Dr_Microbe/iStock via Getty Images

Investment Thesis

Aris Water Solutions, Inc. (NYSE:NYSE:ARIS) was founded in 2015 as Solaris Midstream Holdings LLC, and went public as ARIS in October 2021.

They describe themselves as a “growth-oriented environmental infrastructure and solutions company that directly helps our customers reduce their water and carbon footprints”.

In simple terms – they remove wastewater from, and deliver usable water to, oil and gas well sites, largely in two counties in New Mexico, in the Permian Basin.

For 2022, revenue was up 40%, removed wastewater volume up 23%, and recycled water sold up 44% Y/Y. The revenue split between removing wastewater and delivering usable water was 3:1 in 2022

Major clients include ConocoPhillips (NYSE:COP), Mewbourne Oil Company, Inc. (private), Chevron Corporation (NYSE:CVX), and ExxonMobil (NYSE:XOM).

ARIS is a near term bet that improved operations and increased recycling for oilfield use will support better margins, a medium term bet on scale expansion via organic growth and M&A, and a perhaps riskier bet that more sophisticated water treatment will eventually allow recycled water to be sold for use outside the oilfield.

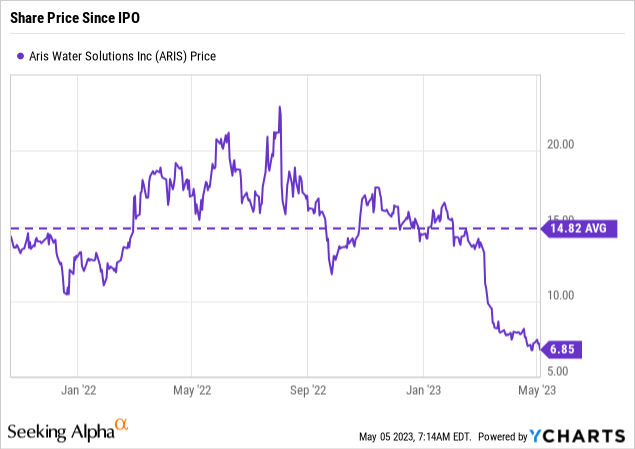

Share prices are down ~ 70% from 52 week highs and 50% from recent levels, and may provide an attractive entry point.

Introduction

In this article we will discuss the business of water in the oilfield, the company, financial and operational results for 2022, competition, offer some analysis on growth, risks, valuation, and wrap up with summary for investors.

Water and oil volumes in the US oilfield are typically measured in barrels, and flow rates in barrels per day (bpd), thousand barrels per day (kbpd), or millions of barrels per day (mbpd). A U.S. oil barrel is 42 U.S. gallons.

Unless otherwise noted, the information in this article regarding ARIS is from the 06 March Q4 2022 Earning Release, the Q4 2022 Earnings Call from 07 March 2022, and the 2022 10-K Annual Report, published 9 March 2023.

The Business of Water in the Oilfield

Produced Water

The U.S. generates about 20 billion barrels of what is termed “produced water” per year as a byproduct of oil and gas production, from around 900,000 active wells. Oil production is ~ 12 million bpd, or 4.4 billion barrel per year. Back of the envelope, this means 4.5 barrels of produce water for every barrel of oil.

Produced water is salty, and may contain many other impurities, often measured in terms of total dissolved solids (TDS). The amount and nature of the impurities can vary significantly by location. For hydraulically fracked wells, the water used in the fracturing process flows back to the surface, adding both impurities and volume.

Thus produced water is a high volume waste product which must be removed from the well site, and disposed of in a manner that meets U.S. and state regulatory requirements.

The most basic solution is to use tanker trucks to remove the waste water to a commercial disposal facility. If the waste water volume is high enough, it may become cost effective to build a pipeline to move the water away.

Disposal is achieved by injecting the produced water into EPA regulated Class II salt water disposal wells where it enters hydraulically isolated rock formations for permanent storage.

Removal and disposal is an ongoing cost for the well operator, and reduces the profitability of the well. As oil production declines, these costs may become significant or eventually prohibitive.

The costs include transportation from the producing well site to the disposal location, plus a disposal fee. This 2019 overview reported that transportation by truck cost ~ $1 per barrel per hour of transportation time, resulting in fees in the U.S. ranging from $0.50 – $6.00. Actual injection fees ranged from $0.50 – $2.50 per barrel.

This 2019 Society of Petroleum Engineers article discusses disposal in the Permian Basin, noting that the cost using traditional transport via trucking could reach $6 per barrel in 2025, vs. 2019 spot costs of $0.60-$1.50 using pipelines operated by third party contractors.

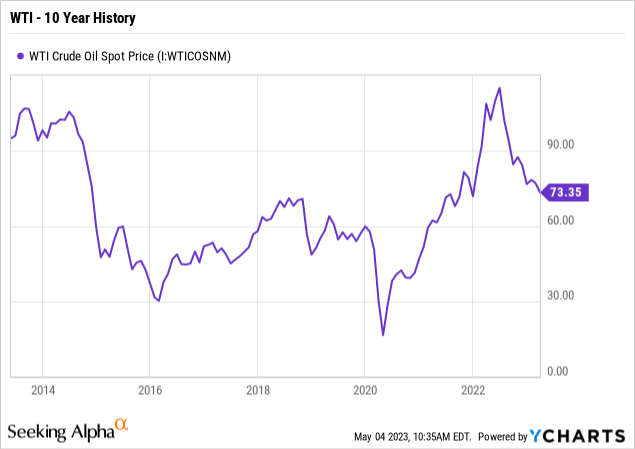

As a back of the envelope calculation, if disposal costs are $2 per barrel for an operator, and the water-to-oil ratio is 5, each barrel of oil requires the disposal of 5 barrels of water, and incurs $10 of disposal costs. As the WTI oil price chart below shows, a $10 per barrel of oil water disposal cost would be a material OpEx line item. Options to reduce this cost could be compelling.

Recycled Water for Oilfield Use

Water is also required at the well site to drill and complete the well, with the fluid for hydraulic fracking being a large use. Fracking requirements vary, but 250,000 barrels (10.5 million gallons) per well seems frequently reported. In

By default, and historically, the demand for water for well site use was met with purchased ground water, from either surface or aquifer sources, usually delivered to the well site by truck.

As a benchmark, the cost of water in Midland, Texas (the largest city in the Permian Basin) is $13.50 per thousand gallons ($0.57/barrel) for potable water, for users above 50,000 gallons per month. The rate in Carlsbad, N.M. for industrial use in $94.84 per thousand gallons ($3.98/barrel) and $47.41 ($1.99) for non-potable water from the nearby city operated Double Eagle system.

In many cases, waste water can be processed, delivered, and sold to meet the requirements for fracking operations. Treatment may include bactericide and removal of excess salt and iron, all of which can interfere with fracking and future production. In August 2021, COP outlined their water use strategy for fracking, with aggressive goals to use recycled water.

Economically, any water that can be treated and sold incurs the expense of treatment and delivery, but avoids the expense of actual injection. Also, it frees up disposal capacity for additional waste water, where that freed up capacity may be sold on the higher margin spot market.

The most economically interesting segment of the market would be areas where production volume is high and wells are geographically concentrated (i.e. supporting efficient use of capital assets to move and recycle water).

The premier example is the Permian Basin (see description and list of major operators here). This area in southeastern New Mexico and western Texas, accounts for a large fraction U.S. oil production, and is expected to yield a record 5.6 million BOPD in April 2023. It also yields a large majority (~ 66-91%) of the produced water in Texas.

The EIA reports that the average horizontal length of horizontal wells in the Delaware Basin (the western part of the Permian) in 2021 reached about 9,000 feet, with drillers pushing lengths to 15,000 feet. The average number of wells per pad is ~ 5, with 25% of pads having at least 9 wells. This densification means more produced water per drilling location.

Recycled Water for Use Outside the Oilfield

Beyond that, additional processing can potentially improve the quality of the water for other beneficial uses outside the oilfield – agricultural, industrial, and commercial. This incurs more treatment cost, but offers the opportunity for the water to be sold, and avoids the injection cost.

Studies at the University of Texas suggests that the volume of produced water in the Delaware Basin is about 4x the volume required for fracturing, so there is potentially a large volume available.

The Texas Produced Water Consortium was created by the state of Texas in 2021 to “study the economics and technologies related to beneficial uses of produced water, including environmental and public health considerations”. New Mexico created a similar organization in 2019. ARIS is one of several dozen Members of the Consortium.

The Consortium produced a 125 page report for the Texas Legislature in 2022. The Permian Basin dominated Texas produced water by volume (66%-91%); the report focuses on the Permian entirely. A few key points:

- oil and gas reuse in the Permian is primarily as fluid for hydraulic fracturing, with waster intended for this use treated to standard termed “clean brine”

- 4 billion barrels per year of excess produced water could yield 2 billion barrels per year of water for beneficial use

- there is no current capacity in the Permian Basin to treat water to a standard adequate for beneficial use, but this is expected to eventually be economically viable

- typical water to oil ratios are 5.0 and 2.6 for the Delaware and Midland basins in the Permian

The Company

Background

Solaris Midstream Holdings, LLC (Solaris LLC”) was formed in November 2015.

Aris Water Solutions, Inc. (ARIS) was created to take Solaris LLC public, and did so on 26 October 2021 at $13, closing at $14.30. ARIS is a holding company, and owns about 52% of Solaris LLC which is the vehicle for all actual business operations. The IPO, and the major backing from COP, is discussed here.

There are two classes of stock, Class A common stock and Class B common stock, both voting equally. Class B stock is not publicly traded, and is 100% owned by the legacy Solaris LLC owners. As of 31 December 2022, COP owned 47% of the Class B stock, and Yorktown Energy Partners XI, L.P. owned 37% of the Class B stock.

As of 03 March 2023, 30,072,875 shares of Class A and 27,554,566 shares of Class B were outstanding.

ARIS emphasizes the positive environmental benefits of their operations – and by extension shares credit for those benefits with their clients. Direct benefits include water recycling, reduced water use, and reduced truck traffic and emissions.

There are about 200 employees, about equally split between office and field.

A quarterly dividend of $0.09 had been paid since going public.

Operational Footprint

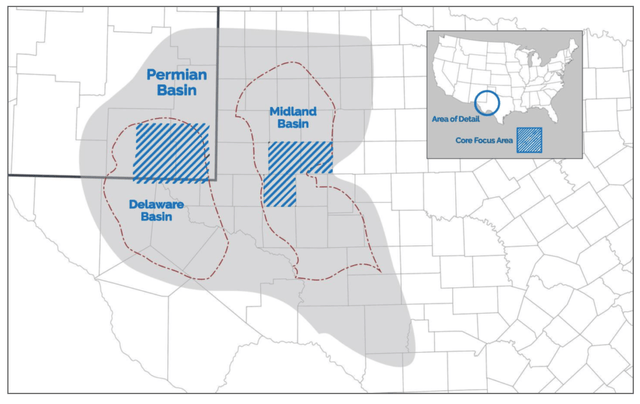

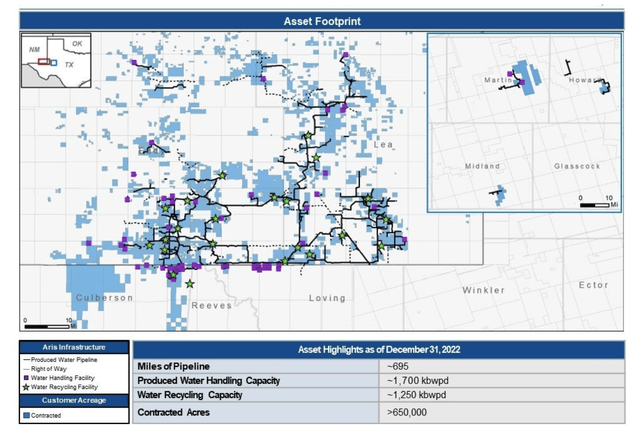

The two maps below show the ARIS operational area and asset footprint as of 31 December 2022.

ARIS Footprint Area Map (ARIS Website)

Operational area and assets are located primarily in Eddy and Lea counties in New Mexico, and in Martin, Howard, and Midland counties in Texas. Geologically, they are entirely in the Delaware and Midland Basins of the overall Permian Basin.

ARIS Capital Asset Map (ARIS 10-K)

Note that the large majority of the asset footprint falls in New Mexico, including all but three water recycling facilities, with a large number of water handling facilities near the New Mexico – Texas border. The inset at the upper right shows smaller and isolated pipeline elements in three Texas counties.

About 650,000 acres are under contract for water removal (see blue areas above), with ~ 8 year remaining contract, and account for ~ 75% of water removal revenue. The remainder of the revenue is split about evenly between ad hoc removal at a spot price, and minimum volume commitments.

This 2020 Searchlight New Mexico article describes the boom in produced water recycling in the New Mexico section of the Permian Basin.

Capital Assets

Capital assets include 695 miles of produced water pipeline and 65 produced water handling facilities, and 23 high-capacity produced water recycling facilities. Pipelines include 492 miles of larger diameter (12- to 24-inch) pipelines.

The water handling facilities have the capacity to dispose of 1700K bpd of waste water.

The term “water handling facility” here means salt water disposal well. Current wells have an average capacity of 26 kbpd, permitted new wells 29 kbpd.

The 23 recycling facilities provide water filtration, treatment, storage and redelivery capability, with the major facilities including the initial Lobo Reuse Complex near Carlsbad in Eddy County, followed by the Bronco Reuse Complex in Lea county, and the larger Eddy State Complex.

All are in the Delaware Basin. Total treatment capacity is 1.2 million bpd. Owned or leased storage capacity is 18 million barrels. In addition to these fixed facilities, ARIS has some mobile treatment equipment.

In addition, ARIS has permits for an additional 205 miles of pipelines and 42 water handling facilities, with 1,234 kbpd capacity, and permits in place or pending for 17 recycling facilities with 1250 kbpd capacity.

Salt water disposal (SWD) wells are an expensive capital assets. One 2020 estimate for the cost to construct a fit-for-purpose disposal facility, including SWD well, is $4-6 million. See a detailed report on a SWD facility constructed in 2019 in Martin County, Texas with an injection zone at 12-13 thousand feet, permitted for 25 kbpd and 6000 psi.

These capital assets don’t last forever and can be expensive to retire. For the years ended December 31, 2022 and 2021, ARIS recognized abandoned well costs of $15.8 million and $28.5 million, respectively, and long-lived asset impairment expense of $15.6 million and none, respectively.

Activity Level and Revenue

ARIS’s business is concerned with three market segments:

- the removal and disposal of produced water

- the sale of produced water treated to “clean brine” standards and delivered for well site operations, primarily hydraulic fracking

- the sale of excess produced water treated to agriculture, industrial, or commercial use standards

Aris currently has no commercial volume or revenue in the third segment.

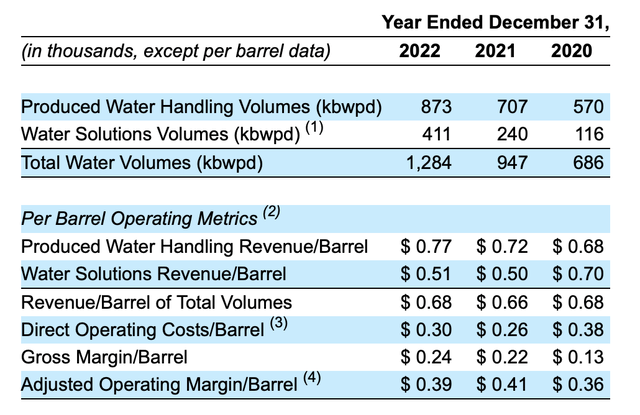

One table from the 10-K allows a fair indication of activity and annual progress.

ARIS Key Operating Metrics (ARIS 2022 10-K)

(1) The Water Solutions Volumes includes 300, 123, and 44 kbwpd of recycled water for 2022, 2021, and 2020, respectively.

We can compute that there was 73%, 51%, and 38% recycled content in the barrels sold for well site use. The balance of the volume was non-potable ground water.

Similarly, 34%, 17%, and 8% of produced water was recycled in 2022, 2021, and 2020, with the balance being injected into disposal wells.

The 73% recycled content for water sold in 2022 comfortably exceeded the 60% target set in the Sustainability-Link Bond. The 10-K notes elsewhere that 177 million barrels have been recycled since at-scale recycling began in July 2019, arguably a significant environmental success.

Looking at revenue for 2022, produced water handling generated $245 million. Water Solutions generated $76 million. So for 2022, 76% of revenue is for removing water from a well site, 24% is for delivering water to a well site.

Revenue per barrel includes skim oil recovery, which was $0.08 per barrel in 2022, and $0.03 per barrel in 2021. Skim recovery accounted for 10% of revenue from water handling in 2022 and 4% in 2021.

Its interesting to note that revenue for removing a barrel is 50% higher than for delivering a barrel, and that all the treating costs fall on the to-be-delivered barrels.

One last point; their customer base is very concentrated. ConocoPhillips accounted for 34% of revenue in 2022, the next two largest customers accounted for an additional 23%.

Beneficial Use – A Future Business ?

The term of art for cleaning up and selling produced water for use outside the oilfield seems to be “beneficial use”. It may become an important future business, but does not generate revenue for ARIS today.

To develop this business, ARIS acquired “certain intellectual property rights and related proprietary treatment technologies and assets” from Water Standards in October 2022.

In November 2022, ARIS signed a strategic agreement with ConocoPhillips and Chevron, and with ExxonMobil in January 2023. The goal for 2023 is to develop, pilot test, and evaluate cost effective and scalable methods to treat produced water for non-consumptive agricultural, industrial, and commercial use, including hydrogen production and direct air capture of CO2.

Reading only very slightly between the lines, the oil companies will provide the technology and secure regulatory approvals, and ARIS will provide their facilities and perform the hands on pilot testing. I would not be surprised to see the agreement extended.

2022 Results / 2023 Projections

2022 Annual Results

- Total revenue of $321 million, up 40% from $229 million for 2021.

- Net income of $4.8 million for 2022, up from a net loss of $7.0 million for 2021.

- Adjusted Net Income of $44.1 million for 2022, up 68% from $26.2 million for 2021.

- Adjusted EBITDA of $149.0 million for 2022, up 24% from $120.5 million for 2021.

- Gross margin per barrel for the year of 2022 was $0.24 versus $0.22 for 2021.

- Adjusted Operating Margin per barrel for 2022 was $0.39 per barrel versus $0.41 for 2021.

- $146.5 million CAPEX for property, plant, and equipment expenditures in 2022, up 96% from $74.7 million for 2021.

- Adjusted EBITDA ratio of 3.0 at year end.

- 29,919,217 shares of Class A common stock and 27,575,519 shares of Class B common stock outstanding at a year end.

- Total volume of 1.28 million barrels of water per day for 2022, up 36% from 2021.

- Recycled Produced Water volumes of 300 thousand barrels per day for 2022, up approximately 144% from 2021.

- Greater than 70% of water sold during 2022 was Recycled Produced Water, exceeding target of 60%.

- 87% of produced water handling volumes were under long-term fee-based contracts in 2022.

- 278 thousand barrels of skim oil recovered in 2022, up 99% from 145 thousand in 2021. Skim revenue was $24.7 million in 2022, vs. $8.8 million in 2021.

Projections for 2023

- 1.01 to 1.04 mbpd produced water.

- Produced water rates $0.02 to $0.04 per barrel increase from 2022 (excluding skim), offset by $2.5 million of increased well maintenance expense.

- Skim oil recovery of 0.09% of produced water volume for 2023 due to operational improvements, increased from 0.08% in Q4 2022.

- Skim revenue down due to realized 2023 price of $68 per barrel vs. $86 in 2022.

- 375,000 – 395,000 bpd of water provided to customers in 2023, with revenue per barrel up $0.02 to $0.05 vs. 2022, with adjusted margins down 5-10%

- Recycle 20% of produced water; 1% change in recycle rate yield ~ $1 million in EBITDA (including disposal OpEx savings)

- Adjusted Operating Margins between $0.38 and $0.41 per barrel of Total Volumes

- $150-170 million EBITDA.

- expect to be able to recommend dividend increase after reaching free cash flow

- $140 – $155 million CapEx, of which $110-$120 million is growth CapEx, $11-13 million maintenance CapEx

- Growth CapEx includes six new disposal wells, and $16-18 million in system optimization

- Typical 6-9 month lag between CapEx spend and revenue.

- Reduced annualized OpEx Y/Y by $3.2 million Y/Y as permanent facilities replace rented pumps and tank, and $4.4 million as grid power replaces rented diesel generators.

- Redesigned disposal facilities expect to save $2.5 million capital costs per well, as well as reduce ongoing OpEx.

- 15-20% increase in produced water volumes for 2023 vs. 2022.

- Lower customer completion activity in 2023 will yield lower recycled water sales; impacts (1) lower revenue and margins in recycled water, (2) increased cost for disposal of remaining water, (3) reduced capacity for and revenue from higher margin spot disposal

- about 9% spot volume in 2023 versus 13% in 2022; margin premium on spot disposal is about $0.10 per barrel higher

- Delaware volume delayed; disposal well connected but upgrades delayed to Q2; expect to achieve $11-13 million EBITA annual rate in second half of year

- Expect primary pilot for beneficial use strategic agreement to be completed by Q1 2024

- DOE grant for desalination pilot project announced in February

- Completed 6 month pilot with Texas A&M to use treated water for irrigation of cotton and the grass

In response to a question in the Q4 call on the timing of achieving free cash flow, Amando Brock responded:

And in terms of free cash flow, on the basis of our current outlook, current forecast, looking at the operating margin improvements and efficiencies that we expect to achieve, we do at this point see that early 2024 should be that infection point.

Competition

There are a number of direct and indirect competitors in the Permian, and more generally elsewhere. Due to the natural monopoly inherent in pipeline water transport, this competition may be considered more wholesale – for acreage and clients – that retail, by well sites. Many oil company operators have in house facilities.

One example is Waterbridge (private); website here. They claim to be the largest pure play water solutions provider in the industry. Active in the southern Delaware Basin, they have 2.1 million bpd of water handling, reuse and redelivery capacity via 959 miles of large-diameter pipelines and 97 water handling facilities in Texas and Arkoma Basin in Oklahoma.

Kinetic Holdings, Inc. (NYSE:KNTK), primarily a midstream gathering system, recently acquired a small water system in the Delaware Basin.

Outside the Permian, the Antero Midstream (NYSE:AM) water business provides an interesting point of comparison. Per their 2021 ESG report, the business currently includes 350 miles of fresh water pipelines, 37 fresh water storage facilities, and has 100K BPD of flowback and PW recycling and reuse capacity.

In 2021, 97% of the fresh water used in Antero Resources was transported by pipeline, eliminating 16 million miles of truck traffic in. About 87% of produced water was reused or recycled, including with mobile processing facilities, with the balance going to disposal wells.

Analysis

The perception and reality of growth is important in assessing ARIS. I see several options:

- optimize operations in their current acreage and client footprint (e.g. conversion to grid power, increase recycling to reduce disposal costs, etc.)

- increase scale via M&A

- achieve commercially significant levels of beneficial reuse

Optimization

In addition to improving oil skim efficiency, it might be possible to extract other valuable materials such as lithium (currently about $10 per pound) from produced water. There are startups trying to do this today from lithium rich brines.

Amanda Brock, CEO, said in the Q4 call

We recognize that raw produced water contains various concentrations of minerals such as lithium and bromine and other inorganic compounds such as ammonia that may have commercial value, and are exploring and assessing the feasibility of various extractive technologies.

Increase Scale via M&A

M&A has the potential to leverage their existing capital assets and reduce the G&A burden.

Bill Zartler talked about M&A in the Q4 call. The only deal in 2022 was the acquisition of certain Delaware Energy assets. But they are still looking:

We see future opportunities for consolidation, and remain focused on strategic fit, complementary capabilities, and financial discipline. We are positioned to be a natural consolidator of the fragmented, private and operator-owned oil field water infrastructure industry and adjacent opportunities treating complex water for other verticals outside of the oil and gas industry.

Commercial Scale Beneficial Use

ARIS pitches beneficial use of produced water as a major growth opportunity. There are certainly some positive feasibility indicators.

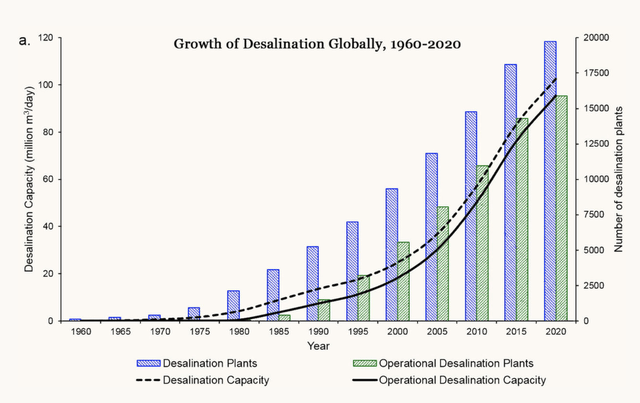

Desalinization of seawater for example is widespread, with over 15,000 plants in operation. This 2019 article from Yale provides an overview of the desalinization market. Among other issues, however, energy cost is high.

Growth of Desalinization (Yale University)

In Texas, San Antonio operates the H2Oaks desalination plant that takes brackish shallow subsurface water, uses a reverse osmosis filter that removes 99.9 percent of the salts and minerals from the water, produces drinking water, and re-injects the concentrated brine into a deeper formation. In 2022, 4,300 acre-feet was produced.

But well site produced water is not seawater. The May 2020 University of Texas study reported above, Can we beneficially reuse produced water from oil and gas extraction in the U.S.?, notes that the Delaware Basin will have a significant volume of produce water after satisfying all oilfield use, but that the path to beneficial use may be longer and harder than hoped. Co-author Mark Engle noted:

There is definitely potential to do some good, but it will require cautious and smart approaches and policies.

In response to a question on the beneficial use pilot, Bill Zatler, Founder said:

It actually is a series of pilots. We have set it aside at our (Spanos) SWD. And working with Chevron, with Exxon, with Conoco … and sharing all of those costs with them. We will be piloting a series of different technologies at scale. We will be looking … throughout this entire year and early next year for the ability to scale up robust lower costs. After these pilots, we will then determine which technologies we wish to use.

What we’ve done in our financial statements is, we’ve broken this out into R&D. so, it’s a separate line item.

With all due respect to ARIS, COP, CVX, and XOM, turning this into a successful business may be a challenge. And I suspect that the primary motivation of the oil companies is to improve their ESG standing, rather than generate revenue. But it’s still early days.

Risks

There are risks, the 10-K describes them in exhausting if repetitive detail. Long term decline of the oil industry, year to year changes in activity due to oil and gas prices, aggressively adverse political climate, regulation, bigger and better funded competitors – its a long list, but not really surprising given the business they are in.

There are a few less generic risks that might warrant additional consideration.

Client Concentration

Client concentration is very high. ConocoPhillips provides a third of their revenue, and is a major stockholder. Things could happen.

Tax Receivable Agreement

The Tax Receivable Agreement may be an underestimated liability.

In connection with the IPO, Aris Inc. entered into a Tax Receivable Agreement (TRA) with the TRA Holders. There is a good discussion from Bloomberg of what TRAs are and how they work here, and an unflattering 2015 Seeking Alpha article here. Such agreements are increasingly common when a private company goes public.

Under this agreement, net cash savings actually realized by ARIS in income and franchise taxes will be split 15%/85% between ARIS and the TRA Holders. No payments were made in 2022.

The effect of this contract appears to be to transfer value to the legacy private company owners. These future payments might be significant; ARIS calculated the lump sum liability for TRA termination as ~ $159 million. Although fully disclosed, some believe the effects of such agreements may not be well understood by investors.

Beneficial Use Impact

ARIS may be a customer for, rather than a provider of, the technology for processing water for beneficial use. Expectations for valuation multiples associated with the beneficial use business may reflect small midstream gathering systems rather than tech companies.

Valuation

The current share price is ~ 70% below the 52 week high of $23.58, and more than 50% below the average price since IPO.

The Wall Street analysts estimates collected by Seeking Alpha indicate an average price target of $13.75.

ARIS Price Targets (Seeking Alpha)

I think it’s reasonable to assess fair value as materially above the current price.

I would not be surprised to see a further, if temporary, decline based on disappointing Q1-Q2 2023 margins, or recession induced declines in the price of oil.

Investor Takeaway

Aris is a small cap with a limited history as a public company. The bulk of their operations and physical assets are in two counties in New Mexico. Both revenue and ownership are unusually concentrated.

The business has two major sources of revenue – removing waste water from actively producing well sites, and delivering moderately processed water, augmented by ground water, to well sites fracking operations.

Volume growth in 2022 for these two segments was significant, respectively 23% and 71% respectively, but growth in revenue per barrel was modest at 7% and 2%. Results are projected to improve in the second half of 2023, reaching positive cash flow in early 2024. They pay a $0.09 quarterly dividend.

A third potential source of revenue, selling water that has been highly processed for non-oilfield use, is not yet commercial.

I view ARIS as a near term bet that improved operations and increased recycling for the oilfield will support better margins, a medium term bet on scale expansion via organic growth and M&A, and a speculative bet that more sophisticated water treatment will eventually allow recycled water to be sold for use outside the oilfield.

Overall, I would rate ARIS as a Buy. Investors interested in this exposure might consider using a limit order to take advantage of price excursions. Personally, after researching and writing this article, I placed a small limit order just under the current price, and would consider adding on further price declines.

Credit: Source link