KeremYucel/iStock via Getty Images

Thesis

AppLovin (NASDAQ:APP) was going through difficulties in their core business two years ago, but now the company is firing on all cylinders. We believe that the company learned a lot from the Apple (AAPL) tracking changes and slowdown in the ad market. They are now growing at a rapid clip, and doing so profitably. We believe the company is currently undervalued.

The Backstory

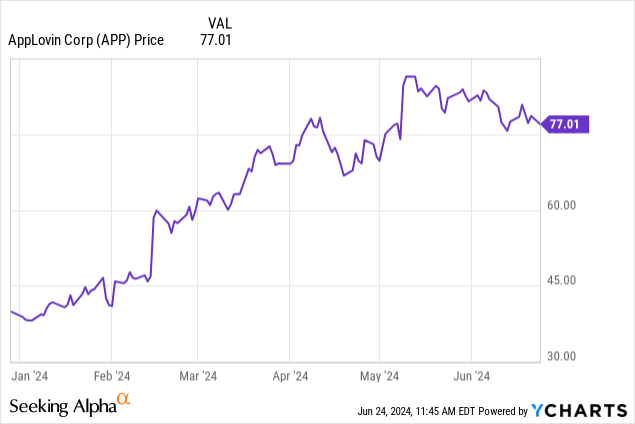

AppLovin was one of the companies negatively impacted by Apple’s tracking changes, making it more difficult for AppLovin to achieve good outcomes for those spending ad dollars on their platform. For investors familiar with the industry, this is similar to how Meta (META) was impacted by the changes, but not exact. Around that time, the ad market was also in a slow period. This double whammy caused AppLovin’s core business to struggle, which was likely the main cause of their stock price plummeting from $95 at the start of 2022 to $10 at the start of 2023. This massive drawdown has since been followed by strength in both the core business and the stock, and shares are now trading at $77.

When a stock goes down by so much it is natural to be wary of investing in it, even after it recovers. Some investors may be wondering if such a nasty drawdown is going to be repeated in the future. Over the long-term, stock prices tend to track business fundamentals, and we believe that AppLovin’s business is much stronger than it has been in the past. While not out of the question, a drawdown as steep as the last one seems unlikely at this time.

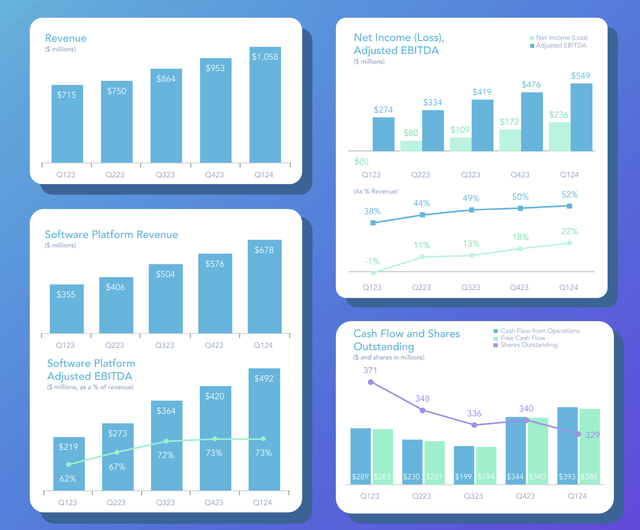

The company is currently executing at a high level, and it appears likely that this strength is here to stay. AppLovin has made wonderful progress on the GAAP profitability front (their unprofitability, along with the debt load, is what kept us away in the past). In their most recent quarter they reported an impressive year over year revenue growth rate of 48%.

AppLovin’s 1Q24 Shareholder Letter

The strong turnaround exhibited by AppLovin is due mainly to the strength of their software business, and improvements to their AXON technology.

AXON

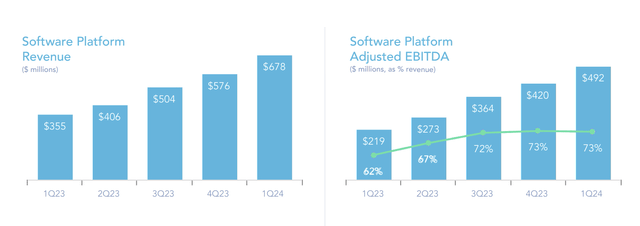

The main reason to invest in AppLovin is their Software Platform segment. This segment includes AXON, AppLovin’s technology that helps them get advertisers better results. This segment is growing much faster than the overall business (91% vs 48%), and has higher adjusted EBITDA margins (73% vs 52%). The company debuted their AXON technology about a year ago, and management has expressed optimism that the technology will continue to improve and drive better outcomes for advertisers.

AppLovin’s 1Q24 Shareholder Letter

In their first quarter shareholder letter the company stated (emphasis ours):

Our Software Platform segment grew significantly in the first quarter with Software Platform revenue of $678 million, up 91% year-over-year driven by further improvement of our AXON technology, which continues to benefit from ongoing self-learning, additional data, and engineering enhancements. Our technology improvements contributed to greater return on ad spend (ROAS) for our advertisers, leading to increased investment. Continued discipline and a relatively fixed cost-base led to exceptional flow-through from revenue to Software Platform Adjusted EBITDA during the quarter, with year-over-year growth of 125% to $492 million at an Adjusted EBITDA margin of 73%.

As long as this high margin segment can continue growing at a fast rate, the stock will likely continue its uptrend.

Price Action and Valuation

AppLovin has been on a tear this year, up nearly 100%. That being said, we don’t expect such rapid gains going forward, as the market now has greater respect for AppLovin and has gone through the process of re-rating the shares.

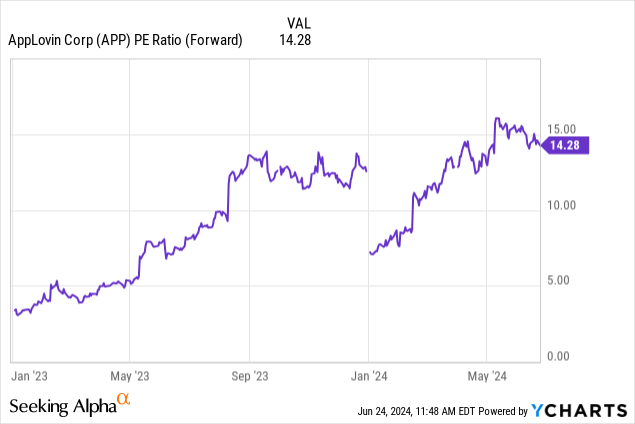

AppLovin currently trades at a forward PE of 14, based on an aggregation of analyst estimates according to YCharts. We view these estimates as being a little aggressive. Our estimate is for around $3.2 in earnings over the next twelve months, which would equate to a forward PE of 24. In our opinion, a business that is growing at a rate of 48% year over year should trade at a multiple closer to 30-35. A 30 multiple to our estimate of forward earnings would mean a share price of $96, a 35 multiple would mean a share price of $112. This certainly looks reasonable when compared to the current price of $77.

Risk Factors

There are three major risk factors to consider regarding an investment in AppLovin:

1. AppLovin is beholden to policies that others (such as Apple and Google (GOOGL)) create, and changes in these policies may damage AppLovin’s business.

2. AppLovin derives their revenue from advertising spend. This segment of the economy is prone to cutbacks during times of economic hardship.

3. Competitive pressures could result in slower growth and contracting margins. Apple and Google could choose to compete more directly with AppLovin, and companies such as Unity (U) could improve their value proposition.

Given the strong performance of the business, we are willing to accept these risks and the potential downside associated with them. We believe that bullish investors should limit exposure to a small part of their portfolio due to the potential for a steep drawdown.

Key Takeaway

We believe AppLovin is trading at attractive levels, and that their revenue and earnings will continue to grow at a high rate. Due to the nature of the business, bullish investors would be wise to limit their exposure to a small part of a diversified portfolio.

Credit: Source link