jetcityimage/iStock Editorial via Getty Images

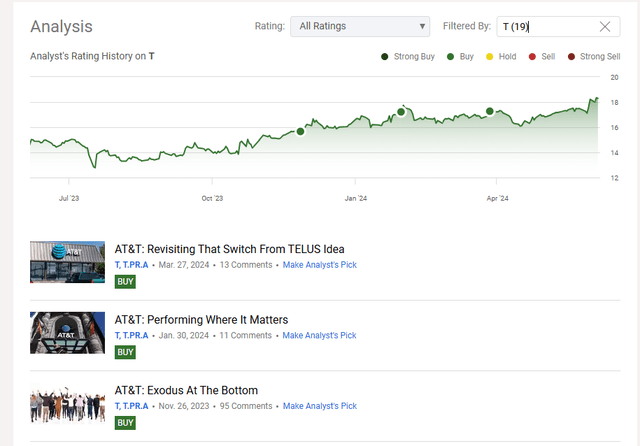

In the last one year, we have supported the bull case for AT&T Inc. (NYSE:T). This has come from recognizing extremely beaten down valuations, alongside relatively attractive fundamentals.

Seeking Alpha

The stock has done well over the last 12 months, even though there have been some hiccups along the way. We go over how the bull thesis is shaping up and tell you why a dividend hike is not yet a done deal.

Q1 2024

The first quarter of 2024 was solid across multiple key metrics including Postpaid phone subscribers, mobility services revenues and mobility EBITDA. The firm also delivered spectacular growth in Fiber revenues.

AT&T Presentation Q1-2024

But if investors needed a reminder that this is still a behemoth that moves really slowly, you got that with the next slide. Total revenues were down marginally. Adjusted EPS was also down.

AT&T Presentation Q1-2024

For an investor standpoint, the key reason to get excited here is that expanding free cash flow story. As capex dials down from extreme levels, and revenues stay steady, the free cash flow outlook is expanding. This is something that AT&T guided for, but there was significant doubt over this. Investors mistakenly assumed that the quarter to quarter volatility was actually a sign that management was not going to be able to meet estimates.

The Q1 2024 numbers and the associated guidance confirm that the company remains on track. Revenues will grow at about the inflationary pace, and EBITDA should expand in the same ballpark. The free cash flow still looks juicy relative to AT&T’s market capitalization ($131 billion).

AT&T Presentation Q1-2024

Outlook & Verdict

For AT&T, there have been three factors that have weighed the stock down over the long run. The first was simply valuation compression. The stock reached ridiculously expensive levels (like all tech companies today) and we took some time to fix that.

The second was poor capital decisions, and AT&T has had a lot of those. Pretty much everything the company got excited about, was bought at a bad price. Finally, the debt load got rather wild, especially for a non-ZIRP (Zero Interest Rate Policy) environment. All 3 factors appear to be headed for a fix. The valuation compression looks like it is close to being done. AT&T management has shown some restraint in the past few years. The debt load is now headed for 2.5X debt to EBITDA.

AT&T Presentation Q1-2024

Assuming we don’t hit a recession, the management guideline of “first half of 2025” looks probable.

AT&T Presentation Q1-2024

One of the best things about the picture above is the last line. The weighted average debt term of 16 years with an interest rate of 4.2% is about as good as it gets. AT&T management did many things wrong, but they did not mess around with interest rate risk. The maturing debt over the next 18 months is also perfect to be paid off with free cash flow, and AT&T should be in the enviable position of seeing interest costs trend down.

AT&T Debt Maturity Schedule

The perfect situation for a telecom like AT&T would be debt to EBITDA marginally under 2.5X. If they maintained that long term and did not have any more missteps, they would likely be in store for “A-” equivalent credit rating. Currently, Fitch has the most faith in them, but we suspect over the next 2 years, assuming this plays out as expected, the other two should at least upgrade by 1 notch.

AT&T

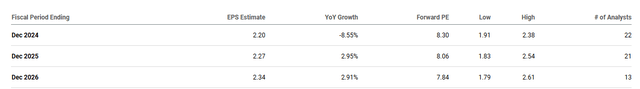

Currently, AT&T sports a 13.5% free cash flow yield. You tend to worry about these if they come with a high degree of cyclicality or if the debt levels are too high. The latter is definitely not a concern, but there will likely be some turbulence in a recession. Analysts generally never price in a recession scenario unless it is staring them in the face. Even then, you can see an expansive dispersion of EPS estimates.

Seeking Alpha

We think that whatever cyclicality we get, the current valuation does offer investors a good buffer. Once we hit that target, a dividend hike is extremely likely. We continue to rate AT&T Inc. shares a Buy and maintain a $21 fair value target.

Preferred Shares

AT&T has two issues of preferred shares listed.

1) AT&T Inc. 5% DEP RP PFD A (NYSE:T.PR.A)

2) AT&T Inc. 4.7% DEP SHS PFD C (NYSE:T.PR.C).

They tend to trade almost identically, adjusted for the slightly different coupons. In our last update on these, the preferreds were quite expensive as T.PR.C approached $21.00. Interestingly enough, these have declined about 7% while AT&T common shares are up 4.5%. This delta has made the preferred shares relatively more attractive in relation to the common shares. Both are now yielding about 6%.

Of course, the common shares hold more upside in our view. The dividend will likely go up over time, as the gap between the dividend yield and free cash flow yield is quite massive. On the other hand, the preferred dividends are even safer than the common share dividend if things don’t go according to plan. Looking across preferred land space, though, AT&T preferred shares remain on the expensive side. We can get higher yields for the same credit quality. But as these preferreds shares are no longer as expensive as they were 3 months back, we are upgrading these to a “hold” rating.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult a professional who knows their objectives and constraints.

Credit: Source link