monsitj

Dear Appleseed Fund Shareholders:

“The cure for high prices is high prices. The cure for low prices is low prices.” – James Ernest Boyle, Speculation and the Chicago Board of Trade

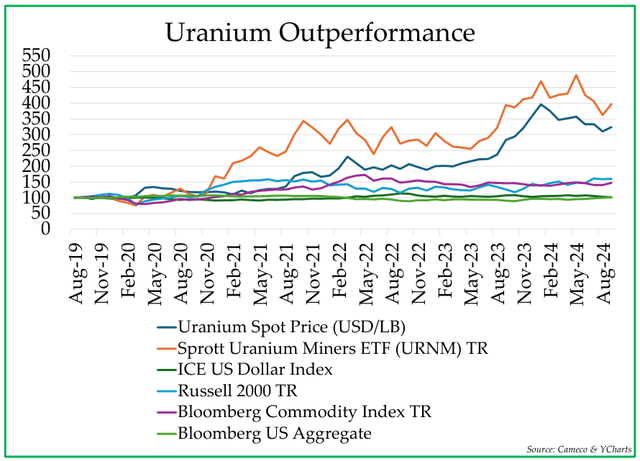

After many years of unsustainably low prices for physical uranium, or perhaps as a reaction to these low prices, the fundamental medium-term to long-term outlook for higher uranium prices has never been more promising. Uranium prices have increased significantly over the last 5 years, but there are good reasons to believe that the bull market in uranium prices is still in the early innings due to a structural supply deficit that is likely to persist over the coming decade. With higher prices for uranium, we would expect increasing profits for nuclear power plant builders and uranium miners, along with higher share prices for these businesses.

To meet the future demand growth from emerging markets, data centers, and electric vehicles, while fulfilling ambitious climate goals, the nuclear energy industry is making plans to fulfill a pledge (COP28) that will triple nuclear energy production by 2050. 1 This is a dramatic improvement from the nuclear energy outlook just a few years ago when many EU countries were looking to phase out their nuclear programs and when Japan shut down many of its reactors in the wake of the 2011 nuclear accident at the Fukushima nuclear plant. The demand growth trajectory for uranium is accelerating at the same time that its supply outlook is becoming increasingly more precarious. With the uranium price remaining too low to incentivize additional greenfield development projects, risks remain skewed heavily to the upside for prices. While forecasted demand growth is increasing for uranium, the forecasted supply of uranium has instead experienced downward revisions, as the uranium price remains too low to incentivize additional production. Important to note, the cost of physical uranium represents only ~14% of the total cost to produce electric energy at a nuclear power plant.

Dramatically Increasing Demand for Nuclear Energy

The drivers for increasing demand for nuclear energy are, first and foremost, dramatically increasing demand for electricity. Inexorably, global GDP continues to increase, and emerging market countries may continue to develop more wealth. With increased wealth, emerging market consumers are using more electricity.

In addition, new technologies are driving increased demand for electricity.

- Data centers are driving significant demand growth for electricity; in the United States, power consumption from data centers is forecasted to increase from 3% today to 8% of total power consumption by 2030. If demand for artificial intelligence meets investors’ lofty expectations, it is quite likely that data centers representing 8% of total power by 2030 3 could turn out to be low.

- Electric vehicles and plug-in electric hybrid vehicles are replacing internal combustion vehicles around the world, which should reduce the demand for oil but greatly increase the demand for electricity.

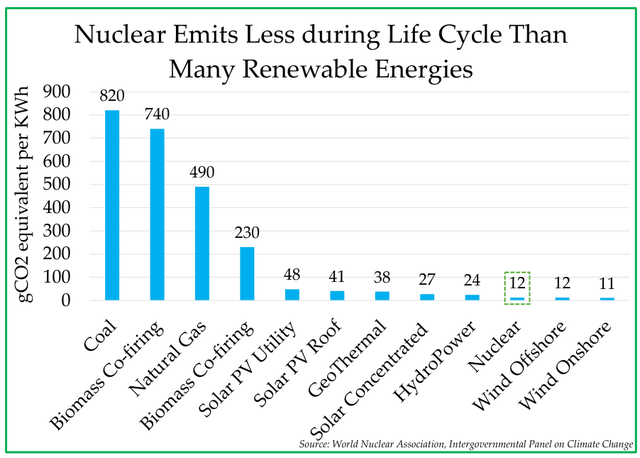

Source: World Nuclear Association, Intergovernmental Panel on Climate Change

To fulfill this growing demand for electricity, nuclear power is well positioned as an energy source. Unlike coal, oil, and natural gas, all of which are used to fuel power plants and generate electricity, nuclear power carbon emissions are de minimis. For that reason, regulators and legislators around the world are expanding nuclear power capacity. Also, for countries like Japan, which are bereft of fossil fuel resources, nuclear energy represents energy security and independence, which is becoming increasingly important as geopolitical risks increase. Moreover, unlike intermittent renewables such as wind and solar, nuclear energy is consistent and reliable as a baseload energy source; one can operate a nuclear power plant when the wind is not blowing and after the sun has set. As a power source, nuclear energy has a reliability, cost, and carbon-free profile which is simply unmatched by any other source.

As a result, according to public capacity expansion and life extension announcements tracked by the World Nuclear Energy Association, nuclear plant capacity should expand from 390 GW today to 552 GW by 2035.4 The following are some examples of recent nuclear capacity expansion announcements:

- China has approved the construction of 46 new nuclear plants during the past 5 years. By 2030, China will be the largest nuclear energy producer in the world with over 113 GW of electricity generated, using 56 million pounds of uranium each year, roughly double what China is consuming today. Moreover, China expects to approve more reactors in the future, targeting a nuclear fleet that will require 90 million pounds of uranium each year.

- The United States passed the ADVANCE Act on a bipartisan basis in July 2024, which will make it easier to achieve the U.S. Department of Energy’s goal of tripling nuclear capacity by 2050 to 200 GW in order to meet emission goals. Thus far in 2024, many announcements have been made related to a) nuclear plant life extensions, such as the North Anna Power Plant in Virginia; and b) restarting closed nuclear plants, such as Michigan’s Palisades power plant and Pennsylvania’s infamous Three Mile Island nuclear facility.

- India has announced plans to triple India’s nuclear capacity from 8.2 GW to 22.5 GW by 2031-2032 and to 100 GW by 2047.

- Russia announced plans to double its nuclear power capacity over the next 18 years.

Inadequate Supply for Uranium

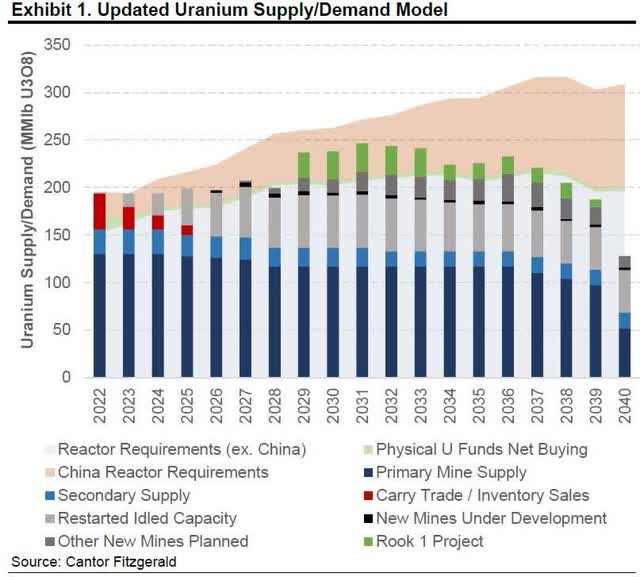

Given all the costs and challenges required in adding new uranium mining capacity, the supply of uranium is not growing at the pace required to meet future expectations of sharply higher demand for uranium. There is some capacity expansion activity, to be sure, just not enough. Without a change in the supply growth trajectory, it seems likely that supply will fall short of meeting expected demand, given the current price of uranium.

The key phrase in the above paragraph, of course, is “given the current price of uranium.” When the price of uranium is too low, as it is now, uranium producers are not able to develop new uranium mines at a satisfactory profit. Therefore, it seems likely that the price of uranium must increase materially from current levels, either gradually or suddenly. And, when this increase occurs, any investor who owns physical uranium should enjoy price appreciation on their investment, and any investor who owns uranium producers should profit from growing profitability and investor expectations for more profits in the future.

The problem of inadequate supply growth is made worse by the fact that current uranium mines are suffering from production shortfalls. Kazakhstan-based Kazatomprom (OTC:NATKY), the largest uranium miner in the world with more than 40% of the world’s proved reserves, lowered its 2025 production forecast by 17%, representing a shortfall of 14 million pounds, or ~10% of expected world uranium production.5 And the problem is not just limited to 2025; this will be the fifth consecutive year when Kazatomprom missed its production targets. These shortfalls relate to cost escalation, increased government royalties, rising sanctions on countries aligned with Russia, and lower profits on uranium mining activity. Lower prices are resulting in lower production which will eventually cause shortages that drive up the price of uranium. As James Ernest Boyle eloquently put it over a century ago, the cure for low prices is low prices.

Several major new mines are currently under construction, but those projects are suffering from delays, financing challenges, construction problems, and generally higher costs than originally projected. There is simply not enough profit associated with the current uranium price to incentivize the kind of risk-taking on the supply side that is necessary to match the tsunami of demand that should be arriving in the coming years.

This structural supply deficit should set the stage for higher uranium prices until the structural supply deficit disappears as new mines come online to take advantage of those higher prices. The chart to the right beautifully demonstrates why a structural supply deficit will exist in the uranium market for years to come unless the uranium price increases.

Era of Inflation

For reasons that we have discussed at length in other investor letters, we expect persistently high inflation during the 2020s, driven by unsustainably high government deficits financed by unprecedented fiat money printing. While inflation has cooled compared to 2022, we expect the decline in the inflation rate will be a temporary phenomenon.

If our inflation outlook is correct, investments in scarce, hard assets should outperform. Uranium is certainly scarce, and we believe that it is only going to become increasingly more scarce. While printing more money is easy, producing more uranium is risky, costly, and difficult. And, for a nuclear power plant, there are simply no substitutes for uranium. A plant operator will seek to obtain uranium at any cost to prevent a nuclear reactor, which has very large fixed costs, from going idle. The scarcity of uranium, along with the fact that uranium is a small percentage of the total cost of operating a nuclear reactor, makes uranium and companies that benefit from increasing uranium prices an attractive investment, in our view.

Moreover, uranium is still under-owned by investors. While almost every investor has direct or indirect exposure to AI-related companies such as Nvidia (NVDA), Alphabet (GOOG,GOOGL), or Microsoft (MSFT), their share prices already reflect a coming rosy future for AI, in our view. Meanwhile, the companies that directly or indirectly provide the necessary energy to accommodate all of the data center growth required for AI are mostly ignored and/or are under-owned.

Investment Implications

As a result of the coming nuclear renaissance, we foresee continued announcements of new nuclear reactors being built, existing nuclear reactors receiving life extensions, and closed nuclear reactors being reopened. Just as nuclear energy use increased dramatically in the 1970s in response to the oil crisis, we expect a similar dramatic increase in the 2020s.

At some point, it will become increasingly evident that the demand growth for uranium is far outstripping supply growth. When this happens, the uranium price should increase, perhaps dramatically, and those companies and countries who have not maintained a sufficient safety stock of uranium will be forced to pay exorbitant prices to keep their reactors operating at capacity. We believe that investors in physical uranium trusts, should benefit from these price increases.

With increased uranium prices, mines will become more profitable, and the share price of mining companies should increase sharply. Increased profits will attract competition and new entrants, resulting in new mines, more production, an eventual end to higher uranium prices, and possibly the beginning of a decline in uranium prices. But we are probably still a decade away from such a time.

Accordingly, Appleseed Fund took a position in Canada-based Cameco Corporation ( CCJ), the largest uranium supplier in North America and the second largest supplier in the world behind Kazatomprom. Cameco offers deep uranium reserves without significant financial, operational, political, and exploration risks. In addition, we also purchased shares of Sprott Physical Uranium Trust ( OTCPK:SRUUF), a Canadian physical trust that simply owns physical uranium; SRUUF allows shareholders to benefit directly from changes in spot prices from uranium without bearing equity risk.

Performance and Portfolio Changes

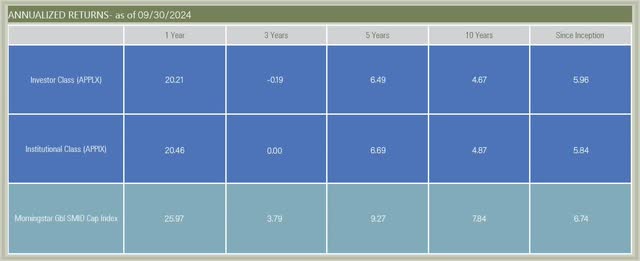

Over the 12 months ended 9/30/24, Appleseed Fund Institutional Class has generated an absolute return of 20.46%, slightly underperforming the Morningstar Global Small/Midcap Index, which generated a total return of 25.97%. With less than 70% of the Appleseed portfolio invested in stocks, we find the performance to be quite strong on a risk-adjusted basis. Throughout most of the past several years, Appleseed Fund has been positioned for an inflationary, slow growth economy. With inflation levels falling, causing a ripping stock market since the end of 2022, Appleseed’s cautious positioning held back investment returns.

Appleseed Fund added four new names to the portfolio in the past six months: Estée Lauder (EL), Willis Lease Finance (WLFC), Diana Shipping (DSX) and Gravity (GRVY). Estée Lauder is one of the world’s largest producers of cosmetics products, and valuation has become very attractive as this premier beauty company is suffering from a post-COVID-19 hangover. Willis Lease Finance is the largest pure-play commercial jet engine lessor in the world. With jet engine availability plaguing the commercial aircraft industry, rental rates for leases jet engines are flying upwards, as should be Willis Lease Finance’s stock price. Diana Shipping is a Greek dry goods shipping company with a compelling valuation and a fetching double-digit dividend yield. Gravity is a profitable Korean video game producer whose market capitalization nearly exceeds the cash on its balance sheet; we believe good things happen when valuation is so staggeringly cheap.

In terms of portfolio sales, Appleseed Fund liquidated its holdings in Synovus (SNV), MRC Global (MRC), Burberry (OTCPK:BURBY, BRBY-LON), and Sprouts Farmers Markets (SFM). All four securities reached our estimates for intrinsic value, and we took the capital and invested it elsewhere. Within the equity portion of the portfolio, the biggest contributors to the Fund’s performance over the past 12 months were Sprouts Farmers Markets (SFM), AerCap (AER), AGNC (AGNC), Ardelyx (ARDX), and physical gold trusts. The most significant detractors to performance over the past 12 months have been Mosaic (MOS), Herbalife (HLF), Estée Lauder (EL), Dollar General (DG), and Burberry (BRBY-LON).

Currently, Appleseed Fund is positioned defensively in light of this bearish outlook on the economy. With regards to equities, we are favoring companies in the consumer staples, healthcare, and agriculture sectors as well as inexpensive, out-of-favor value stocks. We do not believe that inflation is under control, as most of the long-term drivers of inflation are secular not cyclical and remain in place. As an example, the Federal Reserve may make incremental progress on reported inflation, but falling U.S. Treasury receipts without a decline in unemployment is a highly problematic signal. The U.S. fiscal situation needs the dollar down and inflation back up to avoid significant fiscal problems in the near-term. Beyond equities, Appleseed Fund is overweight U.S. Treasuries and physical gold trusts.

We thank Appleseed Fund shareholders for their continued support of us in the management of their investable assets.

Sincerely,

Adam Strauss, CFA | William Pekin, CFA | Joseph Plevelich, CFA | Shaun Roach, CFA | Joshua Strauss, CFA

Appleseed Fund Portfolio Managers

|

Footnotes 1 https:// www.energy.gov/articles/cop28-countries-launch-declaration-triple-nuclear-energy-capacity-2050- recognizing-key 2https://en.wikipedia.org/wiki/Economics_of_nuclear_power_plants#:~:text=Fuel%20costs%20account%20for%20abou t,14%20percent%20of%20operating%20costs. 3 https:// www.goldmansachs.com/insights/articles/AI-poised-to-drive-160-increase-in-power-demand 4 World Nuclear Energy Association 5 Kazatomprom’s uranium production in 2025 should actually increase slightly v. 2024 levels but will nonetheless fall short of its prior output goals for 2025 by a wide margin via Kazatoprom company statements This commentary is prepared by Pekin Hardy Strauss, Inc. (dba Pekin Hardy Strauss Wealth Management, “Pekin Hardy”) for informational purposes only and is not intended as an offer or solicitation for the purchase or sale of any security. The information contained herein is neither investment advice nor a legal opinion. The views expressed are those of the authors as of the date of publication of this report, and are subject to change at any time due to changes in market or economic conditions. Although information has been obtained from and is based upon sources Pekin Hardy believes to be reliable, we do not guarantee its accuracy. There are no assurances that any predicted results will actually occur. Pekin Hardy holds Nvidia (NVDA), Microsoft (MSFT), Alphabet (GOOG,GOOGL), Kazatomprom (KAP.IL) and other companies mentioned in this edition in some of its client accounts.  The funds past performance does not guarantee future results. Italics indicate extended performance, as APPIX did not exist until 1/31/11. APPIX extended performance is an estimate based on the performance of APPLX, adjusted for the difference in fees. The investment return and principal value of an investment in the Fund will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 1-800-470-1029

Fund Inception date: 12/08/2006 The gross expense ratio of the Fund’s investor class is 1.69%, and the institutional class is 1.38%; the net expense ratio after contractual fee waivers through January 31, 2025 is 1.22% and 1.03%. The Fund’s ninety day redemption fee is 2.00%. Investments in commodities such as gold may be affected by overall market movements, changes in interest rates, and other factors such as embargoes and international economic and political developments. Commodities are assets that have tangible properties, such as oil, metals, and agricultural products. These instruments may subject the Fund to greater volatility than investments in traditional securities. The views and opinions expressed in this material are those of the authors. While we believe we have a reasonable basis for our appraisals and we have confidence in our opinions, actual results may differ materially from those we anticipate. These opinions are current as of the date of this letter but are subject to change. There is no guarantee that any forecasts or opinions in this material will be realized. Information should not be construed as investment advice nor be considered a recommendation to buy, sell, or hold any particular security. You should consider the fund’s investment objectives, risks, charges, and expenses carefully before you invest. The Fund’s prospectus contains important information about the Fund’s investment objectives, potential risks, management fees, charges and expenses, and other information and should be read carefully before investing. You may obtain a current copy of the Fund’s prospectus or performance data current to the most recent month by calling 1-800-470-1029. The MSCI World Index is a widely followed, unmanaged group of stocks from 23 international markets and is not available for purchase. The Index returns do not reflect the deduction of expenses, which have been deducted from the Fund’s returns. The Index returns assume reinvestment of all distributions and does not reflect the deduction of taxes and fees. Individuals cannot invest directly in the Index. However, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. Distributed by Ultimus Fund Distributors, LLC (Member FINRA). |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Credit: Source link