alvarez/E+ via Getty Images

Armstrong World Industries (NYSE:AWI) faces the prospect of lower demand and profitability. The troubles in the real estate market may wreak havoc across the U.S. economy, causing much pain in the building products industry. The company has manageable debt levels and a low dividend payout ratio. These are the positives for the company, and it should wither any economic slowdown or a recession without any financial stress. But there may be better times to buy the stock. Long-term investors may need a lower valuation before buying Armstrong World Industries.

Outstanding Q1 Results

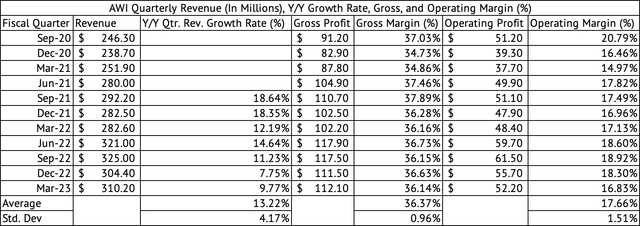

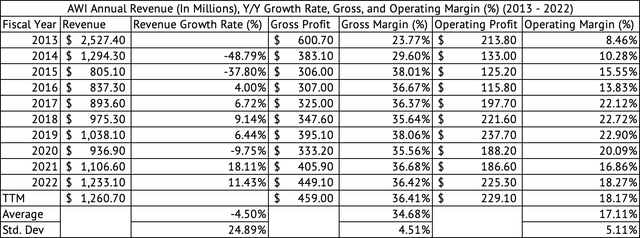

Armstrong World Industries had an excellent Q1 2023. Sales increased by 9.7% in the quarter ending March 2023 compared to the same quarter in the previous year (Exhibit 1). Its quarterly revenue growth was 7.7% in the December 2022 quarter. Quarterly sales growth may have decelerated, but the year-over-year comparisons are based on solid 2021 and 2022 revenue numbers when the company saw double-digit y/y revenue growth. The company’s annual y/y revenue grew by 18% and 11% in 2021 and 2022 (Exhibit 2). Given the current economic conditions and the tough comparisons to the previous year, the company’s management estimates it will grow revenue between 2% and 6% y/y in 2023 (Exhibit 3).

Exhibit 1:

Armstrong World Industries Quarterly Revenue, Gross, Operating Profit, and Margins (%) (Seeking Alpha, Author Compilation)

Exhibit 2:

Armstrong World Industries Annual Revenue, Gross, Operating Profit, and Margins (%) (Seeking Alpha, Author Compilation)

Exhibit 3:

Armstrong World Industries 2023 Guidance (Armstrong World Industries Q1 2023 Investor Presentation)

Good margins

The company has shown remarkable stability in its quarterly gross and operating margins, with low standard deviations of 0.9% and 1.5%, respectively (Exhibit 1). The company’s annual gross margins have improved from its pandemic slump from 35.5% in 2020 to 36.4% in 2022 (Exhibit 2). The company has averaged 36.3% in quarterly gross margins since September 2020 (Exhibit 1). The company’s operating margins have averaged 17.6% since September 2020. Due to strong demand, the company’s operating leverage may have boosted its operating margins in 2021 and 2022. It may be no surprise that operating margins have trended lower in Q1 2023, reaching 16.8%.

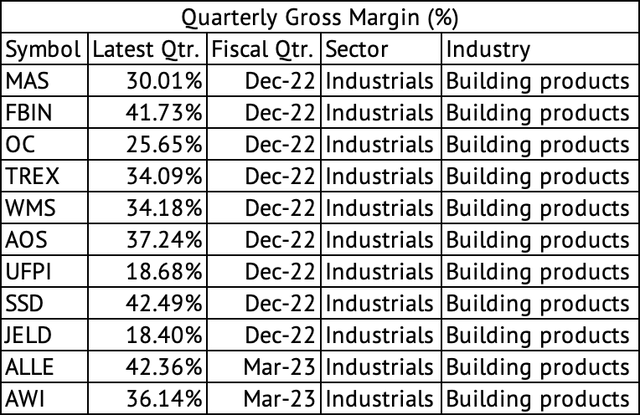

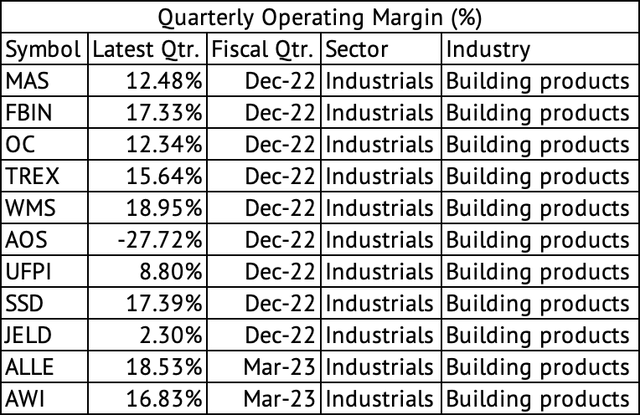

By reviewing its revenue growth, profitability, and management’s comments on its prospects, demand uncertainty may be the company’s most significant challenge in 2023. Although the company does not have best-in-class gross and operating margins, its margins compare favorably to the margin leaders in the industry (Exhibits 4 & 5).

Exhibit 4:

Gross Margins Across Building Products Companies (Seeking Alpha, Author Compilation)

Exhibit 5:

Quarterly Operating Margins Across Building Products Companies (Seeking Alpha, Author Compilation)

The commercial real estate market is under much pressure in the U.S., leading to less demand for the company. Vic Grizzle, the CEO, mentioned that he sees weak demand in places where return-to-office activity has stalled. However, he sees demand from larger projects tied to the Infrastructure bill scheduled in 2024 and beyond. This growth, driven by Federal spending due to the passage of the Inflation Reduction Act and CHIPS Act, is seen as a tailwind across many industrial companies.

This demand driven by Federal spending speaks volumes about the lack of organic demand from the private sector. These Federal dollars may drive growth for a few more years, but many industrial companies could get into trouble if private sector spending does not recover. For example, Rockwell Automation saw a boost in its sales due to these subsidies. It is supplying Control systems for its direct air capture units for the carbon capture project being built by Occidental Petroleum. The carbon capture industry exists only due to subsidies in the U.S. and other countries. As a long-term investor, I am looking for reasonably valued companies that have the potential to grow faster than the GDP. Although Rockwell Automation has growth potential, I downgraded it due to its high valuation.

A weak competitive moat

Armstrong World Industries has a weak moat around its business and faces uncertain demand in 2023. Its weak moat stems from the fact that the products manufactured by Armstrong World Industries have much competition. Building owners may also decide not to install a dropped ceiling. For instance, a building owner may choose an open plenum finish. However, an open plenum finish may not be cheaper than a dropped ceiling and require more cleaning. The company faces competition from alternative finishing products such as drywall and exposed structure and competitors such as Georgia-Pacific, USG Corporation, Hunter Douglas, and others.

Cash flows may come under pressure in 2023

The company’s price increases and increased volumes boosted its adjusted EBITDA margins favorably. The CFO, Chris Calzaretta, mentioned that energy costs, especially electricity, were still inflationary. But, that cost wasn’t material to its earnings. The company did take a $10 million hit to adjusted EBITDA due to energy, freight, and raw material costs. Chris mentioned that the company has started hedging the price of natural gas for the first time due to the market’s volatility.

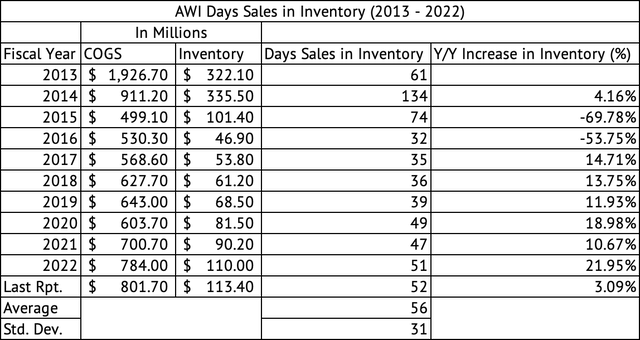

The timing of the company’s receivables and payables negatively impacted its operating cash flow during Q1. The company has slightly higher inventory levels than average over the past decade. Ignoring the company’s extraordinary inventory levels in 2014, the company typically carried an average of 47 days of inventory with a standard deviation of 13 (Exhibit 6). At the end of Q1, the company held 52 days of inventory. The timing of the company’s sales to its Home Center sales channel may cause large volume fluctuations and impact inventory levels. The company’s operating cash flow dropped due to these factors, but the company’s March quarter had lower cash flows in the past years (Exhibit 7).

Exhibit 6:

Armstrong World Industries Days’ Sales in Inventory (Seeking Alpha, Author Calculations)

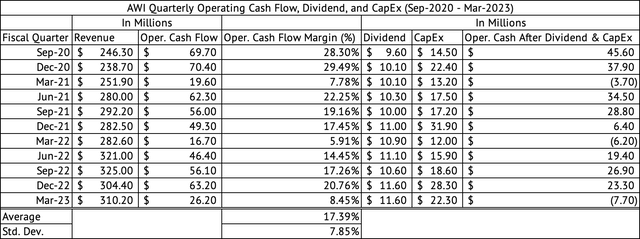

Exhibit 7:

Armstrong World Industries Operating Cash Flow (Seeking Alpha, Author Calculations)

The company generated about $100 million in free cash flow [operating cash – CapEx] and over $300 million in EBITDA in 2021 and 2022. If demand suffers in 2023, the company’s free cash flow will struggle to break the $100 million mark, and its EBITDA will trend lower. If the company achieves $270 million in EBITDA in 2023, close to its 2020 EBITDA, a 10x multiple will put its value at $2.7 billion, about 11% lower compared to its current market capitalization of $3.1 billion. The share price would be closer to $60 based on this valuation.

Valuation

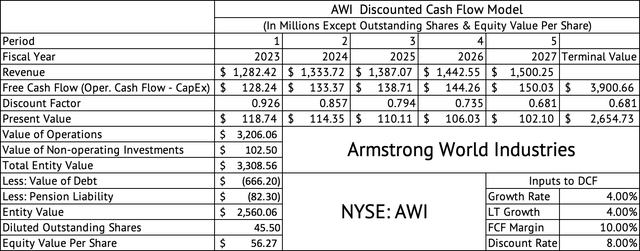

Given the economic uncertainty and the subsequent negative impact on the company’s profits, it may struggle to attain over $300 million in EBITDA. A discounted cash flow model estimates the per-share equity value at $56. This model assumes a growth rate of 4%, a free cash flow margin of 10%, and a discount rate of 8%. The company has a manageable debt load with a debt-to-EBITDA ratio of 1.7x. The company trades at a forward GAAP PE of 14.5x and a PEF ratio of 1.4x. The stock is overvalued based on its PEG ratio.

Exhibit 8:

Armstrong World Industries Discounted Cash Flow Model (Seeking Alpha, Author Calculations)

Long-term investors may consider buying the stock at or below $60; it currently trades at $68.66. The company offers a low dividend yield of 1.4% compared to the 4% yield on the U.S. 2-year Treasury (US2Y). The dividend might be safe given the low payout ratio of 20%, but the company has only paid a dividend for the past four years. The company spends a lot of its cash on share buybacks, which has allowed it to reduce its diluted share count from 58.4 million in 2013 to 46 million at the end of Q1. Since 2016, the company has spent $878 million on share repurchases and reduced its share count by 12.8 million.

The banking crisis, which started with the collapse of Silicon Valley Bank, may be far from over. First Republic is the latest bank to get into trouble due to fast-rising interest rates. The commercial real estate market is most likely in deep trouble due to high-interest rates, upcoming refinancing needs, and the work-from-home trend that has reduced the need for office space. Commercial real estate could see even higher vacancies and defaults, leading to more bank failures if the unemployment rate increases.

Given these economic risks facing the markets, the market’s volatility has surprisingly dropped. The stock market could suddenly rise to these threats and rerate stocks across multiple sectors. The building products industry could be particularly vulnerable and have a lower valuation. Rerating of the valuation may be a buying opportunity.

Armstrong World Industries looks cheap for a reason. It faces much competition, and demand trends look especially vulnerable in 2023. The company may hope that the projects funded by the Federal government subsidies will create demand soon. The stock’s dividend yield is too low for income investors. It may be best for long-term investors to wait for a lower valuation before buying Armstrong World Industries, given the numerous demand uncertainties its faces.

Credit: Source link