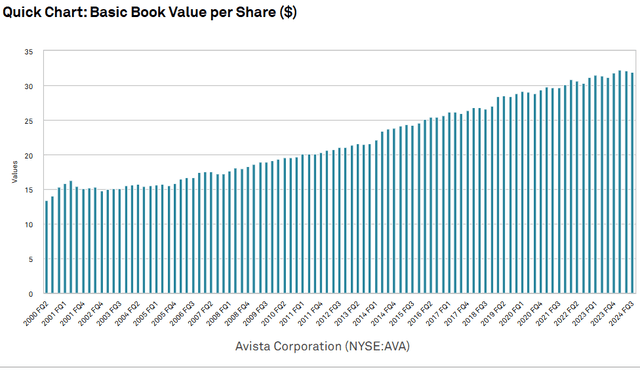

Similarly, stable growth can be seen in book value:

S&P Global Market Intelligence

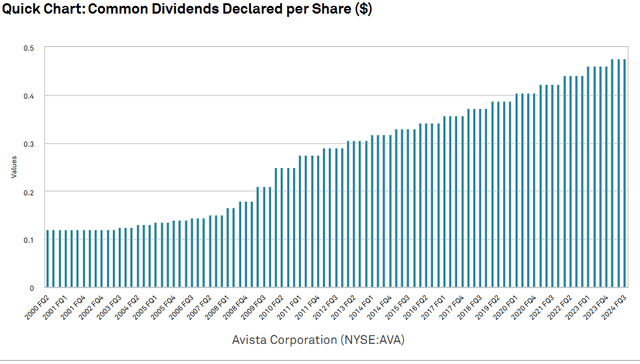

With reliable underlying growth, AVA has been able to fund continuous dividend growth.

S&P Global Market Intelligence

It may not be as exciting, but I would much rather invest in that sort of company than chase high-fliers during boom years.

Regulated utilities like AVA are still positioned to benefit from electricity demand growth. Earnings should increase proportionally to load growth and given the surge in data center demand, load growth should be ample over the next decade.

Load growth

Load growth is widespread throughout the U.S. largely to fuel AI data centers which require an extraordinary amount of power relative to their predecessors. Discussion of this demand growth is ubiquitous throughout various news outlets, and we discussed it thoroughly here, so I won’t repeat it in this article.

As demand increases, it is the job of electric utilities to build new power plants so as to service the increased load.

Kevin Christie, AVA’s CFO, announced updated capex plans on the 3Q24 earnings call:

“We just finalized our capital plan for 2027. And over the next 3 years, we expect to spend about $1.7 billion in capital to ensure that we can continue to support customer growth and maintain our system to provide safe and reliable energy to our customers. That includes investments of $525 million in 2025, $575 million in 2026 and now $600 million in 2027.”

$1.7 billion over 3 years is quite a bit of asset growth for a company with a $2.9B market cap.

AVA will raise capital through a combination of equity and debt and deploy that capital into power plants, transmission assets, and whatever other infrastructure is needed to supply their customers with power. We believe this substantial capex cycle will be significantly accretive to earnings per share.

Quite simply, the return on equity is significantly larger than the cost of equity.

- Cost of equity: ~6.25%

- Return on equity: ~9.8%

- Spread: ~3.55%

This ROE was just backed up by a rate case that concluded in late December 2024, and we believe there will be upward adjustments to the rate across much of AVA’s territory.

Rate cases

Avista CEO Dennis Vermillion discussed AVA’s upcoming rate cases in the 3Q24 earnings report:

“We expect a constructive rate order for our Washington general rate cases in mid-December, and earlier this month, filed a general rate case in Oregon. We plan to file our next case in Idaho in early 2025.”

Well, that rate case has now concluded and AVA did indeed get increases. On December 23rd, Avista announced the results of its Washington rate case:

“For electric operations, the Commission approved rates designed to provide a 0.1 percent, or $0.8 million increase in base revenue for Rate Year 1, and a 11.6 percent, or $68.9 million increase in base revenue for Rate Year 2. For natural gas operations, the Commission approved rates designed to provide a 11.2 percent, or $14.2 million increase in base revenue for Rate Year 1, and a 2.8 percent, or $4.0 million increase in base revenue for Rate Year 2.”

The Commission also approved a 9.8% ROE on the rate base and noted that there will be an upward bias.

Forward earnings outlook

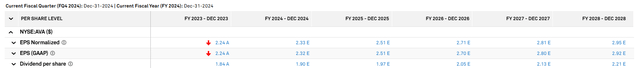

With regulatory support and substantial load growth, AVA is well-positioned for earnings growth. The Wall Street analyst consensus estimates come to the same conclusion.

S&P Global Market Intelligence

It is not rapid growth, but quite strong relative to the valuation at which AVA is trading.

Valuation

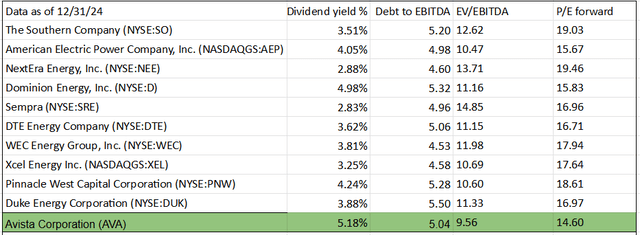

Avista is trading cheaply on a variety of metrics. We have tabulated key electric utility metrics below.

2MC

14.6X earnings is cheap relative to utility peers, and 9.56X EV/EBITDA is also quite cheap.

AVA should trade a little bit cheaper than peers due to being substantially smaller at a market cap of $2.9B, while most of its peer set is $20B+. Perhaps it is slightly opportunistically priced relative to peers, but I think the opportunity is more present in electric utilities relative to the rest of the market.

In other words, electric utilities as a group are of great value right now and positioned to outperform with multiple earnings tailwinds and a substantial discount to the S&P 500. AVA is merely a valid investment option within the pool of electric utilities.

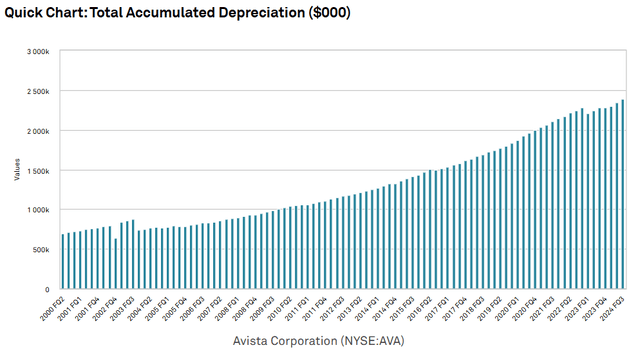

One area where AVA really shines is in book value. Most utilities trade at premiums to book due to depreciation, resulting in book value being significantly lower than the true replacement cost of assets. NextEra Energy (NEE), for example, trades at 2.94X book value.

Avista is trading at only 1.15X book value. Its book value is net of depreciation, which has accumulated to greater than $2.4B.

S&P Global Market Intelligence

Some of this depreciation is real because energy and transmission assets do indeed need to be replaced, but accounting depreciation is consistently faster than true depreciation, so some of it is accounting only.

I believe AVA is trading substantially below the replacement cost of its assets.

Risks to investment in AVA

The Pacific Northwest is a hotbed for wildfires, which requires AVA to adhere to strict wildfire prevention and detection protocols. The company is reimbursed for these expenses and, as far as I can tell, is responsible for handling fire prevention. It is also largely insured against fire. However, as was seen with PG&E, wildfires can still be an enormous interruption to business for electric utilities.

Utilities in general will have to figure out how to get data centers to pay their fair share such that the burden of load growth falls primarily on data centers rather than regular residential customers. This is something that regulators, IPPs, and utilities will have to jointly figure out, and depending on the solution that wins out, it could shift opportunity in one way or another. Presently, I lean toward regulated electric utilities as the way to play it, but that could change with more information.

Credit: Source link