Walter Bibikow/DigitalVision via Getty Images

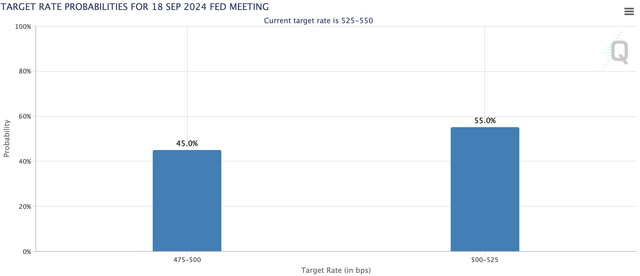

Arbor Realty’s (NYSE:ABR) fiscal 2024 second-quarter earnings saw revenue of $87.96 million. This dipped by 19% year-over-year, but non-GAAP EPS at $0.45 beat consensus by $0.03 cents, meaning the mREIT continues to cover its dividend. ABR most recently paid a $0.43 per share quarterly cash dividend, unchanged versus its prior payment. The annualized dividend at $1.72 per share means a 13.2% dividend yield against commons currently changing hands for roughly $13 per share. ABR could be set to realize some recovery of its dividend coverage as the Fed looks set to reduce interest rates by at least 25 basis points at the September 18 FOMC meeting.

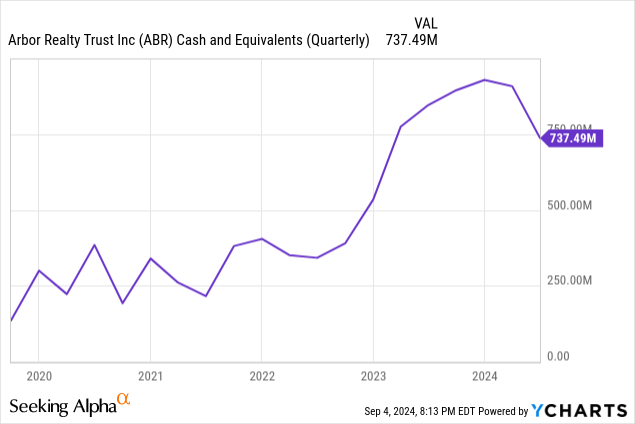

The mREIT has not cut its dividend in over a decade, growing its payouts through the pandemic shutdown and subsequent inflation surge. Critically, ABR has maintained a strong liquidity position, with cash and equivalents at roughly $740 million at the end of the second quarter. This heavily conservative stance reflects the disruptive macroeconomic backdrop and a second quarter that saw CECL reserves rise by an additional $27.5 million in the structured portfolio. This was driven by multifamily loans whose performance has seen increased volatility against a Fed funds rate hiked to a 23-year-high. I last covered ABR in July.

Arbor Realty Fiscal 2024 Second Quarter Form 10-Q

Originations And Book Value

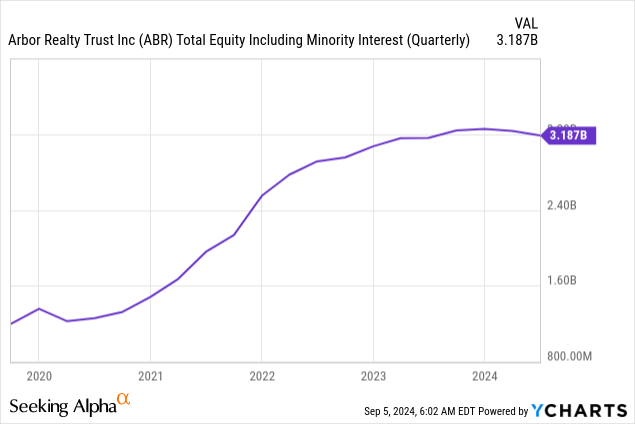

While provision for CECL reserves was up by $70 million from ABR’s year-ago comp, the mREIT total structured portfolio had an unpaid principal balance of $11.87 billion at the end of the quarter. This places CECL reserve as a percent of the portfolio at 2%. The mREIT’s book value stood at $12.46 per share, down 18 cents sequentially but having remained incredibly stable through the last three years since the inflation spike sparked an aggressive Fed response. Total equity ended the second quarter at $3.19 billion, up just under 1% over its year-ago quarter.

Arbor Realty Fiscal 2024 Second Quarter Form 10-Q

ABR’s total loans and investments portfolio at $11.6 billion has been trending down, this figure was $12.3 billion at the start of 2024. ABR has allowed repayments to run ahead of originations to strengthen its balance sheet. Total new loan originations stood at $227.18 million in the second quarter, a $402.46 million difference to loan runoff of $629.64 million. Loan runoff running ahead of originations reduces the asset base ABR can earn interest income on but also means the mREIT’s cash balance expands and its portfolio is exposed to less intrinsic volatility from the difficult macroeconomic backdrop.

Arbor Realty Fiscal 2024 Second Quarter Form 10-Q

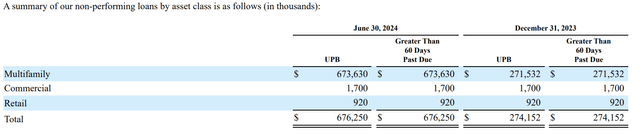

Hence, ABR’s current EPS downtrend also partially reflects a more conservative stance with loan originations and runoffs. It means EPS growth can recover on a management shift to become more aggressive with originations. Non-performing loans, a categorization applied once the contractual payments exceed 60 days past due, ended the second quarter at $676.25 million, up from $274.15 million at the start of the year. This figure was $465 million in the prior quarter.

Arbor Realty Fiscal 2024 Second Quarter Form 10-Q

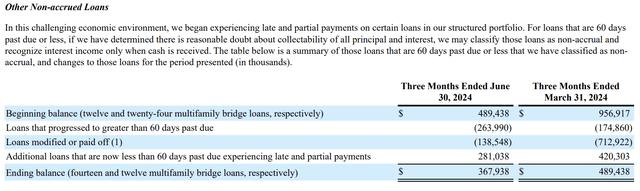

Other non-accrued loans which are less than 60 days past due at $368 million during the second quarter, dipped sequentially from $489 million in the first quarter on the back of some loans moving to 60 days past due and loan repayments and modifications of $139 million. ABR was somewhat sanguine on the trajectory of progress on resolving non-performing loans during its earnings call, softly guiding for new expected delinquencies in the third quarter.

Arbor Realty Fiscal 2024 Second Quarter Form 10-Q

Real Estate Owned, Interest Rate Cuts, And EPS Growth

Taking collateral of non-performing loans will play a part in how ABR manages its loan portfolio outside of its current primary strategy of working with its debtors to modify loans. For example, the mREIT modified fourteen multifamily bridge loans during the second quarter, spread across a total unpaid principal balance of $361.8 million. Borrowers are required to invest additional capital to recapitalize their projects. ABR provides temporary rate relief through a pay and accrual feature in exchange.

CME FedWatch Tool

Against the uncertain backdrop, interest rate cuts form a critical salvo. The probability of this is at 100% according to the CME FedWatch Tool. It will help pump much-needed liquidity into the sector, reduce credit stress on borrowers, and build a rise in investor sentiment towards the mREIT business model. However, as ABR’s loans are priced at floating rates, rate cuts would also have a downward impact on interest income even as its cost of funding also dips. ABR’s dividend is currently covered, but I rate a dividend cut as highly unlikely against what is still $140 million in capacity remaining on the mREIT’s share buyback plan. The first interest rate cut since early 2020 will likely spark a surge of euphoria, possibly compounded if we see consecutive rate cuts. This is potent for a stock that currently has 36% of its float sold short. I continue to own the commons and the series D preferreds (NYSE:ABR.PR.D).

Credit: Source link